Nyheter

ETC Group Crypto Market Compass #12 2024

Publicerad

1 år sedanden

• Cryptoassets pull back after a strong rally as short-term BTC investors are taking profits

• Our in-house “Cryptoasset Sentiment Indicator” has declined significantly and currently signals neutral sentiment

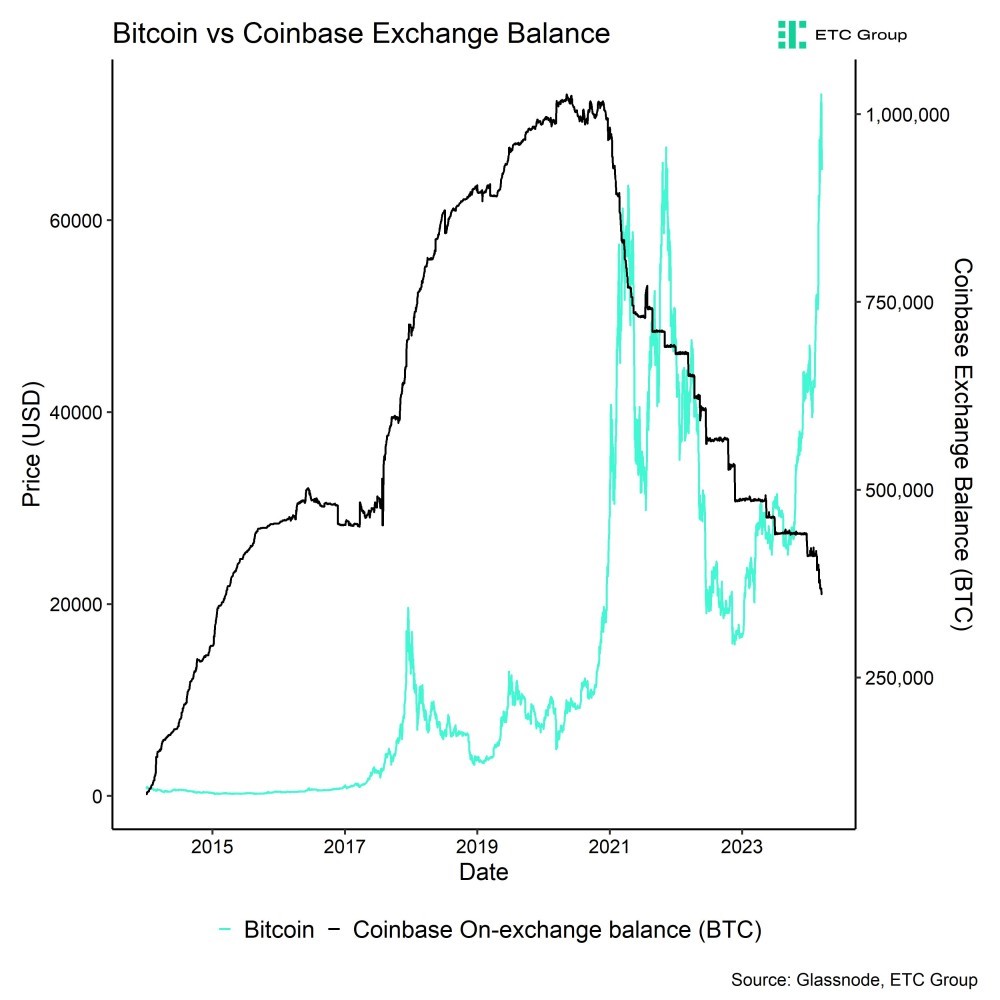

• Meanwhile, large investors continue to accumulate bitcoins as Coinbase BTC on-exchange balances just hit a 9-year low

Chart of the Week

Performance

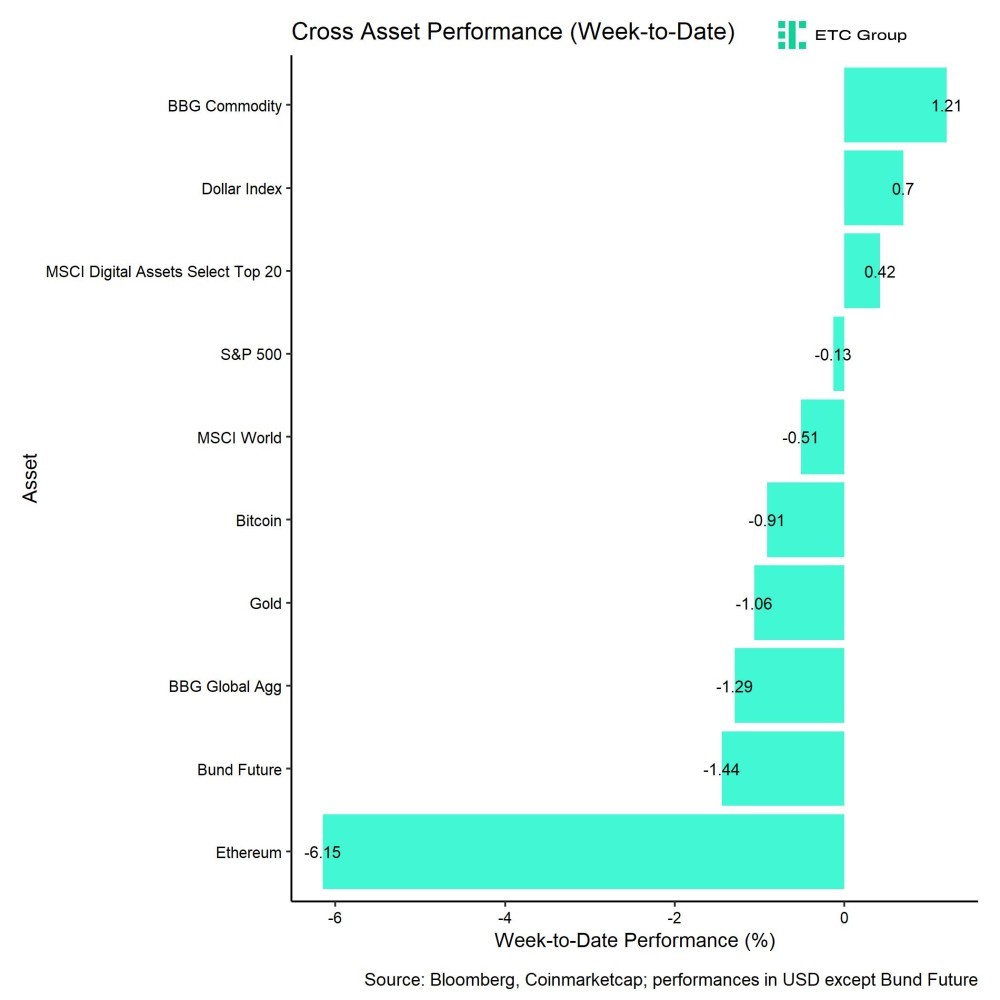

Last week, cryptoassets pulled back after a strong rallye to new all-time highs. The major catalyst for this latest move appears to be related to short-term investors and smaller wallet cohorts taking profits already. The downside move was also exacerbated by an increase in long futures liquidations as well as a deceleration in fund inflows more recently.

However, overall exchange balances imply that the demand overhang for bitcoins is still very much present and that larger investors continue to accumulate bitcoins at a very large scale. Amongst others, this is visible in Coinbase on-exchange balances that have just touched a fresh 9-year low (Chart-of-the-Week).

Thus, the most recent on-chain data suggest that there is currently a renewed redistribution of bitcoins from smaller to larger wallet cohorts taking place.

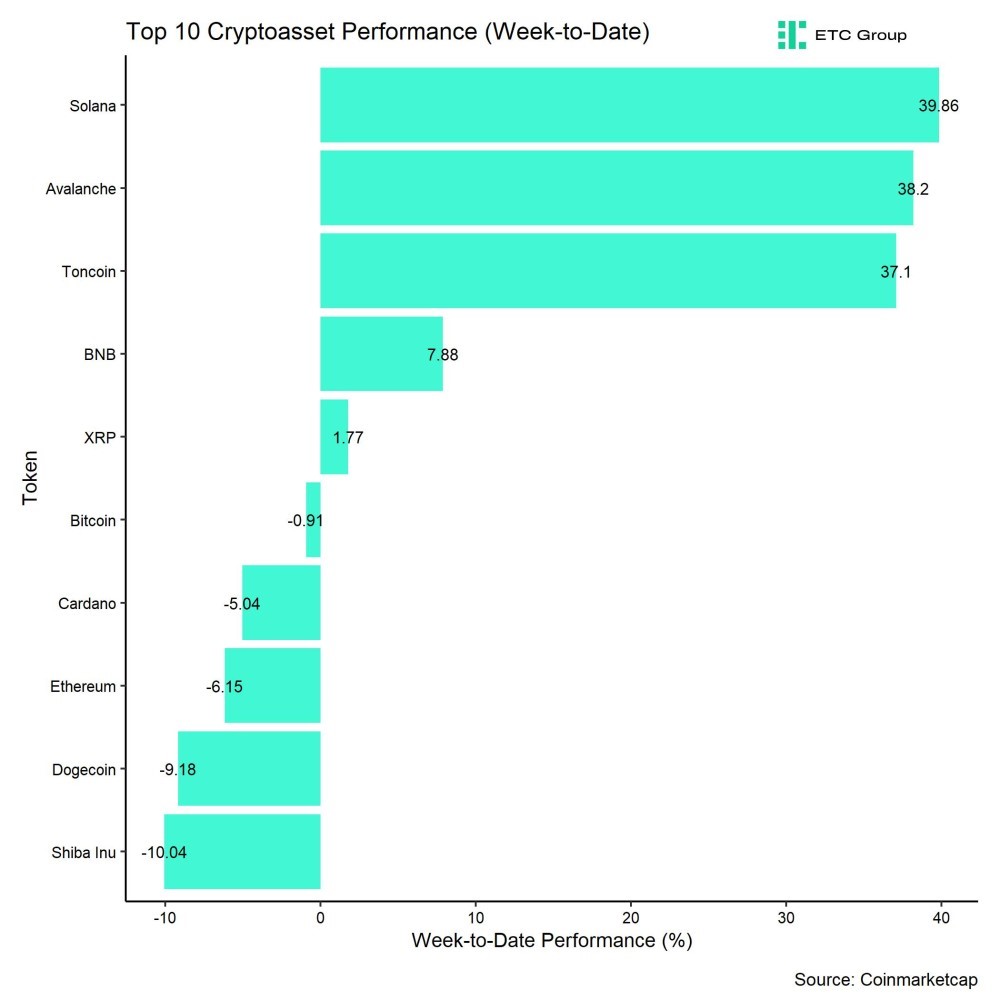

All in all, Bitcoin was more or less flat compared to last week. However, there was a significant underperformance of Ethereum vis-à-vis Bitcoin that was most likely related to an open letter of two US senators to SEC chairman Gary Gensler who oppose additional crypto spot ETF approvals by the SEC.

Moreover, the influential Bloomberg ETF analyst Eric Balchunas has also reduced his personal probability of an earlier Ethereum ETF approval in May 2024 to around 35% due to less activity between issuers and the SEC relative to the activity in the run-up to the Bitcoin spot ETF approval. However, he also thinks that an Ethereum spot ETF will ultimately be approved at some later point in the future. The underperformance was also accompanied by accelerating net outflows from global Ethereum-based ETPs.

This comes at a time when Ethereum has undergone the so-called Dencun upgrade which amongst others includes the EIP-4844 that promises to increase scalability and reduce fees on Layer 2s. Some major Layer 2s like Base and Arbitrum have already implemented the upgrade and fee reductions are so far very significant.

This will most likely put Ethereum and ETH Layer 2s in a better position to compete with low-cost and highly scalable chains like Solana.

In general, among the top 10 crypto assets, Solana, Avalanche, and Toncoin were the relative outperformers.

Nonetheless, overall altcoin outperformance vis-à-vis Bitcoin was low compared to the week prior, with only 30% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. This was most likely due to a general decline in risk appetite due to the most recent pull-back in Bitcoin.

Sentiment

Our in-house “Cryptoasset Sentiment Index” has declined significantly and currently signals neutral sentiment.

At the moment, 8 out of 15 indicators are above their short-term trend.

There were significant reversals to the downside in BTC perpetual futures funding rate and the short-term holder spent output profit ratio (STH-SOPR).

The Crypto Fear & Greed Index still remains in ”Extreme Greed” territory as of this morning.

Besides, our own measure of Cross Asset Risk Appetite (CARA) has increased again throughout the week which signals ongoing bullish sentiment in traditional financial markets. This index is currently at the highest reading since July 2023.

Performance dispersion among cryptoassets has declined further due to the most recent correction. However, overall performance dispersion still remains relatively high.

In general, high performance dispersion among cryptoassets implies that correlations among cryptoassets are low, which means that cryptoassets are trading more on coin-specific factors and that cryptoassets are increasingly decoupling from the performance of Bitcoin.

At the same time, altcoin outperformance vis-à-vis Bitcoin was relatively unchanged compared to the week prior with only 30% of our tracked altcoins that have outperformed Bitcoin on a weekly basis. However, there was a significant underperformance of Ethereum vis-à-vis Bitcoin last week.

In general, decreasing altcoin outperformance tends to be a sign of declining risk appetite within cryptoasset markets.

Fund Flows

Overall, we saw another week of record net fund inflows in the amount of +2,862.7 mn USD (week ending Friday) based on Bloomberg data across all types of cryptoassets.

Global Bitcoin ETPs continued to see significant net inflows of +2,856.2 mn USD of which +2,565.7 mn (net) were related to US spot Bitcoin ETFs alone. The ETC Group Physical Bitcoin ETP (BTCE) saw net outflows equivalent to -13.3 mn USD last week.

The Grayscale Bitcoin Trust (GBTC) experienced a significant increase in net outflows of approximately -1246.1 mn USD last week. However, this was also more than offset by net inflows into other US spot Bitcoin ETFs which managed to attract +3,812 bn USD (ex GBTC).

Last week on Tuesday (12/03/2024), US spot Bitcoin ETFs saw the highest daily net inflow since trading launch of above 1 bn USD on a single day. However, since then, we have seen a gradual deceleration in net inflows overall and also a reacceleration in net outflows from GBTC which probably also contributed to the most recent downside move. This was also evident in negative NAV discounts of those ETFs towards the end of last week.

Apart from Bitcoin, we saw comparatively small flows into other cryptoassets last week again.

Global Ethereum ETPs even saw significant net outflows last week of around -56.6 mn USD which represents an acceleration of outflows compared to the week prior. Meanwhile, the ETC Group Physical Ethereum ETP (ZETH) had -0.7 mn USD while the ETC Group Ethereum Staking ETP (ET32) was able to attract almost +20.0 bn USD in net inflows last week.

Besides, Altcoin ETPs ex Ethereum managed to attract inflows of around +24.7 mn USD last week.

Thematic & basket crypto ETPs also experienced net inflows of +38.4 mn USD, based on our calculations. The ETC Group MSCI Digital Assets Select 20 ETP (DA20) saw neither in- nor outflows last week (+/- 0.0 mn USD).

Besides, the beta of global crypto hedge funds to Bitcoin over the last 20 trading remained at around 1.00 which implies that global crypto hedge funds have currently a neutral market exposure.

On-Chain Data

The major catalyst for this latest move appears to be related to short-term investors and smaller wallet cohorts taking profits already. Amongst others, this was very visible in the short-term holder spent output profit ratio (STH SOPR) that spiked to the highest reading since May 2019 on Wednesday last week. So, there was a very significant degree of short-term profit-taking.

However, overall exchange balances imply that the demand overhang for bitcoins is still very much present and that larger investors continue to accumulate bitcoins at a very large scale. Amongst others, this is visible in Coinbase on-exchange balances that have just touched a fresh 9-year low (Chart-of-the-Week).

In general, we saw record net outflows from exchanges last week. Both Coinbase and Bitfinex, which is known to be an exchange for larger investors, saw their highest net outflows of 2024 last week which implies a continued high buying interest for bitcoin.

The highest outflows just happened yesterday (Sunday) which implies that larger investors have accumulated into the most recent price correction.

Meanwhile, smaller wallet cohorts have continued to distribute their bitcoins into the most recent rallye. This is particularly visible in net exchange flows by wallet cohort. While large wallet cohorts in excess of 1 mn USD have seen net exchange outflows of -50.4k BTC over the past 7 days, smaller wallet cohorts have sent around +12.7k BTC to exchanges during the same time period.

This observation is corroborated by the fact that Bitcoin whales have taken around -2,878 BTC off exchanges over the past 7 days. Whales are defined as unique entities holding at least 1k coins. The absolute number of whales also continues to grow.

Overall, we have seen the highest weekly net exchange outflows in 2024 last week with around -37.6k BTC net outflows over the past 7 days.

Thus, the most recent on-chain data suggest that there is currently a renewed redistribution of bitcoins from smaller to larger wallet cohorts taking place.

The fact that long-term holders have increasingly been distributing bitcoins can be reconciled with the fact that many long-term holders are actually part of smaller wallet cohorts.

Futures, Options & Perpetuals

The most recent downside move from all-time highs was exacerbated by an increase in long futures liquidations as well. Long futures liquidations spiked above 100 mn USD on Friday last week according to data provided by Glassnode.

Nonetheless, both futures and perpetual open interest managed to increase over the past week. Especially CME saw a significant increase in futures open interest despite the most recent rout which implies that CME futures traders, which is dominated by institutional investors, have continued to increase their exposure to Bitcoin.

The futures basis rate has also remained elevated throughout the past correction at around 24.2% p.a.

In the context of the most recent correction, it is worth noting that the weighted Bitcoin futures perpetual funding rate across multiple derivatives exchanges has not turned negative during the most recent correction. However, funding rates have certainly declined to more moderate levels that do not imply excessive risk-taking to the upside anymore.

BTC options’ open interest has also increased last week. The Put-call open interest continued to decline compared to last week and is now at around 0.56 which does not signal a significant appetite for downside protection. Put-call volume ratios also remained relatively low despite the most recent correction.

However, the 25-delta BTC 1-month option skew increased last week signalling higher bids for puts relative to call options.

However, BTC option implied volatilities have come off the highs recorded on Monday last week. Implied volatilities of 1-month ATM Bitcoin options are currently at around 73.6% p.a.

Bottom Line

• Cryptoassets pull back after a strong rallye as short-term BTC investors are taking profits

• Our in-house “Cryptoasset Sentiment Indicator” has declined significantly and currently signals neutral sentiment

• Meanwhile, large investors continue to accumulate bitcoins as Coinbase BTC on-exchange balances just hit a 9-year low

Disclaimer

Important Information

The information provided in this material is for informative purposes only and does not constitute investment advice, a recommendation or solicitation to conclude a transaction. This document (which may be in the form of a blogpost, research article, marketing brochure, press release, social media post, blog post, broadcast communication or similar instrument – we refer to this category of communications generally as a “document” for purposes of this disclaimer) is issued by ETC Issuance GmbH (the “issuer”), a limited company incorporated under the laws of Germany, having its corporate domicile in Germany. This document has been prepared in accordance with applicable laws and regulations (including those relating to financial promotions). If you are considering investing in any securities issued by ETC Group, including any securities described in this document, you should check with your broker or bank that securities issued by ETC Group are available in your jurisdiction and suitable for your investment profile.

Exchange-traded commodities/cryptocurrencies, or ETPs, are a highly volatile asset and performance is unpredictable. Past performance is not a reliable indicator of future performance. The market price of ETPs will vary and they do not offer a fixed income. The value of any investment in ETPs may be affected by exchange rate and underlying price movements. This document may contain forward-looking statements including statements regarding ETC Group’s belief or current expectations with regards to the performance of certain asset classes. Forward-looking statements are subject to certain risks, uncertainties and assumptions, and there can be no assurance that such statements will be accurate and actual results could differ materially. Therefore, you must not place undue reliance on forward-looking statements. This document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment. An investment in an ETC that is linked to cryptocurrency, such as those offered by ETC Group, is dependent on the performance of the underlying cryptocurrency, less costs, but it is not expected to match that performance precisely. ETPs involve numerous risks including, among others, general market risks relating to underlying adverse price movements and currency, liquidity, operational, legal, and regulatory risks.

Du kanske gillar

-

Bitcoin is resilient despite the Middle East war

-

Grattis till Bitwise Europe på femårsjubileet för deras fysiska Bitcoin ETP

-

Bitwise Asset Management säger att stark företagsefterfrågan stöder Bitcoin över 100 000 dollar

-

VIRBTCP är ett säkert och kostnadseffektivt sätt att få exponering mot Bitcoin

-

Bitcoin ETFs are cheaper than crypto stocks. Here’s why

-

3 highlights from the Bitcoin conference: What do they mean for ETF investors?

De senaste månaderna har det varit större förändringar på denna lista än normalt. Under juni 2025 förändrades listan på de mest eftersökta ETFerna åter kraftigt, vilket numera är ganska normalt. Denna månad var det hetaste investeringstemat i månadsutdelande ETFer . Vi noterar är att Montrose befäster sin position som den populäraste ETFen på Etfmarknaden.se samtidigt som listan är mer koncentrerad än tidigare.

Det går att handla andelar i dessa ETFer genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Månadsutdelande fonder tilldrar sig stort intresse

Den 6 november förra året, bara dagar efter att vi publicerat en artikel om månadsutdelande fonder, lanserade JP Morgan en helt ny variant av en månadsutdelande fond. JPMorgan US Equity Premium Income Active UCITS ETF USD (dist) (JEIP ETF) med ISIN IE000U5MJOZ6, är en aktivt förvaltad ETF.

Den börshandlade fonden investerar i företag från USA. Ytterligare intäkter söks genom användning av en överlagringsstrategi med derivatinstrument. Denna ETF strävar efter att generera en högre avkastning än S&P 500-index.

Detta ledde till att vi fick uppdatera vår artikel om månadsutdelande fonder med JEIP men också med JPMorgan Nasdaq Equity Premium Income Active UCITS ETF USD (dist) (JEQP ETF) med ISIN IE000U9J8HX9, som är en aktivt förvaltad ETF, men som mäter sig mot Nasdaq-100 istället.

Under den sista veckan i februari 2025 noterade Montrose den första svenska ETFen på fem år. MONTDIV ETF är Sveriges första månadsutdelande ETF och rusade snabbt på listan efter de mest eftersökta börshandlade fonderna på vår sida. Det finns emellertid en hel del andra ETFer som ger utdelning varje månad. Vi uppdaterar löpande denna artikel.

När kommer utdelningen från MONTDIV?

Som nämnts så är MONTDIV den allra populäraste börshandlade fonden på vår sida. Tillsammans med sin syster ETF, MONTLEV, är de även populära på andra håll. Fram till idag har MONTDIV lockat närmare 300 miljoner kronor och seglat upp som den tredje mest ägda i Sverige. Dessutom stod Montroses två ETFer för vart fjärde ETF-avslut på Stockholmsbörsen (ex. Bull/Bear-produkter) under perioden mars-april 2025. Det ser vi som ett kvitto på att det finns en stor efterfrågan på börshandlade fonder.

ETP, ETF, ETC, ETN, ETI

Många är osäkra på terminologin när det gäller börshandlade produkter och vi ser dels hur de söker – och hittar många av de informativa artiklar som vi skrivit på Etfmarknaden.se, men också vår ordlista som förklarar det mesta som kan verkar förvirrande. En av våra äldre artiklar, Vad är vad? ETP, ETF, ETC, ETN och ETI från september 2012, har nu helt plötsligt dykt upp som en av de mer lästa artiklarna.

Fortsatt intresse för försvarsfonderna

Vilken ETF för försvarsindustrin är bäst och hur investerar man i denna sektor med hjälp av börshandlade fonder? I dag finns det flera ETFer som ger exponering mot flyg och försvar som följer tre olika index. De årliga förvaltningskostnaderna ligger 0,35 och 0,55 procent. Vi har skrivit en artikel om olika försvarsfonder. Du hittar mer om ETFer för försvarsindustrin här.

Utöver detta har samtliga de större aktörerna lanserat en en börshandlad fond för den europeiska försvarsindustrin vilka alla blirvit stora succcéer.

Inte längre populärast av dem alla

XACT Norden Högutdelande är utan tvekan en av de mest populära av alla de ETFer som vi har skrivit om på vår sida. Den kvartalsvisa utdelningen och dess satsning på aktier med en låg volatilitet och hög direktavkastning gör det till en populär fond som återfinns i mångas depåer. Nyligen lämnades årets andra utdelning från denna börshandlade fond.

Hur högt kommer vi när du Googlar på ordet ETF?

Under maj 2025 såg vi många sökningar på begreppen ETF, börshandlad fond och Etfmarknaden. Om det var vår egen sida eller om det var den totala marknaden för ETFer som besökarna sökte på vet vi inte, men efter att ha fått mail från en av de större emittenterna vet vi att de försöker kartlägga de svenska placerarnas exponering mot börshandlade fonder.

Om du söker på ordet ETF på Google, hur högt hamnar vi då?

Investerna söker information om försvarsfonder med fokus på Europa

Wisdomtree har under året lanserat en försvarsfond som investerar i europeiska företag, vilket även HANetf har gjort, kortnamnet är ARMY i London och 8RMY på tyska Xetra.

Populariteten för europeiska försvarsbörshandlade fonder (ETF:er) har ökat kraftigt på senare tid, drivet av betydande inflöden som återspeglar ett växande investerarintresse för sektorn. Dessa imponerande inflöden understryker det ökande erkännandet av försvarssektorns tillväxtpotential mot bakgrund av den nuvarande geopolitiska dynamiken.

SAVRs ETF-satsning skapar stort intresse

SAVR har precis valt att lansera handel med börshandlande fonder. SAVR som tidigare varit kände för att erbjuda handel med traditionella fonder har nyligen valt att lansera handel med aktier, men också med ETFer på framför allt tyska Xetra. På denna marknad erbjuder nu SAVR med flera ETFer än vad både Nordnet och Avanza gör.

Samtidigt har SAVR valt att lansera en egen produkt tillsammans med amerikanska Vanguard, SAVR Global by Vanguard.

Halalfonder är nu hetare än ESG

Tidigare var det många som sökte på begreppet ESG, men detta sökord har fallit från listan under de senaste månaderna. En variant av ESG-fond är de fonder som har en islamistisk inriktning, så kallade halalfonder, och det är fortfarande något som våra besökare letar information om. En sådan fond är ASWE, som är en aktivt förvaltad shariafond men till exempel HSBC har en serie fonder med fokus på att investera enligt islam. Det är ingen speciell enskild fond som sticker ut och lockar mer än andra.

Går det att handla ETFer hos Swedbank?

Swedbank ETF tror vi kan tolkas att det endera finns intresse för att veta om Swedbank har ETFer i sitt utbud, eller om det går att handla börshandlade fonder på Swedbank. Svaret på denna fråga återfinns här.

Räntesänkningar ökar intresset för fastigheter

Ett annat begrepp på listan är ETF fastigheter. Allt fler investerare tror att vi kommer att få se ytterligare räntesänkningar, inte bara i Sverige och Europa, men även i USA. Lägre räntor gör det enklare att räkna hem en investering i fastigheter. Kan det vara så att våra besökare undersöker möjligheterna att positionera sig i en ETF för fastigheter innan räntorna sänks för att de tror att det kommer att leda till en uppvärdering av fastighetsbolagen? Vill du ha några idéer så skrev vi en text om börshandlade fonder som investerar i fastigheter.

Du kan även läsa den text vi skrev i januari 2025 som heter 10 ETFer för att investera i fastigheter.

Är det värt att satsa på tyska aktier?

Många söker information om tyska aktier och tyska fonder. I mars publicerade vi en text som hette De bästa börshandlade fonderna för tyska utdelningsaktier. Kan det vara denna som lockar?

En investering i tyska utdelningsaktier, i alla fall sådana med hög utdelning anses av många vara en solid investering. Utdelning betalas vanligtvis av lönsamma och etablerade företag. För investerare som söker regelbunden inkomst i tider med låga räntor kan tyska utdelningsaktier ge attraktiv avkastning.

Det finns två huvudindex tillgängliga för att investera med ETFer i tyska högutdelningsaktier. Denna investeringsguide för tyska utdelningsaktier hjälper dig att navigera mellan särdragen hos DivDAX®-index och DAXplus® Maximum Dividend-index samt de börshandlade fonder som spårar dem. Det gör att du kan hitta de mest lämpliga ETFerna för dig genom att rangordna dem enligt dina preferenser.

Amerikanska large caps är något många vill veta mer om

Fonder som följer S&P 500 är, föga förvånande, en typ av fonder som det finns stort intresse kring. Det är ingen speciell enskild fond som sticker ut och lockar mer än andra. Det skall emellertid noteras att många sökningar sker på ord som ”Fond som följer S&P500 Avanza”. Vi skrev tidigare en artikel om S&P500 fonder, 26 börshandlade fonder som spårar S&P500 där vi jämförde alla de ETFer som spårar detta index i sin grundform.

BNP lanserade en europeisk försvarsfond i maj

BNP Paribas Asset Management (’BNPP AM’) tillkännagav idag noteringen av sin BNP Paribas Easy Bloomberg Europe Defense ETF på Euronext Paris, snart tillgänglig på Deutsche Börse Xetra, Borsa Italiana och SIX Swiss Exchange. Den handlas under kortnamnet BJL8 på tyska Xetra.

Investera i Polen med börshandlade fonder

I början av april skrev vi en text som sammanfattade att Investera i Polen med börshandlade fonder. Det tog en liten tid, men den har dykt upp på listan bland de mest populära fonderna.

I slutet av samma månad meddelade SAVR att företaget nu erbjuder handel på mer än 700 polska aktier.

Du kan handla Ripple med olika börshandlade produkter

Valour Ripple (XRP) SEK är en börshandlad produkt som spårar priset på XRP, Ripples infödda token. XRP förbättrar främst globala finansiella överföringar och utbyte av flera valutor. Snabb och miljövänlig, den digitala tillgången XRP designades för att fungera som den mest effektiva kryptovalutan för olika applikationer inom finanssektorn.

Valour Ripple (XRP) SEK ETP (ISIN: CH1161139584) är en börshandlad produkt som spårar priset på XRP, Ripples infödda token.

XRP har ett börsvärde på 29,57 miljarder USD och rankas på en sjätte plats bland alla kryptovalutor globalt. Ripple XRP är en nyckelspelare inom det digitala valutaområdet, känd för sin användning för att underlätta snabba och billiga internationella pengaöverföringar. XRP fungerar på RippleNet och fungerar som en bryggvaluta i Ripples betalningsnätverk, vilket möjliggör sömlösa valutaväxlingar över hela världen. Detta har positionerat XRP som ett föredraget val för finansiella institutioner som söker effektiva alternativ till traditionella gränsöverskridande betalningsmetoder.

Är du nyfiken på vilka börshandlade produkter det finns för att investera i XRP? Vi har självklart skrivit en artikel om detta där vi jämför alla de börshandlade alternativ vi hittat.

BlackRock lanserar europeisk försvars-ETF för europeiska investerare

’I slutet av maj lanserade BlackRock iShares Europe Defence UCITS ETF (DFEU), en europeisk försvars-ETF för europeiska investerare, som följer STOXX Europe Targeted Defence Index. Fonden är utformad för att ge exakt exponering mot europeiska försvarsföretag genom ett intäktsbaserat urval i en tid då europeiska nationer ökar de offentliga utgifterna för att förbättra sin försvarskapacitet.

Det går att handla börshandlade fonder hos Nordea

Nordea har en plattform, och i denna handelstjänst erbjuder denna bank tusentals olika ETFer. Det går att handla ETFer med fokus på räntemarknaden, aktiemarknaden, landspecifika ETFer och börshandlade fonder med fokus på olika branscher. Att handla ETFer hos Nordea sker endera i Nordea Investor och nätbanken.

Månadsutdelande fond med fokus på Europa

Global X EURO STOXX 50 Covered Call UCITS ETF EUR Distributing (SY7D ETF) med ISIN IE000SAXJ1M1, syftar till att följa EURO STOXX 50 Covered Call ATM-indexet. EURO STOXX 50 Covered Call ATM-indexet följer utvecklingen av en täckt köpoption på EURO STOXX 50-indexet. En täckt köpoption kombinerar en lång position i en tillgång med försäljning av köpoptioner på denna tillgång.

Dyrare kaffe skapar intresse för börshandlade produkter

Det stigande kaffepriset (som du kan följa här) har lett till ett ökat intresse bland investerarna för att köpa en ETF som spårar kaffepriset. Det finns emellertid ingen ETF som spårar kaffepriset, då Eus regler kräver att det finns minst 16 olika komponenter i en ETF. Det finns emellertid ett par ETCer som gör samma sak, till exempel WisdomTree Coffee (OD7B ETC).

Investera i platina med börshandlade produkter

När en investerare har bestämt sig för vilken eller vilka metaller de vill köpa kvarstår frågan om ”hur investera i platina”. Det finns flera investeringsprodukter tillgängliga för potentiella platinaägare. I artikeln utforskar vi några av de vanligaste metoderna, och tittar på några av deras fördelar och nackdelar, för att hjälpa dig att fatta det beslut som bäst passar dina investeringsbehov och ambitioner.

Världens största fond

VOO är nu världens största börshandlade fond. Fredagen den 14 februari 2025 (Alla hjärtans dag), sista arbetsdagen före Presidents Day, firandet av George Washingtons födelsedag, kommer verkligen att komma ihåg som dagen VOO kunde överträffa SPYs enorma AUM (631,9 miljarder USD respektive 630,4 miljarder USD).

SPY, som lanserades 1993 och förvaltas av State Street SPDR ETFer, är fortfarande den överlägset mest likvida ETFen i världen och den första ETF som är tillgänglig för amerikanska investerare.

Introducerad 2010 och förvaltad av Vanguard, är VOO nu den största ETF i världen.

Indien är en marknad som många söker information om

ETF Indien är inte en specifik börshandlad fond, men förekommer i en mängd olika varianter. Det finns tydligen ett stort intresse för att investera i indiska aktier bland sidan besökare, och då är kanske en ETF ett bra sätt att göra det. Vi skrev under i början av året en artikel om olika Indienfonder. Sedan dess har det dykt upp ytterligare ett par ETFer med fokus på Indien så vi har uppdaterat artikeln.

Virtune attraherar åter intresse från spararna

I maj 2025 lanserade denna svenska förvaltare en ny produkt, Virtune Bitcoin Prime ETP är en fysiskt backad börshandlad produkt (ETP) designad för att erbjuda investerare ett säkert och kostnadseffektivt sätt att få exponering mot Bitcoin (BTC).

En bred satsning på råvarumarknaden

Fler och fler läsare söker information om råvarufonder. En av ETF som fått många sökningar är L&G Multi Strategy Enhanced Commodities UCITS ETF (EN4C ETF) syftar till att spåra resultatet för Barclays Backwardation Tilt Multi-Strategy Capped Total Return Index (”Indexet”).

Normalt sett är det samma fonder och börshandlade produkter som de nordiska investerarna söker på. Av den anledningen är det extra roligt att se att nya produkter hamnar bland de mest sökta. I detta fall är det Torbjörn Iwarsons råvarufond som lockar ett stort intresse. Det är Nordens enda riktiga råvarufond. Notera att just nu är råvarumarknaden är litet nedtryckt, så det är ett bra tillfälle att komma in billigt. Läs mer om Centaur Commodity Fund på deras hemsida.

WINC ETF en aktiv satsning på att skapa inkomster

iShares World Equity High Income UCITS ETF USD (Dist) (WINC ETF), med ISIN IE000KJPDY61, är en aktivt förvaltad ETF som investerar i företag från utvecklade marknader över hela världen. Titelurvalet baseras på kvantitativa (matematiska eller statistiska) prognosmodeller och ESG-kriterier. Dessutom syftar ETFen till att generera ytterligare intäkter genom att sälja köpoptioner och köpa terminer på utvecklade marknader med stora och medelstora index.

Nyheter

C9DY ETF investerar i företag med ett positivt bidrag till FNs hållbarhetsmål

Publicerad

4 timmar sedanden

30 juni, 2025

UmweltBank UCITS ETF – Global SDG Focus (C9DY ETF) med ISIN LU2679277744, strävar efter att spåra Solactive UmweltBank Global Investable Universe SDG PAB-index. Solactive UmweltBank Global Investable Universe SDG PAB-index spårar aktier från utvecklade och tillväxtländer över hela världen. Indexet syftar till att välja ut företag med ett positivt bidrag till FNs 17 Sustainable Development Goals (SDG). Aktierna som ingår filtreras enligt ESG-kriterier (miljö, social och bolagsstyrning). Dessutom beaktas EUs direktiv om klimatskydd.

ETF:s TER (total cost ratio) uppgår till 0,80 % p.a. UmweltBank UCITS ETF – Global SDG Focus är den enda ETF som följer Solactive UmweltBank Global Investable Universe SDG PAB-index. ETFen replikerar det underliggande indexets prestanda genom samplingsteknik (köper ett urval av de mest relevanta indexbeståndsdelarna). Utdelningarna i ETFen ackumuleras och återinvesteras.

UmweltBank UCITS ETF – Global SDG Focus är en mycket liten ETF med 13 miljoner euro under förvaltning. Denna ETF lanserades den 1 juli 2024 och har sin hemvist i Luxemburg.

Handla C9DY ETF

UmweltBank UCITS ETF – Global SDG Focus (C9DY ETF) är en europeisk börshandlad fond. Denna fond handlas på Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| XETRA | EUR | C9DY |

VanEck Quantum Computing UCITS ETF A (QUTM ETF) med ISIN IE0007Y8Y157, syftar till att följa MarketVector Global Quantum Leaders-indexet. MarketVector Global Quantum Leaders-indexet följer företag världen över som är aktiva inom kvantberäkning.

Den börshandlade fondens totala kostnadskvot (TER) uppgår till 0,55 % per år. VanEck Quantum Computing UCITS ETF A är den enda ETFen som följer MarketVector Global Quantum Leaders-indexet. ETFen replikerar det underliggande indexets resultat genom fullständig replikering (genom att köpa alla indexkomponenter). Utdelningarna i ETFen ackumuleras och återinvesteras.

Den börshandlade fondens lanserades den 21 maj 2025 och har sitt säte i Irland.

Kvantberäkning övergår från teori till verklighet och lovar att omdefiniera vad som är beräkningsmässigt möjligt. Som Europas första fångar VanEck Quantum Computing UCITS ETF potentialen hos en av vår tids mest transformerande teknologier. Medan tidiga användningsfall framträder, är kommersiell framgång fortfarande osäker, och finansiell exponering kan sträcka sig bortom renodlade kvantberäkningsföretag.

- Tidig, diversifierad tillgång till en potentiell banbrytande teknologi

- Exponering mot företag som driver forskning, utveckling och tillämpning av kvantberäkning

- Inkluderar nya framväxande renodlade innovatörer och globala teknikledare med verifierat starkt patentägande

Huvudsakliga riskfaktorer: Likviditetsrisk, koncentrationsrisk, risk att investera i mindre företag. Investerare måste beakta alla fondens egenskaper eller mål som beskrivs i prospektet eller relaterade dokument innan de fattar ett investeringsbeslut. Se KID och prospektet för annan viktig information innan du investerar. Marknadsutveckling garanteras inte.

Underliggande index

MarketVector™ Global Quantum Leaders Total Return Net Index (MVQTMLTR)

Handla QUTM ETF

VanEck Quantum Computing UCITS ETF A (QUTM ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

Största innehav

| Värdepapper | Ticker | Vikt % |

| Ionq Inc | IONQ US | 13,45 |

| D-Wave Quantum Inc | QBTS US | 10,01 |

| Rigetti Computing Inc | RGTI US | 8,13 |

| Boeing Co/The | BA US | 3,86 |

| Microsoft Corp | MSFT US | 3,66 |

| Synopsys Inc | SNPS US | 3,63 |

| Sony Group Corp | 6758 JP | 3,40 |

| Bank Of America Corp | BAC US | 3,38 |

| Honeywell International | HON US | 3,36 |

| Hitachi Ltd | 6501 JP | 3,35 |

| Wells Fargo & Co | WFC US | 3,28 |

| Deutsche Telekom Ag | DTE GR | 3,26 |

Innehav kan komma att förändras

Hetaste investeringstemat i juni 2025

C9DY ETF investerar i företag med ett positivt bidrag till FNs hållbarhetsmål

QUTM ETF Europas första fond för Quantumdatorer

De bästa ETFerna med fokus på momentum

USAH ETF investerar i amerikanska företagsobligationer och hedgar dem till euro

De bästa ETFer som investerar i europeiska utdelningsaktier

YieldMax® lanserar sin andra produkt för europeiska investerare

Nya börshandlade produkter på Xetra

3EDS ETN ger tre gånger den negativa avkastningen på flyg- och försvarsindustrin

Big News for Nuclear Energy—What It Means for Investors

Populära

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanDe bästa ETFer som investerar i europeiska utdelningsaktier

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanYieldMax® lanserar sin andra produkt för europeiska investerare

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNya börshandlade produkter på Xetra

-

Nyheter2 veckor sedan

Nyheter2 veckor sedan3EDS ETN ger tre gånger den negativa avkastningen på flyg- och försvarsindustrin

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBig News for Nuclear Energy—What It Means for Investors

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanNordea Asset Management lanserar nya ETFer på Xetra

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanHANetfs VD Hector McNeil kommenterar FCAs kryptonyheter

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanJPM noterar nya ETFer på Xetra och Börse Frankfurt