Nyheter

ETFmarknaden i Europa firar sitt 24-årsjubileum med tillgångar på två biljoner USD

Publicerad

2 veckor sedanden

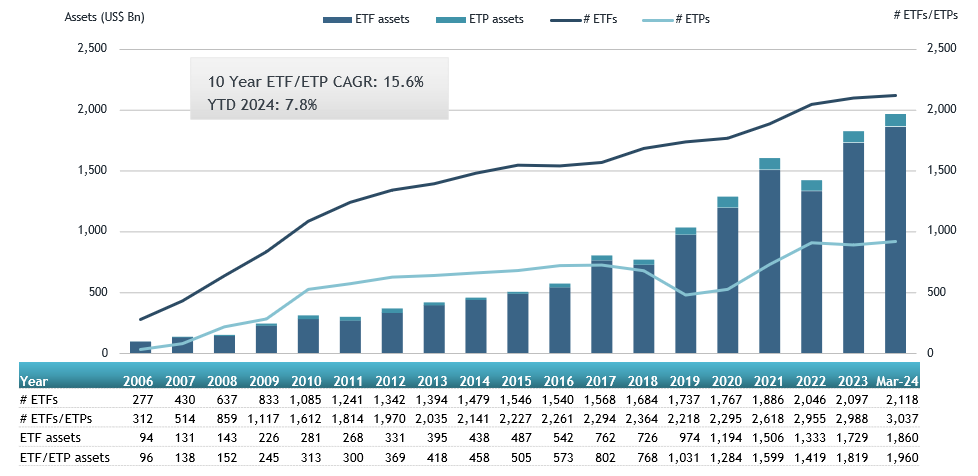

ETFGI, ett ledande oberoende forsknings- och konsultföretag som täcker trender i det globala ETF-ekosystemet, rapporterar att ETFmarknaden i Europa firar sitt 24-årsjubileum med rekordtillgångar på nästan 2 biljoner US-dollar. De första europanoterade ETF:erna gjorde sin debut den 11 april 2000. Dessa två ETFer var baserade på Euro Stoxx 50– och Stoxx Europe 50-indexen, och de var noterade på Deutsche Boerse i Tyskland.

Tillgångar som investerats i ETF-branschen i Europa nådde rekordhöga 1,96 biljoner USD i slutet av mars. Under mars samlade ETF-branschen i Europa nettoinflöden på 11,02 miljarder USD, vilket ger årets nettoinflöden till 49,52 miljarder USD, enligt ETFGIs mars 2024 europeiska ETFer och ETPers industrilandskapsrapport, den månatliga rapporten som är en del av en årlig betald forskningsprenumerationstjänst. (Alla dollarvärden i USD om inget annat anges.)

Höjdpunkter

- Tillgångar som investerats på ETFmarknaden i Europa nådde ett rekord på 1,96 Tn i slutet av mars och slog det tidigare rekordet på 1,90 Tn i slutet av februari 2024.

- Tillgångarna ökade med 7,8 % YTD 2024, från 1,82 Tn USD i slutet av 2023 till 1,96 Tn USD.

- Nettoinflöden på 11,02 miljarder USD i mars 2024.

- YTD nettoinflöden på 49,52 miljarder USD är tredje högsta någonsin efter YTD nettoinflöden på 59,30 miljarder USD 2021 och YTD nettoinflöden på 49,73 miljarder USD 2022.

- Artonde månaden med på varandra följande nettoinflöden.

”S&P 500-indexet ökade med 3,22 % i mars och är upp 10,56 % YTD 2024. De utvecklade marknaderna exklusive det amerikanska indexet ökade med 3,62 % i mars och steg 5,26 % YTD 2024. Spanien (upp 10,72 %) och Italien (upp 6,34 %) såg de största ökningarna bland de utvecklade marknaderna i mars. Emerging markets-indexet ökade med 1,50 % under mars och steg 2,08 % YTD 2024. Peru (upp 10,27 %) och Columbia (upp 8,19 %) såg de största ökningarna bland tillväxtmarknaderna i mars”, enligt Deborah Fuhr, managing partner, grundare och ägare av ETFGI.

Tillgångstillväxt i ETF-branschen i slutet av mars

Källa: ETFGI

I slutet av mars hade ETFmarknaden i Europa 3 037 produkter, med 12 209 noteringar, tillgångar på $1,96 Tn, från 99 leverantörer listade på 29 börser i 24 länder.

Under mars samlade ETFer nettoinflöden till 11,02 miljarder USD. Aktie-ETFer samlade nettoinflöden på 9,81 miljarder USD under mars, vilket förde YTD nettoinflöden till 39,30 miljarder USD, högre än 19,38 miljarder USD i nettoinflöden av eget kapital YTD 2023. Ränte-ETFer rapporterade nettoinflöden på 719,00 USD YTD under 1 mars, vilket gav 25 USD nettoinflöden. miljarder, lägre än 15,49 miljarder USD i nettoinflöden YTD år 2023. Råvaru-ETFer rapporterade nettoutflöden på 75,35 miljoner USD under mars, vilket förde YTD nettoutflöden till 2,32 miljarder USD, lägre än 1,67 miljarder USD i nettoinflöden YTD 2023. på 670,27 miljoner USD under månaden, vilket samlade ett nettoinflöde för året i Europa på 2,33 miljarder USD, högre än 2,17 miljarder USD i nettoinflöden YTD 2023.

Betydande inflöden kan tillskrivas de 20 bästa ETFerna av nya nettotillgångar, som samlat in 9,63 miljarder USD under mars. iShares Core S&P 500 UCITS ETF – Acc (CSSPX SW) samlade in 918,91 miljoner USD, det största enskilda nettoinflödet.

Topp 20 ETFer efter nettoinflöden i mars 2024: Europa

| Namn | Kortnamn | Assets ($ Mn) Mar-24 | NNA ($ Mn) YTD-24 | NNA ($ Mn) Mar-24 |

| iShares Core S&P 500 UCITS ETF – Acc | CSSPX SW | 84,308.60 | 4,744.81 | 918.91 |

| UBS ETF (LU) MSCI United Kingdom UCITS ETF (GBP) A-acc – Acc | UKGBPB SW | 2,485.72 | 653.33 | 753.94 |

| Invesco MSCI USA ESG Universal Screened UCITS ETF – Acc | ESGU LN | 2,188.25 | 792.66 | 741.48 |

| Xtrackers II EUR Overnight Rate Swap UCITS ETF – 1C – Acc | XEON GY | 7,281.96 | 2,089.43 | 596.35 |

| HSBC S&P 500 UCITS ETF | HSPX LN | 6,756.08 | 661.46 | 562.23 |

| iShares MSCI EM ESG Enhanced UCITS ETF | EEDM LN | 5,000.88 | 886.95 | 556.22 |

| Vanguard FTSE All-World UCITS ETF | VWRD LN | 24,771.34 | 1,410.78 | 545.51 |

| Invesco S&P 500 UCITS ETF – Acc | SPXS LN | 25,176.99 | 939.08 | 497.72 |

| iShares MSCI ACWI UCITS ETF – Acc | ISAC LN | 12,806.01 | 1,453.06 | 469.35 |

| iShares USD Treasury Bond 0-1yr UCITS ETF | IBTU LN | 14,990.95 | 1,433.49 | 431.07 |

| iShares € High Yield Corp Bond UCITS ETF | IHYG LN | 7,694.75 | 1,427.77 | 413.53 |

| SPDR S&P 500 UCITS ETF | SPY5 GY | 12,491.17 | 3,418.58 | 388.74 |

| iShares Core MSCI World UCITS ETF – Acc | IWDA LN | 75,051.88 | 3,236.70 | 382.75 |

| Amundi Bloomberg Equal-weight Commodity ex-Agriculture UCITS ETF – Acc | COMO FP | 1,668.95 | 367.30 | 378.26 |

| iShares STOXX Europe Small 200 UCITS ETF (DE) | SCXPEX GY | 916.86 | 401.43 | 357.42 |

| Amundi MSCI Japan UCITS ETF – Acc | LCUJ GY | 4,400.85 | 158.96 | 343.86 |

| UBS ETF (CH) – MSCI Switzerland (CHF) A-dis – Acc | SWICHA SW | 1,126.17 | 354.69 | 335.87 |

| SPDR MSCI World UCITS ETF – Acc | SPPW GY | 5,653.51 | 715.38 | 324.95 |

| Amundi S&P 500 Climate Net Zero Ambition PAB UCITS ETF | ZPA5 GY | 3,965.66 | 925.46 | 320.42 |

| JPMorgan US Research Enhanced Index Equity ESG UCITS ETF – Acc | JREU LN | 7,047.30 | 1,230.55 | 315.09 |

Källa ETFGI

De 10 bästa ETPerna av nya nettotillgångar samlade ihop 1,69 miljarder USD under mars. WisdomTree Physical Silver – Acc (PHAG LN) samlade in 832,90 miljoner USD, det största enskilda nettoinflödet.

Topp 10 ETPer efter nettoinflöden i mars 2024: Europa

| Namn | Kortnamn | Assets ($ Mn) Mar-24 | NNA ($ Mn) YTD-24 | NNA ($ Mn) Mar-24 |

| WisdomTree Physical Silver – Acc | PHAG LN | 2,057.21 | 793.35 | 832.90 |

| iShares Physical Silver ETC – Acc | SSLN LN | 785.65 | 254.30 | 245.97 |

| Xtrackers IE Physical Gold ETC Securities – Acc | XGDU LN | 3,640.08 | 231.87 | 167.72 |

| AMUNDI PHYSICAL GOLD ETC (C) – Acc | GOLD FP | 4,575.61 | 307.29 | 127.12 |

| Xtrackers Physical Gold ETC (EUR) – Acc | XAD5 GY | 2,202.38 | 92.10 | 80.28 |

| WisdomTree Copper – Acc | COPA LN | 1,667.78 | 337.85 | 68.51 |

| Xtrackers Physical Gold Euro Hedged ETC – Acc | XAD1 GY | 1,335.65 | 5.06 | 50.49 |

| SG ETC FTSE MIB -3x Daily Short Collateralized – Acc | MIB3S IM | 33.07 | 88.10 | 40.49 |

| 21Shares Toncoin Staking ETP | TONN SW | 40.81 | 39.94 | 39.94 |

| Invesco Physical Gold ETC – EUR Hdg Acc | SGLE IM | 564.18 | 59.65 | 33.11 |

Källa: ETFGI

Investerare har tenderat att investera i Equity ETFs under mars.

Du kanske gillar

Nyheter

De mest populära börshandlade fonderna april 2024

Publicerad

21 minuter sedanden

29 april, 2024

April, är nu slut, och vi har som vanligt gjort en sammanställning av de mest populära börshandlade fonderna april 2024. Dessa månadsvisa sammanställningar är ett sätt för oss att se vilka ETFer som trendar och vad våra läsare finner intressant. Vi använder sedan detta för att skriva nya artiklar på Etfmarknaden.se.

XACT Norden Högutdelande är utan tvekan den mest populära av alla de ETFer som vi har skrivit om på vår sida. Den kvartalsvisa utdelningen och dess satsning på aktier med en låg volatilitet och hög direktavkastning gör det till en populär fond som återfinns i mångas depåer. Vi har aldrig sett någon annan ETF vara med populär på vår sajt än denna börshandlade fond. Denna månad såg vi mer än 20 olika varianter av denna ETF bland de mest populära börshandlade fonderna på vår sida.

Fonder som satsar på försvarsindustrin har kommit att bli allt mer populära, något som förklaras av att Sverige gått med i NATO, men också av det geopolitiska läget i världen. En börshandlad fond som har tilldragit sig stort intresse är ASWC.

Future of Defense UCITS ETF (ASWC) noterades på Londonbörsen och Deusche Börse XETRA den 4 juli där den handlas under kortnamnet (ASWC ETF) försöker spåra EQM NATO+ Future of Defense-index. EQM NATO+ Future of Defense-index spårar resultatet för företag världen över som är engagerade i militär- eller försvarsindustrin.

ASWC, som följer EQM Future of Defense Index, strävar efter att ge exponering för de globala företag som genererar intäkter från NATO och icke-NATO (NATO+) allierade försvars- och cyberförsvarsutgifter.

Vi befinner oss för närvarande mitt i det största landkriget i Europa sedan 1945. Medan det omedelbara hotet om militär konflikt mellan Ryssland och USA är lågt, utgör Ryssland och andra stater ett allvarligt och föränderligt hot mot Amerika och dess allierade. Nato är en viktig första försvarslinje.

En annan populär försvarsfond är VanEck Defence UCITS ETF en europeiska försvarsfond som nyligen nådde förvaltad volym på 500 miljoner MUSD ett år efter lanseringen. Fonden investerar över hela världen i företag som är verksamma inom försvarsindustrin eller är involverade i försvarsrelaterade statliga kontrakt. Mot bakgrund av de nuvarande globala kriserna har synen på säkerhets- och försvarssektorn också förändrats i Europa,

Stort intresse för amerikanska large caps

Fonder som följer S&P 500 är, föga förvånande, en typ av fonder som det finns stort intresse kring. Det är ingen speciell enskild fond som sticker ut och lockar mer än andra. Det skall emellertid noteras att många sökningar sker på ord som ”Fond som följer S&P500 Avanza”.

För sju månader sedan köpte den amerikanska fondförvaltaren Ark Invest den tematiska ETF-emittenten Rize ETF från AssetCo, vilket markerar företagets första intåg på den europeiska ETF-marknaden. Efter detta har Rize ETF bytt namn till ARK Invest Europé, lagt ned större delen av alla de fonder som Rize ETF hade lanserat. Under april 2024 kom nyheten om att ARK Invest Europé lanserade tre europeiska börshandlade fonder, som är kopior av de fonder som den amerikanska förvaltaren erbjuder i USA. Detta ledde till att många som tidigare varit förhindrade att köpa denna ETF nu sökt ytterligare information om ARKs europeiska fonder.

Efter att ETFer för Bitcoin har godkänts i USA, och även Storbritannien har indikerat ett grönt ljus vänds nu fokus mot nästa kryptovaluta, Etherum. Den mest populära börshandlade produkten på vår sida är Ethereum Zero SEK en börshandlad produkt, som exakt speglar priset på Ethereum (ETH) utan avdrag för förvaltningsavgifter, vilket gör investeringar i världens näst största digitala tillgång enklare, säkrare och mer kostnadseffektivt än andra alternativ.

Produkten är en strukturerad investering i form av ett tracker certifikat enligt svensk lag. Den handlas på Nordic Growth Market (NGM) som är den primära marknadsplatsen.

ETFer med månatlig utdelning lockar

ETF med månatliga utdelningar är något som vi sett på denna lista de senaste månaderna. Det finns flera sådana tillgängliga för svenska investerare, till exempel JPM Global Equity Premium Income UCITS ETF – USD (dist) och Global X Nasdaq 100 Covered Call UCITS ETF USD Distributing (QYLE ETF), som emellertid skiljer sig mycket åt från varandra.

Många av de besökare som kommer till ETFmarknaden för att söka information om börshandlade fonder letar efter utdelande ETFer, och dessa två ETFer har något som sticker ut från andra ETFer. Det är en av de få aktier-ETFer som vi sett där utdelningen sker månadsvis.

I december 2023 lanserade J.P. Morgan Asset Management sin JPMorgan Global Equity Premium Income UCITS ETF (ticker: JEPG), en aktivt hanterad resultatorienterad ETF-strategi som syftar till att erbjuda investerare konsekventa inkomster: 7 till 9 procent årligen, betald månadsvis och uppskattningspotential med mindre volatilitet än JEPGs respektive riktmärke.

Månadsvis utdelning är en av orsakerna till att kanadensiska aktier som till exempel Boston Pizza har kommit att bli så pass populära, då de ger utdelning varje månad. Utdelning varje månad fungerar för många investerare som ett alternativ till lön när de går i tidig pension.

En annan börshandlad fond som har fokus på utdelningar är Global X SuperDividend UCITS ETF USD Distributing (UDIV ETF) som investerar i utdelningsaktier från hela världen. Utdelningarna i fonden delas ut till investerarna (halvårsvis).

Många vill handla kakao

Kakao har under det senaste året stigit med mer än 100 procent i pris. Det gör att många söker efter börshandlade produkter som ger exponering mot priset på denna råvara. Det finns emellertid ingen ren ETF som investerar i kakao i Europa. Det finns däremot börshandlade produkter, till exempel ETPer, så kallade certifikat.

WisdomTree Cocoa (COCO) är det enda rena alternativet vi har hittat. Annars finns WisdomTree Cocoa 2x Daily Leveraged (4RUP ETC) som ger den dubbla kursutvecklingen för kakaopriset, både när det stiger och faller.

Valour Ripple (XRP) SEK är en börshandlad produkt som spårar priset på XRP, Ripples infödda token. XRP förbättrar främst globala finansiella överföringar och utbyte av flera valutor. Snabb och miljövänlig, den digitala tillgången XRP designades för att fungera som den mest effektiva kryptovalutan för olika applikationer inom finanssektorn.

Valour Ripple (XRP) SEK ETP (ISIN: CH1161139584) är en börshandlad produkt som spårar priset på XRP, Ripples infödda token.

XRP har ett börsvärde på 29,57 miljarder USD och rankas på en sjätte plats bland alla kryptovalutor globalt. Ripple XRP är en nyckelspelare inom det digitala valutaområdet, känd för sin användning för att underlätta snabba och billiga internationella pengaöverföringar. XRP fungerar på RippleNet och fungerar som en bryggvaluta i Ripples betalningsnätverk, vilket möjliggör sömlösa valutaväxlingar över hela världen. Detta har positionerat XRP som ett föredraget val för finansiella institutioner som söker effektiva alternativ till traditionella gränsöverskridande betalningsmetoder.

En annan populär ETFen är XACT Sverige, som även denna lämnar utdelning. Till skillnad från XACT Norden Högutdelande sker utdelningen endast en gång per år. Denna ETF meddelade att den fastställt utdelningen för 2024 under februari månad.

I februari 2024 lanserades Valour Binance (BNB) SEK, en börshandlad produkt som spårar priset på kryptovalutan BNB, den inhemska kryptovalutan som utfärdas av Binance-börsen och körs på Binance-kedjan. Den kan användas för betalningar på transaktionsavgifter (på Binance-kedjan), resebokningar, underhållning, onlinetjänster och andra finansiella tjänster. Valour Binance (BNB) gör investeringar i detta ekosystem enkel, säker och kostnadseffektiv, tillgänglig för köp på reglerade börser via vilken bank eller mäklare som helst.

BNB kan användas för att betala avgifter vid handel på Binance, och vanligtvis till en rabatterad kurs. På grund av den primära nyttan har BNB sett en betydande tillväxt i intresse genom åren. Flera omgångar av token burn-händelser har uppskattat BNB-priset och drivit det upp som en av de fem bästa kryptovalutorna efter börsvärde.

Är det dags att titta på fastighetsbolagen igen?

Ett relativt nytt begrepp på listan är ETF fastigheter. Allt fler investerare tror att vi kommer att få se räntesänkningar i år, inte bara i Sverige och Europa, men även i USA. Lägre räntor gör det enklare att räkna hem en investering i fastigheter. Kan det vara så att våra besökare undersöker möjligheterna att positionera sig i en ETF för fastigheter innan räntorna sänks för att de tror att det kommer att leda till en uppvärdering av fastighetsbolagen?

Valour SOLANA (SOL) är en börshandlad produkt, som gör investeringar i SOL enkla, säkra och kostnadseffektiva. Solana är en decentraliserad blockchain och den snabbaste blockchain i världen, med mer än 400 projekt som spänner över DeFi, NFT, Web3 och mer.

Produkten är en en strukturerad investering i form av ett tracker certifikat enligt svensk lag. Den handlas på Nordic Growth Market (NGM) som är den primära marknadsplatsen.

Swedbank ETF tror vi kan tolkas att det endera finns intresse för att veta om Swedbank har ETFer i sitt utbud, eller om det går att handla börshandlade fonder på Swedbank. Svaret på denna fråga återfinns här.

Tidigare var det många som sökte på begreppet ESG, men detta sökord har fallit från listan under de senaste månaderna. En variant av ESG-fond är de fonder som har en islamistisk inriktning, så kallade halalfonder., och det är fortfarande något som våra besökare letar information om. En sådan fond är ASWE, som är en aktivt förvaltad shariafond men till exempel HSBC har en serie fonder med fokus på att investera enligt islam. Det är ingen speciell enskild fond som sticker ut och lockar mer än andra.

Utöver Valour finns det flera andra emittenter av börshandlade kryptovalutor. Faktum är att det finns en svensk sådan, Virtune. Detta företag kommer inte bland de högsta när våra läsare söker på vår sida, men när det söks är det tydligen kunder hos Avanza som söker. Vi ser många sökningar på Virtune Bitcoin Avanza. Vi ser märkligt nog ännu flera sökningar på Henry Forelius som arbetar på Virtune. Av någon anledning söker fler besökare på honom än på Virtune. Denna emittent skulle återkomma till oss efter jul, så vi hoppas att det kan bli mer artiklar om deras produkter i framtiden.

Valour Cardano (ADA) SEK är inte bara en Cardano ETP, det är också den första att handlas på en nordisk börs. Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

VGWD ETF, eller VGWD Vanguard FTSE All-World High Dividend Yield UCITS ETF Distributing som är dess fullständiga namn, handlas bland annat på tyska Xetra, vilket gör att det går att handla den direkt genom DEGIRO, Nordnet, Aktieinvest och Avanza. VGWD ger bred exponering mot de största företagen med högre avkastning på utvecklade och tillväxtmarknader, men utesluter fastighetsbolag. Som alla andra av Vanguards ETFer så har den en låg förvaltningsavgift, 0,29 procent. Den kan liknas vid en global variant av XACT Norden Högutdelande eftersom den investerar i högavkastande aktier från hela världen.

Även Nasdaq-spårande fonder lockar sparare

Fond som följer Nasdaq-100 är ett annat relativ nytt begrepp på denna lista. Det är däremot inte konceptet, i princip varje större emittent på marknaden erbjuder minst en sådan ETF. Invesco som i USA har den populära fonden QQQ, erbjuder flera olika alternativ på den europeiska marknaden.

HBAR är en börshandlad produkt som inte ens har hunnit lanseras ännu. I slutet av januari kommunicerade Valour att företaget hade för avsikt att lansera en fysiskt uppbackad börshandlad produkt (ETP) Valour HBAR Staking ETP i samarbete med The Hashgraph Association (THA) – en schweiziskbaserad produkt oberoende och ideell organisation fokuserad på att ge en digital framtid för alla genom att utnyttja Hederas miljövänliga distribuerade ledger-teknologi (DLT).

Lanseringen har ännu inte skett, men vi är övertygade om att vi ser denna inom kort. Om den kommer att handlas under kortnamnet HBAR är ännu inte kommunicerat.

ETF Indien är inte en specifik börshandlad fond, men förekommer i en mängd olika varianter. Det finns tydligen ett stort intresse för att investera i indiska aktier bland sidan besökare, och då är kanske en ETF ett bra sätt att göra det. Vi skrev under i början av året en artikel om olika Indienfonder.

Stigande guldpris

I och med att guldpriset har rört sig uppåt har intresset för guldfonder kommit att bli mer populärt överlag. Den mest populära fonden är 4GLD, Xetra-Gold som erbjuder investerare en optimal och enkel möjlighet att delta i utvecklingen av guldmarknaden. Dessutom är handel med Xetra-Gold också mycket kostnadseffektiv eftersom den till skillnad från andra värdepapper inte kommer med varken abonnemangsavgifter eller förvaltningsavgifter.

Under januari 2024 gav den amerikanska finansinspektionen SEC tillstånd för de första amerikanska Bitcoin ETFerna. Detta i samband med att priset på denna kryptovaluta har stigit till nivåer som Bitcoin inte handlats till på flera år, en effekt av just de nya börshandlade fonderna, har gjort att vi sett ett mycket stort intresse för detta på sidan. Många söker på just Bitcoin ETF, något som inte är tillåtet i Europa, på grund av att en ETF måste ha mer än en underliggande tillgång. Istället kallas dessa produkter för ETP eller ETC, och skillnaden är relativt liten. Vi skrev för ett par veckor sedan en artikel som i kallade för Vilken Bitcoinprodukt är bäst? i syfte att titta närmare på alla de fonder, certifikat och produkter som spårar Bitcoin.

Många söker information om fonder som investerar i halvledare

Många besökare har letat efter information om halvledarfonder, vilket vi tagit fasta på. Denna månad har vi publicerat texter om flera olika ETFer som investerar i halvledarföretag, och under maj kommer en artikel som samlar i hop alla dessa fonder i samma artikel.

VanEck Vectors Semiconductor UCITS ETF (VVSM ETF) som investerar i det övergripande resultatet för företag som är involverade i halvledarproduktion och utrustning.

VanEck Vectors Semiconductor UCITS ETF (VVSM ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Borsa Italiana, Deutsche Boerse Xetra och London Stock Exchange. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Från och med den 14 februari 2024 kan för första gången en Exchange Traded Note (ETN) på Internet Computer (ICP), en ICP ETN, handlas via Xetra och handelsplatsen Börse Frankfurt. Utgivaren av denna ETN är Valour Digital Securities.

Med 1Valour Internet Computer Physical Staking (1VIC) kan investerare på Xetra delta i utvecklingen för Internet Computers kryptovaluta i kombination med insats för första gången utan att behöva sätta upp kryptoplånböcker. Staking är processen att deponera respektive kryptotillgångar på blockkedjan för att validera transaktioner. I gengäld betalas en premie. På detta sätt kan investerare delta inte bara i prestanda för kryptovalutan, utan också i respektive insatsinkomst.

Utdelningsfonder lockar, men en som fallit i intresse är Global X SuperDividend UCITS ETF USD Distributing (UDIV ETF) som investerar i utdelningsaktier från hela världen. Utdelningarna i fonden delas ut till investerarna (halvårsvis).

Nyheter

INQQ ETF ger exponering mot Internet och e-commerce i Indien

Publicerad

1 timme sedanden

29 april, 2024

HANetf INQQ India Internet & Ecommerce ESG-S UCITS ETF (INQQ ETF) med ISIN IE000WYTQSF9, strävar efter att spåra INQQ The India Internet & Ecommerce ESG Screened index. INQQ The India Internet & Ecommerce ESG Screened index spårar indiska företag från sektorerna internet och e-handel. Aktierna som ingår filtreras enligt ESG-kriterier (miljö, social och bolagsstyrning).

Den börshandlade fondens TER (total cost ratio) uppgår till 0,86 procent p.a. HANetf INQQ India Internet & Ecommerce ESG-S UCITS ETF är den enda ETF som följer INQQ The India Internet & Ecommerce ESG Screened index. ETFen replikerar det underliggande indexets prestanda genom full replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen ackumuleras och återinvesteras.

Denna börshandlade fond lanserades den 15 november 2023 och har sin hemvist i Irland.

Fondöversikt

INQQ India Internet & Ecommerce ESG-S UCITS ETF ger investerare en riktad exponering mot den indiska internet- och e-handelssektorn.

Indien är nu världens folkrikaste land, Indien har blivit en av de snabbast växande stora ekonomierna. Centralt för denna tillväxt har varit medelklassens expansion, vilket har gjort det möjligt för delar av befolkningen att få tillgång till internet och ökat onlinekonsumtionen.

Samtidigt har Indien snabbt utökat sin digitala infrastruktur, vilket möjliggör oöverträffade nivåer av anslutning. Dessa faktorer har fått analytiker att tro att landet går in i en digital guldålder. Innehav i Indien ETF kontrolleras för att säkerställa att majoriteten av deras intäkter kommer från internet- och e-handelsaktiviteter i Indien.

India ETF spårar INQQ The India Internet & Ecommerce ESG Screened Index och använder en ESG-screening.

Varför INQQ India ETF

Snabb digitalisering av Indien: Indien är den snabbast växande stora ekonomin och har blivit det folkrikaste landet i världen. Med cirka 7 miljoner nya smartphoneanvändare varje månad kommer delar av befolkningen online i en aldrig tidigare skådad hastighet – men data tyder på att vi fortfarande är tidigt ute när det gäller smartphonepenetration.

Rent exponering mot Indien: Bredare Indiens index kan drabbas av problem som att inkludera statligt ägda företag, överviktning av äldre bank- och oljesektorer och företag ”förklädda” till indiska som genererar det mesta av sin verksamhet i Europa eller USA. INQQ strävar efter att uppnå ren exponering för Indien genom omfattande screening.

ESG-screenad exponering: Unik möjlighet att få tillgång till den snabba tillväxten av den indiska internet- och e-handelsekonomin via en ESG-skärm. Aktier som inte uppfyller de strikta kriterierna exkluderas från indexet.

Handla INQQ ETF

INQQ India Internet & Ecommerce ESG-S UCITS ETF (INQQ) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Största innehav

| Värdepapper | Vikt % |

| ZOMATO LTD | 9.91% |

| RELIANCE INDUSTRIES LTD | 6.47% |

| BAJAJ FINANCE LTD | 6.33% |

| INFO EDGE (INDIA) LIMITED | 6.31% |

| MAKEMYTRIP LTD | 6.20% |

| FRESHWORKS INC-CL A | 5.55% |

| INDIAN RAILWAY CATERING & TO | 5.52% |

| FSN E-COMMERCE VENTURES LTD | 5.16% |

| PB FINTECH LTD | 5.09% |

| ONE 97 COMMUNICATIONS LTD | 4.94% |

Innehav kan komma att förändras

Nyheter

Vilken är den bästa fond som följer Nasdaq-100?

Publicerad

23 timmar sedanden

28 april, 2024

Nasdaq 100-indexet följer de 100 största aktierna noterade på Nasdaq-börsen. De utvalda företagen kommer huvudsakligen från sektorer som hårdvara och mjukvara, telekommunikation, detaljhandel och bioteknik – inklusive alla stora amerikanska teknikföretag. Däremot ingår inte företag från energi-, finans- och fastighetssektorerna i Nasdaq-100. Vilken är den bästa fond som följer Nasdaq-100?

I USA har den populära QQQ ETF, som spårar Nasdaq 100, varit tillgänglig sedan 1999. Den förvaltas av Invesco. Den europeiska motsvarigheten till denna ETF använder tickersymbolen eQQQ. Till skillnad från den amerikanska marknaden finns det dock flera ETF-leverantörer i Europa som spårar Nasdaq 100 – så det är värt att jämföra.

ETF-investerare kan dra nytta av värdeökningar och utdelningar från Nasdaq 100-beståndsdelarna. För närvarande spåras Nasdaq 100-indexet av tretton ETFer.

Förvaltningsarvode fond som följer Nasdaq-100

Nedan har vi listat förvaltningsarvoden för fond som följer Nasdaq-100. Samtliga dessa ETFer har en konkurrenskraftig prissättning, allt från AXA IM Nasdaq 100 UCITS ETF USD Acc, som debiterar sina andelsägare 0,14 procent per år till iShares Nasdaq 100 UCITS ETF (Acc) som tar ut 0,33 procent i arvode. I jämförelse kostar de flesta aktivt förvaltade fonder mycket mer avgifter per år.

| Namn | Valuta | ISIN | Kortnamn | Förvaltningsavgift |

| AXA IM Nasdaq 100 UCITS ETF USD Acc | USD | IE000QDFFK00 | ANAU | 0.14% |

| Invesco Nasdaq-100 Swap UCITS ETF Acc | USD | IE00BNRQM384 | EQQX | 0.20% |

| Invesco Nasdaq-100 Swap UCITS ETF Dist | USD | IE000RUF4QN8 | EQQD | 0.20% p.a. |

| Xtrackers Nasdaq 100 UCITS ETF 1C | USD | IE00BMFKG444 | XNAS | 0.20% |

| Amundi Nasdaq-100 II UCITS ETF Acc | EUR | LU1829221024 | LYMS | 0.22% |

| Amundi Nasdaq-100 II UCITS ETF Dist | USD | LU2197908721 | NADQ | 0.22% |

| Amundi Nasdaq 100 UCITS ETF EUR (C) | EUR | LU1681038243 | 6AQQ | 0.23% |

| Amundi Nasdaq 100 UCITS ETF USD | USD | LU1681038326 | 10A4 | 0.23% |

| Deka Nasdaq-100® UCITS ETF | EUR | DE000ETFL623 | D6RH | 0.25% |

| Invesco EQQQ Nasdaq-100 UCITS ETF | USD | IE0032077012 | EQQQ | 0.30% |

| Invesco EQQQ Nasdaq-100 UCITS ETF Acc | USD | IE00BFZXGZ54 | EQQB | 0.30% |

| iShares Nasdaq 100 UCITS ETF (DE) | USD | DE000A0F5UF5 | EXXT | 0.31% |

| iShares Nasdaq 100 UCITS ETF (Acc) | USD | IE00B53SZB19 | SXRV | 0.33% |

Som alltid vill vi påminna att om det finns flera olika börshandlade fonder som täcker samma index eller segment är det förvaltningskostnaden som avgör. Antar vi att dessa Nasdaqfonder ger samma avkastning kommer den som har lägst avgift att utvecklas bäst, allt annat lika. Grundregeln är alltså, betala aldrig för mycket då detta kommer att äta upp din avkastning.

Nasdaq 100 ETFer i jämförelse

Förutom avkastning finns det ytterligare viktiga faktorer att tänka på när du väljer en Nasdaq 100 ETF. För att ge ett bra beslutsunderlag hittar du en lista över alla Nasdaq 100 ETFer med detaljer om vinstanvändning, fondens hemvist och replikeringsmetod.

| Namn | Utdelningspolicy | Hemvist | Replikeringsmetod |

| iShares Nasdaq 100 UCITS ETF (Acc) | Ackumulerande | Irland | Fysisk replikering |

| Invesco EQQQ Nasdaq-100 UCITS ETF | Utdelande | Irland | Fysisk replikering |

| iShares Nasdaq 100 UCITS ETF (DE) | Utdelande | Tyskland | Fysisk replikering |

| Amundi Nasdaq-100 II UCITS ETF Acc | Ackumulerande | Luxemburg | Ofinansierad swap |

| Invesco EQQQ Nasdaq-100 UCITS ETF Acc | Ackumulerande | Irland | Fysisk replikering |

| Amundi Nasdaq 100 UCITS ETF EUR (C) | Ackumulerande | Luxemburg | Ofinansierad swap |

| Amundi Nasdaq-100 II UCITS ETF Dist | Utdelande | Luxemburg | Ofinansierad swap |

| AXA IM Nasdaq 100 UCITS ETF USD Acc | Ackumulerande | Irland | Fysisk replikering |

| Xtrackers Nasdaq 100 UCITS ETF 1C | Ackumulerande | Irland | Fysisk replikering |

| Invesco Nasdaq-100 Swap UCITS ETF Acc | Ackumulerande | Irland | Ofinansierad swap |

| Amundi Nasdaq 100 UCITS ETF USD | Ackumulerande | Luxemburg | Ofinansierad swap |

| Invesco Nasdaq-100 Swap UCITS ETF Dist | Utdelande | Irland | Ofinansierad swap |

| Deka Nasdaq-100® UCITS ETF | Utdelande | Tyskland | Fysisk replikering |

Handla fond som följer Nasdaq-100

Samtliga dessa ETFer är europeiska börshandlade fonder. Dessa fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

De mest populära börshandlade fonderna april 2024

INQQ ETF ger exponering mot Internet och e-commerce i Indien

Vilken är den bästa fond som följer Nasdaq-100?

Inevitable in India: Crowds, cricket and capital gains tax

XB33 ETF köper företagsobligationer i euro som förfaller 2033

ETFmarknaden i Europa firar sitt 24-årsjubileum med tillgångar på två biljoner USD

De mest populära börshandlade fonderna mars 2024

Tillgång till obligationsmarknaden för företagsobligationer från utvecklade marknader

FUIG ETF investerar i hållbara företagsobligationer som följer Parisavtalet

Försvarsfond når förvaltad volym på 500 MUSD

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDe mest populära börshandlade fonderna mars 2024

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTillgång till obligationsmarknaden för företagsobligationer från utvecklade marknader

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFUIG ETF investerar i hållbara företagsobligationer som följer Parisavtalet

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanFörsvarsfond når förvaltad volym på 500 MUSD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanVad händer härnäst för Bitcoin?

-

Nyheter23 timmar sedan

Nyheter23 timmar sedanVilken är den bästa fond som följer Nasdaq-100?

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNy börshandlad fond från Deka ger tillgång till S&P 500-index

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanBygg din egen pengamaskin