Nyheter

Successfully navigate through Bitcoin & Cryptoasset Markets

Publicerad

1 år sedanden

• Market sentiment has stabilized as outflows from Grayscale’s Bitcoin Trust (GBTC) have slowed down

• Our in-house “Cryptoasset Sentiment Index” declined to levels that signal a short-term tactical bottom last week

• We expect the influence of macro factors on Bitcoin & Cryptoassets to reassert itself over the coming weeks

Chart of the Week

Performance

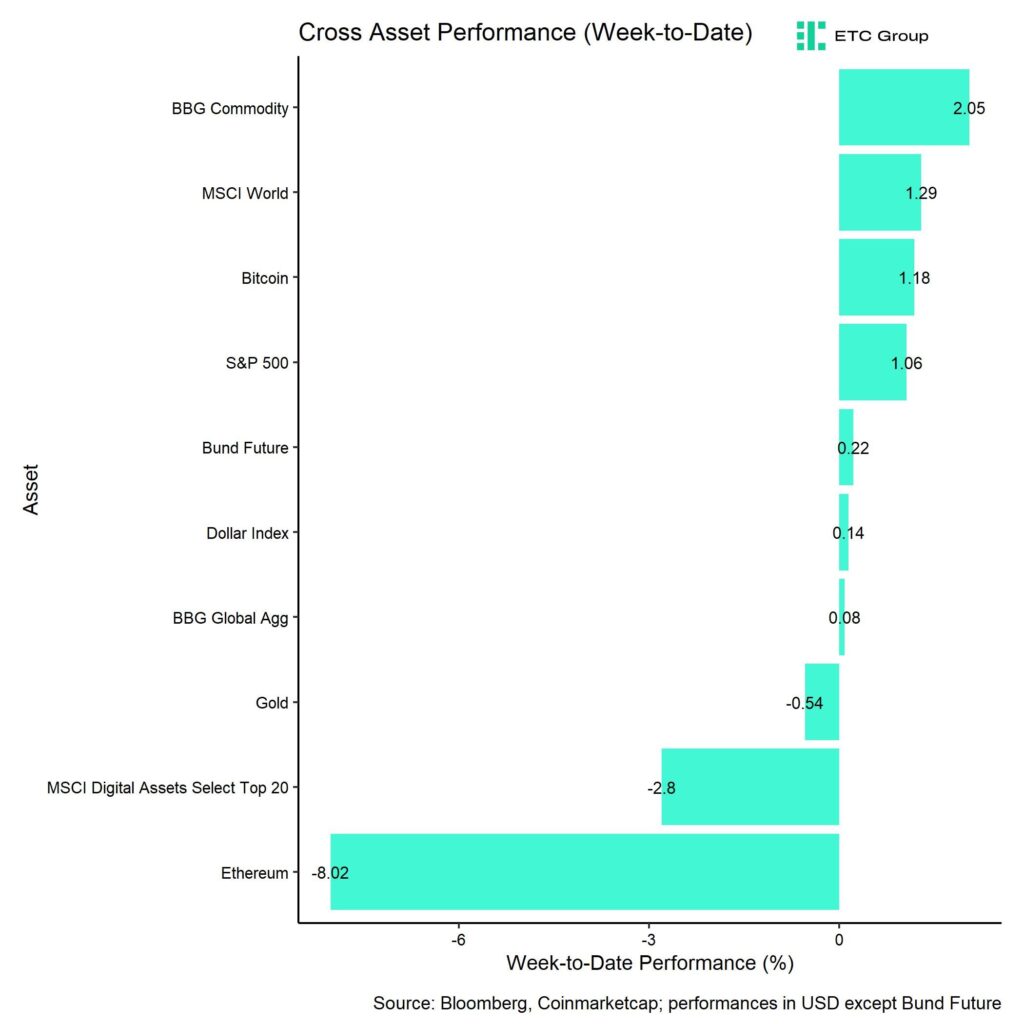

Last week, cryptoassets mostly recovered from the sell-off in the prior week. One of the main reasons for this recovery was that outflows from the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – have slowed down recently which has lifted market sentiment a bit.

Market sentiment was relatively bearish at the beginning of last week, with our in-house “Cryptoasset Sentiment Index” hitting the lowest level since March 2023 amid heightened fund outflows and increasing bitcoin exchange inflows.

The index has decreased to such low levels that at least a short-term tactical bottom appears to be quite likely.

Over the course of last week, we saw a significant reversal in sentiment from low levels amid reversals in spot bitcoin exchange inflows and bitcoin put-call volume ratios that had put pressure on the market.

Ethereum also came under pressure after a portion of the chain’s major operators were rendered inoperable on Sunday due to a problem in Ethereum’s Nethermind client software, which is used by blockchain validators to communicate with the network.

The incident has raised concerns about the centralization and high reliance on single dominant client softwares like Geth – a risk referred to as “supermajority client risk” – which has dampened market sentiment towards Ethereum last week.

Overall, although ETF fund flows in the US still appear to be relatively influential, the market clearly lacks some new catalysts in the short term. It is quite likely that the influence of macro factors such as global growth expectations or monetary policy could reassert itself over the coming months, at least until the Bitcoin Halving in April 2024.

In this context, the FOMC will convene to decide on US monetary policy on the 30th and 31st of January this week. The FOMC is expected to hold interest rates unchanged this week and only to cut rates later in March based on expectations priced into Fed Funds Futures.

However, interest rate cuts have recently been priced out which was also seen as a potential bearish macro catalyst for the latest sell-off in cryptoassets.

In this context, we are currently measuring a dominant influence of global growth expectations and general level of risk appetite on Bitcoin and only to a lesser extent an influence by other macro factors such as monetary policy or the US Dollar.

Our own measure of Cross Asset Risk Appetite (CARA) has also recovered last week which has likely supported the recovery in for Bitcoin and other cryptoassets as well.

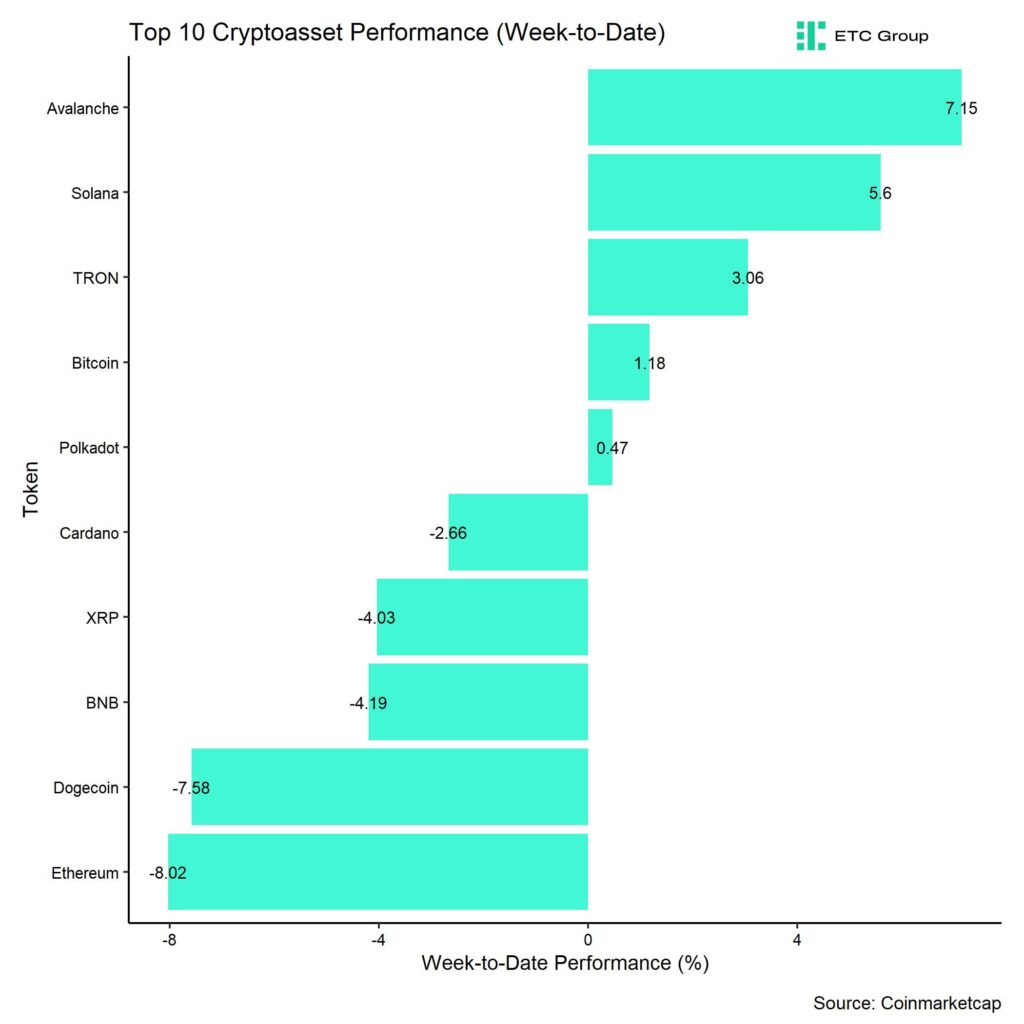

In general, among the top 10 crypto assets, Avalanche, Solana, and TRON were the relative outperformers.

Altcoin outperformance vis-à-vis Bitcoin was relatively weak compared to the week prior, with only 5% of our tracked altcoins managing to outperform Bitcoin on a weekly basis.

Sentiment

Market sentiment was relatively bearish at the beginning of last week, with our in-house “Cryptoasset Sentiment Index” hitting the lowest level since March 2023.

The index has decreased to such low levels that at least a short-term tactical bottom appears to be quite likely.

At the moment, only 6 out of 15 indicators are above their short-term trend.

Compared to last week, we saw major reversals to the upside in BTC exchange inflows and BTC put-call volume ratios.

The Crypto Fear & Greed Index has swung back to ”Greed” territory as of this morning.

Meanwhile, our own measure of Cross Asset Risk Appetite (CARA) has recently increased. Overall, this is signalling a return in risk appetite in traditional financial markets.

Performance dispersion among cryptoassets has recently remained elevated.

In general, high-performance dispersion among cryptoassets implies that correlations among cryptoassets have decreased, which means that cryptoassets are trading more on coin-specific factors and that diversification among cryptoassets is high.

At the same time, altcoin outperformance vis-à-vis Bitcoin has declined considerably amid an underperformance of Ethereum vis-à-vis Bitcoin. Only 5% of our tracked altcoins have outperformed Bitcoin on a weekly basis.

In general, low altcoin outperformance tends to be a sign of low risk appetite within cryptoasset markets.

Fund Flows

In aggregate, we saw weekly net fund outflows from all types of cryptoassets in the amount of -500.1 mn USD (week ending Friday) based on Bloomberg data.

Global Bitcoin ETPs saw significant outflows of -491.5 mn USD of which -417.0 mn were related to US spot Bitcoin ETFs. This was mostly related to continuing outflows from the Grayscale Bitcoin Trust (GBTC) which amounted to -2,234.3 mn USD last week alone. This was partially counteracted by net inflows into other US spot Bitcoin ETFs that were able to attract 1,818.0 mn USD in net inflows.

On a positive note, the outflows from GBTC have slowed down over the past 5 trading days which has also improved market sentiment as well.

Note that some fund flows data for US major issuers are still lacking in the abovementioned numbers due to T+2 settlement.

Apart from Bitcoin, we saw comparatively small flows into other cryptoassets last week.

Ethereum ETPs also saw net outflows in the amount of -37.3 mn USD while other altcoin ETPs ex Ethereum managed to attract +1.1 mn USD.

Thematic & basket crypto ETPs also managed to attract net inflows of +27.6 mn USD, based on our calculations.

Besides, the beta of global crypto hedge funds to Bitcoin over the last 20 trading still remains low at below 0.8, implying that global crypto hedge funds still remain under-exposed to Bitcoin market risks. It appears as if crypto hedge funds are still waiting on the sidelines for new catalysts.

On-Chain Data

Last week, in- and outflows related to spot Bitcoin ETFs continued to exert a significant influence on Bitcoin on-chain data as well.

High outflows from the Grayscale Bitcoin Trust (GBTC) led to increased exchange inflows into crypto exchanges, in particular Coinbase.

More particularly, last Monday GBTC transfers to Coinbase accounted from approximately 76% of overall whale exchange deposits to Coinbase on that day. That percentage has declined gradually throughout the past week and was at around 30% last Friday.

We have analysed the effect of the GBTC selling on the price of Bitcoin in more detail here.

However, although GBTC percentage in whale exchange inflows has somewhat declined, whale exchange inflows still remain relatively high from a structural point of view. This could put a lid on any significant price advances in the short term.

Besides, the average coin dormancy also remains relatively high which tends to be a bearish signal.

Dormancy, defined as the ratio of coin days destroyed to total transfer volume, is the average number of days destroyed per coin traded. The higher the coin days destroyed, the longer a coin has been dormant. It usually signals whether older coins are on the move.

On a positive note, Bitcoin miners have ceased to sell their BTC reserves – a process which had started around November 2023 already. Aggregate BTC miner balances have moved sideways over the past week.

It is also positive to observe that the number of BTC whale has increased significantly over the past week.

Whales are defined as unique entities holding at least 1k BTC. This increase implies that, on aggregate, whales might be accumulating coins again.

In fact, we are observing an increase in BTC holdings in wallets that hold between 1k BTC and 100k BTC.

Futures, Options & Perpetuals

BTC futures open interest declined somewhat last week while perpetual open interest was mostly unchanged. There were no significant futures long or short liquidations last week.

The 3-months annualized BTC futures basis has stabilized at around 9.7% p.a. and perpetual funding rates have been positive throughout the week.

There were more significant developments in the BTC option space, which saw a massive expiry last week on Friday that led to a decrease of around -86k BTC in option open interest. Put-call open interest ratio remains relatively low implying that most traders have relatively low put exposure.

That being said, last Thursday saw a significant spike in put buying as put-call volume ratios spiked to the highest level since October 2023. The BTC 25-delta 1-month option skew had also increased before that amid the sell-off but has recently declined from high levels.

There is generally a declining trend in implied volatilities since early January 2024 that continued last week as well. BTC option traders have generally been pricing out the uncertainty around the ETF approvals.

Bottom Line

• Market sentiment has stabilized as outflows from Grayscale’s Bitcoin Trust (GBTC) have slowed down

• Our in-house “Cryptoasset Sentiment Index” declined to levels that signal a short-term tactical bottom last week

• We expect the influence of macro factors on Bitcoin & Cryptoassets to reassert itself over the coming weeks

To read our Crypto Market Compass in full, please click the button below:

GENERAL DISCLAIMER

The information provided in this advertising material is for informative purposes only and does not constitute investment advice, a recommendation or solicitation to conclude a transaction.

This document (which may be in the form of a press release, social media post, blog post, broadcast communication or similar instrument – we refer to this category of communications generally as a “document” for purposes of this disclaimer) is issued by ETC Issuance GmbH (the “issuer”), a limited company incorporated under the laws of the Germany. This document has been prepared in accordance with applicable laws and regulations (including those relating to financial promotions). If you are considering investing in any securities issued by ETC Group, including any securities described in this document, you should check with your broker or bank that securities issued by ETC Group are available in your jurisdiction and suitable for your investment profile.

Exchange-traded commodities/cryptocurrencies, or ETCs, are a highly volatile asset and performance is unpredictable. Past performance is not a reliable indicator of future performance. The market price of ETCs will vary and they do not offer a fixed income. The value of any investment in ETCs may be affected by exchange rate and underlying price movements. This document may contain forward looking statements including statements regarding ETC Group’s belief or current expectations with regards to the performance of certain asset classes. Forward looking statements are subject to certain risks, uncertainties and assumptions, and there can be no assurance that such statements will be accurate and actual results could differ materially. Therefore, you must not place undue reliance on forward-looking statements.

This document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment. An investment in an ETC that is linked to cryptocurrency, such as those offered by ETC Group, is dependent on the performance of the underlying cryptocurrency, less costs, but it is not expected to match that performance precisely. ETCs involve numerous risks including among others, general market risks relating to underlying adverse price movements and currency, liquidity, operational, legal and regulatory risks.

ETC Issuance GmbH, incorporated under the laws of Germany, is the issuer of any securities described in this document, under the base prospectus dated 23 November 2021, and previously the the base prospectus dated 14th January 2021 and prospectus dated 4 June 2020,, and various sets of final terms (in relation to BTCE, ZETH and other series of securities issued under that base prospectus), in each case as supplemented from time to time, and approved by BaFin. Any decision to invest in securities offered by ETC Group (including products and amounts) should take into consideration your specific circumstances after seeking independent investment, tax and legal advice. You should also read the latest version of the prospectus and/or base prospectus before investing and in particular, refer to the section entitled ‘Risk Factors’ for further details of risks associated with an investment. These prospectuses and other documents are available under the “Resources” section at etc-group.com. When visiting this website, you will need to self-certify as to your jurisdiction and investor type in order to access these documents, and in so doing you may be subject to other disclaimers and important information.

IF YOU ARE IN THE UK, US, OR CANADA

Information contained in this document is not, and under no circumstances is to be construed as, an advertisement or any other step in furtherance of a public offering in the United States or Canada, or any state, province or territory thereof, where neither the issuer nor its products are authorised or registered for distribution or sale and where no prospectus of the issuer has been filed with any securities regulator. Neither this document nor information in it should be taken, transmitted or distributed (directly or indirectly) into the United States.

PUBLICATIONS & SOCIAL MEDIA DISCLOSURE

Social media posts (including, but not limited to, LinkedIn and Twitter) of ETC Group and its subsidiaries (“Social Media”) are not, and should not be considered to be recommendations, solicitations or offers by ETC Group or its affiliates to buy or sell any securities, futures, options or other financial instruments or other assets or provide any investment advice or service. ETC Group makes all reasonable efforts to ensure that the information contained on Social Media is accurate and reliable; however, errors sometimes occur. You should note that the materials on Social Media are provided “as is” without any express or implied warranties. ETC Group does not warrant or represent that the materials on Social Media are accurate, valid, timely or complete.

RISKS OF CRYPTOCURRENCIES

Cryptocurrencies are highly volatile assets and are known for their extreme fluctuations in prices. While there is potential for significant gains, you are at risk of losing parts or your entire capital invested. The value of the ETCs is affected by the price of its underlying cryptocurrency. The price of cryptocurrencies can fluctuate widely and, for example, may be impacted by global and regional political, economic or financial events, regulatory events or statements by regulators, investment trading, hedging or other activities by a wide range of market participants, forks in underlying protocols, disruptions to the infrastructure or means by which crypto assets are produced, distributed, stored and traded. The price of cryptocurrencies may also change due to shifting investor confidence in future outlook of the asset class. Characteristics of cryptocurrencies and divergence of applicable regulatory standards create the potential for market abuse and could lead to high price volatility. Amounts received by Bondholders (i) upon redemption of the Bonds in USD, in cases where Bondholders are prevented from receiving cryptocurrency for legal or regulatory reasons; or (ii) upon sale on the stock exchange depend on the price performance of the relevant cryptocurrency and available liquidity.

For a detailed overview of risks associated with cryptocurrencies and specifically associated with the ETCs, please refer to the prospectus and base prospectus available at the issuer’s website at www.etc-group.com.

Du kanske gillar

-

Why Bitcoin belongs in your portfolio

-

BlackRocks Bitcoin ETF genererar nu mer intäkter än deras S&P 500 ETF

-

Thinking of buying your first Bitcoin? Read these 5 tips first

-

Bitcoin is resilient despite the Middle East war

-

Grattis till Bitwise Europe på femårsjubileet för deras fysiska Bitcoin ETP

-

Bitwise Asset Management säger att stark företagsefterfrågan stöder Bitcoin över 100 000 dollar

Nyheter

Defence and AI dominate as European Thematic ETF flows hit record $8.73 billion H1 2025

Publicerad

11 timmar sedanden

8 juli, 2025

• Top Performer: Defence (+$7.87 billion)

• Emerging Themes: Cybersecurity (+$318 million), Uranium (+$253 million)

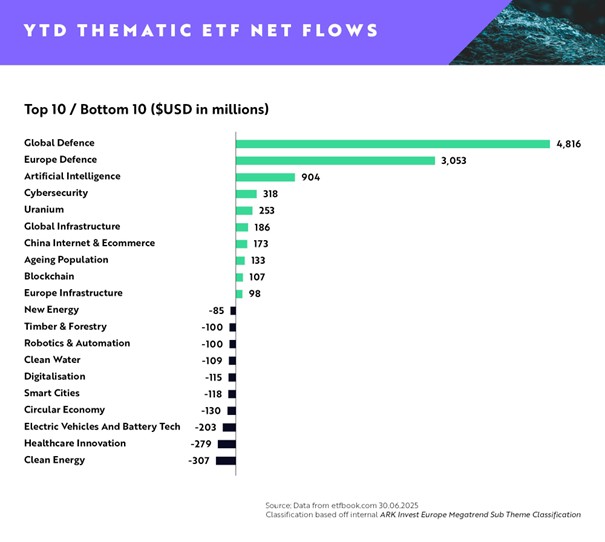

European thematic UCITS ETFs posted a dramatic resurgence in the first half of 2025, with net inflows of $8.73 billion year-to-date, according to ARK Invest Europe’s latest quarterly update detailing H1 2025 European thematic ETF flows.

The turnaround marks a decisive reversal from the muted flows of 2024 ($308 million net outflows for the whole of 2024), as investors rotate back into forward-looking, innovation-driven themes with clearer earnings visibility.

Defence remains the dominant thematic allocation, capturing $7.87 billion in combined net inflows between Global ($4.81 billion) and European ($3.05 billion) defence ETFs underscoring its evolution from a tactical trade to a structural portfolio allocation. Maintaining its position as the defining technological theme, AI ETFs saw $904 million in net inflows, with investor appetite fuelled by relentless innovation in large language models, robotics, and autonomous systems.

In the same period, Cybersecurity ETFs continued to rebuild momentum after significant outflows in 2024 ($311 million net outflows for H1 2024), drawing $318 million, reflecting growing investor conviction in cybersecurity as a structural necessity amid rising digital threats.

Clean Energy ETFs saw outflows of $307 million. As policy momentum stalls in key markets, investors are increasingly selective within the energy transition space. Capital is rotating toward subsectors with clearer economic moats, such as nuclear and grid infrastructure. Supporting this sentiment, Uranium ETFs rank fifth at $253 million, reflecting growing investor interest in the nuclear sector as a potential solution to global energy needs.

Healthcare Innovation ETFs recorded net outflows of $279 million. The drawdown reveals investor caution around legacy biotech firms with uncertain drug pipelines and reimbursement risks. Interest is shifting toward AI-driven healthcare platforms offering faster innovation cycles and more scalable business models.

Electric Vehicles and Battery Tech ETFs saw net outflows of $203 million as investor enthusiasm cools amid subsidy rollbacks and plateauing EV demand in major markets. Persistent concerns around battery raw materials and production bottlenecks have further weighed on the theme.

Rahul Bhushan says, “After a cautious 2024, it’s evident that investors are re-engaging with innovation themes that offer clearer earnings visibility and resilience in an increasingly complex macro landscape. We’re seeing investor conviction in megatrends with structural tailwinds, particularly defence, AI, and energy security. Thematics are no longer just tactical bets, they’re core strategic exposures.”

2025/2024 Comparative Study

Thematics are back

After a weak 2024, investor appetite for thematic risk has returned in force:

• H1 2025 total net inflows: +$8.74B

• That’s a sharp reversal from -$791M in H2 2024 and only +$483M in H1 2024

• The rotation is clear: capital is moving back into forward-looking themes with stronger earnings visibility.

Defence is now a structural trade

• Global and Europe Defence saw a combined $7.87B in inflows in H1 2025 and $1.59B in June alone.

• This continues a multi-quarter surge as geopolitical tensions, rising military budgets, and renewed industrial policy drive long-term allocations.

• Defence is no longer a tactical trade—it’s becoming a core exposure.

AI inflows normalise, but conviction remains

• Artificial Intelligence ETFs drew $904M in H1 2025, following $1.47B in H1 2024.

• Inflows may be slowing, but investor conviction is holding firm.

• With earnings delivery now catching up to narrative, AI remains a centrepiece of thematic portfolios.

Cybersecurity shows signs of stabilisation

After brutal outflows in 2024 (-$311M H1, -$260M H2), cybersecurity ETFs finally saw inflows:

• $318M in H1 2025, including $67M in June.

• This rebound suggests investors are once again prioritising digital resilience in an AI-driven world.

Infrastructure themes are quietly regaining traction

• Global and Europe Infrastructure ETFs pulled in $284M in H1 2025, following modest gains in H2 2024.

• Infrastructure is benefiting from government stimulus, defence modernisation, and the reshoring trade.

Uranium’s steady climb continues

• $253M in H1 2025, after $216M in H2 2024 and $67M in June alone.

• Indeed, the $67M in June alone nearly matches the $66M pulled in during the entirety of H1 2024.

• A rare clean energy theme that’s bucking the downtrend, reflecting growing recognition of nuclear as a pragmatic decarbonisation solution.

Clean Energy sentiment is so bad, it might be investable

• Outflows across all periods: -$307M (H1 2025), -$505M (H2 2024), -$409M (H1 2024)

• June 2025: A mere -$8M

• Sentiment is arguably as negative as it’s ever been—yet structural drivers remain in place. The setup for a contrarian rebound is building.

About ARK Invest Europe

ARK Invest International Ltd (”ARK Invest Europe”) is a specialist thematic ETF issuer offering investors access to a unique blend of active and index strategies focused on disruptive innovation and sustainability. Established following the acquisition of Rize ETF in September 2023 by ARK Investment Management LLC, ARK Invest Europe builds on over 40 years of expertise in identifying and investing in innovations that align financial performance with positive global impact.

Through its innovation pillar and the ”ARK” range of ETFs, ARK Invest focuses on companies leading and benefiting from transformative cross-sector innovations, including robotics, energy storage, multiomic sequencing, artificial intelligence, and blockchain technology. Meanwhile, its sustainability pillar, represented by the ”Rize by ARK Invest” range of ETFs, prioritises investment opportunities that reconcile growth with sustainability, advancing solutions that fuel prosperity while promoting environmental and social progress.

Headquartered in London, United Kingdom, ARK Invest Europe is dedicated to empowering investors with purposeful investment opportunities. For more information, please visit https://europe.ark-funds.com/

Nyheter

UBS Asset Management lanserar sin första aktivt förvaltade ETF

Publicerad

12 timmar sedanden

8 juli, 2025

- UBS Asset Management planerar att erbjuda ett utbud av aktiva ETFer som utnyttjar deras differentierade räntebärande kapacitet, följt senare av en serie avkastningsfokuserade ETFer med optionsöverlägg.

- Den första som lanseras idag ger tillgång till den aktiva förvaltningsexpertisen hos UBS AMs Credit Investments Group (CIG), en av de ledande förvaltarna av collateralized loan obligations globalt.

- Den nya UBS EUR AAA CLO UCITS ETF erbjuder investerare exponering mot den högsta kreditkvaliteten inom CLO-strukturen i ett likvidt och kostnadseffektivt omslag.

UBS Asset Management (UBS AM) tillkännager idag lanseringen av sin första aktivt förvaltade ETF, som ger kostnadseffektiv exponering mot de högst rankade trancherna av marknaden för collateralized loan obligation (”CLO”). UBS EUR AAA CLO UCITS ETF kombinerar den aktiva förvaltningsexpertisen hos UBS AMs Credit Investments Group med skalan hos deras väletablerade ETF-erbjudande.

André Mueller, chef för kundtäckning på UBS Asset Management, sa: ”CLOer erbjuder stark avkastningspotential och diversifieringsfördelar. Att navigera på denna marknad kräver dock förståelse för CLO-strukturer, regleringar och riskerna i denna sektor. Vi har kombinerat mer än 20 års ETF-innovation med expertisen hos vår Credit Investments Group för att effektivt och transparent tillhandahålla de högst rankade CLO-värdepapperen. Den aktiva förvaltningsdelen erbjuder kostnadseffektiv exponering med potential att överträffa.”

John Popp, chef för Credit Investments Group på UBS Asset Management, tillade: ”Vi är glada att kunna erbjuda vår expertis inom hantering av CLO-trancher i över två decennier till en bredare investerarbas. Vårt teams djupa kreditkunskap och meritlista genom flera kreditcykler gör oss väl positionerade för att tillhandahålla övertygande investeringar. På dagens marknad anser vi att AAA CLO-skulder erbjuder en attraktiv risk-avkastningsprofil. Att erbjuda denna investering via en ETF kommer att utöka tillgången till denna växande marknad.”

Den aktiva UBS EUR AAA CLO UCITS ETF* erbjuder tillgång till den växande CLO-marknaden genom en likvid och kostnadseffektiv ETF-struktur, vilket innebär:

- Förbättrad avkastningspotential med strukturellt skydd – AAA CLOer erbjuder högre avkastning jämfört med liknande rankade investeringar, med strukturella egenskaper som har testats genom cykler, utan fallissemang ens under perioder av ekonomisk kris**

- Portföljdiversifiering – tillgångsslagets rörliga ränta ger betydande diversifieringspotential i samband med en bredare ränteportfölj

- Aktiv fördel – Credit Investments Group, en av de främsta förvaltarna av säkerställda låneförpliktelser globalt, hanterar dynamiskt risk och avkastning för att fånga marknadsmöjligheter

- ETF-effektivitet – ETF-strukturen möjliggör likviditet och kostnadseffektiv tillgång till denna komplexa tillgångsklass

*Fonden är registrerad för försäljning i Österrike, Schweiz, Tyskland, Danmark, Spanien, Finland, Frankrike, Irland, Italien, Liechtenstein, Luxemburg, Nederländerna, Norge och Sverige.

**S&P Global Ratings, “Default, Transition, and Recovery: 2023 Annual Global Leveraged Loan CLO Default and Rating Transition Study”, 27 juni 2024

Nyheter

AZEH ETF är en aktivt förvaltad ETF som investerar i Asien ex Japan

Publicerad

13 timmar sedanden

8 juli, 2025

iShares Asia ex Japan Equity Enhanced Active UCITS ETF USD (Acc) (AZEH ETF) med ISIN IE000D5R9C23, är en aktivt förvaltad ETF.

Den börshandlade fonden investerar minst 70 procent i aktier från Asien (exklusive Japan). Upp till 30 procent av tillgångarna kan placeras i private equity-instrument, värdepapper med fast ränta med investment grade-rating och penningmarknadsinstrument. Värdepapper väljs utifrån hållbarhetskriterier och en kvantitativ investeringsmodell.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,30 % p.a. iShares Asia ex Japan Equity Enhanced Active UCITS ETF USD (Acc) är den enda ETF som följer iShares Asia ex Japan Equity Enhanced Active-index. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen ackumuleras och återinvesteras.

iShares Asia ex Japan Equity Enhanced Active UCITS ETF USD (Acc) är en mycket liten ETF med 9 miljoner euro förvaltade tillgångar. ETFen lanserades den 31 juli 2024 och har sin hemvist i Irland.

Investeringsmål

Fonden förvaltas aktivt och syftar till att uppnå långsiktig kapitaltillväxt på din investering, med hänvisning till MSCI AC Asia ex Japan Index (”Riktmärket”) för avkastning.

Handla AZEH ETF

iShares Asia ex Japan Equity Enhanced Active UCITS ETF USD (Acc) (AZEH ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

Största innehav

| Kortnamn | Namn | Sektor | Vikt (%) | ISIN | Valuta |

| USD | USD CASH | Cash and/or Derivatives | 12.85 | – | USD |

| ISTUSAD | BLK ICS US TREAS AGENCY DIS | Cash and/or Derivatives | 9.01 | IE00B3YQRB45 | USD |

| 2330 | TAIWAN SEMICONDUCTOR MANUFACTURING | Informationsteknologi | 8.55 | TW0002330008 | TWD |

| 700 | TENCENT HOLDINGS LTD | Kommunikationstjänster | 5.58 | KYG875721634 | HKD |

| 005930 | SAMSUNG ELECTRONICS LTD | Informationsteknologi | 4.40 | KR7005930003 | KRW |

| 9988 | ALIBABA GROUP HOLDING LTD | Sällanköpsvaror | 2.50 | KYG017191142 | HKD |

| GSIFT | CASH COLLATERAL USD GSIFT | Cash and/or Derivatives | 2.02 | – | USD |

| 1299 | AIA GROUP LTD | Finans | 1.99 | HK0000069689 | HKD |

| 000660 | SK HYNIX INC | Informationsteknologi | 1.27 | KR7000660001 | KRW |

| PDD | PDD HOLDINGS ADS INC | Sällanköpsvaror | 1.27 | US7223041028 | USD |

Innehav kan komma att förändras

Defence and AI dominate as European Thematic ETF flows hit record $8.73 billion H1 2025

UBS Asset Management lanserar sin första aktivt förvaltade ETF

AZEH ETF är en aktivt förvaltad ETF som investerar i Asien ex Japan

Regan Capital debuterar i Europa med aktivt förvaltad totalavkastande inkomst-ETF

EUPD ETF köper aktier i undervärderade sektorer i USA

De bästa ETFer som investerar i europeiska utdelningsaktier

YieldMax® lanserar sin andra produkt för europeiska investerare

Big News for Nuclear Energy—What It Means for Investors

Svenska investerare — 21Shares Nasdaq Stockholm-sortiment har just blivit starkare

3EDS ETN ger tre gånger den negativa avkastningen på flyg- och försvarsindustrin

Populära

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanDe bästa ETFer som investerar i europeiska utdelningsaktier

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanYieldMax® lanserar sin andra produkt för europeiska investerare

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBig News for Nuclear Energy—What It Means for Investors

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSvenska investerare — 21Shares Nasdaq Stockholm-sortiment har just blivit starkare

-

Nyheter4 veckor sedan

Nyheter4 veckor sedan3EDS ETN ger tre gånger den negativa avkastningen på flyg- och försvarsindustrin

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanNordea Asset Management lanserar nya ETFer på Xetra

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanHetaste investeringstemat i juni 2025

-

Nyheter1 vecka sedan

Nyheter1 vecka sedan12 000 artiklar om börshandlade fonder