Van Eck Global’s gold specialist Joe Foster shares his monthly perspective on the gold market, this one is named Gold Markets Tormented by Rate Hike Intrigue in 2015

» Open Gold Market Commentary

Gold Markets Tormented by Rate Hike Intrigue in 2015

Gold Market Commentary

By: Joe Foster, Gold Strategist

Market Review

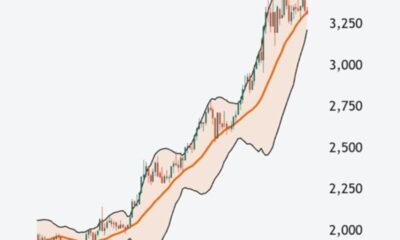

During November gold came under pressure and the U.S. dollar strengthened as the market gained conviction for a December Federal Reserve (Fed) rate increase. This selling pressure continued into the early days of December and gold fell to a new cycle low of $1,046 per ounce on December 3. At that point, it appeared that the gold market had already priced in this anticipated rate hike. On December 4, gold gained $24 per ounce despite a strong U.S. payroll report that earlier in the year would have spelled trouble for gold. Gold gained $11 on December 16, the day the Fed announced its a 25 basis point increase in the targeted federal funds rate, the first rate increase in over nine years. Time will tell if this change in direction by the Fed also marks a turning point for gold, but it looks as if there are some prominent investors that might hold this view. As evidence, on December 18 gold bullion exchange traded products (ETPs) booked 18.7 tonnes ($641 million) of inflows, the largest one day increase in four years. Overall for the month, gold was little changed, finishing December down $3.35 at $1,061.42 per ounce.

By contrast, although gold stocks also felt the downward pressure leading up to the Fed’s rate decision, they did not make new lows in December. The low point of this cycle for the NYSE Arca Gold Miners Index (GDMNTR)1 was on September 11. This was the first time since the bear market began in 2011 that the GDMNTR has not followed gold bullion to new long-term lows. For the month, the GDMNTR advanced 0.9%, while the Market Vectors Junior Gold Miners Index (MVGDXJTR)2 gained 2.8%.

Gold funds had a difficult year – tormented by the Fed’s seemingly endless machinations around the timing of a rate increase. For the year 2015 the gold price declined $123 per ounce (10.4%). Gold miners exhibited their leverage to gold with a decline of 24.8% in the GDMNTR and a drop of 19.2% for the MVGDXJTR. The overall downward price trend was interrupted twice by concerns over financial risks. The first came in January when the Swiss broke the franc’s peg to the euro, the European Central Bank (ECB) started a massive quantitative easing (QE)3 program, and radical leadership came to power in Greece. Gold rose to its high for the year at $1,307 on January 22. The second risk driver started in August when China’s stock market collapse panicked markets globally. While these events each created $100 moves in the gold price and substantial increases across gold stocks, in the longer term they were not enough to overcome the negative sentiment brought on by persistent anticipation of rising rates in the U.S. This enabled the U.S. Dollar Index (DXY)4 to make new long-term highs in March and again in December, while bullion ETPs experienced heavy redemptions in July and November. Gold was also pressured by the bear market in the broader commodities complex, shown by the 32% decline in WTI crude and 25% fall in copper for 2015.

Market Outlook

As the positive moves in the gold price in January and again in August – October have shown, gold responds to heightened levels of financial stress. Gold is commonly used as a portfolio diversifier and a hedge against onerous levels of inflation or deflation, currency turmoil, insolvencies brought on by poor debt and/or risk management by governments and financial institutions, and difficulties caused by overall economic weakness, to name a few. For our investors and clients, we endeavor to identify the systemic risks that might drive the gold price. With the start of the New Year, we make several observations that may offer clues as to where the gold price might trend in 2016.

To begin, it is instructive to look at where the market has been. For gold fund managers, it has been the worst of times. When it seems the market can’t go lower, it finds new lows. In our view, gold and gold stocks are unloved and oversold. We have felt this sentiment before, in the crash of 2008, the grueling bear market from 1996 to 2001, and the epic collapse from 1980 to 1985. The current period of 2011 to 2015 ranks historically among the worst bear markets for gold and gold stocks, as measured by peak-to-trough performance in percentage terms. Given the depth and duration of this bear market, using past markets as guides suggests this market should begin to improve in 2016.

In order for the market to improve, there must be a fundamental driver or drivers. Because of radical monetary policies and unsustainable debt levels globally, the financial system remains quite vulnerable to another crisis event or crash like the tech bust or subprime crisis. However, 2016 may not be the year for such a calamity. Think of German economist Rudi Dornbusch’s famous quote: “The crisis takes a much longer time coming than you think, and then it happens much faster than you would have thought

We see 2016 as a year when many of the headwinds to the gold price begin to ease. Such headwinds have included:

■ Fed tightening

■ Strong U.S. dollar

■ Weak commodities

■ Rising real rates

■ Rising gold production

■ Market positioning

Here is a brief look at each:

The Fed has guided towards roughly another one percent in rate increases in 2016, which would probably amount to four 25 basis point increases. Given the extreme caution the Fed has exhibited in getting to this point in the rate cycle, it is hard to imagine it being more aggressive. In fact, we believe there is a good possibility that the Fed will not be as aggressive as its current guidance suggests. In our view, the U.S. economy is no longer capable of generating more than 2% annual growth due to policy uncertainty, the debt burden, and a byzantine tax and regulatory structure that has reached economically stifling proportions. A low-growth economy is vulnerable to impediments and rising rates could become a significant impediment in 2016.

Easy Fed policies have supported growth in residential and commercial real estate as well as booming auto sales. Fed tightening usually increases rates on everything from mortgages and car loans, to the cost of financing fiscal deficits. It looks like the recent decline in the size of U.S. federal deficits will end as Congress has approved a rash of tax breaks and credits that are expected to add more than $800 billion to the debt load over the coming decade. While federal debt is now a staggering 100% of GDP, interest on that debt is at multi-decade lows of around 11% of GDP. Debt service would double if rates returned to the levels of 2007, which suggests that increasing rates could become unpopular politically.

The U.S. dollar had a tremendous run from July 2014 through March 2015 during which the DXY advanced 25% to new long-term highs. It has maintained those gains through December. A strengthening U.S. economy, weak global growth, and anticipation of rising rates drove the dollar’s rise. These drivers are currently already priced in, in our view, which limits the scope for further gains in the dollar.

Commodities prices have been hurt mainly by slack demand from China. China is transitioning from a commodities intensive industrial revolution to an economy led by consumerism and services. This transition is in full swing and as overproduction of commodities is being addressed by producers, we believe much of the bad news is already reflected in prices. While it is difficult to see a turnaround in things like oil, iron ore, or copper, we believe that downward price pressure is likely to ease in 2016.

Negative real (inflation-adjusted) rates are a common characteristic of gold bull markets. In the 2001 to 2011 bull market, real one-year treasury rates bottomed at -3.75% in 2011, around the same time gold reached its all-time high. Since then, real rates have trended upwards, reaching a high of 0.40% in September. The increase in real rates was achieved through a combination of disinflation in the global economy, deflation in commodities, and tightening in Fed policies through QE tapering and guiding market expectations towards higher rates. We believe real rates could fall somewhat in 2016 if inflation picks up as commodities prices stabilize and if tighter U.S. labor markets put pressure on wages. In addition, economic weakness may cause the Fed to reduce its rate outlook.

Gold production has been on the rise since 2009. We expect mine production to begin a slow, permanent decline in 2016, a trend that would increase should the gold price fall further. Credit Suisse calculates that 15% of production in its coverage universe is free cash flow negative at $1,100 gold. These marginal mines are no doubt doing all they can to cut costs further, but at lower gold prices, some would likely be forced to shut down. While gold production is not a strong price driver due to large above-ground stocks, we believe evidence of a production decline would nonetheless have a positive influence on prices.

Gold positioning indicates that bearish bets are at extreme levels that are typical of turning points in the market. Net speculative long positions on Comex5 are now lower than what occurred following the 2013 gold price collapse and are currently at levels last seen in 2002. Gross speculative shorts reached an all-time high in July, and remain at high levels. This points to the heavy exposure hedge funds, commodities traders, and other speculators already have to falling gold prices. Gold held in bullion ETPs is down to levels last seen in early 2009. This suggests that most of the extraordinary gold buying that occurred in ETPs after the financial crisis has been unwound.

We acknowledge that the gold market is on shaky ground and that there is little positive sentiment as the year begins. However, having been through a number of bear markets in our 47 years as gold fund managers, we also know historically that these markets always come to an end and that gold shares offer their highest leverage to gold when the price is close to the cost of production. Perhaps this leverage will be on display in 2016.

by Joe Foster, Portfolio Manager/Strategist

With more than 30 years of gold industry experience, Foster began his gold career as a boots on the ground geologist, evaluating mining exploration and development projects. Foster offers a unique perspective on gold and the precious metals asset class.

Important Information For Foreign Investors

This document does not constitute an offering or invitation to invest or acquire financial instruments. The use of this material is for general information purposes.

Please note that Van Eck Securities Corporation offers actively managed and passively managed investment products that invest in the asset class(es) included in this material. Gold investments can be significantly affected by international economic, monetary and political developments. Gold equities may decline in value due to developments specific to the gold industry, and are subject to interest rate risk and market risk. Investments in foreign securities involve risks related to adverse political and economic developments unique to a country or a region, currency fluctuations or controls, and the possibility of arbitrary action by foreign governments, including the takeover of property without adequate compensation or imposition of prohibitive taxation.

Please note that Joe Foster is the Portfolio Manager of an actively managed gold strategy.

Any indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

1NYSE Arca Gold Miners Index (GDMNTR) is a modified market capitalization-weighted index comprised of publicly traded companies involved primarily in the mining for gold. 2Market Vectors Junior Gold Miners Index (MVGDXJTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of a global universe of publicly traded small- and medium-capitalization companies that generate at least 50% of their revenues from gold and/or silver mining, hold real property that has the potential to produce at least 50% of the company’s revenue from gold or silver mining when developed, or primarily invest in gold or silver. 3Tail risk is the risk of an asset or portfolio of assets moving more than three standard deviations from its current price. 4S&P 500® Index (S&P 500) consists of 500 widely held common stocks covering industrial, utility, financial, and transportation sectors. 5Dot-com bubble grew out of a combination of the presence of speculative or fad-based investing, the abundance of venture capital funding for startups and the failure of dotcoms to turn a profit. Investors poured money into internet startups during the 1990s in the hope that those companies would one day become profitable, and many investors and venture capitalists abandoned a cautious approach for fear of not being able to cash in on the growing use of the internet. 6Source: Bloomberg.

Please note that the information herein represents the opinion of the author and these opinions may change at any time and from time to time. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results; current data may differ from data quoted. Current market conditions may not continue. Non-Van Eck Global proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of Van Eck Global. ©2015 Van Eck Global.

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter1 vecka sedan

Nyheter1 vecka sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan