Nyheter

SEC v. Binance

Publicerad

2 år sedanden

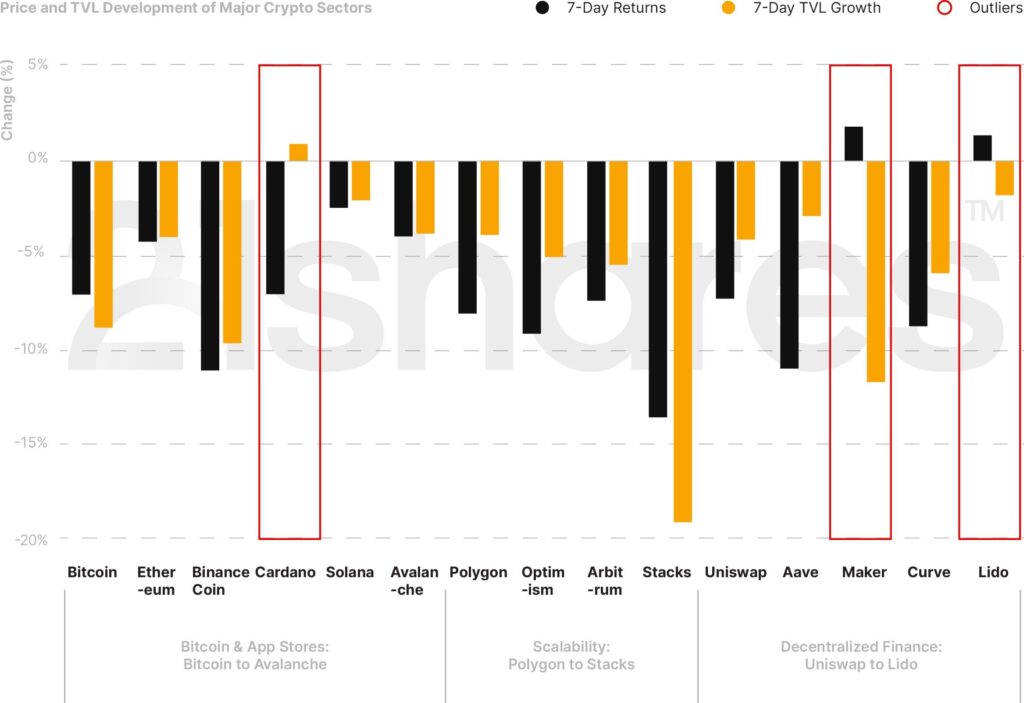

Panic selling drained the cryptoassets market in response to a new lawsuit launched by the Securities and Exchanges Commission (SEC) against Binance, the world’s largest crypto exchange, alleging that Binance operated an unregistered national securities exchange, broker-dealer, and clearing agency, allegedly misused user funds, and offered and sold unregistered securities, among other allegations. The news added to the selling pressure of Bitcoin and Ethereum, falling by 7% and 4%, respectively.

Figure 1: Weekly TVL and Price Performance of Major Crypto Categories

Source: Coingecko and DeFi Llama. Close data as of Jun 5, 2023.

5 Things to Remember in Markets this Week

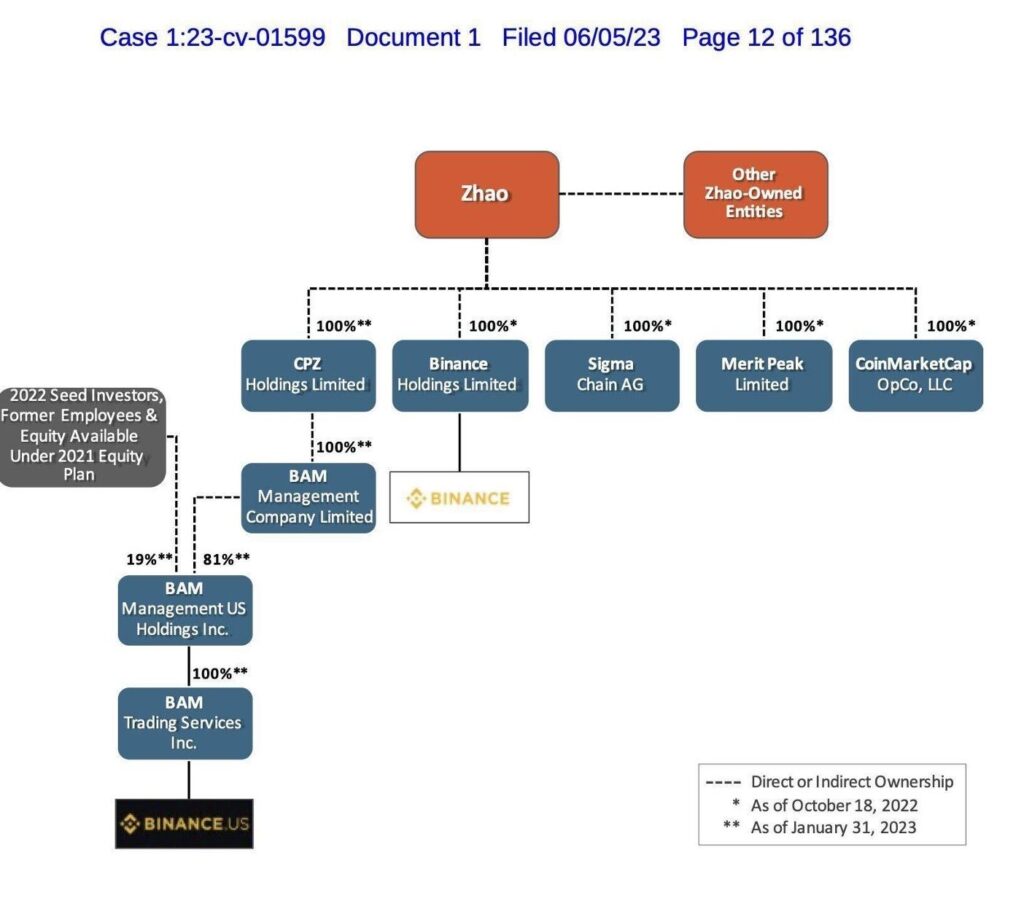

• Binance is facing a civil lawsuit launched by the US securities regulator: The SEC filed 13 charges against the world’s largest crypto exchange, shrinking crypto’s market cap by 5% overnight. Starting with the primary claim of operating an unregistered national securities exchange, broker-dealer, and clearing agency, the lawsuit is profound because it alleges that a number of cryptoassets are securities under U.S. law, including BNB, BUSD, SOL, ADA, and MATIC. This could nudge exchanges and other platforms to delist these tokens due to fear of regulatory exposure. The SEC also alleged that Binance offered and sold unregistered securities, focusing on BUSD, BNB, and certain lending and staking-as-a-service programs. Furthermore, the SEC alleged that Binance engaged in the commingling of billions in customer funds through entities controlled by the exchange’s CEO Champeng Zhao.

• Commingling of assets: According to the 136-page filing, Binance used the accounts of two Zhao-controlled entities, Merit Peak and Sigma Chain, to transfer tens of billions of dollars involving Binance and related entities. In 2021, at least $145 million was transferred from BAM Trading to a Sigma Chain account, and another $45 million of funds were transferred from BAM Trading’s Trust Company B account to the Sigma Chain account. From this account, Sigma Chain spent $11 million to purchase a yacht, as written in the filing. Since the launch of Binance.US, Merit Peak’s U.S. bank account allegedly received, as a “pass-through” account, over $20 billion that included customer funds from both Binance platforms, the U.S. and the global. Merit Peak then transferred the vast majority of those funds to Trust Company A in transfers that appear to relate to the purchase of BUSD. As Merit Peak was a purportedly independent entity, sending Binance customer funds to Merit Peak may have placed those funds at risk, including loss or theft, and was done without notice to customers.

Figure 2: Web of CZ-controlled Entities

Source: SEC’s Court Filing

• Misrepresenting trading controls: The lawsuit alleges that Binance failed to implement the manipulative trading controls that the exchange claims to have in place. The SEC alleges that the controls were virtually non-existent, and those that did exist did not monitor for or protect against “wash trading” or self-dealing, which was happening on Binance.US. The regulator gave new evidence that Sigma Chain engaged in wash trading from at least September 2019 until June 2022, which in turn artificially inflated the trading volume on the U.S. platform.

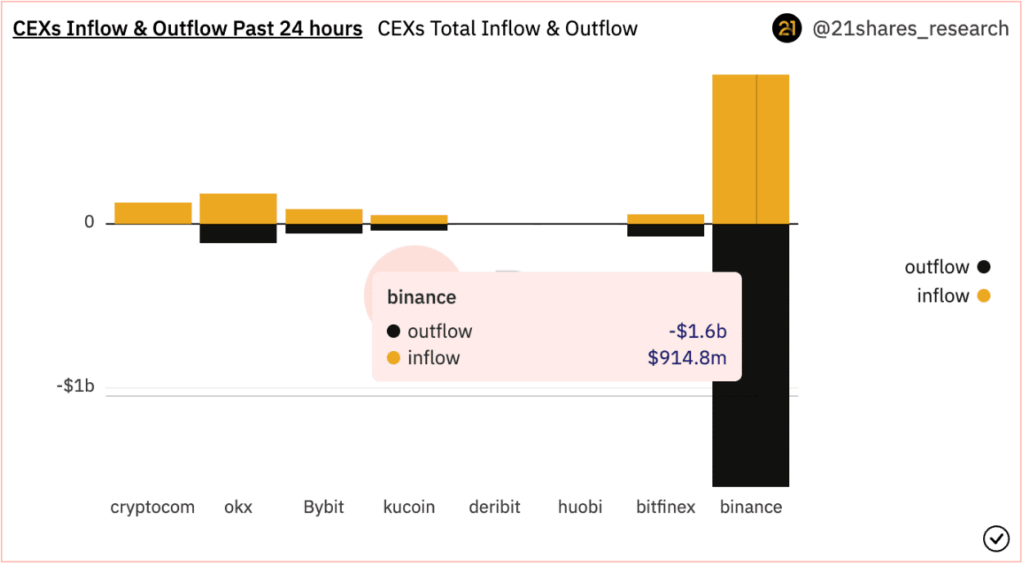

• Over a billion outflows overnight on Binance:

Figure 3: CEXs Inflows and Outflows (24 hours)

Source: 21shares on Dune Analytics

• Binance released a statement expressing their disappointment in the SEC while vowing to continue collaborating with regulators to reach clarity: The exchange took to its blog shortly after the lawsuit broke the news, claiming that the SEC refused to productively engage, even after their recent extensive good-faith discussions to reach a negotiated settlement to resolve their investigations. Binance also denied the allegations of fraud and market manipulation as well as the commingling of user funds through Zhao-controlled entities, which Binance has previously refuted as only being used to facilitate user purchases.

What You Should Pay Attention To

Regarding non-custodial exchanges, we could expect the delisting of specific tokens from Uniswap, akin to how tokenized stock shares were removed in response to the regulatory pressure back in 2021 from the front-end interface, to maintain regulatory conformity. Important to note that delisted assets are still accessible via interacting with the underlying smart contract, which is immutable and uncensorable.

On the other hand, liquidity could improve across the non-custodial infrastructure as users and liquidity providers will opt to utilize their capital using decentralized exchanges that retain ownership of their assets. The gradual migration away from centralized entities began back in November after the collapse of FTX, and thus, the current events should continue to accelerate the trend. In the event that altcoins are officially classified as securities, it is anticipated that the long tail of crypto assets may experience tighter market conditions and reduced liquidity. Prominent market makers like Jane Street and Jump Crypto will likely continue scaling back their operations in the United States until greater clarity regarding the classification of crypto assets is established.

In addition, the SEC isn’t the only agency targeting Binance. Thus it’ll be imperative to watch the developing allegations that the CFTC and the US Department of Justice (DOJ) have put forward against the exchange.

Next Week’s Calendar

These are the top 3 events we’re monitoring for next week.

• CPI print next week will determine whether the FED will pause the next rate hike, especially after the blowout jobs report data sent mixed signals to economists across the board.

• Apple’s WorldWide Developers Conference: Apple’s recently unveiled VR headset could revive interest in metaverse-related tokens during its conference, running from June 5th to the 9th

• Replacing ETH reserves with LSDs: The DeFi industry is witnessing a trend of incorporating Liquid Staking Derivatives (LSD) as reserves, replacing ETH. Maker and Aave have already taken steps in this direction. Liquid staking protocols enable users to earn staking yield without locking their assets, with the added benefit of near-instant redemption as withdrawals become available. Thus, we expect more DeFi blue chips to begin accepting a broader range of LSDs as collateral.

Source: Forex Factory, CoinMarketCal

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

Primer: Injective, infrastructure for global finance

-

Bitcoin is resilient despite the Middle East war

-

Svenska investerare — 21Shares Nasdaq Stockholm-sortiment har just blivit starkare

-

UK looking to lift the retail ban on crypto ETPs

-

21Shares noterarar fem nya krypto-ETPer Nasdaq Stockholm

-

Bitcoin ETFs are cheaper than crypto stocks. Here’s why

De senaste månaderna har det varit större förändringar på denna lista än normalt. Under juni 2025 förändrades listan på de mest eftersökta ETFerna åter kraftigt, vilket numera är ganska normalt. Denna månad var det hetaste investeringstemat i månadsutdelande ETFer . Vi noterar är att Montrose befäster sin position som den populäraste ETFen på Etfmarknaden.se samtidigt som listan är mer koncentrerad än tidigare.

Det går att handla andelar i dessa ETFer genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Månadsutdelande fonder tilldrar sig stort intresse

Den 6 november förra året, bara dagar efter att vi publicerat en artikel om månadsutdelande fonder, lanserade JP Morgan en helt ny variant av en månadsutdelande fond. JPMorgan US Equity Premium Income Active UCITS ETF USD (dist) (JEIP ETF) med ISIN IE000U5MJOZ6, är en aktivt förvaltad ETF.

Den börshandlade fonden investerar i företag från USA. Ytterligare intäkter söks genom användning av en överlagringsstrategi med derivatinstrument. Denna ETF strävar efter att generera en högre avkastning än S&P 500-index.

Detta ledde till att vi fick uppdatera vår artikel om månadsutdelande fonder med JEIP men också med JPMorgan Nasdaq Equity Premium Income Active UCITS ETF USD (dist) (JEQP ETF) med ISIN IE000U9J8HX9, som är en aktivt förvaltad ETF, men som mäter sig mot Nasdaq-100 istället.

Under den sista veckan i februari 2025 noterade Montrose den första svenska ETFen på fem år. MONTDIV ETF är Sveriges första månadsutdelande ETF och rusade snabbt på listan efter de mest eftersökta börshandlade fonderna på vår sida. Det finns emellertid en hel del andra ETFer som ger utdelning varje månad. Vi uppdaterar löpande denna artikel.

När kommer utdelningen från MONTDIV?

Som nämnts så är MONTDIV den allra populäraste börshandlade fonden på vår sida. Tillsammans med sin syster ETF, MONTLEV, är de även populära på andra håll. Fram till idag har MONTDIV lockat närmare 300 miljoner kronor och seglat upp som den tredje mest ägda i Sverige. Dessutom stod Montroses två ETFer för vart fjärde ETF-avslut på Stockholmsbörsen (ex. Bull/Bear-produkter) under perioden mars-april 2025. Det ser vi som ett kvitto på att det finns en stor efterfrågan på börshandlade fonder.

ETP, ETF, ETC, ETN, ETI

Många är osäkra på terminologin när det gäller börshandlade produkter och vi ser dels hur de söker – och hittar många av de informativa artiklar som vi skrivit på Etfmarknaden.se, men också vår ordlista som förklarar det mesta som kan verkar förvirrande. En av våra äldre artiklar, Vad är vad? ETP, ETF, ETC, ETN och ETI från september 2012, har nu helt plötsligt dykt upp som en av de mer lästa artiklarna.

Fortsatt intresse för försvarsfonderna

Vilken ETF för försvarsindustrin är bäst och hur investerar man i denna sektor med hjälp av börshandlade fonder? I dag finns det flera ETFer som ger exponering mot flyg och försvar som följer tre olika index. De årliga förvaltningskostnaderna ligger 0,35 och 0,55 procent. Vi har skrivit en artikel om olika försvarsfonder. Du hittar mer om ETFer för försvarsindustrin här.

Utöver detta har samtliga de större aktörerna lanserat en en börshandlad fond för den europeiska försvarsindustrin vilka alla blirvit stora succcéer.

Inte längre populärast av dem alla

XACT Norden Högutdelande är utan tvekan en av de mest populära av alla de ETFer som vi har skrivit om på vår sida. Den kvartalsvisa utdelningen och dess satsning på aktier med en låg volatilitet och hög direktavkastning gör det till en populär fond som återfinns i mångas depåer. Nyligen lämnades årets andra utdelning från denna börshandlade fond.

Hur högt kommer vi när du Googlar på ordet ETF?

Under maj 2025 såg vi många sökningar på begreppen ETF, börshandlad fond och Etfmarknaden. Om det var vår egen sida eller om det var den totala marknaden för ETFer som besökarna sökte på vet vi inte, men efter att ha fått mail från en av de större emittenterna vet vi att de försöker kartlägga de svenska placerarnas exponering mot börshandlade fonder.

Om du söker på ordet ETF på Google, hur högt hamnar vi då?

Investerna söker information om försvarsfonder med fokus på Europa

Wisdomtree har under året lanserat en försvarsfond som investerar i europeiska företag, vilket även HANetf har gjort, kortnamnet är ARMY i London och 8RMY på tyska Xetra.

Populariteten för europeiska försvarsbörshandlade fonder (ETF:er) har ökat kraftigt på senare tid, drivet av betydande inflöden som återspeglar ett växande investerarintresse för sektorn. Dessa imponerande inflöden understryker det ökande erkännandet av försvarssektorns tillväxtpotential mot bakgrund av den nuvarande geopolitiska dynamiken.

SAVRs ETF-satsning skapar stort intresse

SAVR har precis valt att lansera handel med börshandlande fonder. SAVR som tidigare varit kände för att erbjuda handel med traditionella fonder har nyligen valt att lansera handel med aktier, men också med ETFer på framför allt tyska Xetra. På denna marknad erbjuder nu SAVR med flera ETFer än vad både Nordnet och Avanza gör.

Samtidigt har SAVR valt att lansera en egen produkt tillsammans med amerikanska Vanguard, SAVR Global by Vanguard.

Halalfonder är nu hetare än ESG

Tidigare var det många som sökte på begreppet ESG, men detta sökord har fallit från listan under de senaste månaderna. En variant av ESG-fond är de fonder som har en islamistisk inriktning, så kallade halalfonder, och det är fortfarande något som våra besökare letar information om. En sådan fond är ASWE, som är en aktivt förvaltad shariafond men till exempel HSBC har en serie fonder med fokus på att investera enligt islam. Det är ingen speciell enskild fond som sticker ut och lockar mer än andra.

Går det att handla ETFer hos Swedbank?

Swedbank ETF tror vi kan tolkas att det endera finns intresse för att veta om Swedbank har ETFer i sitt utbud, eller om det går att handla börshandlade fonder på Swedbank. Svaret på denna fråga återfinns här.

Räntesänkningar ökar intresset för fastigheter

Ett annat begrepp på listan är ETF fastigheter. Allt fler investerare tror att vi kommer att få se ytterligare räntesänkningar, inte bara i Sverige och Europa, men även i USA. Lägre räntor gör det enklare att räkna hem en investering i fastigheter. Kan det vara så att våra besökare undersöker möjligheterna att positionera sig i en ETF för fastigheter innan räntorna sänks för att de tror att det kommer att leda till en uppvärdering av fastighetsbolagen? Vill du ha några idéer så skrev vi en text om börshandlade fonder som investerar i fastigheter.

Du kan även läsa den text vi skrev i januari 2025 som heter 10 ETFer för att investera i fastigheter.

Är det värt att satsa på tyska aktier?

Många söker information om tyska aktier och tyska fonder. I mars publicerade vi en text som hette De bästa börshandlade fonderna för tyska utdelningsaktier. Kan det vara denna som lockar?

En investering i tyska utdelningsaktier, i alla fall sådana med hög utdelning anses av många vara en solid investering. Utdelning betalas vanligtvis av lönsamma och etablerade företag. För investerare som söker regelbunden inkomst i tider med låga räntor kan tyska utdelningsaktier ge attraktiv avkastning.

Det finns två huvudindex tillgängliga för att investera med ETFer i tyska högutdelningsaktier. Denna investeringsguide för tyska utdelningsaktier hjälper dig att navigera mellan särdragen hos DivDAX®-index och DAXplus® Maximum Dividend-index samt de börshandlade fonder som spårar dem. Det gör att du kan hitta de mest lämpliga ETFerna för dig genom att rangordna dem enligt dina preferenser.

Amerikanska large caps är något många vill veta mer om

Fonder som följer S&P 500 är, föga förvånande, en typ av fonder som det finns stort intresse kring. Det är ingen speciell enskild fond som sticker ut och lockar mer än andra. Det skall emellertid noteras att många sökningar sker på ord som ”Fond som följer S&P500 Avanza”. Vi skrev tidigare en artikel om S&P500 fonder, 26 börshandlade fonder som spårar S&P500 där vi jämförde alla de ETFer som spårar detta index i sin grundform.

BNP lanserade en europeisk försvarsfond i maj

BNP Paribas Asset Management (’BNPP AM’) tillkännagav idag noteringen av sin BNP Paribas Easy Bloomberg Europe Defense ETF på Euronext Paris, snart tillgänglig på Deutsche Börse Xetra, Borsa Italiana och SIX Swiss Exchange. Den handlas under kortnamnet BJL8 på tyska Xetra.

Investera i Polen med börshandlade fonder

I början av april skrev vi en text som sammanfattade att Investera i Polen med börshandlade fonder. Det tog en liten tid, men den har dykt upp på listan bland de mest populära fonderna.

I slutet av samma månad meddelade SAVR att företaget nu erbjuder handel på mer än 700 polska aktier.

Du kan handla Ripple med olika börshandlade produkter

Valour Ripple (XRP) SEK är en börshandlad produkt som spårar priset på XRP, Ripples infödda token. XRP förbättrar främst globala finansiella överföringar och utbyte av flera valutor. Snabb och miljövänlig, den digitala tillgången XRP designades för att fungera som den mest effektiva kryptovalutan för olika applikationer inom finanssektorn.

Valour Ripple (XRP) SEK ETP (ISIN: CH1161139584) är en börshandlad produkt som spårar priset på XRP, Ripples infödda token.

XRP har ett börsvärde på 29,57 miljarder USD och rankas på en sjätte plats bland alla kryptovalutor globalt. Ripple XRP är en nyckelspelare inom det digitala valutaområdet, känd för sin användning för att underlätta snabba och billiga internationella pengaöverföringar. XRP fungerar på RippleNet och fungerar som en bryggvaluta i Ripples betalningsnätverk, vilket möjliggör sömlösa valutaväxlingar över hela världen. Detta har positionerat XRP som ett föredraget val för finansiella institutioner som söker effektiva alternativ till traditionella gränsöverskridande betalningsmetoder.

Är du nyfiken på vilka börshandlade produkter det finns för att investera i XRP? Vi har självklart skrivit en artikel om detta där vi jämför alla de börshandlade alternativ vi hittat.

BlackRock lanserar europeisk försvars-ETF för europeiska investerare

’I slutet av maj lanserade BlackRock iShares Europe Defence UCITS ETF (DFEU), en europeisk försvars-ETF för europeiska investerare, som följer STOXX Europe Targeted Defence Index. Fonden är utformad för att ge exakt exponering mot europeiska försvarsföretag genom ett intäktsbaserat urval i en tid då europeiska nationer ökar de offentliga utgifterna för att förbättra sin försvarskapacitet.

Det går att handla börshandlade fonder hos Nordea

Nordea har en plattform, och i denna handelstjänst erbjuder denna bank tusentals olika ETFer. Det går att handla ETFer med fokus på räntemarknaden, aktiemarknaden, landspecifika ETFer och börshandlade fonder med fokus på olika branscher. Att handla ETFer hos Nordea sker endera i Nordea Investor och nätbanken.

Månadsutdelande fond med fokus på Europa

Global X EURO STOXX 50 Covered Call UCITS ETF EUR Distributing (SY7D ETF) med ISIN IE000SAXJ1M1, syftar till att följa EURO STOXX 50 Covered Call ATM-indexet. EURO STOXX 50 Covered Call ATM-indexet följer utvecklingen av en täckt köpoption på EURO STOXX 50-indexet. En täckt köpoption kombinerar en lång position i en tillgång med försäljning av köpoptioner på denna tillgång.

Dyrare kaffe skapar intresse för börshandlade produkter

Det stigande kaffepriset (som du kan följa här) har lett till ett ökat intresse bland investerarna för att köpa en ETF som spårar kaffepriset. Det finns emellertid ingen ETF som spårar kaffepriset, då Eus regler kräver att det finns minst 16 olika komponenter i en ETF. Det finns emellertid ett par ETCer som gör samma sak, till exempel WisdomTree Coffee (OD7B ETC).

Investera i platina med börshandlade produkter

När en investerare har bestämt sig för vilken eller vilka metaller de vill köpa kvarstår frågan om ”hur investera i platina”. Det finns flera investeringsprodukter tillgängliga för potentiella platinaägare. I artikeln utforskar vi några av de vanligaste metoderna, och tittar på några av deras fördelar och nackdelar, för att hjälpa dig att fatta det beslut som bäst passar dina investeringsbehov och ambitioner.

Världens största fond

VOO är nu världens största börshandlade fond. Fredagen den 14 februari 2025 (Alla hjärtans dag), sista arbetsdagen före Presidents Day, firandet av George Washingtons födelsedag, kommer verkligen att komma ihåg som dagen VOO kunde överträffa SPYs enorma AUM (631,9 miljarder USD respektive 630,4 miljarder USD).

SPY, som lanserades 1993 och förvaltas av State Street SPDR ETFer, är fortfarande den överlägset mest likvida ETFen i världen och den första ETF som är tillgänglig för amerikanska investerare.

Introducerad 2010 och förvaltad av Vanguard, är VOO nu den största ETF i världen.

Indien är en marknad som många söker information om

ETF Indien är inte en specifik börshandlad fond, men förekommer i en mängd olika varianter. Det finns tydligen ett stort intresse för att investera i indiska aktier bland sidan besökare, och då är kanske en ETF ett bra sätt att göra det. Vi skrev under i början av året en artikel om olika Indienfonder. Sedan dess har det dykt upp ytterligare ett par ETFer med fokus på Indien så vi har uppdaterat artikeln.

Virtune attraherar åter intresse från spararna

I maj 2025 lanserade denna svenska förvaltare en ny produkt, Virtune Bitcoin Prime ETP är en fysiskt backad börshandlad produkt (ETP) designad för att erbjuda investerare ett säkert och kostnadseffektivt sätt att få exponering mot Bitcoin (BTC).

En bred satsning på råvarumarknaden

Fler och fler läsare söker information om råvarufonder. En av ETF som fått många sökningar är L&G Multi Strategy Enhanced Commodities UCITS ETF (EN4C ETF) syftar till att spåra resultatet för Barclays Backwardation Tilt Multi-Strategy Capped Total Return Index (”Indexet”).

Normalt sett är det samma fonder och börshandlade produkter som de nordiska investerarna söker på. Av den anledningen är det extra roligt att se att nya produkter hamnar bland de mest sökta. I detta fall är det Torbjörn Iwarsons råvarufond som lockar ett stort intresse. Det är Nordens enda riktiga råvarufond. Notera att just nu är råvarumarknaden är litet nedtryckt, så det är ett bra tillfälle att komma in billigt. Läs mer om Centaur Commodity Fund på deras hemsida.

WINC ETF en aktiv satsning på att skapa inkomster

iShares World Equity High Income UCITS ETF USD (Dist) (WINC ETF), med ISIN IE000KJPDY61, är en aktivt förvaltad ETF som investerar i företag från utvecklade marknader över hela världen. Titelurvalet baseras på kvantitativa (matematiska eller statistiska) prognosmodeller och ESG-kriterier. Dessutom syftar ETFen till att generera ytterligare intäkter genom att sälja köpoptioner och köpa terminer på utvecklade marknader med stora och medelstora index.

Nyheter

C9DY ETF investerar i företag med ett positivt bidrag till FNs hållbarhetsmål

Publicerad

6 timmar sedanden

30 juni, 2025

UmweltBank UCITS ETF – Global SDG Focus (C9DY ETF) med ISIN LU2679277744, strävar efter att spåra Solactive UmweltBank Global Investable Universe SDG PAB-index. Solactive UmweltBank Global Investable Universe SDG PAB-index spårar aktier från utvecklade och tillväxtländer över hela världen. Indexet syftar till att välja ut företag med ett positivt bidrag till FNs 17 Sustainable Development Goals (SDG). Aktierna som ingår filtreras enligt ESG-kriterier (miljö, social och bolagsstyrning). Dessutom beaktas EUs direktiv om klimatskydd.

ETF:s TER (total cost ratio) uppgår till 0,80 % p.a. UmweltBank UCITS ETF – Global SDG Focus är den enda ETF som följer Solactive UmweltBank Global Investable Universe SDG PAB-index. ETFen replikerar det underliggande indexets prestanda genom samplingsteknik (köper ett urval av de mest relevanta indexbeståndsdelarna). Utdelningarna i ETFen ackumuleras och återinvesteras.

UmweltBank UCITS ETF – Global SDG Focus är en mycket liten ETF med 13 miljoner euro under förvaltning. Denna ETF lanserades den 1 juli 2024 och har sin hemvist i Luxemburg.

Handla C9DY ETF

UmweltBank UCITS ETF – Global SDG Focus (C9DY ETF) är en europeisk börshandlad fond. Denna fond handlas på Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| XETRA | EUR | C9DY |

VanEck Quantum Computing UCITS ETF A (QUTM ETF) med ISIN IE0007Y8Y157, syftar till att följa MarketVector Global Quantum Leaders-indexet. MarketVector Global Quantum Leaders-indexet följer företag världen över som är aktiva inom kvantberäkning.

Den börshandlade fondens totala kostnadskvot (TER) uppgår till 0,55 % per år. VanEck Quantum Computing UCITS ETF A är den enda ETFen som följer MarketVector Global Quantum Leaders-indexet. ETFen replikerar det underliggande indexets resultat genom fullständig replikering (genom att köpa alla indexkomponenter). Utdelningarna i ETFen ackumuleras och återinvesteras.

Den börshandlade fondens lanserades den 21 maj 2025 och har sitt säte i Irland.

Kvantberäkning övergår från teori till verklighet och lovar att omdefiniera vad som är beräkningsmässigt möjligt. Som Europas första fångar VanEck Quantum Computing UCITS ETF potentialen hos en av vår tids mest transformerande teknologier. Medan tidiga användningsfall framträder, är kommersiell framgång fortfarande osäker, och finansiell exponering kan sträcka sig bortom renodlade kvantberäkningsföretag.

- Tidig, diversifierad tillgång till en potentiell banbrytande teknologi

- Exponering mot företag som driver forskning, utveckling och tillämpning av kvantberäkning

- Inkluderar nya framväxande renodlade innovatörer och globala teknikledare med verifierat starkt patentägande

Huvudsakliga riskfaktorer: Likviditetsrisk, koncentrationsrisk, risk att investera i mindre företag. Investerare måste beakta alla fondens egenskaper eller mål som beskrivs i prospektet eller relaterade dokument innan de fattar ett investeringsbeslut. Se KID och prospektet för annan viktig information innan du investerar. Marknadsutveckling garanteras inte.

Underliggande index

MarketVector™ Global Quantum Leaders Total Return Net Index (MVQTMLTR)

Handla QUTM ETF

VanEck Quantum Computing UCITS ETF A (QUTM ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

Största innehav

| Värdepapper | Ticker | Vikt % |

| Ionq Inc | IONQ US | 13,45 |

| D-Wave Quantum Inc | QBTS US | 10,01 |

| Rigetti Computing Inc | RGTI US | 8,13 |

| Boeing Co/The | BA US | 3,86 |

| Microsoft Corp | MSFT US | 3,66 |

| Synopsys Inc | SNPS US | 3,63 |

| Sony Group Corp | 6758 JP | 3,40 |

| Bank Of America Corp | BAC US | 3,38 |

| Honeywell International | HON US | 3,36 |

| Hitachi Ltd | 6501 JP | 3,35 |

| Wells Fargo & Co | WFC US | 3,28 |

| Deutsche Telekom Ag | DTE GR | 3,26 |

Innehav kan komma att förändras

Hetaste investeringstemat i juni 2025

C9DY ETF investerar i företag med ett positivt bidrag till FNs hållbarhetsmål

QUTM ETF Europas första fond för Quantumdatorer

De bästa ETFerna med fokus på momentum

USAH ETF investerar i amerikanska företagsobligationer och hedgar dem till euro

De bästa ETFer som investerar i europeiska utdelningsaktier

YieldMax® lanserar sin andra produkt för europeiska investerare

Nya börshandlade produkter på Xetra

3EDS ETN ger tre gånger den negativa avkastningen på flyg- och försvarsindustrin

Big News for Nuclear Energy—What It Means for Investors

Populära

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanDe bästa ETFer som investerar i europeiska utdelningsaktier

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanYieldMax® lanserar sin andra produkt för europeiska investerare

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNya börshandlade produkter på Xetra

-

Nyheter2 veckor sedan

Nyheter2 veckor sedan3EDS ETN ger tre gånger den negativa avkastningen på flyg- och försvarsindustrin

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBig News for Nuclear Energy—What It Means for Investors

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanNordea Asset Management lanserar nya ETFer på Xetra

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanHANetfs VD Hector McNeil kommenterar FCAs kryptonyheter

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanJPM noterar nya ETFer på Xetra och Börse Frankfurt