Trade Idea – Foreign Exchange – CAD heading lower

Highlights

- The CAD has decoupled from oil prices as economic prospects wane.

- Bank of Canada (BoC) has indicated that further stimulus was considered at the latest monetary policy meeting.

- Weaker oil prices should see short positions mount against the CAD and the USD/CAD climb higher.

Oil prices offer little support

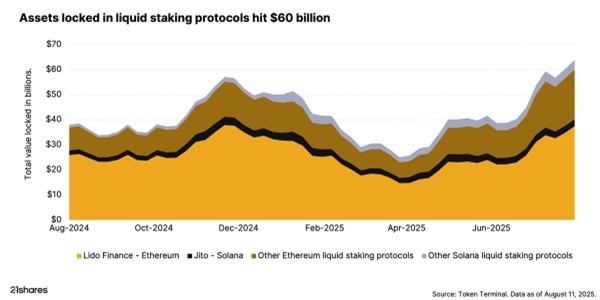

Since OPEC took the surprise decision to limit production last month crude benchmarks have managed to settle in a new trading range in and around the psychologically important $50/bbl level. Typically, this move would have lent support to the Canadian Dollar (CAD) against its major currency counterparts (due to its status as a commodity currency) but on this occasion it has failed to do so (see Figure 1). Instead, the currency has suffered from a widening nominal yield differential with the US (see Figure 1) and meagre economic prospects. This has helped to keep the USD/CAD moving on a well-established upward path for some time and the trend appears well placed to continue. We see a high likelihood of upcoming oil price weakness and an increasingly dovish bias from the Bank of Canada (BoC) helping to push the pair higher in the next few months.

(click to enlarge)

Crude fragility and dovish inclinations

Earlier this week, comments from the Iraqi oil minister claiming that the embattled nation should be exempt from any OPEC production agreement highlighted the challenges the cartel faces in imposing any limits. Several of its members are facing significant financial and geopolitical pressures (Iraq, Venezuela, Saudi Arabia etc.) and so applying country level quotas is almost certain to face obstacles. Until now the market has perceived the deal optimistically but the difficult practicalities of implementing the agreement are likely to see oil prices retrace a portion of their recent gains. This will likely add to bearish sentiment against the CAD and may prompt a monetary reaction from the BoC.

Recent comments and actions from the BoC have been mixed. At the latest meeting the central bank held interest rates steady (as broadly expected) and described risks to the inflation outlook as “roughly balanced”, a positive shift from “tilted to the downside” in the previous meeting. However in a surprising turn, the BoC governor, Stephen Poloz, did mention that the governing council “actively discussed the possibility of adding more stimulus”. In addition, the BoC reduced both its inflation and growth forecasts for this year and the next. While these actions failed to inspire a market repricing of future interest cuts, it does show a return to a dovish bias which may grow if manufacturing, trade and inflation data continue to disappoint.

(click to enlarge)

Shorts could mount

Net speculative positioning towards the CAD fell into negative territory at the end of last month, but still remains moderate. The move resulted from a reduction in long positions rather than a build-up in shorts, which remain a fraction of January levels due to recent strength in oil prices (see Figure 2). Any weakness in oil could see shorts build up and send the USD/CAD to higher levels. The pair is on a strong upward path and is only likely to face resistance at the 1.356 level, which is near March highs and would represent a 50% retracement of its decline earlier in the year.

Investors wishing to express the investment views outlined above may consider using the following ETF Securities ETPs:

Currency ETPs

EUR Base

ETFS Long CAD Short EUR (ECAD)

ETFS Short CAD Long EUR (CADE)

GBP Base

ETFS Long CAD Short GBP (GBCA)

ETFS Short CAD Long GBP (CAGB)

USD Base

ETFS Long CAD Short USD (LCAD)

ETFS Short CAD Long USD (SCAD)

3x

ETFS 3x Long CAD Short EUR (ECA3)

ETFS 3x Short CAD Long EUR (CAE3)

5x

ETFS 5x Long CAD Short EUR (ECA5)

ETFS 5x Short CAD Long EUR (CAE5)

Currency Baskets

ETFS Bullish USD vs Commodity Currency Basket Securities (SCOM)

ETFS Bearish USD vs Commodity Currency Basket Securities (LCOM)

Important Information

This communication has been provided by ETF Securities (UK) Limited (“ETFS UK”) which is authorised and regulated by the United Kingdom Financial Conduct Authority (the “FCA”). The products discussed in this document are issued by ETFS Foreign Exchange Limited (“FXL”). FXL is regulated by the Jersey Financial Services Commission.

This communication is only targeted at professional investors. In Switzerland, this communication is only targeted at Regulated Qualified Investors.

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan