Nyheter

Primer: Bitcoin, An Emerging Store of Value Asset

Publicerad

4 månader sedanden

This research primer acts as a guide for investors to understand Bitcoin fundamentally. You will learn how the technology works, discover the current and future state of Bitcoin, the different ways to value the asset, and finally assess the various associated risks.

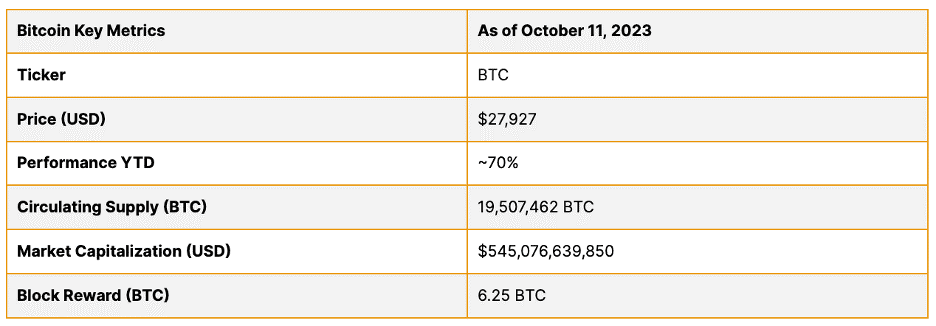

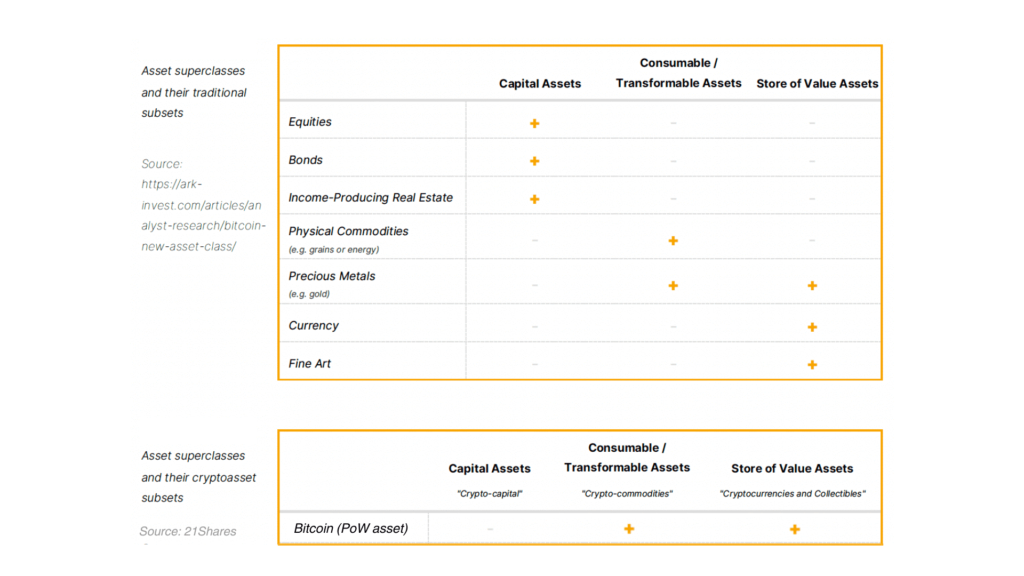

Bitcoin is an emerging store of value asset often called the world’s first “digital gold” and may provide a viable hedge against global economic instability. Over the last three years, Bitcoin surged by over 120%, making it one of the best-performing assets over the last decade. Currently, Bitcoin’s total market capitalization sits at over $540 billion. The rest of this report will also show that there is still a potential upside for Bitcoin and its technology in the foreseeable future. The first table (below) shows some of the current key metrics for Bitcoin, including its price, circulating supply (the number of BTC currently in existence), and market capitalization. The second table demonstrates where Bitcoin sits in the asset superclass amongst equities, commodities, real estate, and other asset classes.

Table 1: Bitcoin Key Metrics

Source: CoinGecko

Figure 1: Asset Superclasses

Source: 21Shares

How Bitcoin Works

So you may be wondering: how exactly does Bitcoin work? The key innovation of Bitcoin is that it allows for peer-to-peer and decentralized transactions on the internet. This is facilitated by two inventions: the ledger or its blockchain acting as the asset’s balance sheet and its security and verification mechanism called Proof of Work mining.

The Bitcoin Blockchain

A blockchain is a data structure — in the same way an Excel sheet is a data structure — which holds a growing list of records, called blocks, which are linked to each other through the use of cryptography. Within a blockchain, each block is ordered in a sequence, and each contains encoded information about its predecessor (a hash), the date and time at which it was created, and data about the transactions included in it. Every transaction that has settled on the Bitcoin network is contained within a particular block of transactions.

Blockchains are helpful for storing sensitive data for which one needs strong assurance, such as security, safety, and integrity. Typically, blockchains are stored on a network of users across the internet who each keep a version of the Bitcoin blockchain. Once data has been recorded onto a blockchain, the block cannot be altered retroactively without changing all subsequent blocks – this is only possible if the majority of the network agrees.

Proof of Work Mining

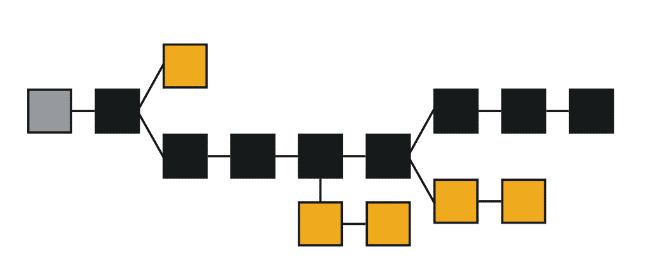

Proof of Work (PoW) mining is the process that allows new transactions and blocks to be added to the Bitcoin blockchain. It is also the method through which new Bitcoin enters the money supply. Proof of Work is similar in abstract to the process of gold mining. Stakeholders (called “miners”) use specialized supercomputers to process an algorithm that creates a piece of data called a proof of work. A proof of work is, by definition, difficult to solve and requires extensive computing power, capital investment, and energy to find. Once a miner finds a solution, it is very easy for others in the Bitcoin network to verify. The Bitcoin network is designed so miners only solve a proof of work on average every 10 minutes and are rewarded for their efforts through newly-issued Bitcoin, currently at an amount of 6.25 BTC per block or approximately $218,750. Bitcoin’s monetary policy has a limit of 21 million BTC. To reach this amount, every 4 years the new emission of Bitcoin happening each 10 minutes programmatically decreases by half, called the Halving. The use of mining makes it extremely hard for Bitcoin’s transactions to be manipulated, as a malicious actor would have to expend a large sum of capital and energy to do so. The diagram below (Fig. 2) shows an illustration of a blockchain where the black blocks represent the path of the blockchain that all miners and nodes in the Bitcoin network agree on. If miners or nodes disagree on a specific blockchain, it is discarded — as demonstrated by the yellow blocks.

Figure 2: A simplified illustration of a blockchain

Source: 21Shares

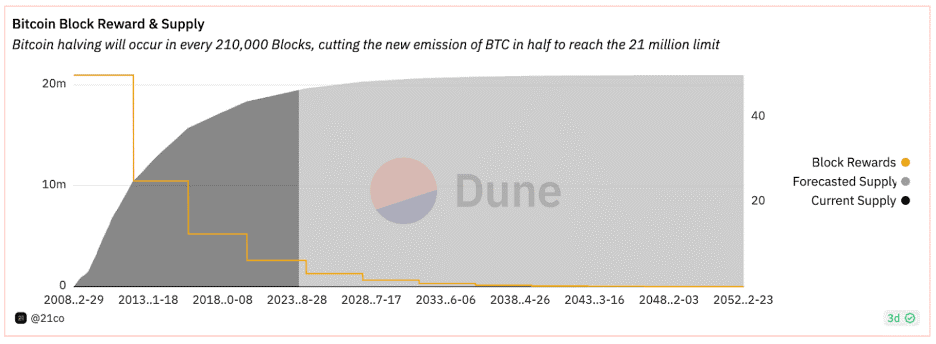

The State of Bitcoin

Since its launch on January 3, 2009, Bitcoin has grown into an asset with a market capitalization of over $540 billion and created an entire asset class, cryptoassets, with a cumulative market capitalization of over $1 trillion. We believe Bitcoin represents a paradigm shift in finance by being the peer-to-peer, decentralized asset class and history’s first digital gold. This claim is justified given that Bitcoin has a fixed and programmatic maximum supply of 21 million ending in 2140— making it an incredibly scarce asset. In recent years, Bitcoin has matured as an investment product and become increasingly institutionalized. The chart below shows how Bitcoin’s supply follows a predictable and trackable schedule as it reaches the 21 million limit. As mentioned, the current block reward amounts to 6.25 BTC, which will be reduced by 50% during Bitcoin’s upcoming halving, which will most likely take place at the end of Q1 or beginning of Q2 2024.

Aside from the adoption side, Bitcoin also has a thriving technological and developer community that will continue to expand the technical tools to interact with the Bitcoin network — making it easier, for example, to self-custody one’s assets, transact at a low cost, or understand Bitcoin’s blockchain data.

Figure 3: Bitcoin projected supply and monetary inflation

Source: 21.co (Parent company of 21Shares)

The Future of Bitcoin – Bitcoin as a tech investment

Part of the appeal of Bitcoin is its yet unrealized potential, whether it be technical developments that enable a deeper range of types of transactions and ways to improve transaction speeds or innovation in the blockchain infrastructure. Several interesting product developments within Bitcoin include the emergence of several promising scaling solutions (Layer 2s)): The Lightning Network — a protocol that exists on top of Bitcoin as a potential way to improve scalability; Rootstock and Stacks — smart contract platforms built on Bitcoin allowing more complex transactions; and Ordinals Inscriptions — similar to NFTs, a way to inscribe digital content on the Bitcoin blockchain.

In addition, Bitcoin is gearing up to rival Ethereum as a settlement platform for stablecoins and real-world assets, thanks to the Lightning Lab’s taproot upgrade. This enables developers to create and oversee a wider array of assets on Bitcoin, with over 2,000 tokens already minted on the testnet, demonstrating the demand for assets issued on the network while helping BTC to serve as a medium of exchange. Additionally, experimental initiatives such as Bitcoin VM and Bitcoin Spiderchains are in the works, aiming to expand on Bitcoin’s capabilities by offering scaling solutions that don’t require modifying the Bitcoin base code itself. Their impact, however, remains uncertain, given their early developmental stages.

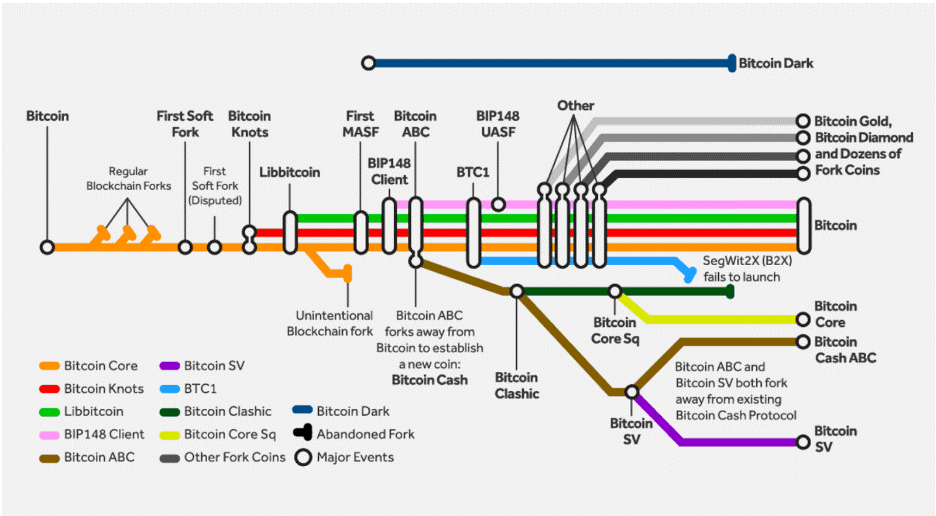

In addition, Bitcoin has played a crucial role in the formation of a range of other cryptoassets — known as “forks” — which either have been inspired by Bitcoin’s technical infrastructure (see Fig. 4) or have borrowed heavily from the software that makes Bitcoin work. This allows for innovation from Bitcoin to spread to the rest of the industry and is a key factor behind the cryptoasset industry’s high level of innovation.

Figure 4: History of Bitcoin forks

Source: Bitcoin Magazine

Valuing Bitcoin

Figure 5: Asset Superclasses

Source: 21Shares

As mentioned previously, Bitcoin relies on a computationally and energy-intensive lottery called mining to verify, settle transactions, and secure the network. The native asset of a PoW network like Bitcoin is not one of the inputs of production but the mere output of it. Hence, we refer to PoW cryptoassets as ”crypto-commodities.” In addition, due to its programmed scarcity, Bitcoin has consolidated as an emerging store-of-value asset. Thus, similar to gold, Bitcoin is both a consumable and store-of-value asset in the asset superclass classification.

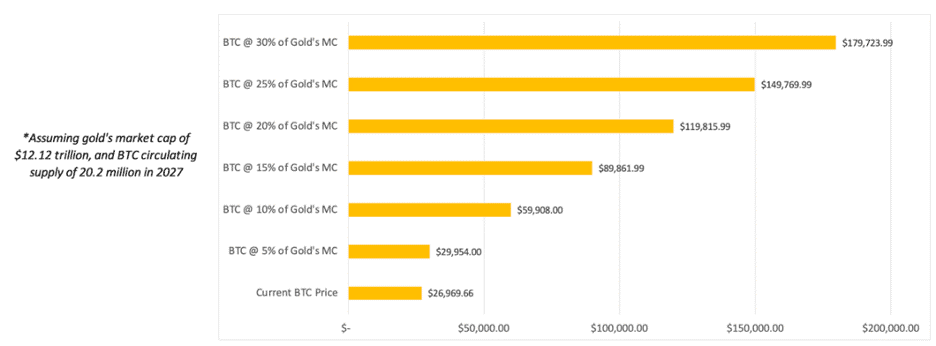

Market Sizing

Bitcoin’s primary value proposition comes from its ability to act as a Store of Value. Therefore, the most accurate way to understand Bitcoin’s potential value in the long term is by doing a market sizing analysis. Thus, we can utilize a simple market sizing approach to estimate a target price. The methodology involves establishing a Total Addressable Market (TAM) and a percent share the asset in question could take — Market Penetration. For instance, an investor could price Bitcoin by setting a proportion it could capture of the market value of gold, the seminal store-of-value asset.

As of September 30, the price of BTC is $26,970, with an implied circulating market cap of ~$526 billion. On the other hand, the market cap of gold sits at around $12.12 trillion. Thus, we can use the market sizing methodology described above to estimate the hypothetical price of BTC if it were to capture a given percent share of gold’s market cap. For instance, Figure 4 shows that if BTC were to capture 10%, it would be priced at $59,908. In the most optimistic scenario contemplated, if BTC penetrates 30% of gold’s market cap, the price of one BTC would be $179,724.

Figure 6: BTC market sizing analysis

Source: 21Shares, Data as of September 30, 2023

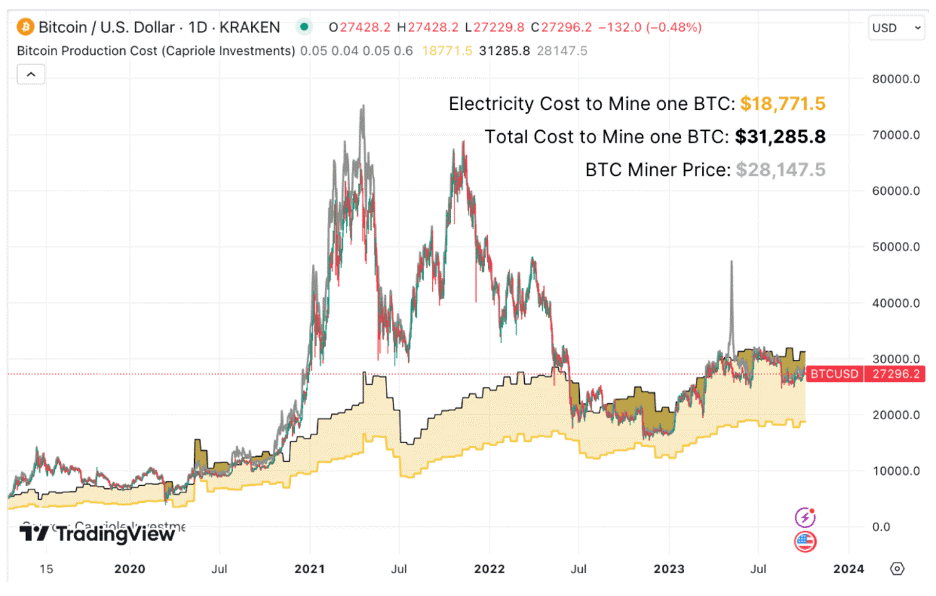

Cost of Production (Bitcoin’s intrinsic value)

When it comes to crypto-commodities, the marginal cost of production is vital as it sets the price floor at which producers (miners) are willing to sell. From the outset, it is crucial to emphasize that we are not suggesting that the price of BTC should be determined by its marginal cost of production. To do so would be to adopt a labor theory of value, which is ostensibly false. Instead, the marginal cost of production is a tool that can help investors estimate a lower bound price level for BTC and other crypto-commodities.

In 2019, Charles Edwards proposed a methodology to estimate the global average US dollar cost of producing one BTC. The first component of the method is the Cambridge Bitcoin Electricity Consumption Index (CBECI), which provides an up-to-date estimate of the Bitcoin network’s daily electricity load. Edwards estimates the cost of production per BTC by:

- Calculating the number of BTC Mined Per Day (based on miner rewards)

- Calculating the daily electricity cost to mine one BTC (Daily Electrical Cost)

- Estimating the global average “Elec-to-Total Cost Ratio” = (Bitcoin Electrical Cost) / (Daily Cost of running a Bitcoin Mining Business)

An investor can then compute Bitcoin Production Cost as (Daily Electrical Cost) / (Elec-to-Total Cost Ratio). Finally, the Bitcoin Production Cost is compared to the “Bitcoin Miner Price,” which attempts to capture the revenue one BTC provides to miners. Bitcoin Miner Price is calculated as follows: BTC Price + (Daily Transaction Fees) / (Daily BTC mined). When the BTC price is below the total cost of mining one BTC, it signals that Bitcoin miners may be struggling and potentially taking short-term losses.

Figure 7: Bitcoin mining cost of production

Source: 21Shares, data as of September 30, 2023.

As of September 30, 2023, the estimated global average electricity cost to mine one BTC is $18,771.5, while the estimated global average total cost to mine one BTC is $31,285.8. To reiterate, investors shouldn’t interpret this range as the fundamental value of Bitcoin, which is subjective, but rather as an estimate of its price floor based on miner profitability and subsequent behavior patterns.

If you’re interested in delving deeper into the world of Bitcoin within a portfolio context and exploring optimal portfolio allocation strategies, we invite you to explore the latest iteration of our comprehensive Portfolio Allocation Primer: Link

Risks

Economic Risk

Bitcoin halvings and reduced block rewards can be considered a double-edged sword. While it usually creates a supply shock leading to new all-time highs post-halving, it also is one of the most significant risks to Bitcoin’s long-term success. Bitcoin miners generate revenue through transaction fees and newly-issued Bitcoin (i.e., the block reward). However, as this block reward decreases over time, miners will be compensated only via transaction fees eventually. Some research shows potential issues with a regime in which block rewards for miners are continually halved. For example, the amount miners receive in transaction fees alone may not be enough, or variability in transaction fees could lead to perverse incentives for miners, such as an increased probability of attempts to reverse transactions through “51% attacks.” Both scenarios could harm Bitcoin’s economic security. However, new innovations emerging on top of Bitcoin, as discussed in this paper, could potentially create sustainable incentives for miners and ensure the longevity of the network’s security. In conclusion, Bitcoin’s block reward halving is a long-term threat to the network’s security, although there are several viable ways to solve the problem going forward.

Environmental Risk

Proof of Work mining is an extremely energy-intensive process that can require miners to be willing to pay up to the current price of Bitcoin in marginal costs to mine a single Bitcoin. The University of Cambridge Centre for Alternative Finance estimates that Bitcoin currently consumes 55.33 Terawatt Hours of energy per year and will only increase as the network continues to grow. We agree that the energy consumption of the Bitcoin network is likely to continue to increase as the mining industry continues to professionalize and as the popularity of the Bitcoin network increases. It is unknown precisely what the energy mix of Bitcoin mining is. Still, one can assume that at least some amount of Bitcoin mining is powered by non-renewable energy sources — meaning that Bitcoin mining may contribute to exacerbating current issues associated with the climate crisis. While it is difficult to verify such numbers, there is no doubt that a large amount of Bitcoin mining is powered by renewable energy. Despite this fact, the mainstream perception is that Bitcoin mining is an unnecessarily energy-intensive process. As policy action around the climate crisis intensifies, there remains the possibility that there could be a regulatory crackdown on Bitcoin predicated on a pro-climate agenda. Researchers in the industry can mitigate the risks of such a scenario by making a concerted effort to prove that Bitcoin mining relies heavily on renewable energy and find ways to reduce its reliance on fossil fuels. Moreover, miners must exercise strategic discernment when selecting their operational bases, considering factors such as operational expenses (including electricity and rent) and geographical vulnerability to environmental hazards like hurricanes and power outages.

Geopolitical Risk

Different countries have adopted various stances toward Bitcoin and cryptoassets. Some have embraced them, while others have imposed strict regulations or outright bans. The best example would be China’s ban on crypto mining in 2021. Even though miners migrated abroad, this regulatory uncertainty can create challenges for individuals and businesses involved in the Bitcoin ecosystem, leading to legal and compliance risks. Additionally, Bitcoin’s global nature makes it sensitive to geopolitical tensions and conflicts. Governments may view Bitcoin as a way to circumvent economic sanctions or capital controls, leading to further regulatory crackdowns and attempts to control its use.

Technology Risk

Bitcoin, like any technology, is not immune to vulnerabilities. For example, as technological progress marches forward, there’s a growing concern about the potential risks posed by quantum computing. Quantum computers, if developed sufficiently, could pose a fundamental threat to Bitcoin’s cryptographic security. This risk requires ongoing research and the development of quantum-resistant cryptographic algorithms. Moreover, as any computer code they are susceptible to potential bugs.

A prime illustration of this is CVE-2018-17144, a code vulnerability that was discovered in 2018, that had the potential to permit an attacker to double-spend bitcoins. Although this bug was never exploited on the Bitcoin mainnet, and a substantial majority of full nodes promptly upgraded to Bitcoin Core versions unaffected by it, it underscores the importance of acknowledging and addressing such risks. Furthermore, in October 2023, the Bitcoin Lightning Network encountered a novel vulnerability, which could potentially empower an attacker to steal funds from Lightning Network channels by exploiting Hash Time Lock Contracts. These contracts serve as a crucial foundation facilitating payment exchanges between counterparties without necessitating trust. Subsequently, a series of interim patches has been introduced to rectify this issue.

To mitigate these technological risks, the Bitcoin community relies on continuous development, peer review of code changes, and a commitment to maintaining the network’s decentralization and security. Participants in the Bitcoin ecosystem, including miners, developers, and users, must stay informed and adapt to evolving technological challenges to ensure the network’s robustness and resilience.

Disclaimer

All content provided by 21Shares is intended for informational and educational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Investments associated with crypto assets, such as cryptocurrencies and crypto tokens, involve risk. These assets are considered highly speculative due to their limited history and new technological nature. Future regulatory actions may impact the usability and tradability of crypto assets. The price of crypto assets can be influenced by a small number of holders and may decline in popularity or acceptance, affecting their value.

For full disclosures, please visit our Disclaimers and Terms & Conditions pages.

Du kanske gillar

-

Regulatory Crackdowns and Ethereum’s Most Anticipated Application

-

Navigating Macro Headwinds, On-Chain Optics, and The Rise of Runes

-

The Bitcoin Halving and Beyond

-

Valour Short Bitcoin (SBTC) för den som tror att Bitcoin skall gå ned

-

Valour lanserar den första Short Spot Bitcoin ETP i Norden

-

Geopolitical Conflict on the Rise, while Ethereum Receives its Biggest Boost

Nyheter

Regulatory Crackdowns and Ethereum’s Most Anticipated Application

Publicerad

20 timmar sedanden

1 maj, 2024

• Regulatory Crackdowns Fire Up in April

• Macro Uncertainty, Geopolitical Headwinds, and Bitcoin’s Fourth Halving

• The Arrival of Ethereum’s Most Anticipated Application

Macro Uncertainty, Geopolitical Headwinds, and Bitcoin’s Fourth Halving

April brought a challenging landscape for Bitcoin. Geopolitical tensions flared in the Middle East when Israel targeted the Iranian Consulate in Syria on the 1st of April. In an unprecedented response, Iran retaliated directly with a drone strike against Israel, intensifying hostilities. The event contributed to a decline in the stock market and a temporary pullback in Bitcoin’s price. As mentioned two weeks ago, although Bitcoin historically served as a safe haven during crises like the Russian Invasion of Ukraine, its response to Iran-Israeli escalation may have been adverse.

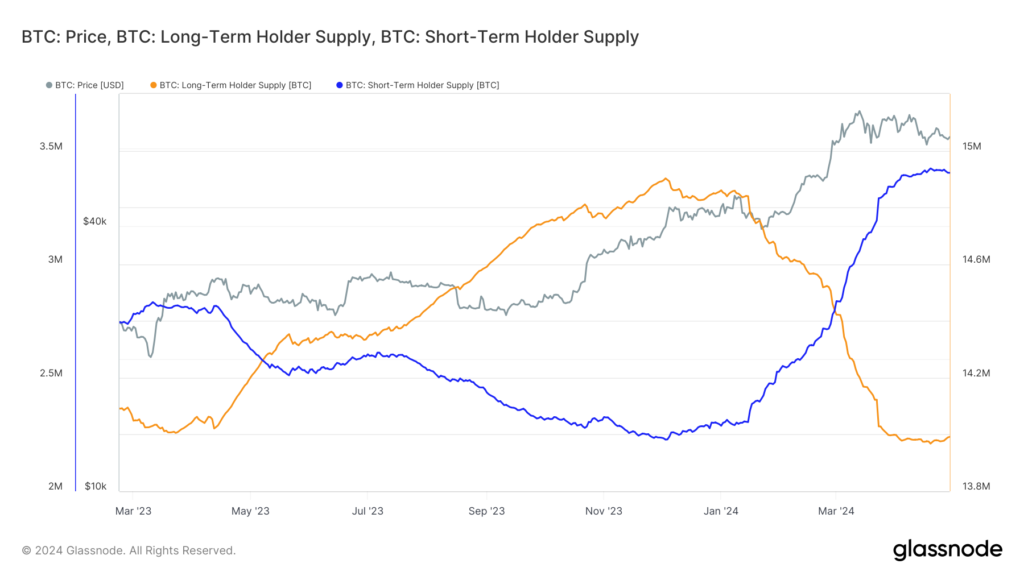

However, a closer look at the market reveals a more nuanced picture. The impact on Bitcoin was primarily felt in the futures market, where open interest peaked at $35 billion on the day of the Consumer Price Index (CPI) print, leading to significant liquidations when inflation came in hotter than expected for the fourth month running. Resilience in the labor market, coupled with strong domestic demand, is evidence that despite Fed efforts, the US is not yet in a position for rate cuts, which may pose further turbulence for risk-on assets. Encouragingly, long-term holders demonstrated resilience amidst escalating tensions. Unlike short-term fears reflected in futures markets, long-term holders increased their supply by 0.1% over the past week, for the first time since January, as the Israeli response seemingly coincided with a local bottom for long-term holder supply. This is a bullish signal, showcasing belief in the asset, irrespective of recent market activity. Nevertheless, we can see that BTC will continue to be stuck in the $60K – $70K range until we get more clarity on the macroeconomic and geopolitical front.

Figure 1: Bitcoin Short-Term Holder Supply vs. Long-Term Holder Supply

Source: Glassnode

Despite the macroeconomic headwinds, significant progress was made in the institutional adoption of Bitcoin. Despite a break in Blackrock’s Bitcoin ETF 71-day net inflow streak, the conclusion of the 90-day due diligence period for fund managers considering the spot ETFs revealed that over 100 institutions, such as BNY Mellon and Banco do Brazil, are exposed to Bitcoin. Morgan Stanley is also actively exploring allowing 15,000 brokers to provide this exposure to their clients. They also filed to broaden access to BTC ETFs by expanding it to 12 more funds, signifying the growing acceptance of Bitcoin by TradFi institutions. Finally, the launch of Bitcoin ETFs in Hong Kong marked a significant step towards adoption in Asia, potentially influencing other jurisdictions like South Korea, Japan, and Singapore to follow suit while expanding Bitcoin’s access to Hong Kong’s $1.15 trillion wealth management sector.

Beyond the market’s activity, April also marked a historic event for Bitcoin: the fourth halving, reducing Bitcoin’s annual inflation rate to below 1%, making it even scarcer than Gold. Historically, Bitcoin trades 50% down from its peak leading up to the halving. This year, Bitcoin defied historical trends, reaching a new all-time high prior to the halving, attributed to the surge in demand from the aforementioned US Bitcoin ETFs, coupled with ongoing technical advancements within the Bitcoin ecosystem, such as Ordinals, BRC-20s, and Runes, as touched upon in the last newsletter.

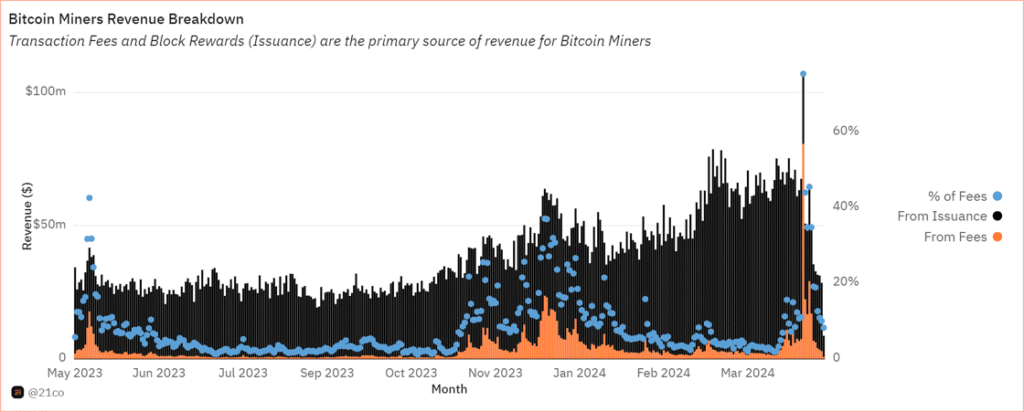

These advancements are transforming Bitcoin beyond its original vision as a purely decentralized payment network. The emergence of Ordinals and Runes has amplified on-chain activity, reflected in surging transaction fees. This is particularly beneficial for Bitcoin miners, who saw their block reward cut in half due to the halving. Higher transaction fees help compensate for this lost revenue, ensuring the continued security of the Bitcoin network. Notably, as shown in Figure 2, Bitcoin transaction fees made up 75% of Bitcoin miner revenue, soaring to $128 on the day of the halving. While the surge might have been driven by the desire to have a historical inscription, it does underscore the potential impact on miners’ revenue as Bitcoin’s on-chain ecosystem matures.

Figure 2: Bitcoin Miners Revenue

Source: 21.co on Dune

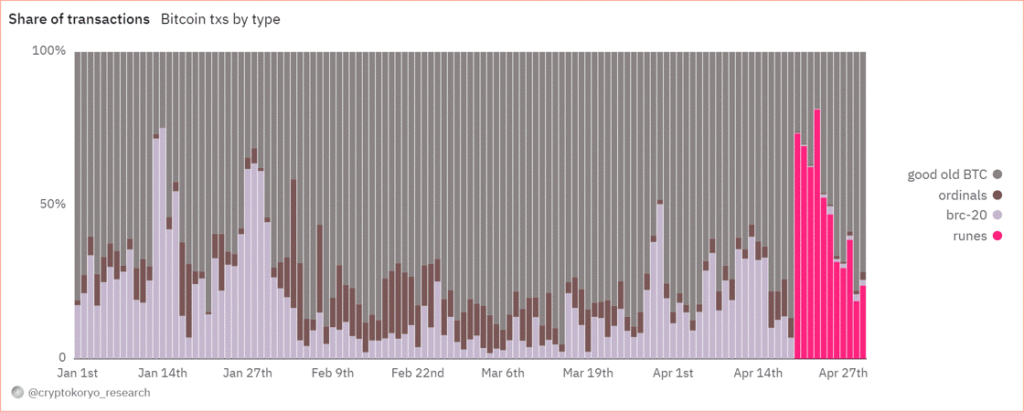

Launched in April, Runes Protocol offers a novel approach to creating fungible tokens on the Bitcoin network. It addresses inefficiencies associated with the BRC-20 standard, which have burdened the Bitcoin blockchain due to its inefficient data handling. Ultimately, Runes presents a key innovation that bolsters Bitcoin’s security budget by offering miners an alternative source of revenue, while reducing their dependence on block rewards. Runes has already rewarded miners with almost $150 million, impressively making up 80% of fees generated on the Bitcoin network on April 23, as shown below.

Figure 3: Share of Bitcoin Transaction Fees

Source: CryptoKoryo on Dune

While Bitcoin’s daily transaction volume surpassed 1 million, rivaling Ethereum’s activity, the initial excitement surrounding Runes might recede before a more long-term, sustainable surge in the network’s DeFi activity. The initial phase often focuses on meme-like tokens attracting rapid but fleeting interest. However, the development of sophisticated DeFi protocols like exchanges and Automated Market Makers (AMMs) will enhance Bitcoin’s application layer, streamlining token trading similar to what ERC-20/ERC-721 standards did for Ethereum. This paves the way for a more robust and mature DeFi ecosystem on Bitcoin, which we will closely monitor in the months to come.

Regulatory Crackdowns Fire Up in April

April saw the continued regulation-by-enforcement trend, cracking down on non-custodial infrastructure and the Ethereum ecosystem. On April 10, the Securities and Exchange Commission (SEC) sent Wells Notices to Uniswap and Consensys for alleged violation of federal securities law. Uniswap announced its intention to resolve this through court. The details of the SEC’s Wells Notice remain unclear. However, it could have been triggered by Uniswap’s pending revenue-sharing initiative, which has had a domino effect on the ecosystem. In the short term, the crackdown could dissuade protocols from following suit, which would have incentivized their users to stake and delegate their tokens for a share of the revenue.

On April 25, Consensys filed a lawsuit against the SEC for “unlawful seizure of authority,” arguing that Ethereum is not a security nor that MetaMask is a securities broker. The recent crackdown could put a strain on the crypto infrastructure industry in the short term, as it could severely disrupt the ecosystem while encouraging companies to explore alternative jurisdictions aside from the U.S. market.

Earlier in February, the SEC adopted rules that widened its interpretation of a dealer to include “as part of a regular business” in addition to the initial definition, “any person engaged in the business of buying and selling securities . . . for such person’s own account through a broker or otherwise.” The newly adopted rules have now triggered an outcry in the crypto community, deeming the legislation too broad, as it includes average market participants in cryptoasset liquidity pools (liquidity providers), who essentially have a very different role than a broker.

For example, liquidity providers on Uniswap can be anyone, given they have the capital to deposit and earn yield, unlike professional market makers in traditional finance whose responsibilities extend beyond that. Providing liquidity on Uniswap is open to anyone to enable permissionless markets, which makes this an important characterization due to the impact it could have on how DeFi functions in the US. While the ongoing crackdown could cause uncertainty in the short term within the Ethereum ecosystem, regulatory clarity will ultimately be reached in the long run, as we’ve seen on several counts of hurdles over the past few years.

Ethereum’s Most Anticipated Application of the Year is Live

EigenLayer is finally live on Ethereum’s mainnet. It’s a new primitive that allows ETH users to “re-stake” their existing staked ETH to validate the security of external networks. EigenLayer has been eagerly anticipated as it optimizes capital efficiency by allowing users to earn additional yield on top of their native staking rewards. Further, it allows younger protocols to borrow the security assurances of Ethereum, circumventing the need to bootstrap their own security from scratch. This translates to a more cost-efficient approach while simultaneously bolstering their decentralization. Nevertheless, the protocol comes with inherent risks.

By opting to earn additional yield, users, and validators subject themselves to heightened smart contract risks as they become exposed to the vulnerabilities of both Ethereum and the additional protocols relying on its security. Moreover, a large portion of ETH could end up being “re-staked” in EigenLayer instead of just validating the security of Ethereum, creating a problem of misalignment. Simply, some validators might opt to maximize their profits by pursuing strategies that prioritize short-term gains over the long-term security of the network. Additionally, the growing enthusiasm for the protocol suggests that a significant portion of the crypto economy might rely on Ethereum’s security. Currently, 15% of all staked ETH is allocated towards Eigen’s re-staking strategy. The continuation of this trend could lead to centralization, posing a risk as Ethereum might inadvertently become a single point of failure over a longer time horizon.

Wide-spread slashing is another concern. In essence, if a substantial amount of ETH is re-staked in a singular protocol, then a slashing event due to unintended or malicious behavior could significantly impact honest ETH stakers. Thus, Eigen proposed a slashing committee comprising esteemed ETH developers and trusted community members, empowered to veto such occurrences and safeguard Ethereum’s integrity.

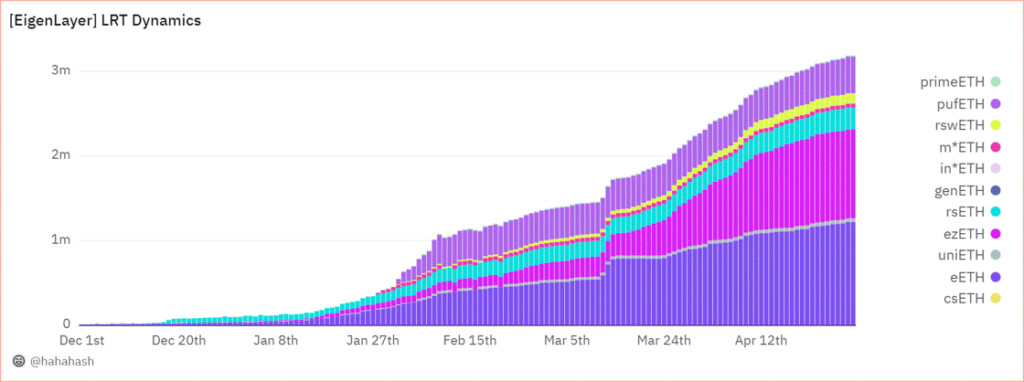

The final risk concerns a new breed of tokens known as Liquid re-staking Tokens (LRTs), which operate atop EigenLayer. LRTs, akin to Liquid Staking Tokens (LSTs) issued by the established Lido Protocol in 2021, aim to unlock similar capital efficiency by allowing users to use their re-staked ETH as collateral for lending and borrowing. Given that re-staked ETH in Eigen can’t be used across DeFi platforms, users have turned to LRT protocols like Ether.fi and Renzo to seek higher levels of capital flexibility, with their re-staked assets. For context, LRTs grew exponentially by a factor of 28 throughout Q1, increasing from nearly 100K units to the current figure of 2.8M, as shown in Figure 4, illustrating its soaring demand.

Figure 4: Growth of Liquid re-staking Tokens (LRTs) on EigenLayer

Source: @hahahash on Dune

While LRTs can offer amplified gains through leveraged lending, they can also exacerbate losses, increasing systemic risk in market downturns. Since some LRT protocols can’t offer withdrawals yet, users may be forced to swap their LRT tokens on thinly traded secondary markets, intensifying their decline. Last week, we saw an instance of this risk manifest when Renzo’s ezETH lost its peg. This happened as the ETH derivative experienced heavy selling on various exchanges, causing it to trade at over a 75% discount compared to ETH. This coincided with the company facing scrutiny over its controversial token distribution plan, which is scheduled to launch on April 30.

All in all, the impact of EigenLayer is not to be understated, as the excitement surrounding the new primitive has propelled it to become the second-largest protocol on Ethereum by Total Value Locked (TVL), boasting an impressive $15.6B. This already eclipses the TVL of established players like Solana by fourfold, highlighting the immense adoption that EigenLayer is witnessing despite its brief existence. Further, the excitement building up to its launch since it unveiled its roadmap in March has propelled the Ethereum validator entry queue to its highest level since October. The queue now necessitates a minimum waiting period of 8 days before new validators can join the network, as seen below in Figure 5. Nevertheless, stay tuned as we prepare to release a more in-depth exploration of EigenLayer risks over the coming weeks.

Figure 5: Ethereum Validator Entry Queue in Days

Source: ValidatorQueue

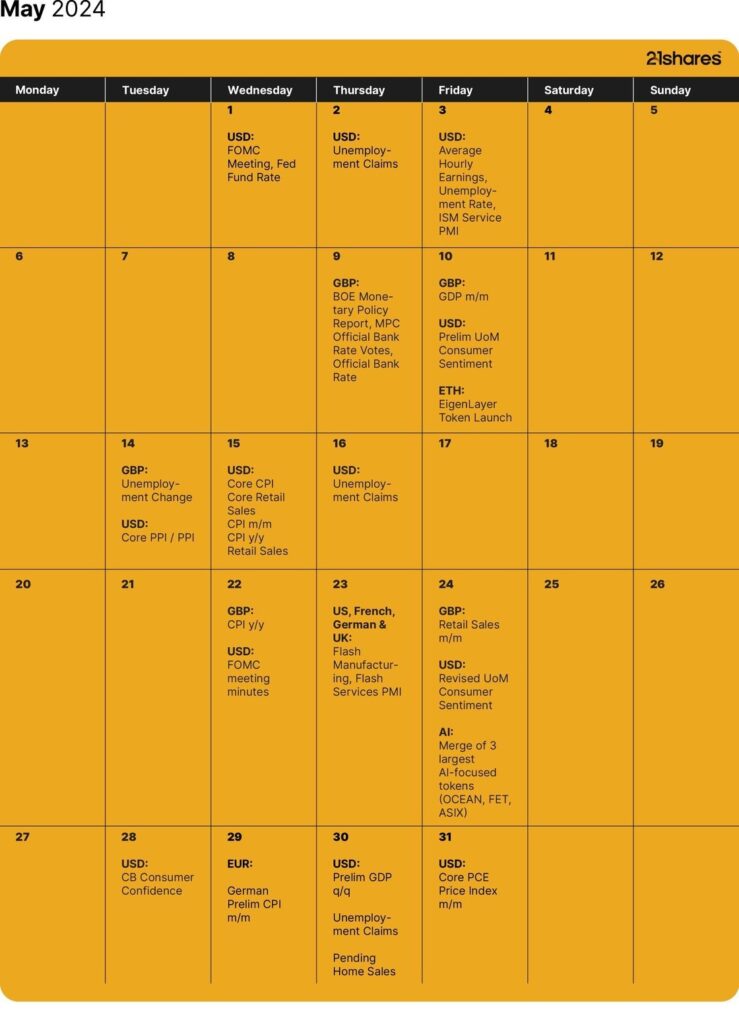

Next Month’s Calendar

Source: Forex Factory, 21Shares

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

ETC Group lanserar BTC1, En unik Core Bitcoin ETP

Publicerad

21 timmar sedanden

1 maj, 2024

BTC1 är en bäst-i-klassen Bitcoin ETP utformad för benchmark-fokuserade långsiktiga investerare. ETC Group tillkännagav i förra veckan lanseringen av sin senaste börshandlade produkt (ETP) på Deutsche Börse XETRA. ETC Group Core Bitcoin ETP (ticker BTC1; ISIN DE000A4AER62) som har skräddarsytts specifikt för benchmarkmedvetna, långsiktiga köp-och-håll-investerare och globala institutionella investerare med utökade behov av likviditet och riskhantering. BTC1 kompletterar ETC Groups befintliga produktsortiment, som bland annat inkluderar den mest likvida och största krypto-ETP i Europa.

Viktiga höjdpunkter

- Kostnadseffektiv: Med en Total Expense Ratio (TER) på 0,30 % erbjuder BTC1 en konkurrensfördel i kostnadseffektivitet.

- Benchmark-fokuserad: BTC1 spårar det institutionella prisindexet för Bitcoin med CF Benchmarks, vilket säkerställer noggrannhet och tillförlitlighet vid spårning av Bitcoins prisrörelser.

- Bredare och bredare primärmarknadslikviditet: Som den första reglerade globala spot-Bitcoin-produkten tillhandahåller BTC1 oöverträffad primärmarknadslikviditet, och överbryggar USA, Europa och Asien spot-BTC-likviditet under de handelsfönster som används av globalt, reglerat institutionellt kapital.

- Tri-NAV-metodik: BTC1 introducerar en unik Tri-NAV-metodik, som erbjuder institutionella investerare ett utökat likviditetsfönster på primärmarknaden som täcker amerikanska, europeiska och asiatiska BTC-spotlikviditeter. Därför tillhandahåller emittenten, förutom börsens öppettider, tre prisbestämningar under dagen (istället för bara en) för att utöka den primära marknadens likviditet över ytterligare tidszoner. Detta innebär att institutionella investerare kan handla med sina innehav under den längsta perioden jämfört med alla andra reglerade Bitcoin spotinstrumement över hela världen på den primära marknaden. Som ett resultat kan BTC1 betraktas som den första globalt orienterade Bitcoin-spot-ETP.

- Robust ETP-struktur: BTC1 använder samma betrodda produktstruktur som ETC Groups övriga produkter, inklusive tysk hemvist med primär notering på XETRA, 100 % fysisk uppbackning och full fungibilitet med det underliggande. Dessutom har BTC1 också en oberoende administratör, ett unikt ETP-strukturattribut som först introducerades av ETC Group 2020. Denna administratörsenhet har laglig vetorätt på alla tillgångar eller värdepappersrörelser hos ETP-utgivaren, övervakar depåbalanser och lägger totalt sett till ett extra lager säkerhet för emittentens produktekosystem.

- Säker förvaringslösning: Tillgångar förvaras säkert hos Zodia Custody, en ledande europeisk institutionell leverantör av kylförvaring, med ett ramverk för efterlevnad och styrning av bankklass.

Varför benchmark och likviditet spelar roll

Bitcoins likviditet är enorm men fragmenterad över flera börser, vilket komplicerar prisbestämningen för investerare. CF Benchmarks har utvecklat det mest robusta riktmärket för att fånga och aggregera denna likviditet, BRR-indexet och dess amerikanska och asiatiska varianter – BRRY och BRRAP som tillsammans har blivit det mest använda riktmärket som används av reglerat institutionellt kapital, inklusive majoriteten av amerikanska spot-ETFer och CME Futures. BTC1 utnyttjar alla tre regionala varianter av detta riktmärke, vilket gör att institutionella investerare kan spåra Bitcoins rättvisa pris exakt och säkert. I slutändan, ger tillgång till tre likviditetspooler/värderingspoäng under 14 timmar (jämfört med värderingspunkt och ett 8-timmarsfönster för alla andra ETFer och ETPer globalt).

BTC1 tar itu med de likviditetsutmaningar som institutionella investerare står inför med befintliga Bitcoin ETPer, som är begränsade till traditionella börstider. Med Bitcoin-handel dygnet runt och Bitcoin Futures-handel 23/5, erbjuder BTC1 institutionella investerare en global och reglerad spot Bitcoin ETP, med för närvarande den bredaste primära marknadslikviditeten för Bitcoin ETPer globalt. Detta utökade likviditetsfönster förbättrar pristransparens och riskhanteringsförmåga för institutionella investerare.

Chanchal Samadder, produktchef på ETC Group, kommenterade, BTC1 representerar en betydande milstolpe i utvecklingen av Bitcoin-investeringsprodukter. Designad med benchmarkmedvetna och långsiktiga investerare i åtanke, erbjuder BTC1 en unik blandning av kostnadseffektivitet, noggrannhet och utökad primärmarknadslikviditet, vilket sätter en ny standard på Bitcoin ETP-marknaden.

Banar kontinuerligt vägen som Tysklands första Crypto ETP-utgivare

Tim Bevan, VD kommenterade: På ETC Group vill vi driva kryptoinvesteringsbranschen framåt och lanseringen av BTC1 representerar ett unikt förslag. Med BTC1 tar vi ut den första globalt orienterade Bitcoin ETP på marknaden, med de utökade funktioner för likviditet och riskhantering som våra kunder behöver. Vi är stolta över att lansera ännu en marknad först och vi tror att BTC1 har potentialen att unikt betjäna institutionella investerare med klassens bästa egenskaper.

BTC1 kommer att kunna handlas på XETRA och många andra plattformar och kommer att läggas till HANetfs paneuropeiska ETP-distributionsplattform.

Nya tillägg till ETC Groups institutionella produktsortiment inkluderar ET32, den unika totalavkastningen Ethereum-satsning ETP kopplad till ett transparent insatsriktmärke, och DA20, den enda breda marknaden Crypto Basket ETP som spårar ett MSCI-riktmärke för digitala tillgångar bland de 20 bästa kryptovalutorna som det går att investera i.

iShares Lithium & Battery Producers UCITS ETF USD (Acc) (LITM ETF) med ISIN IE000WDG5795, försöker följa STOXX Global Lithium and Battery Producers-index. STOXX Global Lithium and Battery Producers index spårar de största företagen i världen som är aktiva inom prospektering och brytning av litium eller produktion av litiumbatterier.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,55 procent p.a. iShares Lithium & Battery Producers UCITS ETF USD (Acc) är den enda ETF som följer STOXX Global Lithium and Battery Producers index. ETFen replikerar det underliggande indexets prestanda genom samplingsteknik (köper ett urval av de mest relevanta indexbeståndsdelarna). Utdelningarna i ETFen ackumuleras och återinvesteras.

Denna ETF lanserades den 31 oktober 2023 och har sin hemvist i Irland.

Varför LITM?

- Ger exponering för litiumindustrins tema genom litiumgruvarbetare, tillverkare av föreningar och tillverkare av litiumbatterier”

- Exponering för aktierelaterade värdepapper från kvalificerade utvecklade och tillväxtmarknader litiumindustrin temaföretag

- Syftar till att utesluta företag som klassificerats som icke-kompatibla av Sustainalytics Global Standards Screening (”GSS”), som tillhandahåller en bedömning av ett företags påverkan på intressenter och i vilken utsträckning ett företag orsakar, bidrar till eller är kopplat till brott mot internationella normer och standarder.

Investeringsmål

Fondens mål är att ge investerare en totalavkastning, med hänsyn till både kapital- och inkomstavkastning, vilket återspeglar avkastningen från STOXX Global Lithium and Battery Producers Index.

Handla LITM ETF

iShares Lithium & Battery Producers UCITS ETF USD (Acc) (LITM ETF) är en börshandlad fond (ETF) som handlas på Euronext Amsterdam.

Euronext Amsterdam är en marknad som få svenska banker och nätmäklare erbjuder access till, men DEGIRO gör det.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Euronext Amsterdam | USD | LITM |

Största innehav

| Kortnamn | Namn | Sektor | Vikt (%) | ISIN | Valuta |

| 6762 | TDK CORP | Informationsteknologi | 12.74 | JP3538800008 | JPY |

| ALB | ALBEMARLE CORP | Materials | 8.09 | US0126531013 | USD |

| PLS | PILBARA MINERALS LTD | Materials | 6.81 | AU000000PLS0 | AUD |

| 300750 | CONTEMPORARY AMPEREX TECHNOLOGY LT | Industri | 6.49 | CNE100003662 | CNY |

| 6758 | SONY GROUP CORP | Sällansköpsvaror | 5.95 | JP3435000009 | JPY |

| 6752 | PANASONIC HOLDINGS CORP | Sällansköpsvaror | 5.28 | JP3866800000 | JPY |

| 373220 | LG ENERGY SOLUTION LTD | Industri | 5.15 | KR7373220003 | KRW |

| 006400 | SAMSUNG SDI LTD | Informationsteknologi | 4.68 | KR7006400006 | KRW |

| SQM | SOCIEDAD QUIMICA Y MINERA DE CHILE | Industri | 4.13 | US8336351056 | USD |

| AKE | ALLKEM LTD | Materials | 3.35 |

Innehav kan komma att förändras

Regulatory Crackdowns and Ethereum’s Most Anticipated Application

ETC Group lanserar BTC1, En unik Core Bitcoin ETP

LITM ETF ger exponering mot litium och batterier

Ombalansering av Valour Digital Asset Basket 10 (VDAB10) inkluderar Toncoin och Shiba Inu Coin

Vad är en utdelnings-ETF?

ETFmarknaden i Europa firar sitt 24-årsjubileum med tillgångar på två biljoner USD

Tillgång till obligationsmarknaden för företagsobligationer från utvecklade marknader

FUIG ETF investerar i hållbara företagsobligationer som följer Parisavtalet

Vilken är den bästa fond som följer Nasdaq-100?

Försvarsfond når förvaltad volym på 500 MUSD

Populära

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanETFmarknaden i Europa firar sitt 24-årsjubileum med tillgångar på två biljoner USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTillgång till obligationsmarknaden för företagsobligationer från utvecklade marknader

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFUIG ETF investerar i hållbara företagsobligationer som följer Parisavtalet

-

Nyheter4 dagar sedan

Nyheter4 dagar sedanVilken är den bästa fond som följer Nasdaq-100?

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFörsvarsfond når förvaltad volym på 500 MUSD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanVad händer härnäst för Bitcoin?

-

Nyheter3 dagar sedan

Nyheter3 dagar sedanDe mest populära börshandlade fonderna april 2024

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanNy börshandlad fond från Deka ger tillgång till S&P 500-index