Nyheter

Regulatory Crackdowns and Ethereum’s Most Anticipated Application

Publicerad

2 veckor sedanden

• Regulatory Crackdowns Fire Up in April

• Macro Uncertainty, Geopolitical Headwinds, and Bitcoin’s Fourth Halving

• The Arrival of Ethereum’s Most Anticipated Application

Macro Uncertainty, Geopolitical Headwinds, and Bitcoin’s Fourth Halving

April brought a challenging landscape for Bitcoin. Geopolitical tensions flared in the Middle East when Israel targeted the Iranian Consulate in Syria on the 1st of April. In an unprecedented response, Iran retaliated directly with a drone strike against Israel, intensifying hostilities. The event contributed to a decline in the stock market and a temporary pullback in Bitcoin’s price. As mentioned two weeks ago, although Bitcoin historically served as a safe haven during crises like the Russian Invasion of Ukraine, its response to Iran-Israeli escalation may have been adverse.

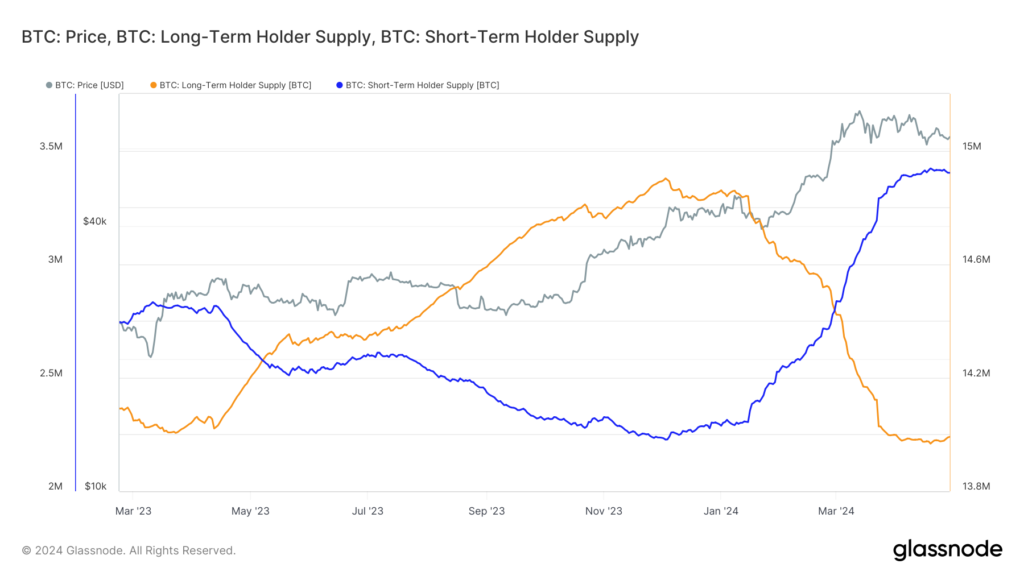

However, a closer look at the market reveals a more nuanced picture. The impact on Bitcoin was primarily felt in the futures market, where open interest peaked at $35 billion on the day of the Consumer Price Index (CPI) print, leading to significant liquidations when inflation came in hotter than expected for the fourth month running. Resilience in the labor market, coupled with strong domestic demand, is evidence that despite Fed efforts, the US is not yet in a position for rate cuts, which may pose further turbulence for risk-on assets. Encouragingly, long-term holders demonstrated resilience amidst escalating tensions. Unlike short-term fears reflected in futures markets, long-term holders increased their supply by 0.1% over the past week, for the first time since January, as the Israeli response seemingly coincided with a local bottom for long-term holder supply. This is a bullish signal, showcasing belief in the asset, irrespective of recent market activity. Nevertheless, we can see that BTC will continue to be stuck in the $60K – $70K range until we get more clarity on the macroeconomic and geopolitical front.

Figure 1: Bitcoin Short-Term Holder Supply vs. Long-Term Holder Supply

Source: Glassnode

Despite the macroeconomic headwinds, significant progress was made in the institutional adoption of Bitcoin. Despite a break in Blackrock’s Bitcoin ETF 71-day net inflow streak, the conclusion of the 90-day due diligence period for fund managers considering the spot ETFs revealed that over 100 institutions, such as BNY Mellon and Banco do Brazil, are exposed to Bitcoin. Morgan Stanley is also actively exploring allowing 15,000 brokers to provide this exposure to their clients. They also filed to broaden access to BTC ETFs by expanding it to 12 more funds, signifying the growing acceptance of Bitcoin by TradFi institutions. Finally, the launch of Bitcoin ETFs in Hong Kong marked a significant step towards adoption in Asia, potentially influencing other jurisdictions like South Korea, Japan, and Singapore to follow suit while expanding Bitcoin’s access to Hong Kong’s $1.15 trillion wealth management sector.

Beyond the market’s activity, April also marked a historic event for Bitcoin: the fourth halving, reducing Bitcoin’s annual inflation rate to below 1%, making it even scarcer than Gold. Historically, Bitcoin trades 50% down from its peak leading up to the halving. This year, Bitcoin defied historical trends, reaching a new all-time high prior to the halving, attributed to the surge in demand from the aforementioned US Bitcoin ETFs, coupled with ongoing technical advancements within the Bitcoin ecosystem, such as Ordinals, BRC-20s, and Runes, as touched upon in the last newsletter.

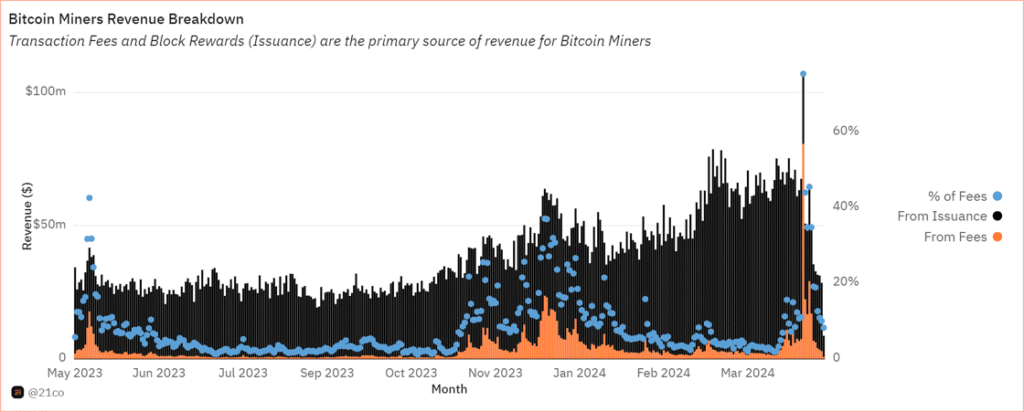

These advancements are transforming Bitcoin beyond its original vision as a purely decentralized payment network. The emergence of Ordinals and Runes has amplified on-chain activity, reflected in surging transaction fees. This is particularly beneficial for Bitcoin miners, who saw their block reward cut in half due to the halving. Higher transaction fees help compensate for this lost revenue, ensuring the continued security of the Bitcoin network. Notably, as shown in Figure 2, Bitcoin transaction fees made up 75% of Bitcoin miner revenue, soaring to $128 on the day of the halving. While the surge might have been driven by the desire to have a historical inscription, it does underscore the potential impact on miners’ revenue as Bitcoin’s on-chain ecosystem matures.

Figure 2: Bitcoin Miners Revenue

Source: 21.co on Dune

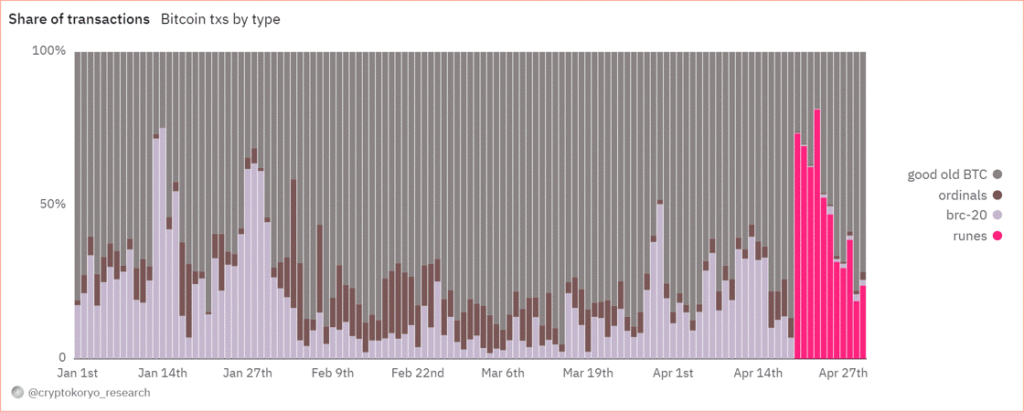

Launched in April, Runes Protocol offers a novel approach to creating fungible tokens on the Bitcoin network. It addresses inefficiencies associated with the BRC-20 standard, which have burdened the Bitcoin blockchain due to its inefficient data handling. Ultimately, Runes presents a key innovation that bolsters Bitcoin’s security budget by offering miners an alternative source of revenue, while reducing their dependence on block rewards. Runes has already rewarded miners with almost $150 million, impressively making up 80% of fees generated on the Bitcoin network on April 23, as shown below.

Figure 3: Share of Bitcoin Transaction Fees

Source: CryptoKoryo on Dune

While Bitcoin’s daily transaction volume surpassed 1 million, rivaling Ethereum’s activity, the initial excitement surrounding Runes might recede before a more long-term, sustainable surge in the network’s DeFi activity. The initial phase often focuses on meme-like tokens attracting rapid but fleeting interest. However, the development of sophisticated DeFi protocols like exchanges and Automated Market Makers (AMMs) will enhance Bitcoin’s application layer, streamlining token trading similar to what ERC-20/ERC-721 standards did for Ethereum. This paves the way for a more robust and mature DeFi ecosystem on Bitcoin, which we will closely monitor in the months to come.

Regulatory Crackdowns Fire Up in April

April saw the continued regulation-by-enforcement trend, cracking down on non-custodial infrastructure and the Ethereum ecosystem. On April 10, the Securities and Exchange Commission (SEC) sent Wells Notices to Uniswap and Consensys for alleged violation of federal securities law. Uniswap announced its intention to resolve this through court. The details of the SEC’s Wells Notice remain unclear. However, it could have been triggered by Uniswap’s pending revenue-sharing initiative, which has had a domino effect on the ecosystem. In the short term, the crackdown could dissuade protocols from following suit, which would have incentivized their users to stake and delegate their tokens for a share of the revenue.

On April 25, Consensys filed a lawsuit against the SEC for “unlawful seizure of authority,” arguing that Ethereum is not a security nor that MetaMask is a securities broker. The recent crackdown could put a strain on the crypto infrastructure industry in the short term, as it could severely disrupt the ecosystem while encouraging companies to explore alternative jurisdictions aside from the U.S. market.

Earlier in February, the SEC adopted rules that widened its interpretation of a dealer to include “as part of a regular business” in addition to the initial definition, “any person engaged in the business of buying and selling securities . . . for such person’s own account through a broker or otherwise.” The newly adopted rules have now triggered an outcry in the crypto community, deeming the legislation too broad, as it includes average market participants in cryptoasset liquidity pools (liquidity providers), who essentially have a very different role than a broker.

For example, liquidity providers on Uniswap can be anyone, given they have the capital to deposit and earn yield, unlike professional market makers in traditional finance whose responsibilities extend beyond that. Providing liquidity on Uniswap is open to anyone to enable permissionless markets, which makes this an important characterization due to the impact it could have on how DeFi functions in the US. While the ongoing crackdown could cause uncertainty in the short term within the Ethereum ecosystem, regulatory clarity will ultimately be reached in the long run, as we’ve seen on several counts of hurdles over the past few years.

Ethereum’s Most Anticipated Application of the Year is Live

EigenLayer is finally live on Ethereum’s mainnet. It’s a new primitive that allows ETH users to “re-stake” their existing staked ETH to validate the security of external networks. EigenLayer has been eagerly anticipated as it optimizes capital efficiency by allowing users to earn additional yield on top of their native staking rewards. Further, it allows younger protocols to borrow the security assurances of Ethereum, circumventing the need to bootstrap their own security from scratch. This translates to a more cost-efficient approach while simultaneously bolstering their decentralization. Nevertheless, the protocol comes with inherent risks.

By opting to earn additional yield, users, and validators subject themselves to heightened smart contract risks as they become exposed to the vulnerabilities of both Ethereum and the additional protocols relying on its security. Moreover, a large portion of ETH could end up being “re-staked” in EigenLayer instead of just validating the security of Ethereum, creating a problem of misalignment. Simply, some validators might opt to maximize their profits by pursuing strategies that prioritize short-term gains over the long-term security of the network. Additionally, the growing enthusiasm for the protocol suggests that a significant portion of the crypto economy might rely on Ethereum’s security. Currently, 15% of all staked ETH is allocated towards Eigen’s re-staking strategy. The continuation of this trend could lead to centralization, posing a risk as Ethereum might inadvertently become a single point of failure over a longer time horizon.

Wide-spread slashing is another concern. In essence, if a substantial amount of ETH is re-staked in a singular protocol, then a slashing event due to unintended or malicious behavior could significantly impact honest ETH stakers. Thus, Eigen proposed a slashing committee comprising esteemed ETH developers and trusted community members, empowered to veto such occurrences and safeguard Ethereum’s integrity.

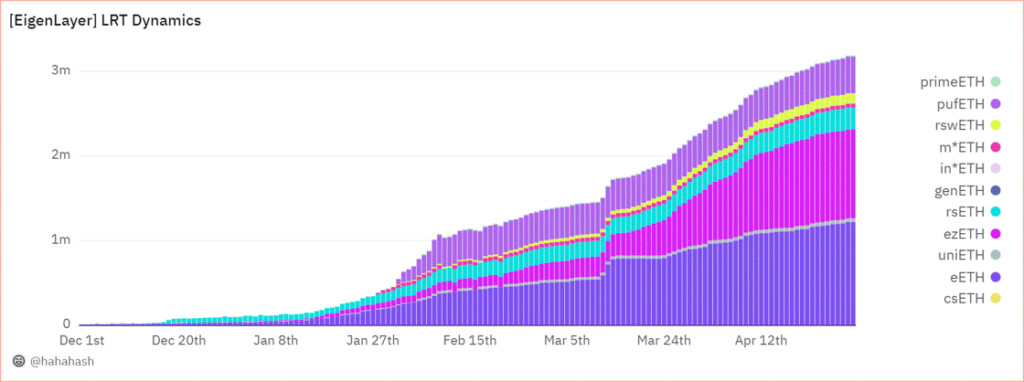

The final risk concerns a new breed of tokens known as Liquid re-staking Tokens (LRTs), which operate atop EigenLayer. LRTs, akin to Liquid Staking Tokens (LSTs) issued by the established Lido Protocol in 2021, aim to unlock similar capital efficiency by allowing users to use their re-staked ETH as collateral for lending and borrowing. Given that re-staked ETH in Eigen can’t be used across DeFi platforms, users have turned to LRT protocols like Ether.fi and Renzo to seek higher levels of capital flexibility, with their re-staked assets. For context, LRTs grew exponentially by a factor of 28 throughout Q1, increasing from nearly 100K units to the current figure of 2.8M, as shown in Figure 4, illustrating its soaring demand.

Figure 4: Growth of Liquid re-staking Tokens (LRTs) on EigenLayer

Source: @hahahash on Dune

While LRTs can offer amplified gains through leveraged lending, they can also exacerbate losses, increasing systemic risk in market downturns. Since some LRT protocols can’t offer withdrawals yet, users may be forced to swap their LRT tokens on thinly traded secondary markets, intensifying their decline. Last week, we saw an instance of this risk manifest when Renzo’s ezETH lost its peg. This happened as the ETH derivative experienced heavy selling on various exchanges, causing it to trade at over a 75% discount compared to ETH. This coincided with the company facing scrutiny over its controversial token distribution plan, which is scheduled to launch on April 30.

All in all, the impact of EigenLayer is not to be understated, as the excitement surrounding the new primitive has propelled it to become the second-largest protocol on Ethereum by Total Value Locked (TVL), boasting an impressive $15.6B. This already eclipses the TVL of established players like Solana by fourfold, highlighting the immense adoption that EigenLayer is witnessing despite its brief existence. Further, the excitement building up to its launch since it unveiled its roadmap in March has propelled the Ethereum validator entry queue to its highest level since October. The queue now necessitates a minimum waiting period of 8 days before new validators can join the network, as seen below in Figure 5. Nevertheless, stay tuned as we prepare to release a more in-depth exploration of EigenLayer risks over the coming weeks.

Figure 5: Ethereum Validator Entry Queue in Days

Source: ValidatorQueue

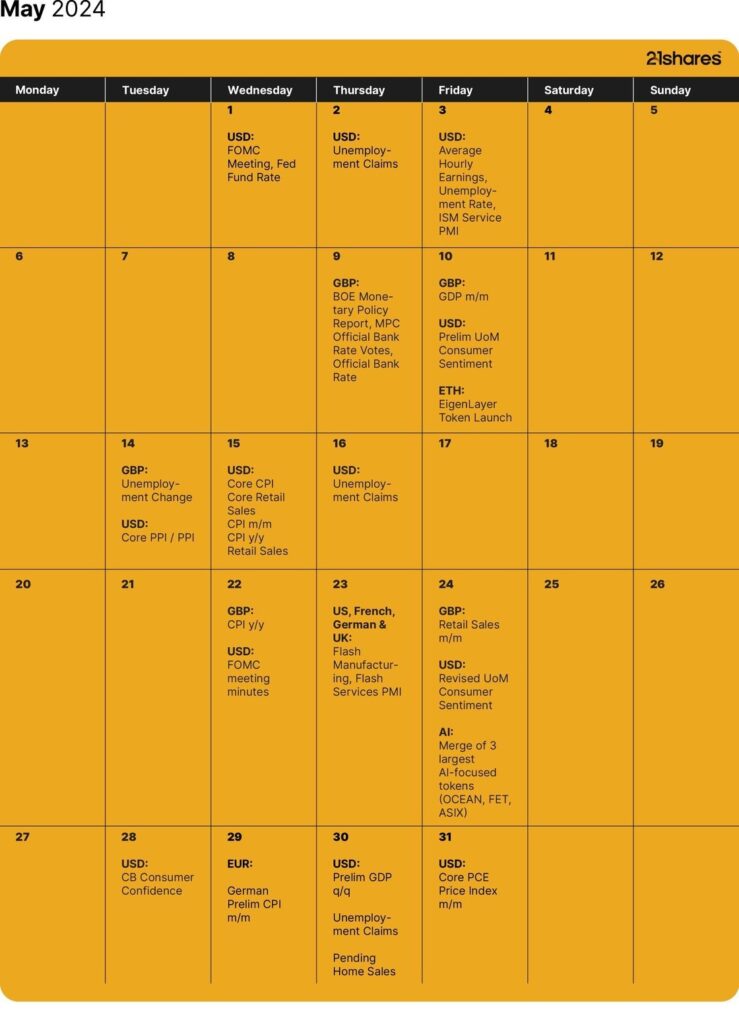

Next Month’s Calendar

Source: Forex Factory, 21Shares

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

Bitcoin Warms up to Climate Goals and Ethereum’s Next Milestone: What Happened in Crypto This Week?

-

Bitcoin’s Volatility and Stablecoin’s Market Viability: What Happened in Crypto This Week?

-

Navigating Macro Headwinds, On-Chain Optics, and The Rise of Runes

-

The Bitcoin Halving and Beyond

-

Geopolitical Conflict on the Rise, while Ethereum Receives its Biggest Boost

-

Bitcoin Shakes off FUD While Solana Gets Help

Nyheter

Bitcoin Warms up to Climate Goals and Ethereum’s Next Milestone: What Happened in Crypto This Week?

Publicerad

2 timmar sedanden

15 maj, 2024

• European Economy Booms while Regulators Consider Adopting Crypto

• Bitcoin’s Growing Fundamentals and Institutionalization

• Ethereum’s Next Leap Forward: A Glimpse at the Upcoming Upgrade

European Economy Booms while Regulators Consider Adopting Crypto

Europe’s economy has exceeded expectations, with Germany’s gross domestic product (GDP) for Q1 2024 increasing by 0.2%, compared to the previous quarter’s reading of -0.5%. Additionally, France, Italy, and Spain are also seeing progress, picking up the bloc’s GDP from -0.1% to 0.3%. This is a good sign that Europe is on the right track away from a recession. Matching the positive outlook, regulators appear receptive to including new alternative assets within the EU’s most established regulatory framework.

Namely, the European Securities and Markets Authority (ESMA) is considering cryptoassets, among other asset classes like commodities and precious metals, in its Undertakings for Collective Investment in Transferable Securities (UCITS). Similar to mutual funds in the U.S., UCITS funds can be registered and sold in any country in the EU using unified regulatory and investor protection requirements. These funds are considered safe, well-regulated investments, hence their €12T market valuation and popularity among pension funds and risk-averse investors.

On May 7, ESMA invited investors and trade associations, among others, for a consultation to assess possible benefits and risks of UCITS gaining exposure to the selected 19 asset classes, having until August 7 to gather input. This is important since UCITS accounts for 75% of all collective retail investments in the EU. Thus, if the conclusions of this consultation are in favor of adopting crypto, it would attract an influx of investors and bring more regulated accessibility to this asset class. Moreover, although still under consultation, ESMA’s deliberation adds more credibility to crypto, considering the regulator’s renowned strict regulatory standards.

Further, the EU’s inflation is inching towards the 2% target, overshooting by only 0.4% in the past month, a level the U.S. is yet to achieve, with March’s inflation hitting 3.5%. Later today, a strong gauge for inflation is coming out, the Producer Price Index (PPI), measuring the change in the price of finished goods and services sold by producers. With the last consumer price index (CPI) disappointing, all eyes are on the CPI print coming out this Wednesday, along with data on retail sales. Although optimism seems to have checked out, a cooled inflation rate would recover investors’ appetite for risk-on assets like crypto, instigating more flows into Bitcoin spot ETFs, which have been especially quiet over the past week, as shown in Figure 1.

Figure 1: US Spot Bitcoin ETFs Flows

Source: Glassnode

Nevertheless, Bitcoin’s narrative has been growing beyond its primary use case as a store of value, with companies and governments alike leveraging Bitcoin mining to reduce their negative impact on the environment, ironically something Bitcoin is often scrutinized for.

Bitcoin’s Growing Fundamentals and Institutionalization

On May 7, Genesis Digital Assets and Argentina’s state-owned YPF Luz, the country’s largest producer of oil and gas with a ∼40% share in 2021, announced their opening of a Bitcoin mining facility. The data center takes ‘stranded gas,’ a byproduct of oil and gas production that would otherwise be flared and contribute to greenhouse gas emissions, to power the mining operation with the potential to reduce carbon dioxide equivalent emissions by 25-63%. Notably, 50 major oil and gas companies, representing over 40% of global petroleum production, signed the Oil and Gas Decarbonization Charter (OGDC), thereby committing to end gas flaring by 2030. The Argentinian project serves as a prime example of how companies can achieve the goals outlined in the OGDC, an approach likely to be replicated by others potentially using Bitcoin.

Aside from the obvious environmental benefits, projects like these actually strengthen Bitcoin’s network! More miners joining the fray means greater computing power, reflected by the growing hash rate in Figure 2. This results in a more secure network, as 51% attacks become more costly to execute successfully. The development comes at a crucial point in time, calming fears over miners exiting the network to cover costs, a dynamic often witnessed post-halving and one we explored in our Bitcoin Halving Report.

Figure 2 – Bitcoin Growing Hash Rate

Source: 21co on Dune

On a more familiar note, institutions continue to gobble up Bitcoin as an investment opportunity. The recent 13F filings mentioned last week revealed a growing appetite for Bitcoin as investment managers continue to disclose their U.S. equity holdings to the SEC. Quantitative trading firm Susquehanna holds over $1B in Bitcoin ETFs, with Boston-based hedge fund Bracebridge disclosing their $380M position too. Furthermore, in Japan, a weakened yen and government debt reaching 250% of GDP confirms sustained economic pressure, which has led early-stage investment firm Metaplanet to adopt Bitcoin as a strategic reserve. They have acquired over $7M since April, another testament to Bitcoin’s value proposition as a safe haven. The continuous adoption of Bitcoin is no surprise, given the accessibility of Bitcoin ETFs to traditional institutions through a regulated and familiar investment vehicle.

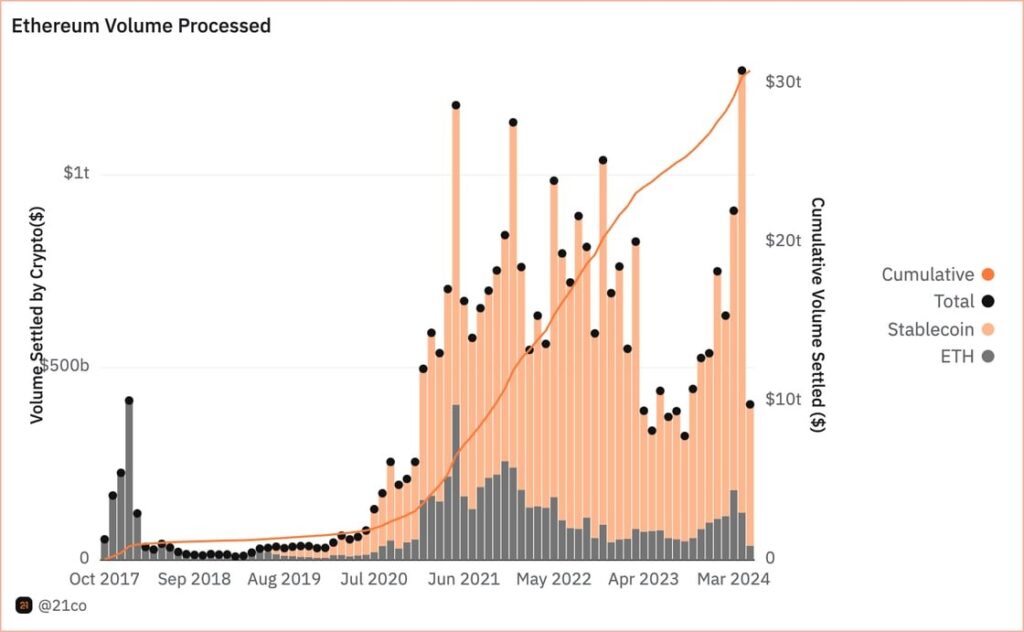

The positive Bitcoin sentiment is amplified by continuous innovation on the network itself. Bitcoin’s prime scaling solution, the Lightning Network, has taken a significant leap forward. By leveraging the Taproot Asset Upgrade, the Lightning Network successfully tested a protocol for issuing stablecoins directly on Bitcoin. This underscores the trend of Bitcoin’s growing use cases following the launch of Runes, which unlocked the ability to launch fungible tokens on Bitcoin. The recent surge in on-chain activity is reminiscent of the ERC-20 explosion in Ethereum’s early days, and stablecoins would truly unlock Bitcoin’s DeFi potential. They facilitate a wide range of transactions, shown below by Ethereum stablecoins amassing $3.8T in 2024 processed volume so far.

Figure 3 – Ethereum Stablecoin Volume

Source: 21co on Dune

While still in the early stages, this development would also significantly boost miner revenue, offering them a much-needed additional income stream through transaction fees, following the halving of block rewards last month. The potential of stablecoins on Bitcoin will be monitored going forward, as they have clear implications for the network’s potential on-chain footprint.

Ethereum’s Next Leap Forward: A Glimpse at the Upcoming Upgrade

More information is finally starting to come out regarding Ethereum’s next major upgrade, slated for late this year or early next year. Known as Pectra, the upgrade promises to introduce a range of enhancements aimed at bolstering the network’s stability and refining user experience. For example, the upgrade will raise the maximum stake per validator from 32 to 2,048 ETH, streamlining the management process for large validators who spread their stake across multiple wallets. Moreover, Pectra will tackle the problem of empty accounts, those with zero assets or funds, by removing them from the network. This action reduces the network’s state size, which effectively leads to lighter transaction processing.

Although the upgrade will incorporate various Ethereum Improvement Proposals (EIPs), one in particular stands out. Referred to as EIP 7702, Vitalik Buterin’s new proposal aims to expand upon the advancements made in Account Abstraction (AA) on Ethereum by refining certain concepts introduced in an earlier proposal, EIP 3074. As a quick recap, AA transforms users’ wallets, externally owned accounts (EOAs), into more sophisticated accounts resembling smart contracts, enhancing security, flexibility, and simplified user management. That said, EIP 7702 addresses some of EIP 3074 criticisms by steering clear of dependencies on EOA-specific functionalities. It aims to establish a versatile system capable of meeting the evolving needs of the Ethereum ecosystem while helping to reduce technical debt for the network

However, EIP 7702 proposes several other enhancements, including batched transactions, which could enhance transaction efficiency and even reduce fees by consolidating multiple user actions. Another exciting feature is the introduction of s sponsored transactions, which allow third-party applications to cover transaction fees for consumers, an ideal solution for onboarding new users. Finally, the upgrade could make users’ accounts resistant to threats from quantum computing. That said, with the proposal’s introduction of a new transaction type enabling EOAs to temporarily transition into smart accounts, concerns arise regarding the heightened risk of malicious actors’ ability to swiftly drain user wallets. Nevertheless, Vitalik’s proposal is intriguing as it charts a more pragmatic course toward realizing the AA vision. This is pivotal because it echoes our thesis at 21Shares that crypto won’t onboard millions of more users without providing them with an intuitive interface resembling the user-friendly experience they are familiar with across Web2.

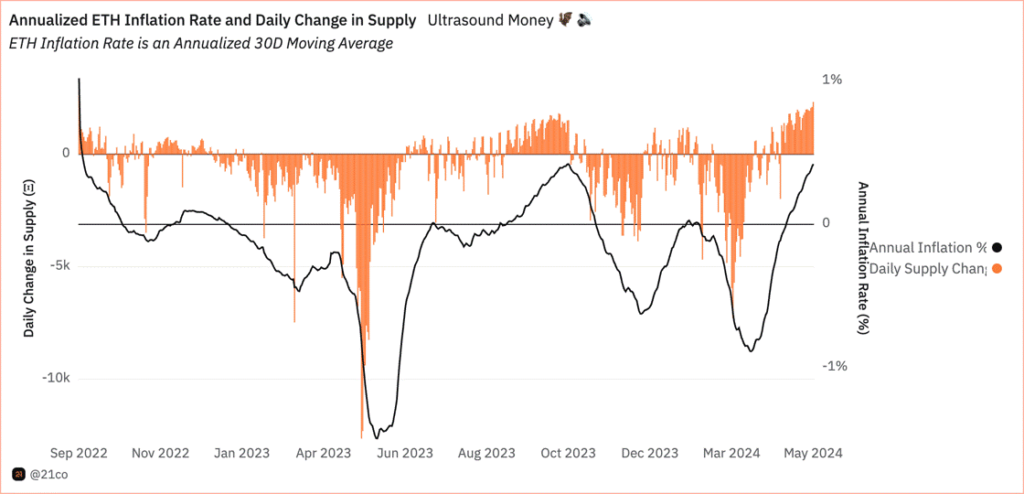

Now, while Ethereum’s long-term prospects remain promising, its status as a deflationary network has come under threat in recent weeks, as seen below in Figure 3. This decline is primarily attributed to decreasing on-chain activity, which peaked at the end of March. Furthermore, the DenCun upgrade, implemented in March, significantly reduced the costs L2s incurred for storing their data on Ethereum by 90%.

Figure 4 – Ethereum’s Inflation

Source: 21co on Dune

It is worth noting that while it is currently more cost-effective for L2s to operate on Ethereum, these reduced costs will eventually onboard a larger user base. This will make it more feasible for applications, especially those requiring a high volume of interactions, to operate within the Ethereum ecosystem, which was previously economically unviable. A pivotal piece of evidence supporting this perspective is Arbitrum’s recent milestone, onboarding approximately 600K daily active users, as depicted in Figure 4. This likely influenced Securitize’s decision to propose deploying Blackrock’s BUIDL on Arbitrum, considering its position as the pioneering L2 platform with such a vibrant user base, alongside being the first L2 to process over $150B in swap volume on Uniswap, putting Arbitrum as the leading Ethereum scaling solution. Nevertheless, readers shouldn’t be wary, as we expect a broader spectrum of applications to arrive at the Ethereum network, helping to fill in the gap for Ethereum’s lost revenue while expanding the universe for what is possible within its ecosystem.

Figure 4 – Daily Active Users of Ethereum’s Leading Solutions

Source: GrowThePie

This Week’s Calendar

Source: Forex Factory, 21Shares

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

CRPA ETF investerar i företagsobligationer och återinvesterar utdelningen

Publicerad

3 timmar sedanden

15 maj, 2024

iShares Global Corporate Bond UCITS ETF USD (Acc) (CRPA ETF) investerar i företagsobligationer med fokus på World. ETF:n innehar hela utbudet av obligationsförfall. De underliggande obligationerna har Investment Grade-betyg. Ränteintäkterna (kupongerna) i fonden återinvesteras (ackumuleras).

Den totala kostnadskvoten uppgår till 0,20 % p.a. Fonden replikerar resultatet för det underliggande indexet genom att köpa ett urval av de mest relevanta indexbeståndsdelarna (samplingsteknik). iShares Global Corporate Bond UCITS ETF USD (Acc) har tillgångar på 116 miljoner GBP under förvaltning. ETF:en är äldre än 3 år och har sin hemvist i Irland.

Varför CRPA?

Diversifierad exponering mot globala företagsobligationer

Direktinvesteringar i företagsobligationer över sektorer (industri, allmännyttiga och finansiella företag)

Obligationsexponering med investeringsgrad

Investeringsmål

Fonden strävar efter att följa utvecklingen av ett index som består av företagsobligationer av investeringsklass från emittenter på tillväxtmarknader och utvecklade marknader.

Investeringsstrategi

Bloomberg Global Aggregate Corporate-index spårar företagsobligationer i amerikanska dollar utgivna av företag över hela världen. Alla löptider ingår. Betyg: Investment Grade.

Handla CRPA ETF

iShares Global Corporate Bond UCITS ETF USD (Acc) (CRPA ETF) är en europeisk börshandlad produkt som handlas på London Stock Exchange.

London Stock Exchange är en marknad som få svenska banker och nätmäklare erbjuder access till, men DEGIRO gör det.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| gettex | EUR | SXRB |

| London Stock Exchange | USD | CRPA |

Största innehav

| Emittent | Vikt (%) |

| BANK OF AMERICA CORP | 1.83 |

| JPMORGAN CHASE & CO | 1.63 |

| GOLDMAN SACHS GROUP INC/THE | 1.29 |

| MORGAN STANLEY | 1.15 |

| CITIGROUP INC | 1.13 |

| WELLS FARGO & COMPANY | 1.12 |

| VERIZON COMMUNICATIONS INC | 0.97 |

| AT&T INC | 0.95 |

| APPLE INC | 0.84 |

| HSBC HOLDINGS PLC | 0.78 |

Innehav kan komma att förändras

Nyheter

Timely and concise insights on Bitcoin & Cryptoasset Markets

Publicerad

4 timmar sedanden

15 maj, 2024

• Growing Mainstream Adoption of Digital Assets: Institutional investors and major asset managers are increasingly incorporating digital assets like Bitcoin into their portfolios, as evidenced by recent filings and the launch of Bitcoin ETFs in the U.S. Despite their current small market share, these investments reflect a broader trend towards mainstream acceptance

• Impact on Portfolio Performance: The inclusion of Bitcoin in portfolio optimizations, using strategies such as Maximum Sharpe Ratio and Risk Parity, has shown to improve the risk-adjusted returns compared to traditional portfolios. Portfolios optimized with Bitcoin not only offer higher returns for the additional risk taken but also present a wider range of efficient risk-return combinations

• Optimal Allocation Recommendations: Empirical studies suggest that even a small allocation to digital assets, specifically between 2% to 3% in broader asset mixes and up to 4% to 6% in more focused digital asset portfolios, significantly enhances portfolio performance without adversely impacting overall risk profiles

Gradually, then suddenly, as they say, digital assets are becoming mainstream.

The biggest asset managers in the world have launched spot Bitcoin ETFs in the US this year and adoption among institutional investors is rising rapidly.

Major financial institutions like Franklin Templeton themselves have just recently disclosed significant investments into Bitcoin ETFs via their latest 13F filings.

Institutional hedge funds that manage money for Ivy League university endowments have disclosed multi-million Dollar holdings. Stanford university’s Blyth Fund has recently disclosed that they hold around 7% allocation in Bitcoin ETFs.

Nonetheless, at the time of writing, US Bitcoin ETFs only account for approximately 0.6% of the overall size of the US ETF market based on data provided by ICI.

In Europe, Bitcoin ETPs also only comprise a tiny fraction of the 11 trn EUR UCITS market of only 0.05%, according to our calculations based on Bloomberg data.

In general, we expect the relative size of digital assets to increase further as even small allocations to digital assets are bound to increase portfolio risk-adjusted returns significantly as demonstrated in our latest deep dive on Bitcoin.

But what is the optimal allocation to Bitcoin and digital assets in general?

What is the optimal allocation to digital assets?

Most empirical portfolio studies usually look at how a classical 60/40 portfolio comprising of 60% allocation in stocks and 40% allocation in bonds responds to a gradual increase in digital asset allocation.

In our previous digital asset study, we did a similar exercise by investigating the effect of increases in digital asset allocation on overall portfolio risk and return metrics.

Since digital assets generally exhibit a higher risk-adjusted return (“Sharpe Ratio”) than other traditional asset classes, a marginal increase in allocation usually leads to an increase in overall portfolio risk-adjusted returns.

However, most institutional asset managers don’t employ a 60/40 portfolio in the first place because of high portfolio volatility and the dominance of the equity allocation for the whole portfolio’s risk-return profile.

In fact, most institutional asset managers in practice allocate based on optimized risk metrics such as portfolio Sharpe Ratio or portfolio volatility which is why we perform a similar exercise here.

In a first step, we looked at optimized multiasset portfolios comprising of global stocks (MSCI World AC), global bonds (Bloomberg Global Aggregate USD-hedged), and commodities (Bloomberg Commodity Index).

More specifically, we optimized these portfolios based on the following approaches:

• Minimum Variance/Volatility

• Maximum Sharpe Ratio

• Equal risk contribution (Risk parity)

The Minimum Variance approach tries to minimize the average portfolio volatility.

The Maximum Sharpe Ratio approach tries to maximize the ratio between average portfolio return (minus a risk-free return) and the corresponding average volatility. The Equal risk contribution or Risk Parity approach varies the respective portfolio weights until every asset has an identical relative contribution to the overall portfolio volatility.

In a second step, we added Bitcoin to the set of potential assets into the optimization. Our period of investigation (July 2010 – May 2024) was constrained by the fact that reliable market prices for Bitcoin only exist since 2010 as it is still a relatively young asset.

Here are the results for the different optimizations. The upper panel excludes Bitcoin while the lower panel includes Bitcoin in the optimization:

Several observations are in order:

Firstly, the minimum variance approach excludes Bitcoin completely since Bitcoin generally exhibits a higher level of volatility than the other assets.

Secondly, the maximum Sharpe Ratio approach excludes commodities in the traditional portfolio but includes Bitcoin in the new portfolio. The Bitcoin allocation is made largely at the expense of the stock allocation.

Lastly, the risk parity approach also includes Bitcoin at the expense of all other asset classes.

Furthermore, a comparison between the historical performances of the traditional portfolios that exclude Bitcoin and those that include Bitcoin reveals that the max Sharpe Ratio and the Risk Parity (ERC) portfolio were able to significantly outperform the Minimum Variance portfolio which didn’t allocate to Bitcoin at all.

It is also important to highlight that the Risk Parity portfolio with Bitcoin even exhibited a smaller maximum drawdown than the Minimum Variance portfolio without Bitcoin. In other words, the increase in portfolio volatility was largely due to an increase in positive upside volatility.

Moreover, investors are over-proportionately rewarded with higher returns for unit of additional risk as the risk-adjusted returns (“Sharpe Ratio”) increase significantly by adding Bitcoin.

The Sharpe Ratios for optimized portfolios with Bitcoin are even significantly higher than for optimized portfolios without Bitcoin.

In fact, by including Bitcoin and digital assets into their portfolio optimization, the universe of potential multiasset portfolios increases vastly.

Asset managers are not only enabled to provide investors with more efficient portfolios, i.e. higher risk-adjusted returns, but also provide investors with a much larger set of risk-return combinations compared to traditional portfolios that only include stocks, bonds, and commodities.

So far so good. What about other digital assets?

We also applied the same portfolio optimization approaches to a basket of the top 20 digital assets based on the MSCI Global Digital Assets Select 20 Capped Index.

–> The optimal % allocation is even higher in case of the Maximum Sharpe Ratio and Risk Parity portfolio optimization.

It is important to note that the period of investigation (November 2019 – May 2024) is much smaller due to the fact that younger digital assets within the top 20 digital assets like Solana or Ethereum have a smaller track record than Bitcoin.

All in all, the abovementioned results imply that even a small allocation to digital assets can have very positive effects on risk-adjusted returns without compromising the risk characteristics of the portfolios.

While highly risk-averse investors should probably avoid digital assets, the optimal allocation based on the Max Sharpe Ratio and Risk Parity approach appears to be between 2% and 3% for the full sample with bitcoin and between 4% and 6% for the smaller sample with a basket of the top 20 digital assets.

The results generally support our previous findings that we presented here.

Most portfolio optimization approaches also include digital assets within the optimal portfolio allocation which demonstrates that any modern portfolio approach that doesn’t include digital assets like Bitcoin is probably sub-optimal.

We recommend that agile asset managers familiarise themselves with this emerging asset class for the benefit of their clients and to remain competitive.

Bottom Line

• Growing Mainstream Adoption of Digital Assets: Institutional investors and major asset managers are increasingly incorporating digital assets like Bitcoin into their portfolios, as evidenced by recent filings and the launch of Bitcoin ETFs in the U.S. Despite their current small market share, these investments reflect a broader trend towards mainstream acceptance

• Impact on Portfolio Performance: The inclusion of Bitcoin in portfolio optimizations, using strategies such as Maximum Sharpe Ratio and Risk Parity, has shown to improve the risk-adjusted returns compared to traditional portfolios. Portfolios optimized with Bitcoin not only offer higher returns for the additional risk taken but also present a wider range of efficient risk-return combinations

• Optimal Allocation Recommendations: Empirical studies suggest that even a small allocation to digital assets, specifically between 2% to 3% in broader asset mixes and up to 4% to 6% in more focused digital asset portfolios, significantly enhances portfolio performance without adversely impacting overall risk profiles

To read our Crypto Market Compass in full, please click the button below:

Bitcoin Warms up to Climate Goals and Ethereum’s Next Milestone: What Happened in Crypto This Week?

CRPA ETF investerar i företagsobligationer och återinvesterar utdelningen

Timely and concise insights on Bitcoin & Cryptoasset Markets

Valour Inc. lanserar världens första avkastningsbärande Bitcoin (BTC) ETP

Virtune lanserar Virtune Staked Cardano ETP på Nasdaq Stockholm

ETFmarknaden i Europa firar sitt 24-årsjubileum med tillgångar på två biljoner USD

Vilken är den bästa fond som följer Nasdaq-100?

De mest populära börshandlade fonderna april 2024

Några av de bästa guldfonderna

Sveriges enda riktiga råvarufond har öppnat

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanETFmarknaden i Europa firar sitt 24-årsjubileum med tillgångar på två biljoner USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanVilken är den bästa fond som följer Nasdaq-100?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanDe mest populära börshandlade fonderna april 2024

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanNågra av de bästa guldfonderna

-

Nyheter3 dagar sedan

Nyheter3 dagar sedanSveriges enda riktiga råvarufond har öppnat

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanEndast en tredjedel av brittiska privatinvesterare har hört talas om ansvarsfulla investeringar eller ESG

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanU.S. Global Investors tar över HANetf Travel

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanNy ETF från UBS ger tillgång till företag på utvecklade marknader med valutasäkring i euro