Nyheter

Three thoughts on 2018 by Carmignac

Publicerad

6 år sedanden

Three thoughts on 2018 By Didier Saint-Georges – Managing Director, Investment Committee Member

Detailed market predictions are only of limited value. For example, the consensus forecast twelve months ago was for the S&P to rise 6% over the year – a result the index achieved in just six weeks. The same analysts, by the way, had anticipated an average 10% increase in the S&P 500 in 2008. What they got instead was a 40% nosedive. The investors with the best track record in 2017 often expected at the start of the year a strong dollar and higher interest rates. However, they were capable of shifting gears, ditching their prior views and leveraging new trends. Or else they were lucky enough to be mainly invested in euros.

To be sure, crafting a central scenario is an essential first step. (We presented ours for 2018 in Carmignac’s Note of December, “Fooled by the Cassandra syndrome”.) But such a scenario must be underpinned by an analysis of both upside and downside risks – in other words, an understanding of the key challenges that could push markets dramatically upwards or downwards in the event of a major inflection.

Awareness of potential risks and rewards does not preclude an opportunistic approach. If anything, we should have been more opportunistic this past year. That said, in the long run, such an awareness is vital to generating solid performance across market cycles.

Those challenges fall into three distinct yet interdependent categories: market configuration (valuations, liquidity, positioning, sentiment, flows), macroeconomic factors (growth, inflation, interest rates) and political factors (sovereign risk, geopolitical risk, electoral upsets).

Our analysis suggests that in 2018 issues with a crucial impact on all financial markets will loom much larger than in 2017. That highlights the need to keep our eyes wide open as the year unfolds.

Political factors

The investment community widely assumes that this area is of only secondary importance to markets, and rightly so. It is even tougher to forecast political developments than economic changes, not to mention their effect on financial markets. Moreover, because this past year’s elections in the United States, the United Kingdom and continental Europe proved to be less momentous than anticipated, a good many investors now seem to feel they can safely ignore politics altogether. We don’t view that as such a good idea at present, and for three main reasons.

First, the financial and economic impact of political events often takes a while to show up on the radar screen. For example, we can reasonably expect the blowback from the pro-Brexit vote to cause greater economic pain in 2018 than in 2017. A weaker pound sterling will raise the cost of imports and thus take a large bite out of household spending. At the same time, the upcoming second phase of the negotiations between Britain and the European Commission on their future trade relations will generate additional uncertainty – regarding both the ultimate terms agreed to and the future of the May Government – that is likely to discourage investment in the country. And lastly, any monetary tightening by the Bank of England to defend the national currency would intensify the nascent economic slowdown. We are therefore starting the year with a short position on sterling which should pay off if a downward spiral gets going.

On the other side of the Atlantic, Donald Trump’s protectionist rhetoric, which was more or less put on the back burner in 2017, will probably move up the list of policy priorities in 2018. Once the US President is back on the economic warpath, most notably against China, he might well wield a more competitive dollar as a weapon. We have accordingly begun the year with ample exchange rate hedges on our dollar-denominated assets. On the other hand, it is worth noting that this outlook will potentially mean good news for our emerging market holdings, which we have beefed up. The second reason for taking politics seriously in 2018 is that several far-from-innocuous elections are scheduled to take place. In Mexico and Brazil, the outcomes will determine whether the reform policies under way will continue or not. Closer to home, the formation of a new Government in Germany in the coming weeks and the Italian elections in March will send out very clear signals as to whether the recent pan-European wave of reform initiated by French President Macron last year will hold out. Special attention must be paid in this environment to sovereign yields on the EU periphery. Assuming political developments take a favourable turn – our central scenario – Europe’s single currency, which is preponderant in our portfolios, will come out ahead.

We are also keeping a close watch on developments in the Middle East, a region currently wracked by the threat of political and therefore economic instability. As the historical record shows, lastingly autocratic regimes find themselves highly vulnerable when they finally make a timid attempt at reform, most often under pressure. (This is a danger that Chinese President Xi Jinping strongly senses and takes great pains to avoid.) We consider our holdings in Western oil producers, particularly American, and our gold stocks a high-potential form of insurance against mounting political risk in the Middle East.

Macroeconomic factors

“Any disappointments in relation to global growth would work to the advantage of growth stocks in the US and emerging markets”

Rippling out from China’s industrial stimulus programme in early 2016, the global economic upswing proceeded so fast that it proved to be the outstanding pleasant surprise of 2017. Citigroup’s US Economic Surprise Index reached an all-time record at year-end, and while the Eurozone equivalent saw less spectacular progress, it still jumped at end-November to its highest level since 2010. No offence is meant to economists when we point out that this index is a fairly reliable contrarian indicator of surprises to come. Now that the economic forecasts for 2017 have turned out to be way too pessimistic, they have predictably been revised upwards for 2018 – just when sentiment, consumer spending and output are going at full steam.

So even if it is fair to expect the global economy to keep up the pace in 2018, the risk this time around is rather that the news will be disappointing. Now, this outlook involves a certain amount of risk for equities, particularly those in cyclical industries fuelled until now by US tax reform and the recovery in Europe. But it also opens up opportunities, above all in the United States – which is where we see the greatest chance of disappointment, leaving the dollar more vulnerable and limiting the rise in interest rates, this scenario would give a hefty boost to growth stocks in the United States and the emerging markets, which make up a significant share of our holdings.

Source: Carmignac, 31/10/2017

Market configuration

“Market price distortion certainly reached a pinnacle in 2017”

Financial markets as a whole have experienced a historic bull phase for close to ten years now, and that’s putting it mildly. Worldwide stock market capitalisation has tripled since its 2009 low. Even more striking is the fact that bond and credit markets have also performed well. It is worth stressing the irony of this financial market chain reaction. After all, the failure of central banks to push up inflation was what justified those long years of systematic bond-buying through expansion of the money supply, whose inevitable effect was to boost all asset classes – in violation of economic rationality. The increasing weight of passive and algorithm-based asset management styles has amplified the trend.

Market price distortion certainly reached a pinnacle in 2017: the long-awaited economic upswing, which accelerated the stock market rally, has yet to trigger any serious adjustment in bond markets. But on that front, 2018 may well mark a major turning-point. Though the central banks won’t abruptly cut off the flood of cash they have poured into financial markets since 2009, they will gradually scale back their monthly worldwide injections, most likely to zero by the end of the year. In fact, the US Federal Reserve will go into net liquidity withdrawal mode for the first time ever. Steering such a historic shift without setting off violent market corrections is the unprecedented challenge soon to face central bankers. Meanwhile, now that even most conventional safe-haven assets have become exceedingly pricey, risk managers will need to make use of appropriate hedge instruments to actively manage exposure levels.

As we mentioned in the introduction, those three categories – political, macroeconomic and technical market factors – are distinct yet interdependent. A belated surge in inflationary pressure would encourage central banks to proceed faster with monetary policy tightening, underscoring in the process how overpriced bonds now are. Conversely, any disappointments on economic growth, or even inflation, would put central bank credibility to the test.

At the same time, investor sentiment, as currently reflected in valuations and historically low market volatility, will be sensitive to both central bank policy and the political environment. Financial markets form a system, one whose internal workings have experienced unprecedented distortion as a result of central bank intervention. Going forward, that system is set for a sea change. And when it comes, there will be radically new risks and opportunities for investors.

Source: Bloomberg, 2/1/2018

Investment strategy

Equities

Equity markets ended the year with a bang as Brazil and other emerging economies pulled out in front in December. With equity exposure close to the maximum allowed for our funds and thanks to our overweight position in emerging markets, we reaped the benefits of that trend. In sectorial terms, our balanced allocation policy enabled us to offset selective profit-taking on tech stocks with our commodity positions (gold mines and oil producers), which posted solid gains during the month. We have also continued to diversify our tech portfolio, seeking out new investment ideas with the potential to capitalise on the structural shifts under way. For example, during our latest study trip to the United States, we initiated a position in Shopify, a multi-brand, multi-channel e-commerce platform.

We also factored in the tax reform passed in the United States and accordingly raised our exposure to the US financial sector. Among other positions, we bought Synchrony Financial, a consumer financial services company. With the business cycle soon likely to peak, we are entering 2018 with a particular attention approach to stock-picking, coupled with a soundly diversified, balanced geographic and sectorial allocation.

Fixed income

The market had well anticipiated both the far-reaching tax-cut law passed by Congress and the Fed’s intention to hike interest rates again. The result was that neither change had much of an impact on US Treasury yields, which along with those of Germany gained less than 10 basis points during the month. Thanks to adroit handling by the central bankers – with Mario Draghi’s patient, prudent stance on normalising the Eurozone’s monetary policy worthy of special mention – safe-haven sovereign yields held largely steady throughout 2017. In contrast, 2018 is likely to be a more trying year for the European Central Bank as the Fed carries on with its normalisation plans. That explains why we maintain our short position on German government bonds.

Because we were invested across bond market segments offering attractive risk premia, we had little trouble managing the mixed developments of December. On the EU periphery, we took advantage of the sharp drop that Greek bond yields experienced in December, even as Italian yields crept upwards. In the emerging market space, our Brazilian debt positions sustained their rally in December, although our Mexican bonds were hurt by the geopolitical climate.

Currencies

The euro finished the year on a positive note, appreciating by over 10% against the dollar over the 12-month period. And as we believe that secular issues underlie the greenback’s current weakness, we plan to maintain our majority allocation to Europe’s single currency. A weaker dollar has translated into greater strength for emerging market currencies, except for a Mexican peso dogged by both domestic political woes and tense negotiations over the future of the North American Free Trade Agreement (NAFTA).

Having identified that risk during our latest trip across the Atlantic, we selectively put in place hedges on the Mexican currency in our emerging market funds. One last point on currencies potentially exposed to geopolitical risk. In our global funds, we continue to be sellers of the British pound.

Du kanske gillar

-

FED är klara nu säger SEB

-

Höjer FED räntan till högsta nivån på 22 år?

-

Stor handelsplattform ser ökat intresse för obligationsfonder

-

Förhållandet guld-till-silver stiger till den högsta nivån sedan 1990

-

Förhållandet guld-till-silver stiger till den högsta nivån sedan 1990

-

HEWW ETF en valutasäkrad börshandlad fond

Successfully navigate through Bitcoin & Cryptoasset Markets

• Cryptoassets rallye supported by the Ethereum ETF approval in the US and strong inflows into global crypto ETPs

• Our in-house “Cryptoasset Sentiment Indicator” has increased and signals slightly above neutral levels in sentiment

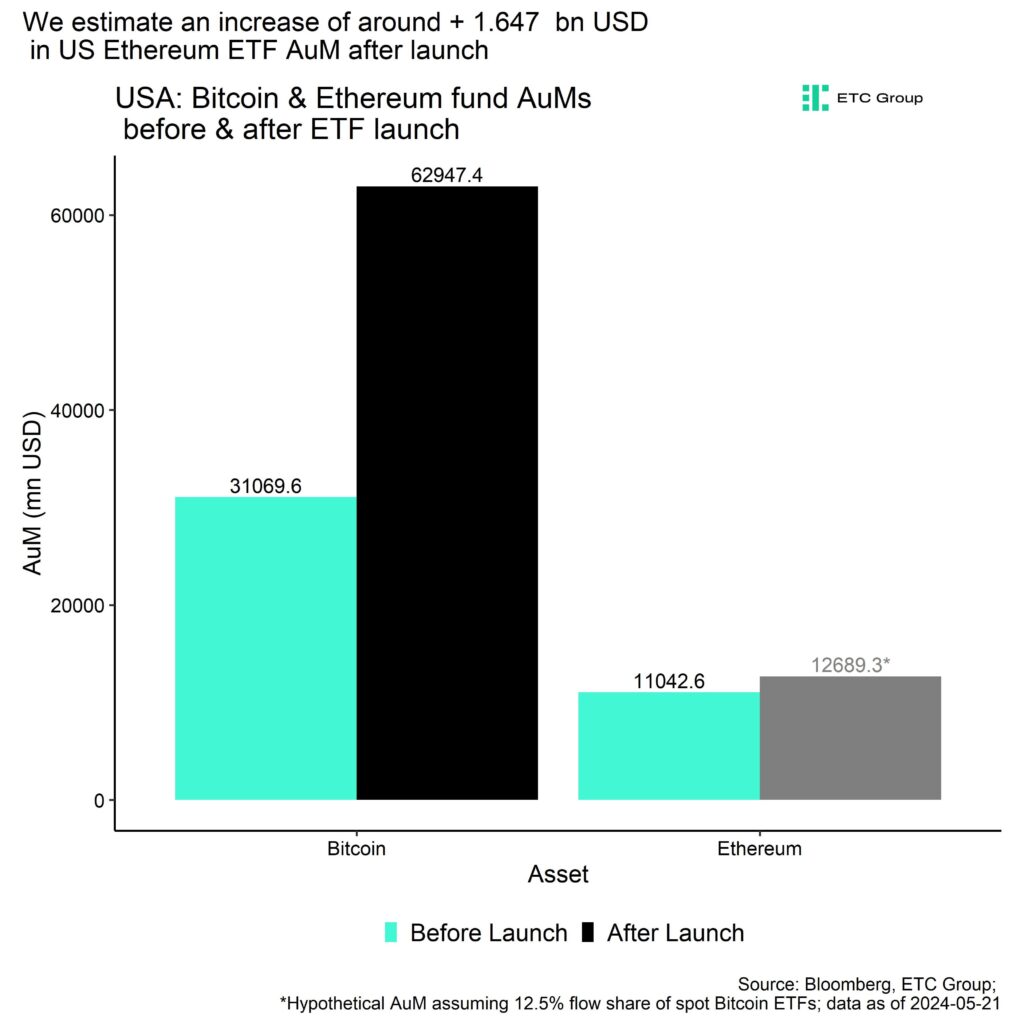

• We expect approximately 1.65 bn USD potential net inflows into US Ethereum ETFs in the first 3 months after trading launch

Chart of the Week

Performance

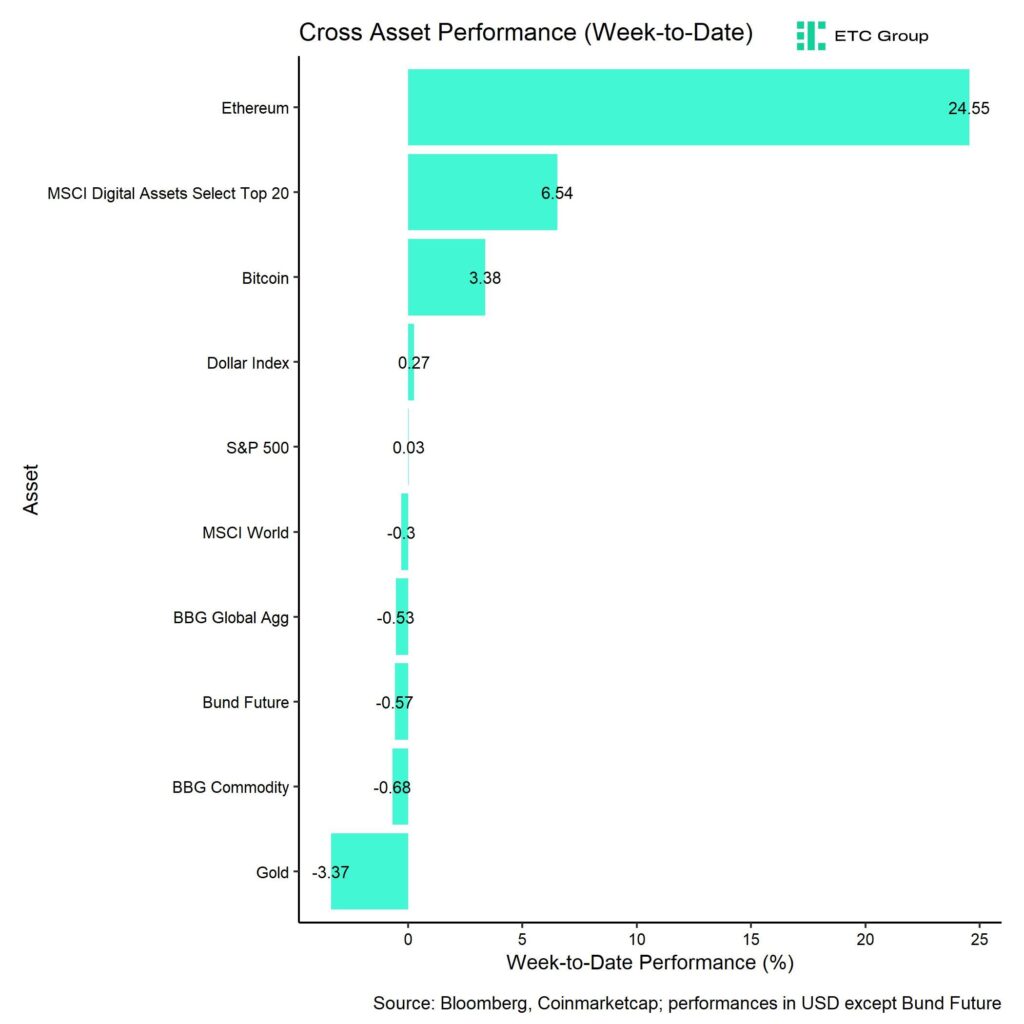

Last week, cryptoassets once again outperformed traditional assets by a very wide margin. Cryptoassets were mainly supported by strong inflows into global crypto ETPs and the final approval of spot Ethereum ETFs in the US.

Weekly net inflows into global crypto ETPs surpassed 1 bn USD last week mainly due to strong inflows into US Bitcoin ETFs while global Ethereum ETP flows were net negative.

Nonetheless, Ethereum managed to outperform Bitcoin strongly buoyed by the prospects of the Ethereum ETF approval in the US. We estimate that approximately 1.65 bn USD could flow into these new spot Ethereum ETFs in the first 3 months after the official trading launch (Chart-of-the-Week).

Although this just represents a small fraction of what has so far flown into spot Bitcoin ETFs, we expect these flows to still have a very significant influence on the performance of Ethereum.

Read more on this topic in our latest Crypto Market Espresso here.

Although the date for the official trading launch still needs to be announced, most

experts expect a trading launch within the next three months and most likely before the US presidential elections in November this year.

The important takeaway from the Ethereum ETF approval is that it marks a significant shift in sentiment within the SEC and among US regulators in general as cryptoassets have increasingly gained majority backing within the US political landscape.

The fact that the US House and Senate have approved the FIT21 Act (“crypto bill”) and that the Trump campaign has officially accepted crypto payments for campaign financing speak volumes in this regard. It seems as if no candidate and party in the US is able to run on an anti-crypto stance anymore.

The Financial Innovation and Technology for the 21st Century Act (FIT21) offers the strong consumer protections and regulatory clarity required for the ecosystem of digital assets.

By providing consumer protections and establishing the Commodity Futures Trading Commission (CFTC) as the primary regulator for digital assets and non-securities spot markets, the legislation seeks to establish a framework for regulating digital assets. This ought to offer more precise definitions for identifying cryptocurrency tokens as commodities or securities.

Despite the short-term euphoria around the Ethereum ETF approval, the market will generally lack major catalysts over the coming months.

In general, performance seasonality tends to be less supportive during the summer months and the positive effects from the Bitcoin Halving will most likely materialize later in the summer (around August onwards). The US spot Ethereum ETF trading launch is also still a couple of months away and the US presidential race will really start to heat up after the summer break.

Barring any buying announcement from a major sovereign or corporation, we still expect that increasing US recession risks could turn out to be a headwind for Bitcoin and cryptoassets in the short-term.

However, given the positive prospects towards the end of the year, any short-term price weakness should be viewed as an opportunity to increase exposure.

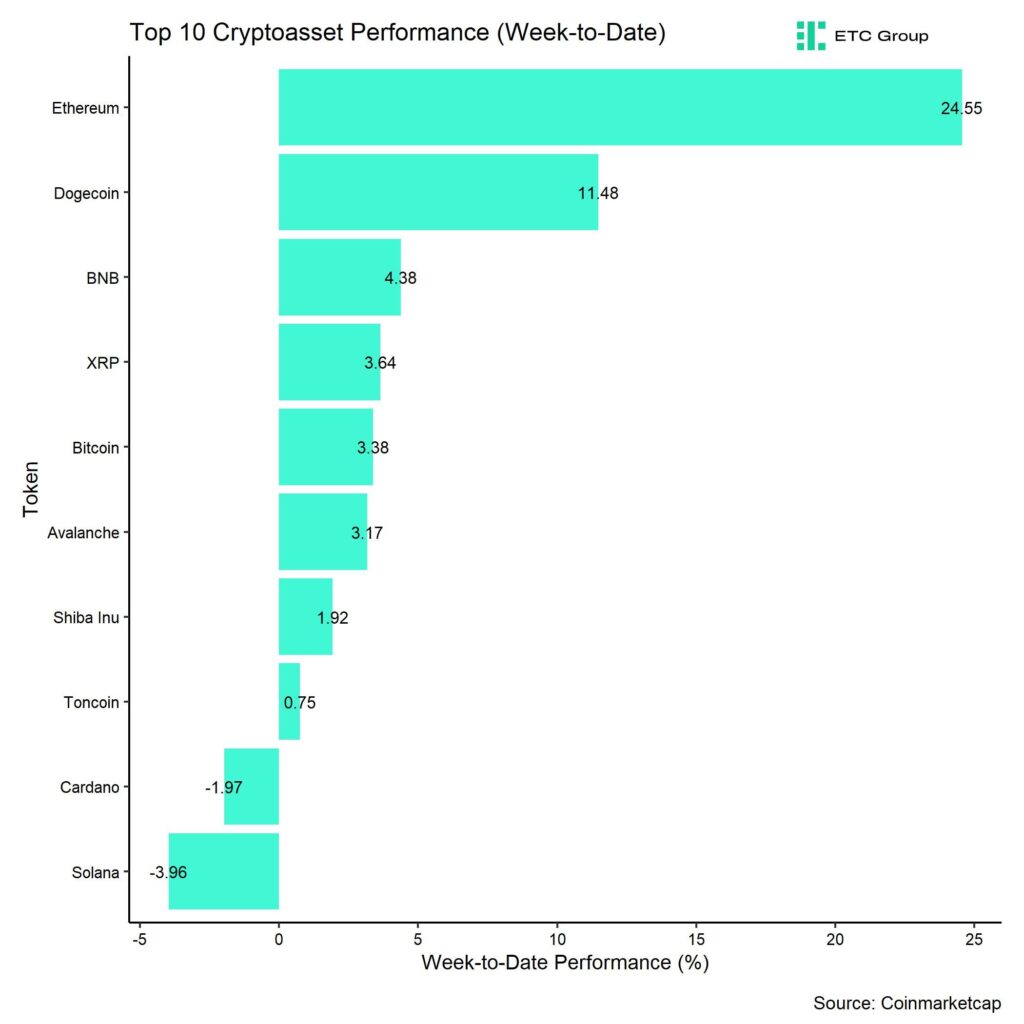

In general, among the top 10 crypto assets, Ethereum, Dogecoin, and BNB were the relative outperformers.

However, overall altcoin outperformance vis-à-vis Bitcoin has started to pick up, with around 60% of our tracked altcoins managing to outperform Bitcoin on a weekly basis.

Sentiment

Our in-house “Cryptoasset Sentiment Index” has increased last week is currently signalling sentiment which is slightly above neutral levels.

At the moment, 8 out of 15 indicators are above their short-term trend.

Last week, there were significant reversals to the upside in our altseason index and Crypto Fear & Greed Index.

The Crypto Fear & Greed Index signals ”Greed” as of this morning.

Performance dispersion among cryptoassets has started to increase, albeit from low levels. Most altcoins remain highly correlated with Bitcoin.

Altcoin outperformance vis-à-vis Bitcoin has picked up following the latest development around the Ethereum ETF approval, with around 60% of our tracked altcoins outperforming Bitcoin on a weekly basis. Altcoin outperformance was generally buoyed by a very significant outperformance of Ethereum vis-à-vis Bitcoin last week.

In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets.

Meanwhile, sentiment in traditional financial markets still remains elevated, judging by our own measure of Cross Asset Risk Appetite (CARA).

Fund Flows

Last week, we saw another week of very positive net inflows into global crypto ETPs with around +1,011.1 mn USD in net inflows across all types of cryptoassets (week ending Friday).

Global Bitcoin ETPs saw net inflows of +1,030.8 mn USD last week of which +1,060.6 mn USD (net) were related to US spot Bitcoin ETFs alone.

Flows into Hong Kong spot Bitcoin ETFs reversed last week with net inflows of around +35.5 mn USD, according to data provided by Bloomberg.

The ETC Group Physical Bitcoin ETP (BTCE) also saw significant net inflows equivalent to +14.6 mn USD while the ETC Group Core Bitcoin ETP (BTC1) saw net inflows of +0.1 mn USD last week.

The Grayscale Bitcoin Trust (GBTC) saw a return of negative net flows with approximately -20.5 mn USD last week while other major US spot Bitcoin ETFs continued to attract new capital, e.g. iShares’ IBIT took in a whopping +719.3 mn USD in a single week.

Despite the Ethereum ETF approval in the US, Global Ethereum ETPs continued to see declining ETP flows last week, with net outflows of around -18.0 mn USD.

Hong Kong spot Ethereum ETFs that saw minor net inflows last week of around +2.1 mn USD, according to data provided by Bloomberg.

Furthermore, the ETC Group Physical Ethereum ETP (ZETH) saw significant net inflows of +13.9 mn USD last week. The ETC Group Ethereum Staking ETP (ET32) also managed to attract capital in the order of +3.9 mn USD.

Besides, Altcoin ETPs ex Ethereum experienced some net inflows of around +14.1 mn USD last week.

Besides, Thematic & basket crypto ETPs continued to see minor net outflows of -15.8 mn USD, based on our calculations. In contrast, the ETC Group MSCI Digital Assets Select 20 ETP (DA20) managed to attract some net inflows last week (+0.3 mn USD).

Meanwhile, the beta of global crypto hedge funds to Bitcoin over the last 20 trading days has started to reverse and decreased to around 0.9. This implies that global crypto hedge funds have started to reduce their market exposure into last week and have currently a slightly less than neutral exposure to Bitcoin.

On-Chain Data

Bitcoin on-chain data remain lukewarm.

Overall net buying minus selling volumes on spot exchanges have been negative over the past week.

So, despite strong inflows into global Bitcoin ETPs and US spot Bitcoin ETFs in particular, spot exchanges continue to see an overhang of selling volumes.

In fact, overall net transfers to exchanges were positive over the past amid significant whale transfers to exchanges. Whales are defined as network entities that control at least 1,000 BTC.

Net transfers to exchanges generally imply increasing selling pressure.

This is generally a negative sign. It seems as if whales are “selling into strength”.

Last week saw the highest weekly net whale transfers of BTC to exchanges year-to-date. This is one of the reasons why we saw a slight increase in BTC exchange balances as well.

Ethereum exchange balances remained relatively flat over the past week with only a temporary drawdown in ETH balances following the pick-up in approval odds at the beginning of last week. However, Ethereum exchange balances are still slightly higher than in April.

In general, there was a slight pick-up in profit-taking by BTC investors as well which was significantly lower than during the all-time highs made in March though.

The market remains overall in a profit environment, i.e. both long- and short-term BTC holders have unrealized profits on aggregate. Short-term holders have recently also spent coins in profit on average.

Futures, Options & Perpetuals

Last week, both BTC futures and perpetual open interest saw a slight significant increase in BTC-terms which seems to be related to a net increase in long open interest. This was most likely associated with a net increase in short open interest.

We only saw a minor increase in BTC short futures liquidations following the turnaround in Ethereum ETF approval odds at the beginning of last week. ETH short futures liquidations spiked to the highest level since mid-April last week.

The Bitcoin futures basis remained relatively flat last week. At the time of writing, the Bitcoin futures annualized basis rate stands at around 12.7% p.a. Perpetual funding rates continued to stay relatively elevated signalling decent demand for long

perpetual contracts.

Bitcoin options’ open interest increased significantly last week as BTC option traders seem to have increased their net long exposure via calls. Relative put-call volume ratios remained below 1.0 last week meaning that relatively more calls than puts were traded.

However, the 25-delta BTC 1-month option skew increased throughout the week, implying an increased demand for puts relative to calls.

BTC option implied volatilities decreased slightly last week. Implied volatilities of 1-month ATM Bitcoin options are currently at around 52% p.a.

Ethereum’s 1-month implied volatilities also declined compared to beginning of last week as the term structure of volatility also normalized. Implied volatilities for Ethereum options expiring last Friday had increased to 140%. Now, Ethereum ATM options expiring this Friday (31st of May) only price around 64% in implied volatility.

Bottom Line

• Cryptoassets rallye supported by the Ethereum ETF approval in the US and strong inflows into global crypto ETPs

• Our in-house “Cryptoasset Sentiment Indicator” has increased and signals slightly above neutral levels in sentiment

• We expect approximately 1.65 bn USD potential net inflows into US Ethereum ETFs in the first 3 months after trading launch

To read our Crypto Market Compass in full, please click the button below:

This is not investment advice. Capital at risk. Read the full disclaimer

© ETC Group 2019-2024 | All rights reserved

Nyheter

JGSD ETF, en aktivt förvaltad fond som investerar i företag från utvecklade länder som följer Parisavtalet

Publicerad

5 timmar sedanden

27 maj, 2024

JPMorgan Global Research Enhanced Index Equity SRI Paris Aligned UCITS ETF USD (dist) (JGSD ETF) med ISIN IE000FYTRRJ6, är en aktivt förvaltad ETF.

JP Morgan Global Research Enhanced Index Equity SRI Paris Aligned Strategy investerar i företag från utvecklade marknader. Denna ETF strävar efter att generera en högre avkastning än MSCI World SRI EU PAB Overlay ESG Custom. Aktierna som ingår filtreras enligt ESG-kriterier (miljö, social och bolagsstyrning). Dessutom beaktas EUs direktiv om klimatskydd.

Denna börshandlade fonds TER (total cost ratio) uppgår till 0,25 % p.a. JPMorgan Global Research Enhanced Index Equity SRI Paris Aligned UCITS ETF USD (dist) är den billigaste och största ETF som följer JP Morgan Global Research Enhanced Index Equity SRI Paris Aligned index. ETFen replikerar det underliggande indexets prestanda genom samplingsteknik (köper ett urval av de mest relevanta indexbeståndsdelarna). Utdelningarna i denna ETF delas ut till investerarna (kvartalsvis).

ETF lanserades den 9 augusti 2023 och har sin hemvist i Irland.

Investeringsmål

Delfondens mål är att uppnå en långsiktig avkastning som överstiger MSCI World SRI EU PAB Overlay ESG Custom Index* (”Referensindexet”) genom att aktivt investera i en portfölj av företag, globalt, samtidigt som man anpassar sig till målen för Parisavtalet.

Riskprofil

Värdet på aktierelaterade värdepapper kan sjunka såväl som upp som svar på enskilda företags resultat och allmänna marknadsförhållanden, ibland snabbt eller oförutsägbart. Om ett företag går i konkurs eller en liknande finansiell omstrukturering förlorar dess aktier vanligtvis det mesta eller hela sitt värde.

Eftersom de instrument som innehas av delfonden kan vara denominerade i andra valutor än basvalutan, kan delfonden påverkas ogynnsamt av valutakontrollregler eller fluktuationer i valutakurser. Av denna anledning kan förändringar i valutakurser påverka värdet på delfondens portfölj och kan påverka värdet på andelarna.

Uteslutning av företag som inte uppfyller vissa kriterier från delfondens investeringsuniversum kan leda till att delfonden presterar annorlunda jämfört med liknande fonder som inte har en sådan policy.

Delfonden strävar efter att ge en avkastning över Benchmark; Delfonden kan dock prestera sämre än jämförelseindexet.

Handla JGSD ETF

JPMorgan Global Research Enhanced Index Equity SRI Paris Aligned UCITS ETF USD (dist) (JGSD ETF) Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| gettex | EUR | JGSD |

| London Stock Exchange | USD | JSGD |

| XETRA | EUR | JGSD |

Största innehav

| Namn | ISIN | Land | Vikt % |

| MICROSOFT CORP | US5949181045 | USA | 5.48% |

| APPLE INC | US0378331005 | USA | 4.85% |

| NVIDIA CORP | US67066G1040 | USA | 2.85% |

| AMAZON.COM INC | US0231351067 | USA | 2.32% |

| TEXAS INSTRUMENTS INC | US8825081040 | USA | 1.96% |

| ZOETIS INC | US98978V1035 | USA | 1.55% |

| NOVO NORDISK A/S-B /DKK/ | DK0060534915 | Denmark | 1.51% |

| ADOBE INC | US00724F1012 | USA | 1.39% |

| AUTOMATIC DATA PROCESSING | US0530151036 | USA | 1.28% |

| TESLA INC | US88160R1014 | USA | 1.12% |

Innehav kan komma att förändras

Nyheter

Virtune erbjuder innovativa stakinglösningar för sina ETPer med stöd av Figment Inc.

Publicerad

6 timmar sedanden

27 maj, 2024

Virtune tillkännager ett avtal med ytterligare en stakingleverantör, Figment Inc. Detta avtal är avsett att förbättra Virtunes börshandlade produkter som inkluderar stakinglösningar, specifikt Virtune Staked Polkadot ETP och Virtune Staked Solana ETP.

Virtunes staking ETPer möjliggör för investerare att ta del av stakingbelöningar på daglig basis, vilket reflekteras i staking ETPernas utveckling utan att man behöver göra något aktivt för att ta del av denna extra avkastning. Detta görs utan någon inlåsningsperiod för investerarna i ETPerna, vilket annars kan vara fallet vid staking av kryptovalutor.

Virtunes innovativa produktportfölj inkluderar för närvarande fem staking ETPer. Dessa är Virtune Staked Ethereum ETP, Virtune Staked Solana ETP, Virtune Staked Polygon ETP, Virtune Staked Cardano ETP och Virtune Staked Polkadot ETP.

Avtalet med Figment som ingicks den 2 februari 2024 bekräftar Virtunes strävan att förbättra sina stakinglösningar inom sina krypto ETPer. Globalt erkänd för sina stakingtjänster stöder Figment ett brett utbud av klienter vilket inkluderar stora förvaringsinstitut, kryptobörser, ETP-leverantörer och kapitalförvaltare.

Genom detta avtal kommer Virtune att använda Figments expertis för att leverera effektiva och robusta stakinglösningar och arbeta tillsammans när de kontinuerligt utvecklar sina produktutbud.

”Vi har varit imponerade av Virtunes tillväxt på den nordiska marknaden och är glada över att bli utsedda som stakingleverantör för Virtunes ETPer. Vi ser fram emot att fortsätta arbeta med Virtune när de utvecklar och breddar sitt ETP-erbjudande i Norden och bortom” – Eva Lawrence, chef för EMEA på Figment.

Förbättring av blockchain-integritet genom staking

Staking spelar en avgörande roll i funktionaliteten hos Proof of Stake (PoS) blockkedjor, såsom Solana och Polkadot. Det möjliggör för kryptovalutainnehavare att tjäna belöningar genom att bidra till valideringen och verifieringen av transaktioner. Denna mekanism säkerställer inte bara säkerheten och äktheten av transaktioner, utan belönar också deltagare med belöningar i den stakade kryptovalutan. Med tanke på de tekniska och ekonomiska kraven för att agera som en validator föredrar många investerare att samarbeta med betrodda stakingleverantörer som Figment för sina stakinglösningar.

Virtunes försäkran om säker och non-custodial staking

Virtune fortsätter sitt dedikerade arbete för att uppnå högsta möjliga säkerhet och förtroende genom att endast använda non-custodial staking. Denna strategi säkerställer att kryptovalutor som allokeras för staking hanteras direkt från säkra, offline förvaringslösningar, framför allt genom förvaringstjänster som Coinbase, vilket eliminerar behovet av att överföra eller låna ut tillgångar till någon tredje part.

Om Figment Inc.

Figment är den ledande leverantören av stakingsinfrastruktur. Figment erbjuder en omfattande stakinglösning till över 500 institutionella klienter, inklusive kapitalförvaltare, börser, digitala plånböcker, stiftelser, förvararingsinstitut och stora tokeninnehavare, för att tjäna belöningar på sina digitala tillgångar. På Ethereum är Figment den största icke-förvaltande stakingleverantören av stakad ETH på Figment-validerare.

Figments institutionella stakingtjänst erbjuder en sömlös peka-och-klicka-stakingsdashboard, spårning av portföljbelöningar, API-integrationer, granskad infrastruktur och skydd mot slashing. Allt detta leder Figments uppdrag att stödja tillväxten och den långsiktiga framgången för det digitala tillgångsekosystemet.

Figment är varken utfärdare eller promotor av ETPerna. Detta pressmeddelande är endast avsett för informationsändamål och utgör inte investeringsrådgivning, ett erbjudande eller en rekommendation att köpa eller sälja några finansiella instrument, och utgör inte heller rekommendationer eller vägledning för beslut om investeringar.

Crypto Market Compass 27. May 2024

JGSD ETF, en aktivt förvaltad fond som investerar i företag från utvecklade länder som följer Parisavtalet

Virtune erbjuder innovativa stakinglösningar för sina ETPer med stöd av Figment Inc.

26 börshandlade fonder som spårar S&P500

JGSC ETF, en aktivt förvaltad fond som investera i globala företag från utvecklade marknader som anpassat sig till Parisavtalet

Endast en tredjedel av brittiska privatinvesterare har hört talas om ansvarsfulla investeringar eller ESG

Sveriges enda riktiga råvarufond har öppnat

Vilken är den bästa fond som följer Nasdaq-100?

De mest populära börshandlade fonderna april 2024

Utdelning i XACT Norden Högutdelande (maj)

Populära

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEndast en tredjedel av brittiska privatinvesterare har hört talas om ansvarsfulla investeringar eller ESG

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSveriges enda riktiga råvarufond har öppnat

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanVilken är den bästa fond som följer Nasdaq-100?

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDe mest populära börshandlade fonderna april 2024

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanUtdelning i XACT Norden Högutdelande (maj)

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNågra av de bästa guldfonderna

-

Nyheter3 veckor sedan

Nyheter3 veckor sedan1VET ETP ger exponering mot Ethereum tillsammans med extra intäkter

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBTC1 ETP spårar priset på kryptovalutan Bitcoin