Nyheter

Bitcoin Nears All-Time High, 26% of ETH Staked, and Uniswap Considers Staking: What Happened in Crypto This Month?

Publicerad

1 år sedanden

February started with short-lived outages and ended with a bull run. As a cherry on top, Gemini Earn customers were promised to be made whole, in kind, after a billion-dollar settlement! Bitcoin’s price has increased by over 250% since the termination of Gemini Earn in January 2023. While profit-taking measures may follow Gemini’s pending payback, the accumulation levels of Bitcoin short-term holders and the record-breaking flows in U.S. spot Bitcoin ETFs, as mentioned in this report, may balance out the potential sell-off. In this monthly review, we’ll discuss the following trends driving the market:

• Bitcoin Nears All-time Highs During Slowing Economy

• More ETH Staked and the Growing Narrative of Liquid Re-staking

• Staking Rewards Revisited, Uniswap Breaks Out of Its 2-Year Lows

Bitcoin Nears All-time Highs During Slowing Economy

The Federal Reserve’s favorite gauge for inflation, the Personal Consumption Expenditure (PCE) index, rose by 2.8% from a year ago, the highest increase in the last 12 months but in line with expectations. After three straight months of increases, there was a 6.1% decline in manufacturing purchase orders of durable goods, less than the forecasted -4.9% and the lowest in almost four years. Although the economy is slowing down, the pace is fast enough to dodge a recession despite rising unemployment claims exceeding expectations. While one print alone is not indicative of how the Fed will respond, it still sets the tone for potential future interest rate cuts. Lower rates usually benefit risk-on assets like tech and crypto.

Bitcoin, in the meantime, has already reached all-time highs, as flows in Bitcoin spot ETFs break the record of $673M in daily net inflows. Speculation as we near the Halving, expedited by the spot Bitcoin ETFs in the U.S., has driven BTC to grow by ~45% this month, the biggest BTC/USD candle we’ve seen before a Halving event. A case in point showing this momentum is that in less than two months, Blackrock’s ETF has accrued the same amount of flows gold’s first ETF was able to accrue in two years: $10B.

As we close the second month since the launch of spot Bitcoin ETFs in the U.S., more institutions are warming up to Bitcoin. Wells Fargo and Merrill Lynch have started providing access to spot Bitcoin ETFs to select wealth management clients. Also, Morgan Stanley is allegedly evaluating the Bitcoin funds for its brokerage platform. Estimated to hold more than $100T in assets under management, the registered investment advisory (RIA) industry and its cautious entry are anticipated to unlock even bigger capital potential for this asset class.

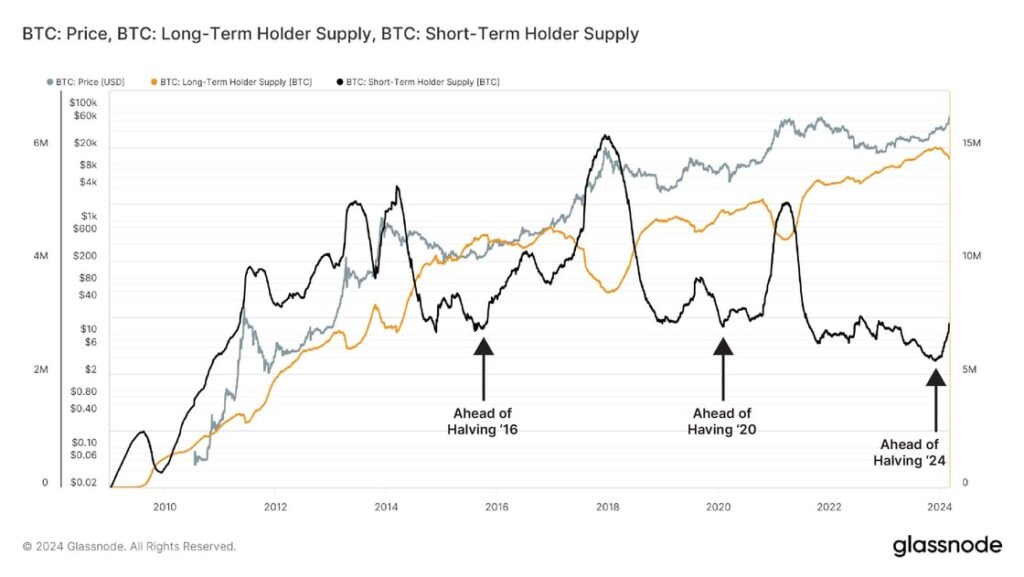

As shown in Figure 1, Bitcoin short-term holders (holding BTC for less than 155 days) have continued accumulating as is customary a few months before the asset’s halving event — the approval of the spot Bitcoin ETFs in the U.S. catalyzed buying interest. Since January 11, short-term holders have increased their BTC supply by 25%. In contrast, long-term holders reduced their holdings by 3%, which is also a trend we’ve seen in the past halving events, as depicted in the chart below. On the other hand, Bitcoin’s Futures Open Interest has spiked significantly to levels not seen since the last bull run in 2021, which investors should be aware of, as it could imply higher volatility going forward.

Figure 1 – ETF launch in the U.S. catalyzes interest for short-term holders

Source: Glassnode, 21Shares

Nevertheless, innovation on the network is still churning. Soon, Bitcoin holders will be able to earn yield by staking their idle coins (SigNet BTC) to increase the security of proof-of-stake chains in a trustless manner. This will be possible through Babylon, a new external POS protocol pioneering the new primitive for Bitcoin, which has been on the testnet since February 28.

More ETH Staked and the Growing Narrative of Liquid Re-staking

ETH jumped by ~50% this month, steadily above the $3K mark since February 25. This jump can be explained by many factors, led by the speculation around a spot ETH ETF in the U.S., as well as a new experimental token standard dubbed ERC404, still not endorsed by the Ethereum Foundation. The experimental standard integrates attributes from ERC-20 (fungible), like transferability and divisibility for its fractionalized tokens, and ERC-721 (non-fungible) standard for its unique identifier feature to track the underlying NFT. ERC404 has the potential for native fractionalizing of digital assets like collectibles and tokenized real-world assets such as funds and real estate without needing third-party solutions.

Other factors may include Bitcoin’s recent rally since ETH has been positively correlated with BTC since 2018. From a user’s perspective, Ethereum’s growing staking ratio highlights its improving fundamentals as it demonstrates more people are willing to secure the network. A little over 26% of all Ethereum has been staked by 179K unique depositing addresses. That puts the total amount of staked ETH at 31M (+$100B), with Lido dominating more than 30% of the staking market, helping to secure the network further and earning around 4-6% yield while freeing up capital that can be used across DeFi. Finally, the hype has fueled the narrative surrounding re-staking, a method enabling users to re-stake their staked ETH or liquid staking tokens (LSTs) – representing staked ETH – for additional yield (approximately 2-4% on average, added to Ethereum’s staking yield).

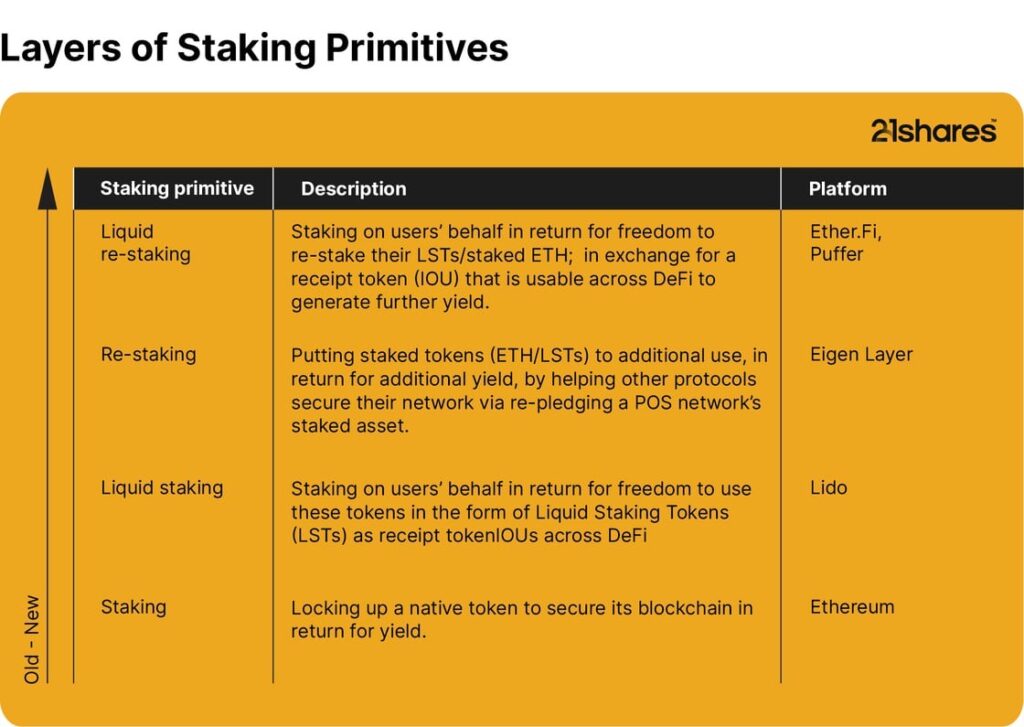

What is re-staking?

Introduced in June by EigenLayer, re-staking offers an innovative way to validate the security of external protocols by harnessing Ethereum’s proof-of-stake network. Within EigenLayer, ETH deposits can be “re-staked” across various protocols, eliminating the need to establish their own validator lists and significantly reducing the cost and time required to launch new networks. That said, liquid re-staking has emerged as a pivotal addition to the staking ecosystem, capitalizing on the growing enthusiasm for re-staking, which has put EigenLayer as the second largest protocol with $10.5B in assets under management, trailing only Lido’s liquid-staking solution with $35.2B, on Ethereum. For further clarity, please refer to Figure 2 to demystify the increasingly complex staking ecosystem.

Figure 2 – Layers of Staking Primitives

Source: 21Shares

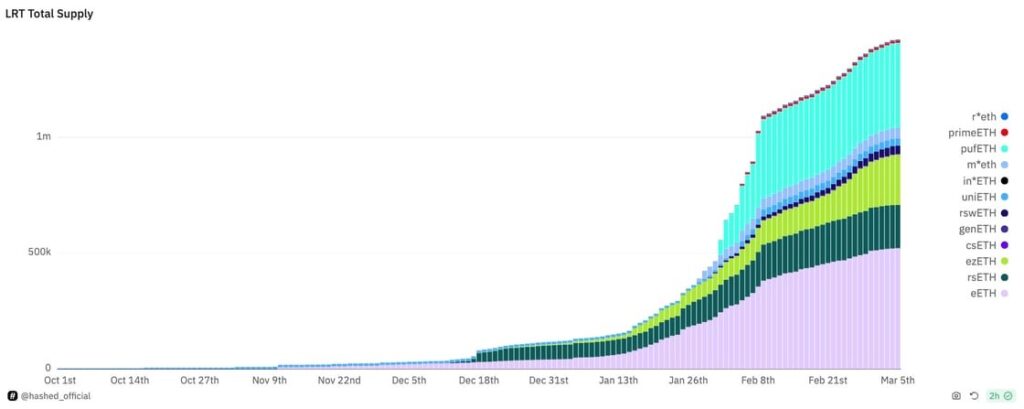

Like liquid staking, liquid re-staking simplifies the process of restaking, enabling users to maintain their capital while contributing to the security validation of the external networks integrated with EigenLayer. However, this new primitive is not without its critics, as it introduces additional slashing risks to ETH validators, who are now subject to the slashing rules of multiple networks. Moreover, Liquid Restaking Tokens (LRTs) have drawn comparisons to Collateralized Debt Obligations (CDOs) from 2008, where investment products were layered with levels of complexity that ordinary users struggled to comprehend. Of course, blockchain’s transparency sets it apart from the traditional financial system structure. Nevertheless, re-staking has been one of the fastest growing industries in 2024, as it increased by tenfold, from less than $500M at the beginning of January to more than $5B, as it continues to push the boundaries of Ethereum’s staking capabilities, as it can be observed in Figure 3 below.

Figure 3 – Growth of Liquid Restaking Tokens built on top of EigenLayer

Source: Hashed on Dune

Meanwhile, throughout February, the Dencun upgrade was successfully tested and is now scheduled for March 13. The biggest beneficiary of this upgrade will be Ethereum’s scaling solutions, such as Polygon, Optimism, and Arbitrum, whose gas fees are anticipated to decrease by around 90% once the upgrade is deployed.

Staking Rewards Revisited, Uniswap Breaks Out of Its 2-Year Lows

Uniswap is the largest decentralized exchange (DEX) by assets under management, with $5.7B in total assets locked. Before October 2023, Uniswap Labs received no fees and, therefore, no revenue; 11 investors, including Polychain and Paradigm, had solely funded the DEX. As of October 17, traders on Uniswap started paying 0.15% on their swaps only if they swapped directly on the DEX’s interface or wallet. This move added the first layer of revenue stream to fund the sustainable development of the DEX without relying on VC; Uniswap has collected $5.8M in fees since. However, the fee accrual did not benefit holders of the DEX’s native token, UNI, which remained an unproductive governance token below the $10 mark for two uninterrupted years following its all-time high of ~$45 in May 2021.

Not for long. Community members had proposed staking rewards earlier in May 2023. Almost a year later, on February 23, the Uniswap Foundation itself proposed enriching the fee mechanism to reward UNI holders who have staked and delegated their tokens. The upgrade is estimated to collectively bring between $62M and $156M to UNI holders in annual dividends. Based on that potential, UNI went on a 92% rally in February (jumping by 53% overnight after the proposal) to pass the $11 mark and increase its market capitalization by 87%. Depending on the fate of this proposal, which will be voted on starting March 8, we could see more applications follow suit as more value creation can be realized on the application layer, evident by protocols like Frax who’s already expected to unveil a revenue sharing mechanism at the end of this week. That said, caution should be exercised as enabling revenue sharing has historically been feared of triggering regulatory scrutiny; it could classify certain assets as a security due to potentially meeting the prongs of the Howey test.

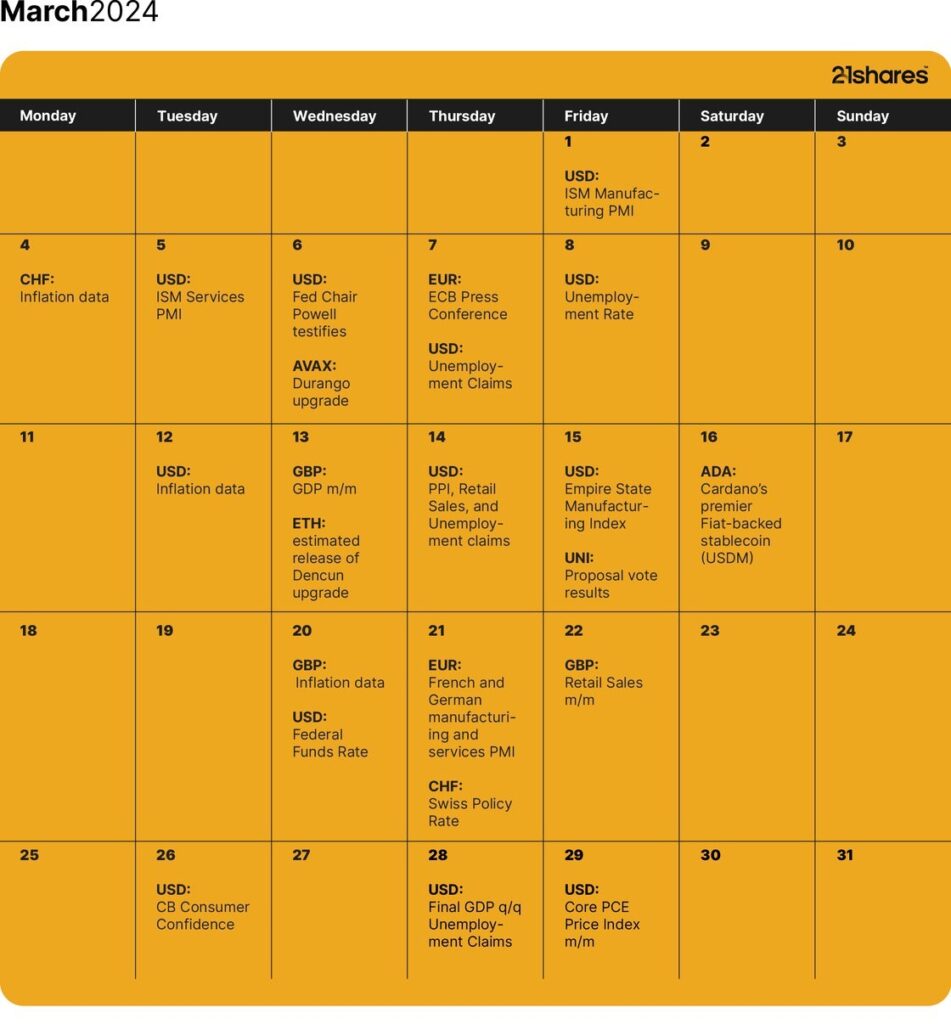

Next Month’s Calendar

Source: Forex Factory, 21Shares

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

Primer: Injective, infrastructure for global finance

-

Bitcoin is resilient despite the Middle East war

-

Grattis till Bitwise Europe på femårsjubileet för deras fysiska Bitcoin ETP

-

Svenska investerare — 21Shares Nasdaq Stockholm-sortiment har just blivit starkare

-

UK looking to lift the retail ban on crypto ETPs

-

21Shares noterarar fem nya krypto-ETPer Nasdaq Stockholm

De senaste månaderna har det varit större förändringar på denna lista än normalt. Under juni 2025 förändrades listan på de mest eftersökta ETFerna åter kraftigt, vilket numera är ganska normalt. Denna månad var det hetaste investeringstemat i månadsutdelande ETFer . Vi noterar är att Montrose befäster sin position som den populäraste ETFen på Etfmarknaden.se samtidigt som listan är mer koncentrerad än tidigare.

Det går att handla andelar i dessa ETFer genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Månadsutdelande fonder tilldrar sig stort intresse

Den 6 november förra året, bara dagar efter att vi publicerat en artikel om månadsutdelande fonder, lanserade JP Morgan en helt ny variant av en månadsutdelande fond. JPMorgan US Equity Premium Income Active UCITS ETF USD (dist) (JEIP ETF) med ISIN IE000U5MJOZ6, är en aktivt förvaltad ETF.

Den börshandlade fonden investerar i företag från USA. Ytterligare intäkter söks genom användning av en överlagringsstrategi med derivatinstrument. Denna ETF strävar efter att generera en högre avkastning än S&P 500-index.

Detta ledde till att vi fick uppdatera vår artikel om månadsutdelande fonder med JEIP men också med JPMorgan Nasdaq Equity Premium Income Active UCITS ETF USD (dist) (JEQP ETF) med ISIN IE000U9J8HX9, som är en aktivt förvaltad ETF, men som mäter sig mot Nasdaq-100 istället.

Under den sista veckan i februari 2025 noterade Montrose den första svenska ETFen på fem år. MONTDIV ETF är Sveriges första månadsutdelande ETF och rusade snabbt på listan efter de mest eftersökta börshandlade fonderna på vår sida. Det finns emellertid en hel del andra ETFer som ger utdelning varje månad. Vi uppdaterar löpande denna artikel.

När kommer utdelningen från MONTDIV?

Som nämnts så är MONTDIV den allra populäraste börshandlade fonden på vår sida. Tillsammans med sin syster ETF, MONTLEV, är de även populära på andra håll. Fram till idag har MONTDIV lockat närmare 300 miljoner kronor och seglat upp som den tredje mest ägda i Sverige. Dessutom stod Montroses två ETFer för vart fjärde ETF-avslut på Stockholmsbörsen (ex. Bull/Bear-produkter) under perioden mars-april 2025. Det ser vi som ett kvitto på att det finns en stor efterfrågan på börshandlade fonder.

ETP, ETF, ETC, ETN, ETI

Många är osäkra på terminologin när det gäller börshandlade produkter och vi ser dels hur de söker – och hittar många av de informativa artiklar som vi skrivit på Etfmarknaden.se, men också vår ordlista som förklarar det mesta som kan verkar förvirrande. En av våra äldre artiklar, Vad är vad? ETP, ETF, ETC, ETN och ETI från september 2012, har nu helt plötsligt dykt upp som en av de mer lästa artiklarna.

Fortsatt intresse för försvarsfonderna

Vilken ETF för försvarsindustrin är bäst och hur investerar man i denna sektor med hjälp av börshandlade fonder? I dag finns det flera ETFer som ger exponering mot flyg och försvar som följer tre olika index. De årliga förvaltningskostnaderna ligger 0,35 och 0,55 procent. Vi har skrivit en artikel om olika försvarsfonder. Du hittar mer om ETFer för försvarsindustrin här.

Utöver detta har samtliga de större aktörerna lanserat en en börshandlad fond för den europeiska försvarsindustrin vilka alla blirvit stora succcéer.

Inte längre populärast av dem alla

XACT Norden Högutdelande är utan tvekan en av de mest populära av alla de ETFer som vi har skrivit om på vår sida. Den kvartalsvisa utdelningen och dess satsning på aktier med en låg volatilitet och hög direktavkastning gör det till en populär fond som återfinns i mångas depåer. Nyligen lämnades årets andra utdelning från denna börshandlade fond.

Hur högt kommer vi när du Googlar på ordet ETF?

Under maj 2025 såg vi många sökningar på begreppen ETF, börshandlad fond och Etfmarknaden. Om det var vår egen sida eller om det var den totala marknaden för ETFer som besökarna sökte på vet vi inte, men efter att ha fått mail från en av de större emittenterna vet vi att de försöker kartlägga de svenska placerarnas exponering mot börshandlade fonder.

Om du söker på ordet ETF på Google, hur högt hamnar vi då?

Investerna söker information om försvarsfonder med fokus på Europa

Wisdomtree har under året lanserat en försvarsfond som investerar i europeiska företag, vilket även HANetf har gjort, kortnamnet är ARMY i London och 8RMY på tyska Xetra.

Populariteten för europeiska försvarsbörshandlade fonder (ETF:er) har ökat kraftigt på senare tid, drivet av betydande inflöden som återspeglar ett växande investerarintresse för sektorn. Dessa imponerande inflöden understryker det ökande erkännandet av försvarssektorns tillväxtpotential mot bakgrund av den nuvarande geopolitiska dynamiken.

SAVRs ETF-satsning skapar stort intresse

SAVR har precis valt att lansera handel med börshandlande fonder. SAVR som tidigare varit kände för att erbjuda handel med traditionella fonder har nyligen valt att lansera handel med aktier, men också med ETFer på framför allt tyska Xetra. På denna marknad erbjuder nu SAVR med flera ETFer än vad både Nordnet och Avanza gör.

Samtidigt har SAVR valt att lansera en egen produkt tillsammans med amerikanska Vanguard, SAVR Global by Vanguard.

Halalfonder är nu hetare än ESG

Tidigare var det många som sökte på begreppet ESG, men detta sökord har fallit från listan under de senaste månaderna. En variant av ESG-fond är de fonder som har en islamistisk inriktning, så kallade halalfonder, och det är fortfarande något som våra besökare letar information om. En sådan fond är ASWE, som är en aktivt förvaltad shariafond men till exempel HSBC har en serie fonder med fokus på att investera enligt islam. Det är ingen speciell enskild fond som sticker ut och lockar mer än andra.

Går det att handla ETFer hos Swedbank?

Swedbank ETF tror vi kan tolkas att det endera finns intresse för att veta om Swedbank har ETFer i sitt utbud, eller om det går att handla börshandlade fonder på Swedbank. Svaret på denna fråga återfinns här.

Räntesänkningar ökar intresset för fastigheter

Ett annat begrepp på listan är ETF fastigheter. Allt fler investerare tror att vi kommer att få se ytterligare räntesänkningar, inte bara i Sverige och Europa, men även i USA. Lägre räntor gör det enklare att räkna hem en investering i fastigheter. Kan det vara så att våra besökare undersöker möjligheterna att positionera sig i en ETF för fastigheter innan räntorna sänks för att de tror att det kommer att leda till en uppvärdering av fastighetsbolagen? Vill du ha några idéer så skrev vi en text om börshandlade fonder som investerar i fastigheter.

Du kan även läsa den text vi skrev i januari 2025 som heter 10 ETFer för att investera i fastigheter.

Är det värt att satsa på tyska aktier?

Många söker information om tyska aktier och tyska fonder. I mars publicerade vi en text som hette De bästa börshandlade fonderna för tyska utdelningsaktier. Kan det vara denna som lockar?

En investering i tyska utdelningsaktier, i alla fall sådana med hög utdelning anses av många vara en solid investering. Utdelning betalas vanligtvis av lönsamma och etablerade företag. För investerare som söker regelbunden inkomst i tider med låga räntor kan tyska utdelningsaktier ge attraktiv avkastning.

Det finns två huvudindex tillgängliga för att investera med ETFer i tyska högutdelningsaktier. Denna investeringsguide för tyska utdelningsaktier hjälper dig att navigera mellan särdragen hos DivDAX®-index och DAXplus® Maximum Dividend-index samt de börshandlade fonder som spårar dem. Det gör att du kan hitta de mest lämpliga ETFerna för dig genom att rangordna dem enligt dina preferenser.

Amerikanska large caps är något många vill veta mer om

Fonder som följer S&P 500 är, föga förvånande, en typ av fonder som det finns stort intresse kring. Det är ingen speciell enskild fond som sticker ut och lockar mer än andra. Det skall emellertid noteras att många sökningar sker på ord som ”Fond som följer S&P500 Avanza”. Vi skrev tidigare en artikel om S&P500 fonder, 26 börshandlade fonder som spårar S&P500 där vi jämförde alla de ETFer som spårar detta index i sin grundform.

BNP lanserade en europeisk försvarsfond i maj

BNP Paribas Asset Management (’BNPP AM’) tillkännagav idag noteringen av sin BNP Paribas Easy Bloomberg Europe Defense ETF på Euronext Paris, snart tillgänglig på Deutsche Börse Xetra, Borsa Italiana och SIX Swiss Exchange. Den handlas under kortnamnet BJL8 på tyska Xetra.

Investera i Polen med börshandlade fonder

I början av april skrev vi en text som sammanfattade att Investera i Polen med börshandlade fonder. Det tog en liten tid, men den har dykt upp på listan bland de mest populära fonderna.

I slutet av samma månad meddelade SAVR att företaget nu erbjuder handel på mer än 700 polska aktier.

Du kan handla Ripple med olika börshandlade produkter

Valour Ripple (XRP) SEK är en börshandlad produkt som spårar priset på XRP, Ripples infödda token. XRP förbättrar främst globala finansiella överföringar och utbyte av flera valutor. Snabb och miljövänlig, den digitala tillgången XRP designades för att fungera som den mest effektiva kryptovalutan för olika applikationer inom finanssektorn.

Valour Ripple (XRP) SEK ETP (ISIN: CH1161139584) är en börshandlad produkt som spårar priset på XRP, Ripples infödda token.

XRP har ett börsvärde på 29,57 miljarder USD och rankas på en sjätte plats bland alla kryptovalutor globalt. Ripple XRP är en nyckelspelare inom det digitala valutaområdet, känd för sin användning för att underlätta snabba och billiga internationella pengaöverföringar. XRP fungerar på RippleNet och fungerar som en bryggvaluta i Ripples betalningsnätverk, vilket möjliggör sömlösa valutaväxlingar över hela världen. Detta har positionerat XRP som ett föredraget val för finansiella institutioner som söker effektiva alternativ till traditionella gränsöverskridande betalningsmetoder.

Är du nyfiken på vilka börshandlade produkter det finns för att investera i XRP? Vi har självklart skrivit en artikel om detta där vi jämför alla de börshandlade alternativ vi hittat.

BlackRock lanserar europeisk försvars-ETF för europeiska investerare

’I slutet av maj lanserade BlackRock iShares Europe Defence UCITS ETF (DFEU), en europeisk försvars-ETF för europeiska investerare, som följer STOXX Europe Targeted Defence Index. Fonden är utformad för att ge exakt exponering mot europeiska försvarsföretag genom ett intäktsbaserat urval i en tid då europeiska nationer ökar de offentliga utgifterna för att förbättra sin försvarskapacitet.

Det går att handla börshandlade fonder hos Nordea

Nordea har en plattform, och i denna handelstjänst erbjuder denna bank tusentals olika ETFer. Det går att handla ETFer med fokus på räntemarknaden, aktiemarknaden, landspecifika ETFer och börshandlade fonder med fokus på olika branscher. Att handla ETFer hos Nordea sker endera i Nordea Investor och nätbanken.

Månadsutdelande fond med fokus på Europa

Global X EURO STOXX 50 Covered Call UCITS ETF EUR Distributing (SY7D ETF) med ISIN IE000SAXJ1M1, syftar till att följa EURO STOXX 50 Covered Call ATM-indexet. EURO STOXX 50 Covered Call ATM-indexet följer utvecklingen av en täckt köpoption på EURO STOXX 50-indexet. En täckt köpoption kombinerar en lång position i en tillgång med försäljning av köpoptioner på denna tillgång.

Dyrare kaffe skapar intresse för börshandlade produkter

Det stigande kaffepriset (som du kan följa här) har lett till ett ökat intresse bland investerarna för att köpa en ETF som spårar kaffepriset. Det finns emellertid ingen ETF som spårar kaffepriset, då Eus regler kräver att det finns minst 16 olika komponenter i en ETF. Det finns emellertid ett par ETCer som gör samma sak, till exempel WisdomTree Coffee (OD7B ETC).

Investera i platina med börshandlade produkter

När en investerare har bestämt sig för vilken eller vilka metaller de vill köpa kvarstår frågan om ”hur investera i platina”. Det finns flera investeringsprodukter tillgängliga för potentiella platinaägare. I artikeln utforskar vi några av de vanligaste metoderna, och tittar på några av deras fördelar och nackdelar, för att hjälpa dig att fatta det beslut som bäst passar dina investeringsbehov och ambitioner.

Världens största fond

VOO är nu världens största börshandlade fond. Fredagen den 14 februari 2025 (Alla hjärtans dag), sista arbetsdagen före Presidents Day, firandet av George Washingtons födelsedag, kommer verkligen att komma ihåg som dagen VOO kunde överträffa SPYs enorma AUM (631,9 miljarder USD respektive 630,4 miljarder USD).

SPY, som lanserades 1993 och förvaltas av State Street SPDR ETFer, är fortfarande den överlägset mest likvida ETFen i världen och den första ETF som är tillgänglig för amerikanska investerare.

Introducerad 2010 och förvaltad av Vanguard, är VOO nu den största ETF i världen.

Indien är en marknad som många söker information om

ETF Indien är inte en specifik börshandlad fond, men förekommer i en mängd olika varianter. Det finns tydligen ett stort intresse för att investera i indiska aktier bland sidan besökare, och då är kanske en ETF ett bra sätt att göra det. Vi skrev under i början av året en artikel om olika Indienfonder. Sedan dess har det dykt upp ytterligare ett par ETFer med fokus på Indien så vi har uppdaterat artikeln.

Virtune attraherar åter intresse från spararna

I maj 2025 lanserade denna svenska förvaltare en ny produkt, Virtune Bitcoin Prime ETP är en fysiskt backad börshandlad produkt (ETP) designad för att erbjuda investerare ett säkert och kostnadseffektivt sätt att få exponering mot Bitcoin (BTC).

En bred satsning på råvarumarknaden

Fler och fler läsare söker information om råvarufonder. En av ETF som fått många sökningar är L&G Multi Strategy Enhanced Commodities UCITS ETF (EN4C ETF) syftar till att spåra resultatet för Barclays Backwardation Tilt Multi-Strategy Capped Total Return Index (”Indexet”).

Normalt sett är det samma fonder och börshandlade produkter som de nordiska investerarna söker på. Av den anledningen är det extra roligt att se att nya produkter hamnar bland de mest sökta. I detta fall är det Torbjörn Iwarsons råvarufond som lockar ett stort intresse. Det är Nordens enda riktiga råvarufond. Notera att just nu är råvarumarknaden är litet nedtryckt, så det är ett bra tillfälle att komma in billigt. Läs mer om Centaur Commodity Fund på deras hemsida.

WINC ETF en aktiv satsning på att skapa inkomster

iShares World Equity High Income UCITS ETF USD (Dist) (WINC ETF), med ISIN IE000KJPDY61, är en aktivt förvaltad ETF som investerar i företag från utvecklade marknader över hela världen. Titelurvalet baseras på kvantitativa (matematiska eller statistiska) prognosmodeller och ESG-kriterier. Dessutom syftar ETFen till att generera ytterligare intäkter genom att sälja köpoptioner och köpa terminer på utvecklade marknader med stora och medelstora index.

Nyheter

C9DY ETF investerar i företag med ett positivt bidrag till FNs hållbarhetsmål

Publicerad

3 timmar sedanden

30 juni, 2025

UmweltBank UCITS ETF – Global SDG Focus (C9DY ETF) med ISIN LU2679277744, strävar efter att spåra Solactive UmweltBank Global Investable Universe SDG PAB-index. Solactive UmweltBank Global Investable Universe SDG PAB-index spårar aktier från utvecklade och tillväxtländer över hela världen. Indexet syftar till att välja ut företag med ett positivt bidrag till FNs 17 Sustainable Development Goals (SDG). Aktierna som ingår filtreras enligt ESG-kriterier (miljö, social och bolagsstyrning). Dessutom beaktas EUs direktiv om klimatskydd.

ETF:s TER (total cost ratio) uppgår till 0,80 % p.a. UmweltBank UCITS ETF – Global SDG Focus är den enda ETF som följer Solactive UmweltBank Global Investable Universe SDG PAB-index. ETFen replikerar det underliggande indexets prestanda genom samplingsteknik (köper ett urval av de mest relevanta indexbeståndsdelarna). Utdelningarna i ETFen ackumuleras och återinvesteras.

UmweltBank UCITS ETF – Global SDG Focus är en mycket liten ETF med 13 miljoner euro under förvaltning. Denna ETF lanserades den 1 juli 2024 och har sin hemvist i Luxemburg.

Handla C9DY ETF

UmweltBank UCITS ETF – Global SDG Focus (C9DY ETF) är en europeisk börshandlad fond. Denna fond handlas på Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| XETRA | EUR | C9DY |

VanEck Quantum Computing UCITS ETF A (QUTM ETF) med ISIN IE0007Y8Y157, syftar till att följa MarketVector Global Quantum Leaders-indexet. MarketVector Global Quantum Leaders-indexet följer företag världen över som är aktiva inom kvantberäkning.

Den börshandlade fondens totala kostnadskvot (TER) uppgår till 0,55 % per år. VanEck Quantum Computing UCITS ETF A är den enda ETFen som följer MarketVector Global Quantum Leaders-indexet. ETFen replikerar det underliggande indexets resultat genom fullständig replikering (genom att köpa alla indexkomponenter). Utdelningarna i ETFen ackumuleras och återinvesteras.

Den börshandlade fondens lanserades den 21 maj 2025 och har sitt säte i Irland.

Kvantberäkning övergår från teori till verklighet och lovar att omdefiniera vad som är beräkningsmässigt möjligt. Som Europas första fångar VanEck Quantum Computing UCITS ETF potentialen hos en av vår tids mest transformerande teknologier. Medan tidiga användningsfall framträder, är kommersiell framgång fortfarande osäker, och finansiell exponering kan sträcka sig bortom renodlade kvantberäkningsföretag.

- Tidig, diversifierad tillgång till en potentiell banbrytande teknologi

- Exponering mot företag som driver forskning, utveckling och tillämpning av kvantberäkning

- Inkluderar nya framväxande renodlade innovatörer och globala teknikledare med verifierat starkt patentägande

Huvudsakliga riskfaktorer: Likviditetsrisk, koncentrationsrisk, risk att investera i mindre företag. Investerare måste beakta alla fondens egenskaper eller mål som beskrivs i prospektet eller relaterade dokument innan de fattar ett investeringsbeslut. Se KID och prospektet för annan viktig information innan du investerar. Marknadsutveckling garanteras inte.

Underliggande index

MarketVector™ Global Quantum Leaders Total Return Net Index (MVQTMLTR)

Handla QUTM ETF

VanEck Quantum Computing UCITS ETF A (QUTM ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

Största innehav

| Värdepapper | Ticker | Vikt % |

| Ionq Inc | IONQ US | 13,45 |

| D-Wave Quantum Inc | QBTS US | 10,01 |

| Rigetti Computing Inc | RGTI US | 8,13 |

| Boeing Co/The | BA US | 3,86 |

| Microsoft Corp | MSFT US | 3,66 |

| Synopsys Inc | SNPS US | 3,63 |

| Sony Group Corp | 6758 JP | 3,40 |

| Bank Of America Corp | BAC US | 3,38 |

| Honeywell International | HON US | 3,36 |

| Hitachi Ltd | 6501 JP | 3,35 |

| Wells Fargo & Co | WFC US | 3,28 |

| Deutsche Telekom Ag | DTE GR | 3,26 |

Innehav kan komma att förändras

Hetaste investeringstemat i juni 2025

C9DY ETF investerar i företag med ett positivt bidrag till FNs hållbarhetsmål

QUTM ETF Europas första fond för Quantumdatorer

De bästa ETFerna med fokus på momentum

USAH ETF investerar i amerikanska företagsobligationer och hedgar dem till euro

De bästa ETFer som investerar i europeiska utdelningsaktier

YieldMax® lanserar sin andra produkt för europeiska investerare

Nya börshandlade produkter på Xetra

3EDS ETN ger tre gånger den negativa avkastningen på flyg- och försvarsindustrin

Big News for Nuclear Energy—What It Means for Investors

Populära

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanDe bästa ETFer som investerar i europeiska utdelningsaktier

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanYieldMax® lanserar sin andra produkt för europeiska investerare

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNya börshandlade produkter på Xetra

-

Nyheter2 veckor sedan

Nyheter2 veckor sedan3EDS ETN ger tre gånger den negativa avkastningen på flyg- och försvarsindustrin

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBig News for Nuclear Energy—What It Means for Investors

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanNordea Asset Management lanserar nya ETFer på Xetra

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanHANetfs VD Hector McNeil kommenterar FCAs kryptonyheter

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanJPM noterar nya ETFer på Xetra och Börse Frankfurt