Nyheter

Primer on Cryptoasset Valuations

Publicerad

3 månader sedanden

Cryptoasset valuations remains an emerging topic seeking consensus, especially as the asset class expands and matures. Robert Greer, author of ”What is an asset class anyway?” argues that assets that lack an objective measure of value and have a supply constraint are more vulnerable to irrational exuberance, citing the dot-com bubble as an example. Cryptoassets lack an objective measure of value today among investors, similar to emerging tech companies in the late 1990s. We propose valuation methodologies that reconcile various investors’ approaches in recent years.

We can value any asset using two approaches – intrinsic or relative. Intrinsic valuation measures an asset’s value based on its capacity to generate cash flows. On the other hand, relative valuation methods, also called ”pricing,” estimate how much to pay for an asset based on what others are paying for comparable ones.

Investors might use a discounted cash flow method (DCF) to value a stock, but they wouldn’t use that for a piece of fine art. Similarly, we must outline the various types of cryptoassets to understand the differences we may expect in their value accrual and specific valuation approaches. In this regard, it’s helpful to categorize cryptoassets according to the three asset superclasses proposed by Robert Greer:

- Capital Assets: “An ongoing source of something of value” (e.g., bonds and stocks).

- Consumable/Transformable Assets: “You can consume it. You can transform it into another asset. It has economic value. But it does not yield an ongoing stream of value” (e.g., physical commodities).

- Store of Value Assets: “They cannot be consumed, nor can they generate income. Yet they do have value” (e.g., currencies and collectibles).

Like the Internet architecture, cryptoassets and blockchain technology have two layers: (1) infrastructure and (2) applications. In his 2019 work, Chris Burniske categorized cryptoassets at the infrastructure layer based on the consensus mechanism of the blockchain:

- Proof-of-Work (PoW): In PoW networks like Bitcoin, the native asset (BTC) relies on a computationally and energy-intensive lottery called mining to determine which block of transactions to settle on the blockchain and reward the miners. Hence, they belong to the Consumable/Transformable asset superclass, as they essentially create “a digital-native commodity in the form of secure, globally accessible ledger space.” Investors can use the mining cost of production as a fundamental metric to gauge the lower-bound price of PoW crypto assets like BTC.

- Proof-of-Stake (PoS): In networks like Ethereum, validators must commit a portion of their capital – the “stake,” in this case, ETH – to gain access to a recurring value stream generated by the network’s rules. Hence, they fall in the Capital Asset category, and their value may be derived from the net present value of annual flows to validators using a DCF method.

While we won’t delve too deeply into the application layer, we can apply the same first-principles thinking:

- Governance tokens yield voting rights and represent ownership of the application. They are analogous to common stock in traditional finance, so they fall in the Capital Asset class.

- Utility tokens drive the economics of the system as their sole function, meaning they fall in the Consumable Asset category.

- Non-fungible tokens (NFTs) are collectibles like fine art in their most typical form today, falling in the Store of Value category.

Figure 1: Asset superclasses and their subsets

Source: 21Shares

Intrinsic Valuation

Ethereum

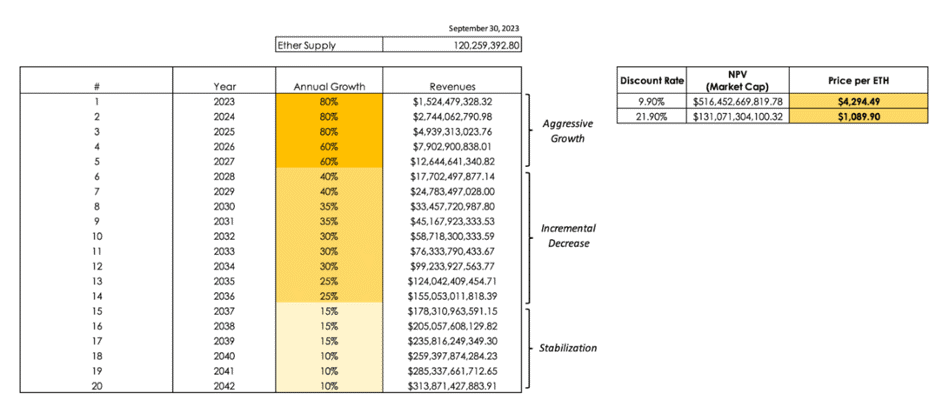

From the standpoint of a validator, PoS assets like ETH are akin to a stock paying a dividend yield, which means we can conduct a DCF valuation following four simple steps:

(1) Estimate the cash flows during the life of the cryptoasset

• a. Transaction fees within the network accrue to validators. Just so, fees are a proxy for revenue. Ethereum validators received $355.01 million in transaction fees (net after the burn mechanism) from September 30, 2022, to September 30, 2023.

• b. Token issuance doesn’t dilute the value of validators. On the contrary, they have the right to new issuance, similar to how shareholders may receive stock-based compensation. ETH Issuance from September 30, 2022, to September 30, 2023, amounted to $1.17 billion.

• c. Total Cash Flows: a + b = $1.52 billion in the first year.

(2) Estimate expected future cash flows and the lifespan of the cryptoasset

• a. Future cash flows: We propose a slight variation of the three-stage growth model to project Ethereum’s future cash flows. Specifically, we forecast an initial period of aggressive growth, followed by an incremental decrease that eventually stabilizes at a more moderate growth rate.

• b. Lifespan of the asset: With public companies that at least in theory can last forever, equity analysts generally assume that cash flows beyond a specific point in time continue in perpetuity. Investors may apply the same logic to PoS cryptoassets, but for simplicity’s sake, we assume ETH’s life will be 20 years.

(3) Estimate the discount rate to apply to these cash flows

• a. Lower-bound discount rate (9.90%): In the past 10 years, the Invesco QQQ Trust ETF obtained a 9.90% compound annual return.

• b. Higher-bound discount rate (21.90%): Obtained using the Fama and French Three-Factor Model (market premium, size premium, and value premium).

(4) Estimate the net present value (NPV) of cash flows using the above parameters

Assuming a discount rate of 9.09%, the implied price per one ETH today would be ~$4,293, a ~157% increase from ETH’s price ($1,668) as of September 30, 2023. On the other hand, if we use a 21.90% discount rate, the implied price per one ETH would be ~$1,090, a ~35% decrease from ETH’s price as of September 30, 2023. Investors should interpret the results of this DCF valuation with caution and run their own assumptions regarding projected cash flows and discount rates. The rationale behind our approach was to be conservative and capture the high volatility of ETH in the discount rate to accurately reflect the asset’s riskiness. Another implicit assumption of this approach is that the asset’s monetary premium (Store of Value) is embedded into the DCF.

Figure 2: ETH DCF Valuation

Source: 21Shares, as of September 30, 2023

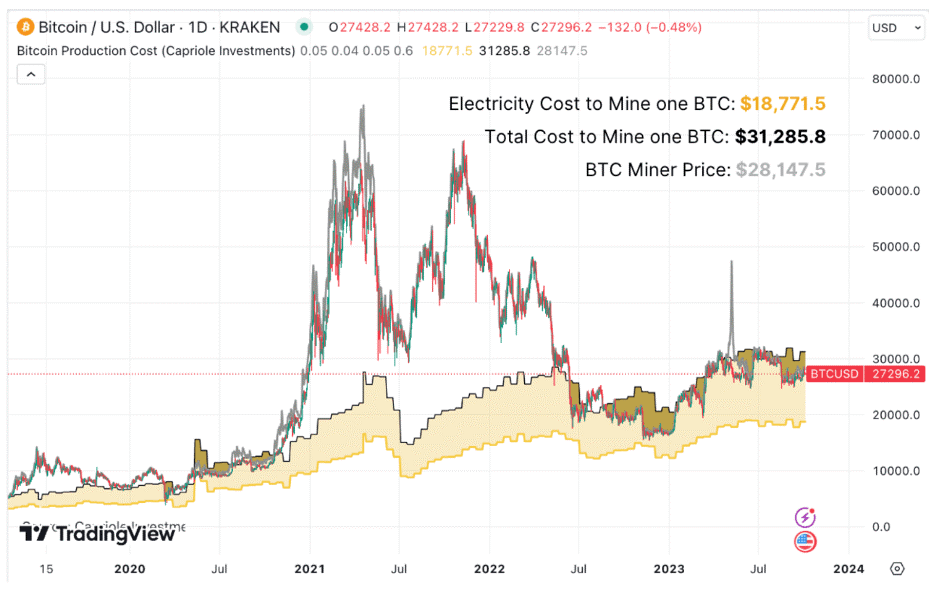

Bitcoin

When it comes to crypto-commodities, the marginal cost of production is vital as it sets the price floor at which producers (miners) are willing to sell. From the outset, it is crucial to emphasize that we are not suggesting that the price of BTC should be determined by its marginal cost of production. To do so would be to adopt a labor theory of value, which is ostensibly false. Instead, the marginal cost of production is a tool that can help investors estimate a lower bound price level for BTC and other crypto-commodities.

In 2019, Charles Edwards proposed a methodology to estimate the global average US dollar cost of producing one BTC. The first component of the method is the Cambridge Bitcoin Electricity Consumption Index (CBECI), which provides an up-to-date estimate of the Bitcoin network’s daily electricity load. Edwards estimates the cost of production per BTC by:

- Calculating the number of BTC Mined Per Day (based on miner rewards)

- Calculating the daily electricity cost to mine one BTC (Daily Electrical Cost)

- Estimating the global average “Elec-to-Total Cost Ratio” = (Bitcoin Electrical Cost) / (Daily Cost of running a Bitcoin Mining Business)

An investor can then compute Bitcoin Production Cost as (Daily Electrical Cost) / (Elec-to-Total Cost Ratio). Finally, the Bitcoin Production Cost is compared to the “Bitcoin Miner Price,” which attempts to capture the revenue one BTC provides to miners. Bitcoin Miner Price is calculated as follows: BTC Price + (Daily Transaction Fees) / (Daily BTC mined). When the BTC price is below the total cost of mining one BTC, it signals that Bitcoin miners may be struggling and potentially taking short-term losses.

Figure 3: Bitcoin mining cost of production

Source: 21Shares, data as of September 30, 2023

As of September 30, 2023, the estimated global average electricity cost to mine one BTC is $18,771.5, while the estimated global average total cost to mine one BTC is $31,285.8. To reiterate, investors shouldn’t interpret this range as the fundamental value of Bitcoin, which is subjective, but rather as an estimate of its price floor based on miner profitability and subsequent behavior patterns.

Relative Valuation

A significant portion of equity valuations in traditional finance consists of relative valuations based upon market sizing and multiples, such as price-to-earnings (P/E ratio). This approach is more likely to reflect market perceptions and sentiment than a fundamental valuation. Moreover, investors can use relative valuations to ”price” any asset, not just ones that generate cash flows.

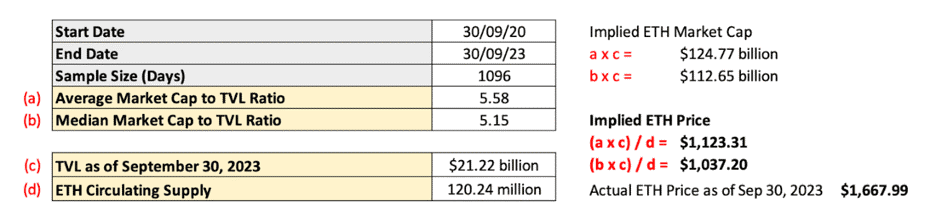

Ethereum

In decentralized finance (DeFi), total value locked (TVL) is a crypto-native metric that investors can use as a proxy for assets under management (AUM). Hence, an ingenious pricing approach is to represent the market value of a smart contract platform like Ethereum as a multiple of TVL. We should clarify that TVL in our exercise includes Ethereum’s base chain and scaling platforms (Layer 2s).

Figure 4 shows that investors are pricing ETH at a premium relative to historical levels. A plausible explanation is that activity has dropped relative to the period of euphoria we experienced during 2020 and 2021. However, a flaw of this metric is that TVL does not necessarily translate to higher profits. Thus, this multiple is only appropriate to the extent that TVL can effectively influence the protocol’s ongoing and future profits.

Figure 4: Ethereum’s Market Cap-to-TVL-based implied price

Source: 21Shares

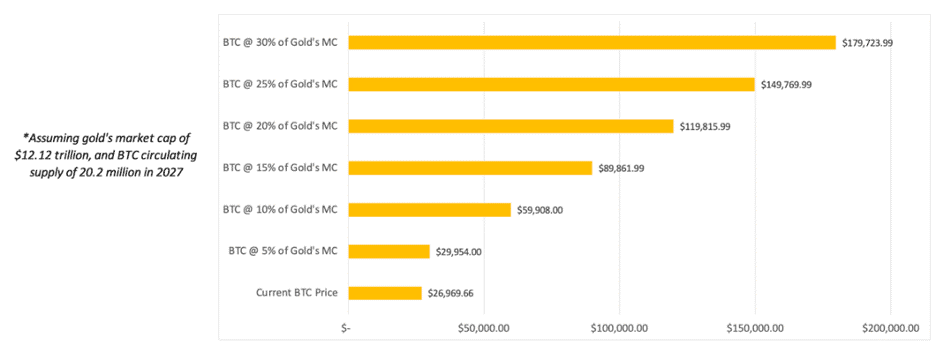

Bitcoin

Investors cannot value store-of-value assets intrinsically because their value is primarily determined by the subjective beliefs of many individuals. Thus, we can utilize a simple market sizing approach to estimate a target price. The methodology involves establishing a Total Addressable Market (TAM) and a percent share the asset in question could take — Market Penetration. For instance, an investor could price Bitcoin by setting a proportion it could capture of the market value of gold, the seminal store-of-value asset.

As of September 30, 2023, the price of BTC is $26,970, with an implied circulating market cap of ~$526 billion. On the other hand, the market cap of gold sits at around $12.12 trillion. Thus, we can use the market sizing methodology described above to estimate the hypothetical price of BTC if it were to capture a given percent share of gold’s market cap. For instance, Figure 8 shows that if BTC were to capture 10%, it would be priced at $59,908. In the most optimistic scenario contemplated, if BTC penetrates 30% of gold’s market cap, the price of one BTC would be $179,724.

Figure 5: Hypothetical value of BTC as a % of gold’s market cap in 2027

Source: 21Shares, Data as of September 30, 2023

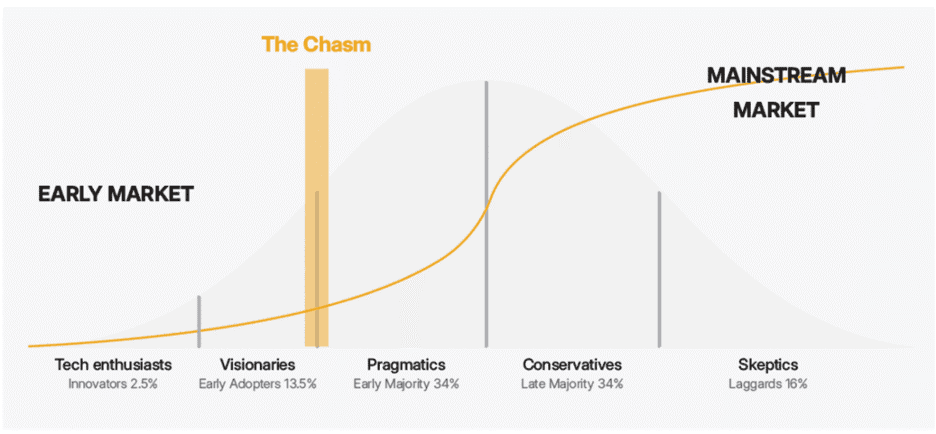

Methodology improvements – Crypto’s S-Curve

One way to more accurately gauge a given cryptoasset’s level of penetration of its TAM is through the “S-curve.” The S-curve theory states that technologies grow and emerge in multiple waves. It was initially proposed by E.M Rogers in 1962 as the Diffusion of Innovation (DOI) Theory to explain how, over time, a new technology gains momentum and spreads through a specific population or social system.

Figure 6: S-curve and the Diffusion of Innovation Theory

Source: 21Shares

There were 431 million crypto users globally at the beginning of 2023, representing about 5.36% of the world population.

The level of crypto adoption today is equivalent to internet adoption in 1999-2000.

Challenges to cryptoasset valuations

There are various challenges and shortcomings regarding cryptoasset valuations, such as insufficient historical data and complexities unique to the asset class.

For instance, the cash flows that PoS networks generate are not paid in fiat currency but rather in the native tokens of the network. This situation is as if Apple charged its customers in Apple shares instead of U.S. dollars. This unique feature creates a reflexivity problem because the dollar-denominated value of the revenue stream is directly dependent on the cryptoasset’s value.

We have provided investors with actionable methods to value cryptoassets. The complexity and uncertainty of valuing this asset class might intimidate investors. However, it is worth remembering that the more uncomfortable an investor feels when valuing an asset, the greater the payoff of doing the valuation.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

Navigating Macro Headwinds, On-Chain Optics, and The Rise of Runes

-

The Bitcoin Halving and Beyond

-

issuance.swiss erbjuder Figment-produkter på Ethereum och Solana med insatsbelöningar

-

Valour Short Bitcoin (SBTC) för den som tror att Bitcoin skall gå ned

-

Valour lanserar den första Short Spot Bitcoin ETP i Norden

-

Geopolitical Conflict on the Rise, while Ethereum Receives its Biggest Boost

Nyheter

Vilken är den bästa fond som följer Nasdaq-100?

Publicerad

8 timmar sedanden

28 april, 2024

Nasdaq 100-indexet följer de 100 största aktierna noterade på Nasdaq-börsen. De utvalda företagen kommer huvudsakligen från sektorer som hårdvara och mjukvara, telekommunikation, detaljhandel och bioteknik – inklusive alla stora amerikanska teknikföretag. Däremot ingår inte företag från energi-, finans- och fastighetssektorerna i Nasdaq-100. Vilken är den bästa fond som följer Nasdaq-100?

I USA har den populära QQQ ETF, som spårar Nasdaq 100, varit tillgänglig sedan 1999. Den förvaltas av Invesco. Den europeiska motsvarigheten till denna ETF använder tickersymbolen eQQQ. Till skillnad från den amerikanska marknaden finns det dock flera ETF-leverantörer i Europa som spårar Nasdaq 100 – så det är värt att jämföra.

ETF-investerare kan dra nytta av värdeökningar och utdelningar från Nasdaq 100-beståndsdelarna. För närvarande spåras Nasdaq 100-indexet av tretton ETFer.

Förvaltningsarvode fond som följer Nasdaq-100

Nedan har vi listat förvaltningsarvoden för fond som följer Nasdaq-100. Samtliga dessa ETFer har en konkurrenskraftig prissättning, allt från AXA IM Nasdaq 100 UCITS ETF USD Acc, som debiterar sina andelsägare 0,14 procent per år till iShares Nasdaq 100 UCITS ETF (Acc) som tar ut 0,33 procent i arvode. I jämförelse kostar de flesta aktivt förvaltade fonder mycket mer avgifter per år.

| Namn | Valuta | ISIN | Kortnamn | Förvaltningsavgift |

| AXA IM Nasdaq 100 UCITS ETF USD Acc | USD | IE000QDFFK00 | ANAU | 0.14% |

| Invesco Nasdaq-100 Swap UCITS ETF Acc | USD | IE00BNRQM384 | EQQX | 0.20% |

| Invesco Nasdaq-100 Swap UCITS ETF Dist | USD | IE000RUF4QN8 | EQQD | 0.20% p.a. |

| Xtrackers Nasdaq 100 UCITS ETF 1C | USD | IE00BMFKG444 | XNAS | 0.20% |

| Amundi Nasdaq-100 II UCITS ETF Acc | EUR | LU1829221024 | LYMS | 0.22% |

| Amundi Nasdaq-100 II UCITS ETF Dist | USD | LU2197908721 | NADQ | 0.22% |

| Amundi Nasdaq 100 UCITS ETF EUR (C) | EUR | LU1681038243 | 6AQQ | 0.23% |

| Amundi Nasdaq 100 UCITS ETF USD | USD | LU1681038326 | 10A4 | 0.23% |

| Deka Nasdaq-100® UCITS ETF | EUR | DE000ETFL623 | D6RH | 0.25% |

| Invesco EQQQ Nasdaq-100 UCITS ETF | USD | IE0032077012 | EQQQ | 0.30% |

| Invesco EQQQ Nasdaq-100 UCITS ETF Acc | USD | IE00BFZXGZ54 | EQQB | 0.30% |

| iShares Nasdaq 100 UCITS ETF (DE) | USD | DE000A0F5UF5 | EXXT | 0.31% |

| iShares Nasdaq 100 UCITS ETF (Acc) | USD | IE00B53SZB19 | SXRV | 0.33% |

Som alltid vill vi påminna att om det finns flera olika börshandlade fonder som täcker samma index eller segment är det förvaltningskostnaden som avgör. Antar vi att dessa Nasdaqfonder ger samma avkastning kommer den som har lägst avgift att utvecklas bäst, allt annat lika. Grundregeln är alltså, betala aldrig för mycket då detta kommer att äta upp din avkastning.

Nasdaq 100 ETFer i jämförelse

Förutom avkastning finns det ytterligare viktiga faktorer att tänka på när du väljer en Nasdaq 100 ETF. För att ge ett bra beslutsunderlag hittar du en lista över alla Nasdaq 100 ETFer med detaljer om vinstanvändning, fondens hemvist och replikeringsmetod.

| Namn | Utdelningspolicy | Hemvist | Replikeringsmetod |

| iShares Nasdaq 100 UCITS ETF (Acc) | Ackumulerande | Irland | Fysisk replikering |

| Invesco EQQQ Nasdaq-100 UCITS ETF | Utdelande | Irland | Fysisk replikering |

| iShares Nasdaq 100 UCITS ETF (DE) | Utdelande | Tyskland | Fysisk replikering |

| Amundi Nasdaq-100 II UCITS ETF Acc | Ackumulerande | Luxemburg | Ofinansierad swap |

| Invesco EQQQ Nasdaq-100 UCITS ETF Acc | Ackumulerande | Irland | Fysisk replikering |

| Amundi Nasdaq 100 UCITS ETF EUR (C) | Ackumulerande | Luxemburg | Ofinansierad swap |

| Amundi Nasdaq-100 II UCITS ETF Dist | Utdelande | Luxemburg | Ofinansierad swap |

| AXA IM Nasdaq 100 UCITS ETF USD Acc | Ackumulerande | Irland | Fysisk replikering |

| Xtrackers Nasdaq 100 UCITS ETF 1C | Ackumulerande | Irland | Fysisk replikering |

| Invesco Nasdaq-100 Swap UCITS ETF Acc | Ackumulerande | Irland | Ofinansierad swap |

| Amundi Nasdaq 100 UCITS ETF USD | Ackumulerande | Luxemburg | Ofinansierad swap |

| Invesco Nasdaq-100 Swap UCITS ETF Dist | Utdelande | Irland | Ofinansierad swap |

| Deka Nasdaq-100® UCITS ETF | Utdelande | Tyskland | Fysisk replikering |

Handla fond som följer Nasdaq-100

Samtliga dessa ETFer är europeiska börshandlade fonder. Dessa fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Nyheter

Inevitable in India: Crowds, cricket and capital gains tax

Publicerad

9 timmar sedanden

28 april, 2024

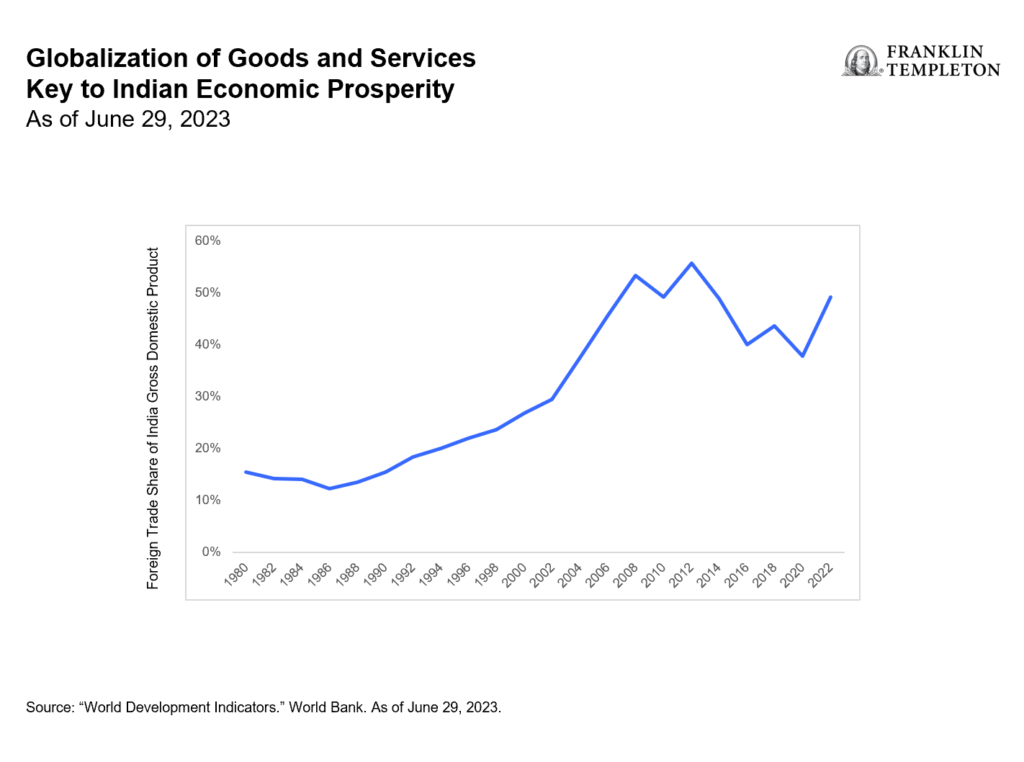

India’s vibrant economy and structural growth opportunities continue to be the envy of many emerging markets. But somewhat unique to this market are tax implications that investors should be aware of. Our Franklin Templeton Global ETF team examines these structural issues in Asia’s third-largest economy.

In merely a decade, India has taken a quantum leap from the world’s 11th largest economy to become its fifth largest. By many accounts, it is expected to remain one of the world’s fastest-growing major economies over the coming years. And even after a banner 2023 during which the country’s benchmark indexes surged and Indian Prime Minister Narendra Modi celebrated high-profile successes—from historic technological and space exploration achievements to rising global diplomatic clout—this election year has already marked more progress in supporting Modi’s pro-growth, pro-jobs efforts.

The world’s most populous nation has advanced ties with Western countries over free trade. In addition to agreements with Australia and the United Arab Emirates, it has worked to better integrate the “Global South’s” development needs and ambitions with that of the G20. Modi has touted innovative partnerships for a new multilateral rail and sea corridor to connect India with the Middle East and the European Union (EU)—seen as a counterweight to China’s vast Belt-and-Road infrastructure corridor.

India reached its latest notable trade pact, nearly 16 years in the making, in March with the European Free Trade Association—Iceland, Liechtenstein, Norway and Switzerland. The agreement lifts Indian tariffs to secure US$100 billion in foreign direct investment commitments from the non-EU markets to India across multiple sectors.

With India still an enviable investment powerhouse, it seems important to clarify a few aspects of this dynamic equity market.

How exchange-traded funds (ETFs) treat India capital gains tax (CGT)

Foreign investors should be aware that CGT is an integral part of investing in Indian equities that cannot be circumvented. Investors in India funds are subject to CGT implications regardless of fund provider, and CGT is based and calculated on a fund as a whole, not an individual investor’s position.

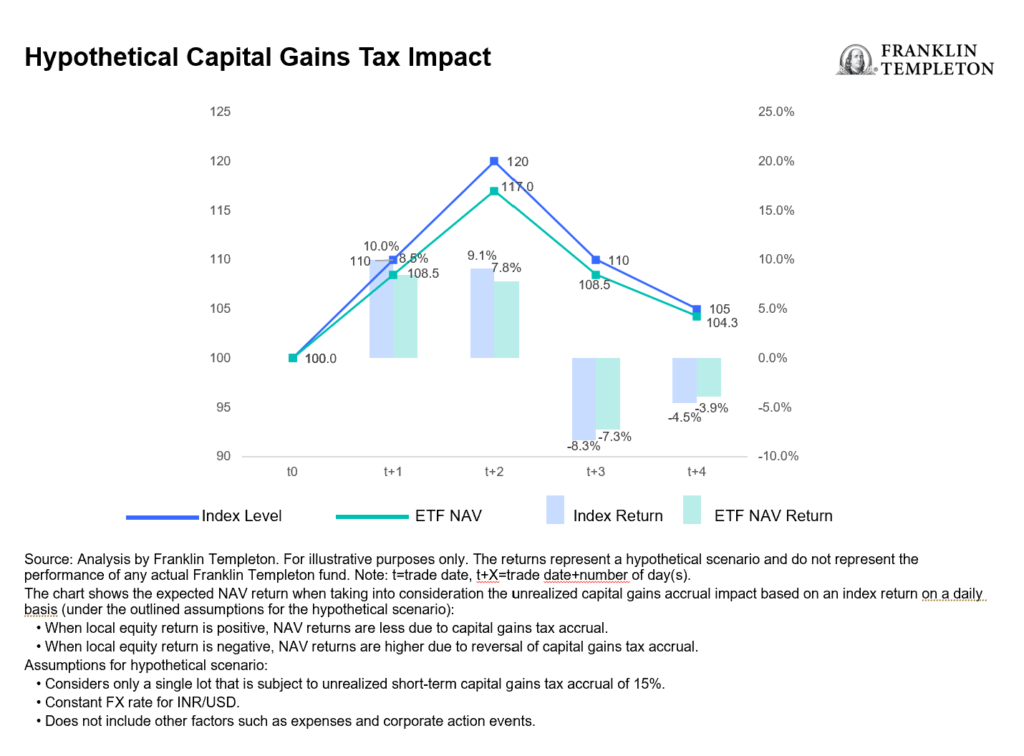

The details: Foreign investors owning local Indian stocks are subject to taxation on capital gains at a short-term rate of 15% for positions held for less than one year and at a long-term rate of 10% for positions held over one year.

To accrue or not to accrue: Consistent with market practice for US-listed India ETF providers, Franklin Templeton accrues unrealized CGT in its daily net asset value (NAV). This can lead to differences in performance relative to the benchmark, which does not include CGT. As a result, rising markets will typically lead to fund underperformance against a benchmark, while weaker market environments will typically generate outperformance (provided the fund is in an unrealized capital gain position where the current market value of fund holdings is above their historical book cost). See chart below.

For UCITS-listed India funds, there is a divergence in methods utilized by fund providers in accruing and reporting CGT. Some do not accrue unrealized CGT in the NAV, but will charge CGT to investors directly at redemption, which we believe leaves investors with a level of opaqueness and uncertainty over their ultimate proceeds. This method also creates an elevated NAV compared to what investors will actually experience. While Franklin Templeton’s approach to CGT may at times lead to a higher tracking difference,1 we believe investors benefit from increased transparency and a more reflective experience.

The magnitude and impact of CGT for a specific fund is heavily dependent on several variables, such as the timing of purchases and sales, performance of the holdings and their volatility, and the size of flows in and out of the fund relative to its assets under management (AUM).

Understanding the impact: The CGT impact to fund performance is driven by the path of returns, timing of individual lots and price points. Very broadly speaking, in rising markets, an NAV-accruing fund will likely underperform its benchmark and vice versa.

Consideration of comparability: Because different providers handle CGT differently, the comparability of fund performance metrics may be affected. As investors, it’s prudent to consider how these nuances may influence investment decisions within the broader context of your financial strategy.

The bigger picture: While CGT considerations are important, they should be viewed within the broader spectrum of investment objectives and risk tolerance. Taking a long-term perspective and being mindful of other important characteristics of the investment vehicle of choice may aid in the decision-making process.

In summary, India remains an attractive investment destination with compelling growth prospects for its equity markets. Investors seeking India allocation through an ETF should be aware of the current tax regime and what varying methods of accounting methodologies really mean for fund valuation.

Nyheter

XB33 ETF köper företagsobligationer i euro som förfaller 2033

Publicerad

10 timmar sedanden

28 april, 2024

Xtrackers II Target Maturity Sept 2033 EUR Corporate Bond UCITS ETF 1D (XB33 ETF) med ISIN LU2673523564, försöker följa Bloomberg MSCI Euro Corporate September 2033 SRI-index. Bloomberg MSCI Euro Corporate September 2033 SRI-index följer företagsobligationer denominerade i EUR. Indexet speglar inte ett konstant löptidsintervall (som är fallet med de flesta andra obligationsindex). Istället ingår endast obligationer som förfaller mellan oktober 2032 och september 2033 i indexet (ETF kommer att stängas i efterhand). Indexet består av ESG (environmental, social and governance) screenade företagsobligationer. Betyg: Investment Grade.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,12 procent p.a. Xtrackers II Target Maturity Sept 2033 EUR Corporate Bond UCITS ETF 1D är den enda ETF som följer Bloomberg MSCI Euro Corporate September 2033 SRI-index. ETFen replikerar det underliggande indexets prestanda genom samplingsteknik (köper ett urval av de mest relevanta indexbeståndsdelarna). Ränteintäkterna (kupongerna) i ETFen delas ut till investerarna (Minst årligen).

Denna ETF lanserades den 8 november 2023 och har sin hemvist i Luxemburg.

Bloomberg MSCI Euro Corporate SRI PAB Index syftar till att spegla resultatet på följande marknad:

- EUR-denominerade företagsobligationer

- Endast obligationer med investeringsklass

- Obligationer med en löptid på minst 1 år

- Minsta utestående belopp på 300 miljoner euro per obligation

- Endast obligationer utgivna av företag med en MSCI ESG-rating på BBB eller högre och en MSCI ESG Impact Monitor över 1 ingår

Indexet övervakar absoluta växthusgasutsläpp (“GHG”) genom att sätta en initial 50 % avkolning av absoluta växthusgasutsläpp i förhållande till moderuniversumet följt av en årlig 7 % avkolningsbana för absoluta växthusgasutsläpp.

Obligationer utgivna av företag som är involverade i alkohol, tobak, hasardspel, vuxenunderhållning, genetiskt modifierade organismer (GMO), kärnkraft, civila skjutvapen, militära vapen (inklusive minor, klusterbomber, kemiska vapen) är undantagna.

Handla XB33 ETF

Xtrackers II Target Maturity Sept 2033 EUR Corporate Bond UCITS ETF 1D (XB33 ETF) är en europeisk börshandlad fond. Denna fond handlas på Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| XETRA | EUR | XB33 |

Största innehav

| ISIN | Namn | Vikt % | Land |

| IE00BZ3FDF20 | DEUTSCHE GLOBAL LIQUIDITY SERI | 0.54% | Irland |

| CH1214797172 | BBG01BFYVYX8 CREDIT SUISSE GROUP AG 3/29 | 0.18% | Schweiz |

| XS0525602339 | RABOBANK 07/25 | 0.14% | Holland |

| FR0000471930 | FRANCE TELECOM 01/33 | 0.13% | Frankrike |

| FR0013324357 | SANOFI SA 1.375% 2030-03-21 | 0.12% | Frankrike |

| XS1001749289 | MICROSOFT CORP 12/28 | 0.12% | USA |

| XS1372839214 | VODAFONE GROUP PLC 08/26 EUR51520 | 0.12% | Storbritannien |

| XS2461234622 | BBG0162QT3D3 JPMORGAN CHASE AND CO 3/30 | 0.11% | USA |

| XS2235996217 | NOVARTIS FINANCE SA 9/28 | 0.11% | Spanien |

| XS2705604234 | BBG01JPP1244 BANCO SANTANDER SA 10/31 | 0.11% | Spanien |

| FR0013398070 | BNP PARIBAS 01/26 AW746868 | 0.11% | Frankrike |

| XS2180007549 | AT&T INC 5/28 | 0.11% | Frankrike |

| XS2149207354 | GOLDMAN SACHS GROUP INC 3/25 | 0.10% | USA |

| XS1603892149 | MORGAN STANLEY DEAN WITTER 04/27 AN318761 | 0.10% | USA |

| CH0537261858 | CREDIT SUISSE GROUP AG SR UNSECURED REGS 04/26 VAR 4/25 | 0.10% | Schweiz |

Innehav kan komma att förändras

Vilken är den bästa fond som följer Nasdaq-100?

Inevitable in India: Crowds, cricket and capital gains tax

XB33 ETF köper företagsobligationer i euro som förfaller 2033

Ny ETF från Franklin Templeton investerar med katolska värderingar

Playing the AI revolution through commodities and gold’s curious rally

ETFmarknaden i Europa firar sitt 24-årsjubileum med tillgångar på två biljoner USD

De mest populära börshandlade fonderna mars 2024

Tillgång till obligationsmarknaden för företagsobligationer från utvecklade marknader

FUIG ETF investerar i hållbara företagsobligationer som följer Parisavtalet

Försvarsfond når förvaltad volym på 500 MUSD

Populära

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanETFmarknaden i Europa firar sitt 24-årsjubileum med tillgångar på två biljoner USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDe mest populära börshandlade fonderna mars 2024

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTillgång till obligationsmarknaden för företagsobligationer från utvecklade marknader

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFUIG ETF investerar i hållbara företagsobligationer som följer Parisavtalet

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanFörsvarsfond når förvaltad volym på 500 MUSD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanVad händer härnäst för Bitcoin?

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNy börshandlad fond från Deka ger tillgång till S&P 500-index

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanBygg din egen pengamaskin