ETF Securities FX Research: Commodity rebound not enough for Aussie dollar Aussie dollar has tracked global commodity prices higher in 2016, but soft domestic conditions will pressure the local currency. Corporate earnings have remained lacklustre, just 5% above the multi-year lows

China’s growth remains robust, but the softening trend is a bearish factor for AUD. The commodity price rebound won’t be enough to offset AUD declines.

Futures market pricing remains buoyant, but appears to be rolling over. The options market indicates that AUD has the lowest level of optimism of G10 currencies for growth in coming months.

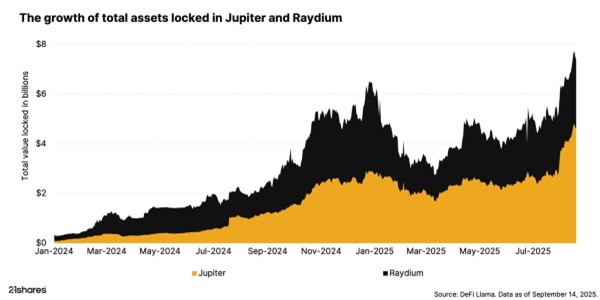

Commodity price rebound

The Australian Dollar (AUD) is one of the major global commodity currencies, as its economy is closely tied to its export base. Commodity markets have begun to recover in 2016, and the AUD has rallied by over 4% in 2016 – the fourth best performing G10 currency in 2016 after the JPY, and the ‘other’ commodity currencies (NOK & CAD). Australia’s major commodity exports are iron ore and coal. Both commodities have recorded stellar gains in 2016, rising 23% and 78%, respectively, and the strong links of the Australian economy to commodity exports have buoyed the local currency. These bulk commodities take a 54% weighting in the Reserve Bank of Australia (RBA) Commodity Index.

(Click to enlarge)

Nonetheless, the Aussie dollar has been weighed down by the sharp decline in company profits in recent years. As a result, capital expenditure plans have been put on hold, particularly in the resources sector. However, the non-mining economy is broadly picking up the slack, with construction, and public spending propping up the economy in 2016. And profits have begun to edge higher this year, helping the AUD to track toward the top of its range in recent months.

(Click to enlarge)

Chinese growth robust but softening

Another area of growth for the Australian economy this year has been exports. There is a strong correlation between the terms of trade (the amount that Australia receives for its exports relative to what it pays for imports) and the Aussie Dollar. As Australia’s largest trading partner, the Chinese economy remains a significant determinant of the performance of the Australian currency.

The growth path of China will determine future demands of Australia’s output, in turn impacting the strength of the Australian dollar – the greater the demand, the greater the buoyancy for commodity prices.

The driver of China’s economy is moving toward a more domestic demand driven, services sector led growth. Accordingly, we feel that growth indicators, like the Li Keqiang index are somewhat outdated and should include new measures that represent a growing services sector, like retail spending and internet usage.

(Click to enlarge)

Our modified Li Keqiang Index shows growth should continue to be elevated, although the trend is lower. The softening growth path is likely to lead to a weaker AUD. While commodity prices will be continually supported by Chinese demand, we expect that it will not be enough to buttress the Aussie dollar at current levels.

Central bank policy

Interest rates also play a key role for currency movements in the shorter term. Accordingly, both Australian and US central bank policy can substantially affect the value of the AUD.

Although the Reserve Bank of Australia (RBA) has continued to cut interest rates (dropping the official rate to 1.5% in August – the lowest level on record) the Aussie Dollar has been resilient. The market expected the central bank should have done more to support the domestic economy in order to fulfil its price stability mandate, and as a result AUD continued to rally. We feel the rally is beginning to lose momentum. Despite cutting rates twice during 2016, in an easing cycle that has spanned the past five years, we expect that the RBA will keep rates on hold for a protracted period, although inflation remains low. Price pressure is likely to remain lacklustre for a prolonged period because of the absence of wage growth. In contrast, the US Fed is likely to continue its tightening cycle.

The combination of a neutral bias for policy in Australia, matched with the upward path for rates in the US, we expect that the Australian dollar is unlikely to break to the upside of its recent A$0.72-0.78 range against the US Dollar. With the US Federal Reserve already beginning to tighten policy, albeit extremely gradually, and with the likelihood of lifting rates again in 2016, widening rate differentials should provide US Dollar support. Accordingly, we expect the Australian dollar to grind lower toward the bottom end of the range in the coming months.

(Click to enlarge)

Another way to trade a softer AUD is via the British Pound (GBP). GBP/AUD is hovering at the lowest level in three years after the ‘flash crash’ in GBP last week. We expect that GBP has overshot fundamental drivers to the downside and with risks balanced for a downside move for AUD, we feel that GBP/AUD could see a significant rebound toward A$1.65 from A$1.60 in the near term.

Market pricing

(Click to enlarge)

Futures market net long positioning has rebounded in recent weeks, towards the 2016 highs. With the AUD trading around the top of the 2016 range, options market pricing shows that the AUD has the lowest level of optimism of G10 currencies for growth.

Important Information

General

This communication has been issued and approved for the purpose of section 21 of the Financial Services and Markets Act 2000 by ETF Securities (UK) Limited (“ETFS UK”) which is authorised and regulated by the United Kingdom Financial Conduct Authority (the “FCA”).

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan