Nyheter

Successfully navigate through Bitcoin & Cryptoassets Markets

Publicerad

1 år sedanden

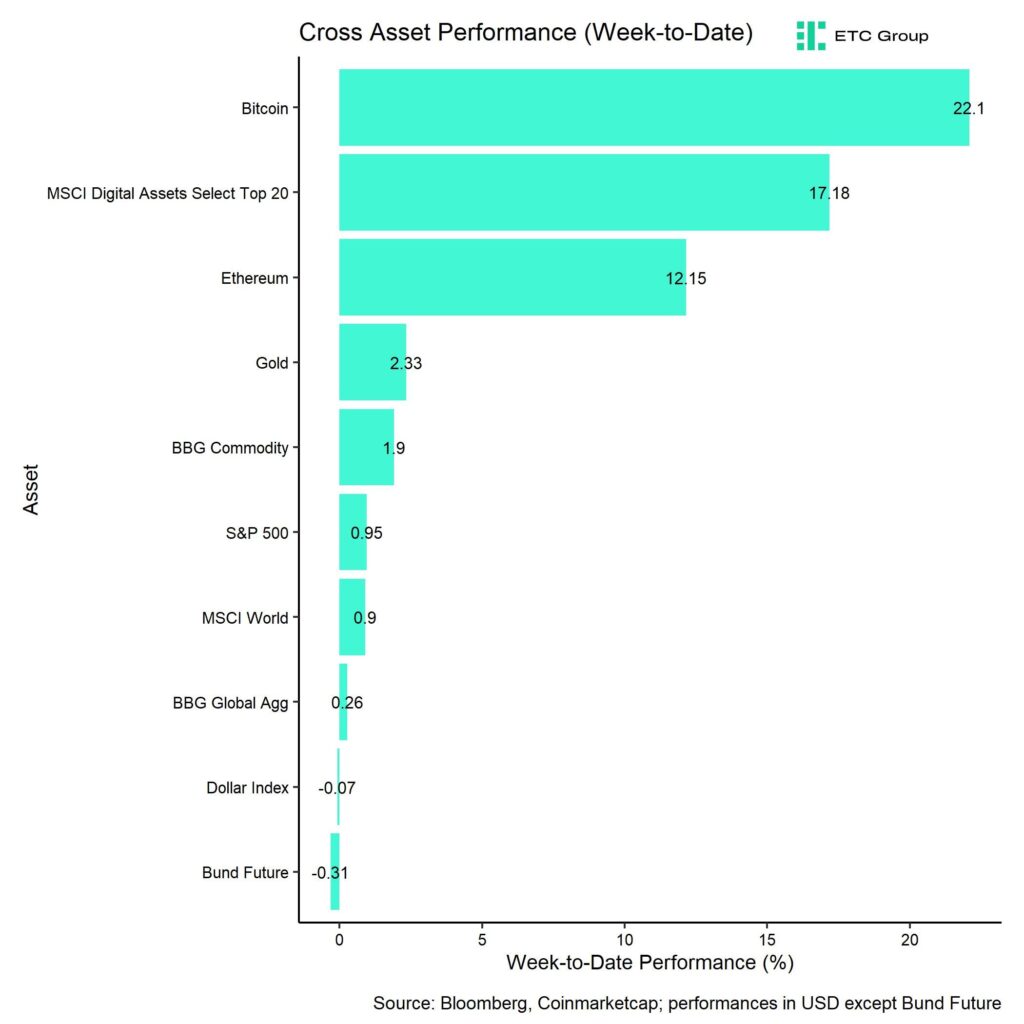

• Last week, cryptoassets posted their strongest weekly performance year-to-date on the back of a significant increase in risk appetite across all areas

• Our in-house “Cryptoasset Sentiment Indicator” has touched the highest reading since November 2021 indicating very bullish sentiment

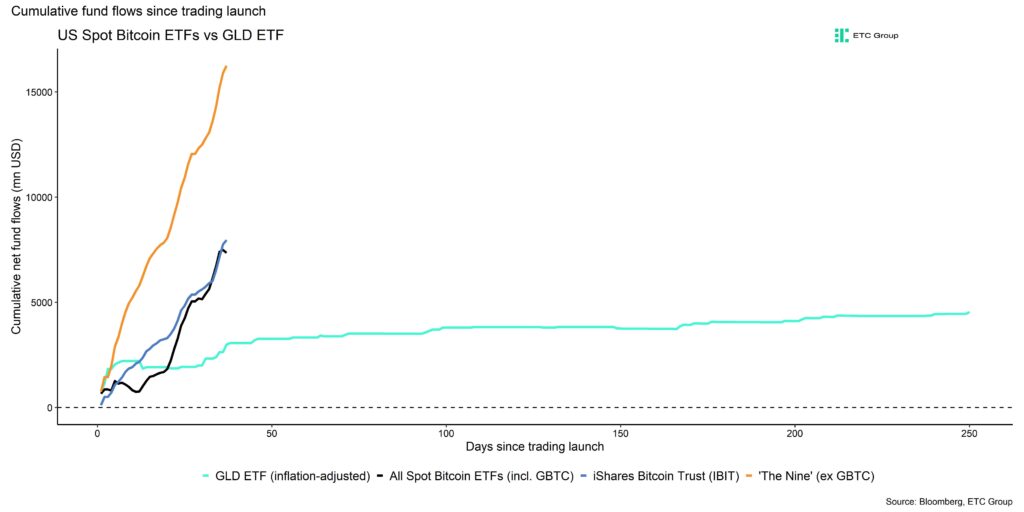

• US spot Bitcoin ETFs have kept a very high momentum of inflows over the past weeks, vastly surpassing historical inflows into the GLD ETF since trading launch in 2004

Chart of the Week

Performance

Last week, posted their strongest performance year-to-date on the back of a significant increase in risk appetite across all areas.

For instance, last week saw record daily inflows into US spot Bitcoin ETFs.

US spot Bitcoin ETFs have kept a very high momentum of inflows over the past weeks, vastly surpassing historical inflows into the GLD ETF since trading launch in 2004 (Chart-of-the-Week).

In fact, iShares Bitcoin Trust (IBIT) was the fastest ETF to ever get to 10 bn USD AuM within that short period of time.

Furthermore, significant BTC net exchange outflows from both Coinbase and Binance implied increased institutional buying interest as well. There were also rumours of a potential sovereign buyer of Bitcoin. Besides, the most recent price spikes were additionally fuelled by futures short liquidations that propelled Bitcoin above 60k USD.

That being said, many sentiment and positioning indicators already imply that sentiment is euphoric, and that positioning appears to be stretched. For instance, our in-house “Cryptoasset Sentiment Indicator” has touched the highest reading since November 2021. Moreover, technical price indicators for Bitcoin such as the Relative Strength Index (RSI) or the Fractal Dimension imply that a short-term price correction is imminent.

Based on these indicators, a short-term pull-back off the recent highs appears to be quite likely.

On-chain indicators imply that around 99% of Bitcoin supply is already in profit and short-term holders have recently sent the highest amount of coins in profit to exchanges since October 2021.

However, net inflows into US spot Bitcoin ETFs are bound to stay strong especially since recent GBTC sales from the Genesis liquidation are bound to level off and big banks like Bank of America or Wells Fargo have just recently declared to explicitly offer Bitcoin ETFs to their clients.

So, the market may stay overbought for a longer period of time.

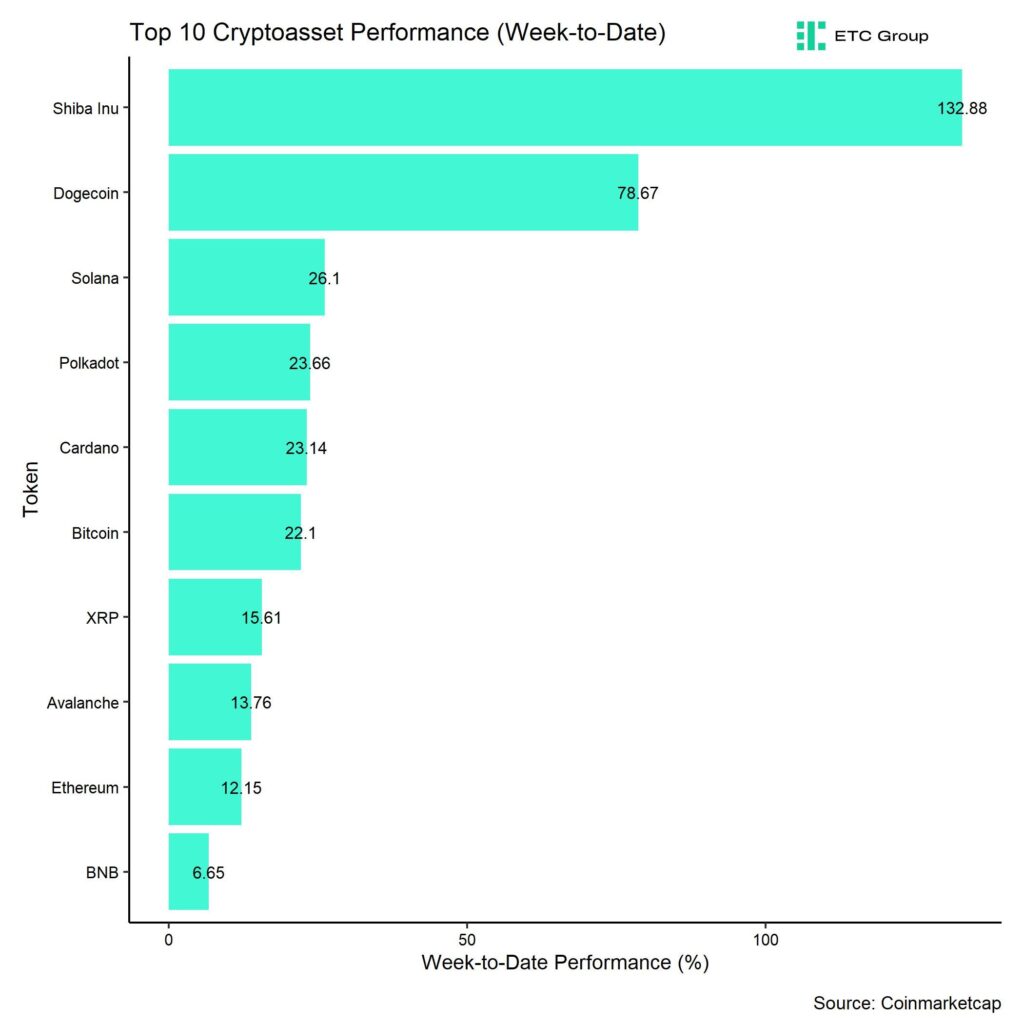

In general, among the top 10 crypto assets, Shiba Inu, Dogecoin, and Solana were the relative outperformers.

As mentioned above, overall altcoin outperformance vis-à-vis Bitcoin declined somewhat compared to the week prior, with 40% of our tracked altcoins managing to outperform Bitcoin on a weekly basis.

Sentiment

Our in-house “Cryptoasset Sentiment Index” has increased significantly and signals euphoric sentiment. In fact, the index increased to the highest level since November 2021 last week.

At the moment, 13 out of 15 indicators are above their short-term trend.

There were significant increases in crypto dispersion and the BTC perpetual funding rate across multiple exchanges.

The Crypto Fear & Greed Index still remains in ”Extreme Greed” territory as of this morning.

Meanwhile, our own measure of Cross Asset Risk Appetite (CARA) also increased throughout the week which signals improving sentiment in traditional financial markets as well.

As mentioned above, performance dispersion among cryptoassets has increased significantly to the highest reading ever recorded in our sample.

In general, high performance dispersion among cryptoassets implies that correlations among cryptoassets are low, which means that cryptoassets are trading more on coin-specific factors and that cryptoassets are increasingly decoupling from the performance of Bitcoin.

At the same time, altcoin outperformance vis-à-vis Bitcoin declined somewhat, with a clear underperformance of Ethereum vis-à-vis Bitcoin last week. Viewed more broadly, around 40% of our tracked altcoins have outperformed Bitcoin on a weekly basis.

In general, decreasing altcoin outperformance tends to be a sign of declining risk appetite within cryptoasset markets.

Fund Flows

Overall, we saw another week of record net fund inflows in the amount of +1873.4 mn USD (week ending Friday) based on Bloomberg data across all types of cryptoassets.

Global Bitcoin ETPs continued to see significant net inflows of +1745.2 mn USD of which +1722.9 mn (net) were related to US spot Bitcoin ETFs alone. The ETC Group Physical Bitcoin ETP (BTCE) saw net outflows equivalent to -48.7 mn USD last week.

The Grayscale Bitcoin Trust (GBTC) experienced a significant increase in net outflows of around -1456 mn USD last week. However, this was also more than offset by net inflows into other US spot Bitcoin ETFs which managed to attract +3179 bn USD (ex GBTC).

Note that some fund flows data for US major issuers are still lacking in the abovementioned numbers due to T+2 settlement.

Apart from Bitcoin, we saw comparatively small flows into other cryptoassets last week again.

Inflows into global Ethereum ETPs picked up significantly last week with around +124.8 mn USD. The ETC Group Physical Ethereum ETP (ZETH) also attracted +1.7 mn USD while the newly-launched ETC Group Ethereum Staking ETP (ET32) attracted +0.1 mn USD in inflows.

Besides, Altcoin ETPs ex Ethereum that managed to attract +5.7 mn USD last week.

In contrast, Thematic & basket crypto ETPs experienced net outflows of -2.2 mn USD, based on our calculations. The ETC Group MSCI Digital Assets Select 20 ETP (DA20) saw neither in- nor outflows last week. (+/- 0.0 mn USD).

Besides, the beta of global crypto hedge funds to Bitcoin over the last 20 trading has also increased significantly to around 1.2 which implies that global crypto hedge funds have significantly increased their Bitcoin market risks.

On-Chain Data

The most recent price increase was very well supported by positive on-chain developments as well. For instance, we saw the significant net exchange outflows from major exchanges that led to a strong decline in BTC exchange balances to a fresh 6-year low. Especially Friday saw very significant exchange outflows.

One of the highest exchange outflows in 2024 also happened last Friday during the Asian session.

In total, little more than 2.3 bn USD worth of Bitcoin was taken off exchanges on Friday. the largest withdrawal in more than five years. Looking more specifically into the numbers, it was more like a 2 bn USD outflow since about 200 mn USD of this went to Coinbase Prime.

Over the previous several days, Binance exchange has also seen significant outflows totalling over 400 mn USD. Coinbase saw the remaining outflows. The interesting outflows are from Binance since they are unrelated to the ETF and could be related to the sovereign buyer rumour mentioned above.

Increasing supply pressure was also intensifying because of decreasing BTC inventories at OTC desks. There were also some rumours that OTC desks were running out of bitcoins last week but which could definitely be seen in the data as well.

Despite all the bullish developments, we also saw increasing profit-taking by short-holders as well. On-chain indicators imply that around 99% of Bitcoin supply is already in profit and short-term holders have recently sent the highest amount of coins in profit to exchanges since October 2021.

This is also visible in the Short-Term Holder Spent Output Profit Ratio (STH SOPR) which spiked significantly last week (see appendix).

This increases the risk of a short-term pull back.

Futures, Options & Perpetuals

The last leg up was mostly fuelled by short futures liquidations that also led to a general decline in open interest both for BTC futures and perpetual contracts last week.

More specifically, we saw the highest number of futures short liquidations of around 149.6 mn USD on Wednesday last week according to data provided by Glassnode.

Besides, the 3-months annualized BTC futures basis also increased significantly to around 19.2% p.a. which is the highest reading since the pre-ETF approval highs.

BTC perpetual funding rates also increased to the highest level since October 2021 indicating very bullish sentiment on in BTC perpetual futures.

BTC options’ open interest also increased last week by around +50k BTC as traders increasingly bought puts to protect for downside risks. The Put-call open interest increased significantly throughout the week and reached 0.64 last Thursday.

The 25-delta BTC option skew for shorter expiries also decreased last week which is somewhat inconsistent with the increase in put-call open interest ratios.

In contrast, BTC option implied volatilities continued to drift higher throughout the week and reached the highest level year-to-date with around 71.6% p.a. for 1-month ATM options.

Bottom Line

• Last week, cryptoassets posted their strongest weekly performance year-to-date on the back of a significant increase in risk appetite across all areas

• Our in-house “Cryptoasset Sentiment Indicator” has touched the highest reading since November 2021 indicating very bullish sentiment

• US spot Bitcoin ETFs have kept a very high momentum of inflows over the past weeks, vastly surpassing historical inflows into the GLD ETF since trading launch in 2004

To read our Crypto Market Compass in full, please click the buton below:

Disclaimer

Important Information

The information provided in this material is for informative purposes only and does not constitute investment advice, a recommendation or solicitation to conclude a transaction. This document (which may be in the form of a blogpost, research article, marketing brochure, press release, social media post, blog post, broadcast communication or similar instrument – we refer to this category of communications generally as a “document” for purposes of this disclaimer) is issued by ETC Issuance GmbH (the “issuer”), a limited company incorporated under the laws of Germany, having its corporate domicile in Germany. This document has been prepared in accordance with applicable laws and regulations (including those relating to financial promotions). If you are considering investing in any securities issued by ETC Group, including any securities described in this document, you should check with your broker or bank that securities issued by ETC Group are available in your jurisdiction and suitable for your investment profile.

Exchange-traded commodities/cryptocurrencies, or ETPs, are a highly volatile asset and performance is unpredictable. Past performance is not a reliable indicator of future performance. The market price of ETPs will vary and they do not offer a fixed income. The value of any investment in ETPs may be affected by exchange rate and underlying price movements. This document may contain forward-looking statements including statements regarding ETC Group’s belief or current expectations with regards to the performance of certain asset classes. Forward-looking statements are subject to certain risks, uncertainties and assumptions, and there can be no assurance that such statements will be accurate and actual results could differ materially. Therefore, you must not place undue reliance on forward-looking statements. This document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment. An investment in an ETC that is linked to cryptocurrency, such as those offered by ETC Group, is dependent on the performance of the underlying cryptocurrency, less costs, but it is not expected to match that performance precisely. ETPs involve numerous risks including, among others, general market risks relating to underlying adverse price movements and currency, liquidity, operational, legal, and regulatory risks.

Du kanske gillar

Nyheter

April in ETFs: Gold at New Highs, Crypto in Transition, and Moat Index Holding Steady

Publicerad

17 timmar sedanden

2 maj, 2025

As April winds down, markets remain on edge, with escalating tariffs and renewed trade tensions keeping volatility in focus. In this summary of our full-length newsletter, we spotlight gold and gold equities, both of which have surged to record levels. We also take a step back from the day-to-day noise in crypto to explore the broader shifts in the regulatory landscape in our latest Whitepaper and present Celestia in detail. Finally, we assess how Moat indexes have held up and evolved amid the turbulence.

Your VanEck Europe team wishes you a great read.

Featured Articles

🥇 Are Gold Mining Equities Regaining Attention Amid Rising Gold Prices?

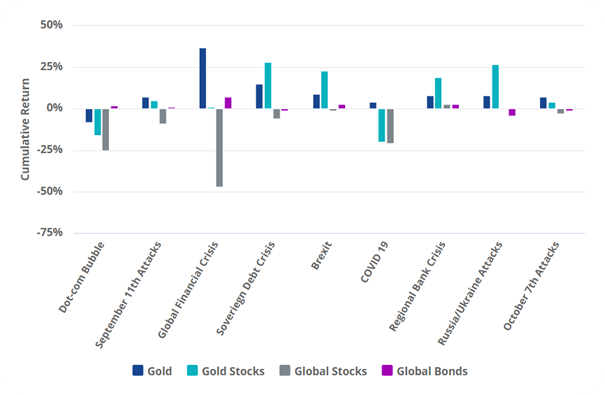

Gold & Gold mining equities tend to shine during stress periods

Source: VanEck, World Gold Council.

Gold has attracted renewed interest from investors amid concerns about inflation, currency volatility, and overall market uncertainty. Gold mining companies have recently reported improved profit margins and cash generation, with some initiating share buybacks and maintaining relatively strong balance sheets. Despite these developments, many continue to trade below their historical valuation averages.

While historical trends indicate that gold and gold mining equities have outperformed during certain periods of market stress, these patterns may not repeat under different economic conditions. Performance can be influenced by a range of factors including interest rates, central bank policy, geopolitical developments, and investor sentiment.

→ Read more

⚖️ Whitepaper Highlights: How New Crypto Regulations May Shape the Future

Cryptocurrencies are entering a new era. With the re-election of Donald Trump and the implementation of the European Union’s Markets in Crypto-Assets (MiCA) regulation, digital assets are moving into a landscape defined not just by innovation, but also by regulatory clarity.

MiCA’s structured and transparent approach aims to promote legitimacy, safeguard investors, and enhance trust in digital asset markets across Europe. It could also serve as a blueprint for other jurisdictions looking to regulate crypto effectively.

→ Read the Whitepaper Highlights

⛓️ Introduction to Celestia

Most blockchains, like Ethereum or Bitcoin, are monolithic which means they perform all major functions (consensus, data availability, and execution) on a single layer. This design ensures security but according to new modular networks, limits scalability and flexibility.

The modular blockchain thesis, which Celestia is leading, proposes separation of layers and respective responsibilities in the network.

→ Read more

Note: This article in not accessible to our UK readers.

🌊 Riding the Gold Wave

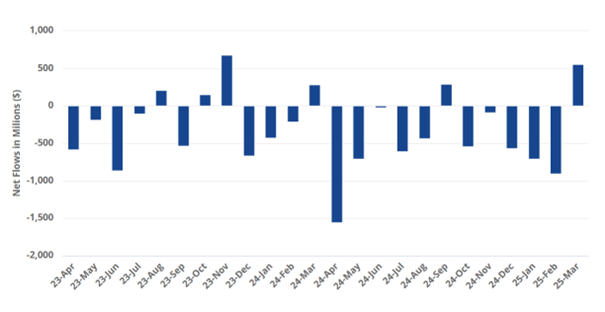

Chasing the Vein: Fund Flows into Gold Miners

Source: Mining.com. Data as of 21 March 2025. Note: Data covers 493 funds with combined assets under management of $62 billion.

U.S. equity markets experienced significant declines during the month of March. Meanwhile, spot gold price recorded new all-time highs, surpassing the $3,000 per ounce mark on 14 March and closing at a record price of $3123.57 on March 31, a 9.30% ($265.73) monthly gain. As of 31 March, gold prices have risen by 93.61% over the past five years (1). Investors should keep in mind that past performance is not representative of future results.

The gold miners, as represented by the NYSE Arca Gold Miners Index (GDMNTR), outperformed significantly, up 15.51% during March (2). This gain reflects both their operational leverage to rising gold prices and market perceptions of relative value. However, gold miners can also be subject to heightened volatility, operational risks, and sensitivity to commodity price swings.

While gold and gold equities may serve as diversifiers in a portfolio due to their historically low correlations with many asset classes, investors should remain mindful of the inherent risks, including price volatility, currency movements, and shifts in investor sentiment that can lead to rapid reversals in performance.

→ Read more

🌪️ Moat Stocks Weather Tariff Tumble

Market turbulence in March weighed on stocks. The Moat Index was not immune to the market turmoil, as it declined along with the broad U.S. equity market ending the month lower. However, the Moat Index showed resilience relative to the S&P 500—thanks in part to defensive sector resilience and underweight exposure to mega-caps.

At the same time, the SMID Moat Index lagged small and mid-caps in March. Smaller U.S. stocks were also impacted by global trade tensions and economic growth concerns with the broad small- and mid-cap benchmarks falling during the month. However, year-to-date, the SMID Moat Index remains ahead of the broader small- and mid-cap markets.

This is a preview of our monthly ETF insights email newsletter.

To receive the full version, sign up here.

(1) Source: World Gold Council, ICE Data Services, FactSet Research Systems Inc.

(2) Source: Financial Times.

IMPORTANT INFORMATION

This is marketing communication. Please refer to the prospectus of the UCITS and to the KID/KIID before making any final investment decisions. These documents are available in English and the KIDs/KIIDs in local languages and can be obtained free of charge at www.vaneck.com, from VanEck Asset Management B.V. (the “Management Company”) or, where applicable, from the relevant appointed facility agent for your country.

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: Zeidler Regulatory Services (Switzerland) AG, Neudtadtgasse 1a, 8400 Winterthur, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: This is a marketing communication targeted to FCA regulated financial intermediaries. Retail clients should not rely on any of the information provided and should seek assistance from a financial intermediary for all investment guidance and advice. VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), which is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated firms such as financial intermediaries and Wealth Managers.

This information originates from VanEck (Europe) GmbH, which is authorized as an EEA investment firm under MiFID under the Markets in Financial Instruments Directive (“MiFiD). VanEck (Europe) GmbH has its registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, and has been appointed as distributor of VanEck products in Europe by the Management Company. The Management Company is incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM).

This material is only intended for general and preliminary information and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed.

Morningstar® Wide Moat Focus IndexSM, Morningstar® US Sustainability Moat Focus Index, Morningstar® US Small-Mid Cap Moat Focus IndexSM, and Morningstar® Global Wide Moat Focus IndexSM are trademarks or service marks of Morningstar, Inc. and have been licensed for use for certain purposes by VanEck. VanEck’s ETFs are not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in the ETFs. Morningstar bears no liability with respect to the ETFs or any securities.

Effective December 15, 2023, the carbon risk rating screen was removed from the Morningstar® US Sustainability Moat Focus Index. Effective December 17, 2021, the Morningstar® Wide Moat Focus IndexTM was replaced with the Morningstar® US Sustainability Moat Focus Index. Effective June 20, 2016, Morningstar implemented several changes to the Morningstar® Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover, and longer holding periods for index constituents than under the rules in effect prior to that date.

NYSE Arca Gold Miners Index is a service mark of ICE Data Indices, LLC or its affiliates (“ICE Data”) and has been licensed for use by VanEck UCITS ETF plc (the “Fund”) in connection with the ETF. Neither the Fund nor the ETF is sponsored, endorsed, sold or promoted by ICE Data. ICE Data makes no representations or warranties regarding the Fund or the ETF or the ability of the NYSE Arca Gold Miners Index to track general stock market performance. ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA GOLD MINERS INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. ICE Data Indices, LLC and its affiliates (“ICE Data”) indices and related information, the name “ICE Data”, and related trademarks, are intellectual property licensed from ICE Data, and may not be copied, used, or distributed without ICE Data’s prior written approval. The Fund has not been passed on as to its legality or suitability, and is not regulated, issued, endorsed’ sold, guaranteed, or promoted by ICE Data.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

It is not possible to invest directly in an index.

Investing is subject to risk, including the possible loss of principal. Investors must buy and sell units of the UCITS on the secondary market via an intermediary (e.g. a broker) and cannot usually be sold directly back to the UCITS. Brokerage fees may incur. The buying price may exceed, or the selling price may be lower than the current net asset value. The indicative net asset value (iNAV) of the UCITS is available on Bloomberg. The Management Company may terminate the marketing of the UCITS in one or more jurisdictions. The summary of the investor rights is available in English at: complaints-procedure.pdf (vaneck.com). For any unfamiliar technical terms, please refer to ETF Glossary | VanEck.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH ©VanEck Switzerland AG © VanEck Securities UK Limited

Nyheter

BBVAE ETF är en spansk ETF som spårar Eurostoxx 50

Publicerad

18 timmar sedanden

2 maj, 2025

BBVA Acción Eurostoxx 50 ETF FI Cotizado Armonizado (BBVAE ETF) med ISIN ES0105321030, strävar efter att spåra EURO STOXX® 50-index. EURO STOXX® 50-indexet följer de 50 största företagen i euroområdet.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,20 % p.a. ETFen replikerar resultatet av det underliggande indexet genom full replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen delas ut till investerarna (halvårsvis).

BBVA Acción Eurostoxx 50 ETF FI Cotizado Armonizado har tillgångar på 133 miljoner euro under förvaltning. Denna ETF lanserades den 3 oktober 2006 och har sin hemvist i Spanien.

Beskrivning BBVA Acción Eurostoxx 50 ETF FI Cotizado Armonizado

Med BBVA Acción Eurostoxx 50 ETF FI Cotizado Armonizado deltar investerare i ökningen av värdet på aktierna i de 50 största konglomeraten i euroområdet (euroområdet). Euro Stoxx 50-indexet inkluderar aktier från 8 länder i euroområdet: Belgien, Finland, Frankrike, Tyskland, Irland, Italien, Nederländerna och Spanien.

Handla BBVAE ETF

BBVA Acción Eurostoxx 50 ETF FI Cotizado Armonizado (BBVAE ETF) är en börshandlad fond (ETF) som handlas på Bolsa de Madrid.

Bolsa de Madrid är en marknad som få svenska banker och nätmäklare erbjuder access till, men DEGIRO gör det.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Bolsa de Madrid | EUR | BBVAE |

Största innehav

| Värdepapper | Vikt % |

| ASML Holding NVNL0010273215 | 8,59% |

| Lvmh Moet Hennessy Louis Vuitton SEFR0000121014 | 5,60% |

| SAP SEDE0007164600 | 5,16% |

| TotalEnergies SEFR0000120271 | 4,59% |

| Siemens AGDE0007236101 | 3,70% |

| Schneider Electric SEFR0000121972 | 3,46% |

| Future on Euro Stoxx 50 | 3,02% |

| Sanofi SAFR0000120578 | 2,99% |

| L’Oreal SAFR0000120321 | 2,98% |

| Allianz SEDE0008404005 | 2,93% |

Innehav kan komma att förändras

Nyheter

The Art of Meme-ing: How Dogecoin Redefined Value

Publicerad

19 timmar sedanden

2 maj, 2025

Explore Dogecoin’s impact on crypto, turning internet memes into cultural and financial assets.

𝕋𝕚𝕞𝕖 ℂ𝕠𝕕𝕖𝕤:

00:00 – Intro

00:27 – Where do Memes come from?

03:13 – What are some of the first Memes you remember?

10:28 – Do these things have value?

14:04 – The different types of cryptocurrencies

17:20 – How did Dogecoin start?

24:26 – What is some of the utility?

28:36 – How does it fit into the portfolio?

30:38 – Final thoughts

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

April in ETFs: Gold at New Highs, Crypto in Transition, and Moat Index Holding Steady

BBVAE ETF är en spansk ETF som spårar Eurostoxx 50

The Art of Meme-ing: How Dogecoin Redefined Value

VGGF ETF köper statsobligationer från hela världen

Vilka ETFer investerar i europeiska Small Cap-aktier?

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

MONTLEV, Sveriges första globala ETF med hävstång

Sju börshandlade fonder som investerar i försvarssektorn

Världens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

Europeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEuropeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedan21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanHANetfs Tom Bailey om framtiden för europeiska försvarsfonder

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanFastställd utdelning i MONTDIV april 2025