Nyheter

Cryptoassets of the Month: November 2023

Publicerad

2 år sedanden

Every month, 21Shares research team will present the cryptoassets of the month that increased or dropped in value by more than 15%. With a data-driven approach, we highlight the most important developments and events causing price movements.

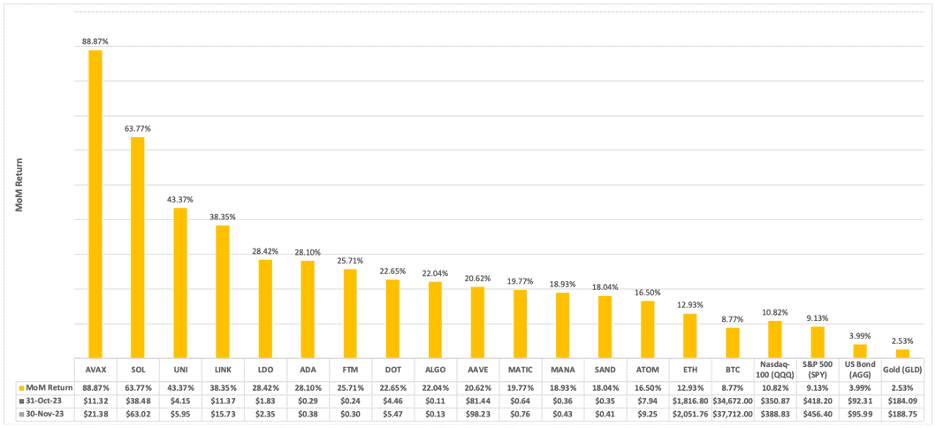

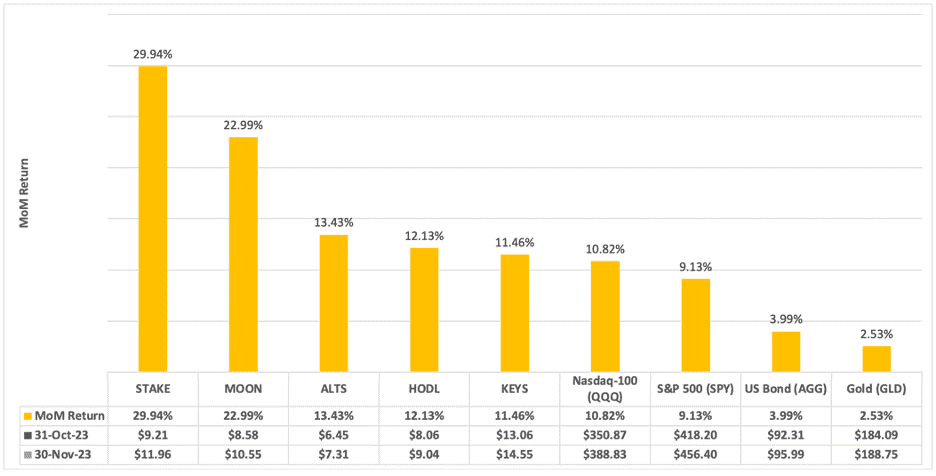

Figure 1 – 30-Day Performance: Cryptoassets of the Month vs. Traditional Asset Classes

Source: 21Shares, CoinGecko, and Yahoo Finance, from 31-Oct-2023 to 30-Nov-2023 (Close Price)

Avalanche (AVAX)

Avalanche’s native token AVAX traded up 88.87% over the past month as a narrative around growing institutional adoption of the platform has been getting traction. On November 16, Ava Labs’ AvaCloud, a launchpad that allows businesses to deploy custom, fully managed blockchains using an intuitive no-code portal, was used by Citi to price and execute simulated bilateral spot foreign-exchange (FX) trades on-chain. In addition, JP Morgan and Apollo Global announced a collaborative effort leveraging a permissioned Avalanche Evergreen Subnet to build an on-chain portfolio management solution. Both proofs of concept are part of the Monetary Authority of Singapore’s (MAS) Project Guardian.

Solana (SOL)

Solana (SOL) rallied 63.77% in November as on-chain activity exploded. In November, trading volume on Solana’s decentralized exchanges (DEXs) hit an all-time high of $7.3 billion. The current wave of ”airdrops” across Solana’s applications is a critical factor contributing to the rise in on-chain activity. Pyth Network – an oracle that provides a variety of price feeds for apps – airdropped PYTH tokens to over 100k users on Solana. Other notable applications like Jupiter (JUP), a DEX aggregator offering unique features such as limit orders and dollar-cost averaging, or Jito (JTO), a liquid staking provider that accrues both staking and MEV rewards, have confirmed upcoming airdrops. Undoubtedly, the wealth effect of meaningful airdrops to the community can have a reflexive impact on Solana’s ecosystem, similar to what Ethereum experienced during the summer of 2020.

Uniswap (UNI)

Uniswap (UNI) rose 43.37% over the past month. On October 17, Uniswap Labs – core contributors of the Uniswap protocol – began charging a 0.15% swap fee on specific tokens in their web interface and mobile wallet. Since then, Uniswap Labs has accrued more than $1.8 million through the fee mechanism, which is highly promising for the sustainability and long-term development of the decentralized exchange. On another note, Thalos, a technology provider for institutions to trade digital assets, partnered with Uniswap Labs to provide its clients with the deepest liquidity venue in DeFi. The partnership will expand opportunities for clients to achieve the best trade execution as they can seamlessly tap into centralized and decentralized liquidity venues.

Chainlink (LINK)

Chainlink (LINK) rallied 38.35% over the past month. Regarding fundamentals, Chainlink Staking v0.2 went live on November 28, with a pool size capped at 45 million LINK. The upgrade is designed to improve the security of the Chainlink network by introducing new features, such as slashing (i.e., losing a portion of the principal staked balance due to being deemed a ”bad actor” on the network). In other words, slashing creates a negative incentive to prevent node operators from behaving maliciously. Another crucial addition of Staking v0.2 is the introduction of a dynamic rewards mechanism that can support new external sources of revenue in the future, such as user fees. For instance, stakers could accrue a portion of the >$150k that Chainlink has generated thanks to CCIP in the past five months.

Lido (LDO)

Lido (LDO) rose 28.42% over the past month. On November 27, the Lido DAO approved the deployment of the ”Distributed Validator Technology” or Simple DVT Module. Rather than relying on a single node operator, DVT relies on multiple node operators, each managing distinct nodes that communicate and collectively reach consensus to fulfill validator responsibilities. As such, it represents a crucial step in significantly enhancing the protocol’s decentralization, distribution, and resilience. Lido estimates it could see over 200 net new operators by Q2 2024, from just 35 today. Regarding fundamentals, Lido’s staked ETH grew 5.23% from 8.80 million on October 31 to 9.26 million ETH (~$19 billion) on November 30. Lido retains 10% of staking rewards, registering ~$6.18 million in revenue in November, and is on track to surpass $60 million in annual revenue for 2023.

Cardano (ADA)

Cardano’s native token ADA traded up 28.10% over the past month. Despite its positive price performance, Cardano’s fundamentals have stayed the same, with only 35.5k daily active users as of November 30, 2023, a fraction of competing smart contract platforms like Solana (384k) and Polygon (329k). Cardano must offer differentiated applications to attract new users and bridge the education gap for developers to learn the Haskell programming language, which is the basis of Cardano’s native smart contract language, Plutus. If we observe the derivatives market, ADA funding rates have been increasing consistently since October, suggesting that many traders are positioned to the upside.

Fantom (FTM)

Fantom’s native token FTM rose 25.71% over the past month. Fantom’s total value locked (TVL) – a crypto-native metric akin to assets under management – was sitting at ~$61 million as of November 30, 2023, still down 99% from its peak in February 2022. Fantom is still struggling to attract liquidity, especially after the Multichain bridge hack in July 2023, which resulted in a ~$120 million loss for the ecosystem. It remains to be seen whether the mainnet launch of Fantom Sonic, the network’s latest upgrade expected to enhance Fantom’s throughput to 2,000 transactions per second (TPS), has any material impact on the user demand for the network.

Polkadot (DOT)

Polkadot’s native token DOT increased by 22.65% over the past month. On November 24, Polkadot welcomed a new parachain to its ecosystem dubbed “Logion.” The application-specific blockchain aims to solve one of the critical challenges with tokenization today – a legal framework for the transfer of ownership. In other words, how to ensure that a token transfer means transferring the ownership of the underlying asset? Logion is operated by a network of judicial officers who must verify the source and integrity of tokenized assets, which are issued by verified counterparties. It remains to be seen whether Logion can succeed in its mission, but it’s positive to see experimentation on this front.

Algorand (ALGO)

Algorand’s native token ALGO rose 22.04% over the past month. On November 14, blockchain firm Quantoz Payments was granted a license as an electronic money institution (EMI) under the supervision of the Dutch Central Bank and was permitted to issue a regulated euro-pegged stablecoin (EURD) on the Algorand network. EURD must have a strong distribution plan to gather sufficient growth as the stablecoin space has become highly competitive. For instance, industry leaders Tether and Circle launched euro-backed stablecoins a while back, and both products have struggled to gain traction, with just about $50 million in market cap for each, compared to their U.S. dollar-pegged counterparts ($23.5 billion for USDC and $90 billion for USDT).

Aave (AAVE)

Aave (AAVE) rallied 20.62% over the past month. In response to an attack vector reported by a white hat (ethical security hacker), core developers took immediate steps to protect the Aave protocol by pausing and freezing the affected markets on November 4. No funds were affected, and an additional proposal was then submitted to disable the stable borrow rate for all assets across all pools on all networks and unfreeze assets. Regarding on-chain metrics, Aave’s decentralized stablecoin grew ~24% in November to 34.8 million GHO in circulation. GHO got within 2% of its $1 peg on November 28 after trading almost 5% below it for most of the month due to a lack of holding demand.

Polygon (MATIC)

Polygon’s native token MATIC traded up 19.77% over the past month. As part of the Polygon 2.0 roadmap, the upgrade to POL token upgrade was initiated on the Ethereum mainnet after months of development. The migration from MATIC to POL is expected to occur early in 2024. Regarding on-chain insights, Polygon’s total value locked (TVL) decreased by almost 10%, as measured in MATIC throughout November, from 1.211 to 1.095 billion. On the other hand, the trading volume on decentralized exchanges rose ~39%, from $3.53 billion in October to $5.81 billion in November, the highest figure since March 2023.

Decentraland (MANA)

Decentraland (MANA) rose 18.93% despite a sharp drop in platform usage. About 1,550 unique wallet addresses interacted with Decentraland throughout November, a ~55% decrease from October. The virtual world has struggled to gain user traction since the peak in activity in 2021. On another note, the Decentraland Foundation announced the first-ever community conference, which will take place in Argentina in May 2024. This initiative may be an excellent opportunity to forge better relationships and a deeper bond with creators and users, as exclusively focusing on virtual events has not had the desired effects on platform growth.

The Sandbox (SAND)

The Sandbox (SAND) traded up 18.04% in November. Like Decentralan’s situation, The Sandbox has struggled to gain user traction, a worrying trend for metaverse projects. About 5,550 unique wallet addresses interacted with the virtual world throughout November, down 65% from October. At this point, it’s fair to conclude that the notable partnerships that The Sandbox struck with recognizable names in 2021 and 2022, such as TIME, Lionsgate, or Snoop Dogg, had little material impact on the long-term growth of the project.

Cosmos (ATOM)

The Cosmos Hub’s native token ATOM rose 16.50% in the past month. On November 25, ATOM’s maximum annual inflation was reduced from 20% to 10% in a close community vote. Those favoring the proposal argued that the Cosmos Hub has overpaid for the network’s security. Another crucial argument was that the high historical inflation has damaged the perception of ATOM’s monetary premium throughout the ecosystem. In contrast, the biggest detractor of the proposal was Cosmos’ co-founder Jae Kwon, who now plans to launch a Cosmos fork dubbed ”AtomOne.” Throughout crypto’s history, contentious hard forks of this type have arisen due to disagreement within a network’s community. The risks of a controversial hard fork are significant, as stakeholders (validators, developers, users) must choose which blockchain they will support when it splits and two are created. Based on the governance forum’s discussions, Kwon’s influence has waned in the community, and most will likely continue supporting the Cosmos Hub, now more unified than ever.

Ethereum (ETH)

Ethereum rose 12.93% over the past month. ETH’s net issuance was negative in November, with a decrease of ~29k ETH in circulating supply, alongside an increase in the amount of ETH burned, a sign that the cryptoasset’s prospects as a deflationary asset depend heavily on network usage. Regarding fundamentals, the amount of staked ETH closed the month at 28.69 million ETH, equivalent to ~$59 billion securing the network. Lido remains the leader in market share, with ~32% of total staked ETH distributed across 35 node operators. Finally, Ethereum remains crypto’s most profitable protocol, registering $238 million in transaction fees during November.

Bitcoin (BTC)

Bitcoin traded up 8.77% over the past month. Regarding the derivatives market, the CME surpassed Binance in BTC futures open interest for the first time in history, with $4.04 billion in notional value as of November 30, 2023. The rise in CME open interest is a testament to the demand for regulated financial products from institutions to gain exposure to Bitcoin. In terms of network activity, fees accrued to miners increased by more than six times from $21.03 million in October to $142.5 million in November. The surge results from new use cases on the network, like Ordinals NFTs, which continue to gain traction. This trend has eased many investors’ concerns regarding the long-term security of the network.

Strategies of the Month: November 2023

Every month, our research team will also present the ten best-performing strategies of the month in our product suite. With a data-driven approach, we highlight the most important developments and events causing price movements.

Figure 2: 30-Day Performance: Strategies of the Month vs. Traditional Asset Classes

Data Source: 21Shares Data Hub and Yahoo Finance, from 31-Oct-2023 to 30-Nov-2023 (Close Price)

STAKE

The 21Shares Staking Basket Index ETP (STAKE) traded up 29.94% over the past month. STAKE seeks to track an index comprising the largest cryptoassets with institutional-grade support for staking. Staking is a process whereby investors, commonly referred to as validators, commit a portion of their cryptoassets (the “stake”) to secure a blockchain by confirming transactions – and gain access to a recurring value stream of native tokens to compensate them for their work. Staking is a core energy-friendly feature of Proof-of-Stake (PoS) blockchains, and each blockchain network has its own set of staking requirements. SOL remains the index’s largest constituent with a weight of 33.64% after strong price performances in October and November.

MOON

The Sygnum Platform Winners Index ETP (MOON) rose 22.99% over the past month. MOON seeks to track the investment results of an index composed of the native tokens of the most prominent blockchain protocols, including only the largest network in a family of forks. MOON’s weighting methodology goes beyond backward-looking metrics like market cap and liquidity. It also includes early and leading indicators of value creation in the underlying ecosystems, such as developer engagement and public interest via social media.

ALTS

The 21Shares Crypto Mid-Market Index ETP (ALTS) appreciated 13.43% over the past month. ALTS seeks to track the investment results of an index capturing the mid-cap portion of the cryptoasset market. BNB and XRP are the largest constituents of the index with weights of ~26% and ~24%, respectively. BNB underperformed the broader crypto market with an almost flat performance (0.45%), likely due to Binance’s ~$4 billion settlement with the Department of Justice (DOJ) and subsequent change in leadership.

HODL

The 21Shares Crypto Basket Index ETP (HODL) traded up 12.13% over the past month. HODL seeks to track the investment results of an index of the top 5 cryptoassets ranked by the 2050 market capitalization. The 2050 market capitalization is calculated using a projected 2050 supply number and current prices. Bitcoin and Ethereum’s weights are currently around 52% and 29%, respectively. Bitcoin’s weight in the index has increased over the past month due to its relative outperformance compared to other constituents like ETH, XRP, and DOT.

KEYS

The 21Shares Bitwise Select 10 Large Cap Crypto ETP (KEYS) rose 11.46% over the past month. KEYS seeks to track the investment results of an index of the top 10 cryptoassets ranked by inflation-adjusted market capitalization. Because Bitcoin and Ethereum’s weights in the index represent about 91%, the index’s performance tends to be highly correlated with both assets, as was the case over this period.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

Thinking of buying your first Bitcoin? Read these 5 tips first

-

Primer: Injective, infrastructure for global finance

-

Bitcoin is resilient despite the Middle East war

-

Grattis till Bitwise Europe på femårsjubileet för deras fysiska Bitcoin ETP

-

Svenska investerare — 21Shares Nasdaq Stockholm-sortiment har just blivit starkare

-

UK looking to lift the retail ban on crypto ETPs

Nyheter

Thinking of buying your first Bitcoin? Read these 5 tips first

Publicerad

9 timmar sedanden

2 juli, 2025

New to Bitcoin and feeling unsure? You’re not alone. Getting started can feel intimidating, but a few simple tips can help you invest with more confidence and make smarter choices from the start.

Crypto is growing up: 3 things we heard from a recent conference

Crypto’s journey toward mainstream adoption is picking up speed, and the recent Permissionless conference in New York made that more evident than ever. Read the highlights and how they could define the future of crypto.

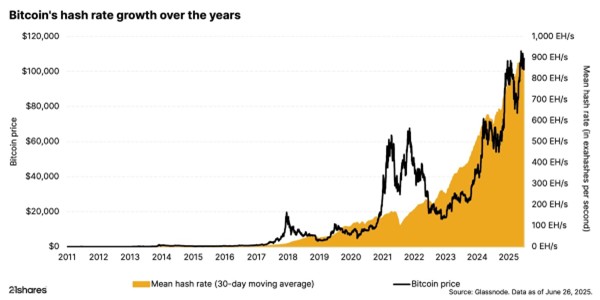

What keeps Bitcoin mining sustainable and why it matters for investors

If you’re new to Bitcoin (BTC), you might be curious about where it comes from. Unlike traditional money printed by central banks, Bitcoin is generated through a process called mining. The people behind this process are called miners. Understanding what Bitcoin mining is and what makes it sustainable can help you make more informed long-term investment decisions.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

REX Shares lanserar tre nya covered call ETFer i Europa

Publicerad

10 timmar sedanden

2 juli, 2025

- REX Shares har inlett ett samarbete med HANetf för att lansera tre nya covered call ETFer i Europa.

- De tre ETFerna är REX Tech Innovation Income & Growth UCITS ETF (ticker: FEGI), REX Tech Innovation Premium Income UCITS ETF (ticker: FEPI) och REX Crypto Equity Income & Growth UCITS ETF (ticker: CEGI).

- Enligt en nyligen genomförd oberoende undersökning uttryckte fondväljare i hela Europa den största efterfrågan på strategier med covered call och räntebärande tillgångar inom hela spektrumet av aktiva ETFer.

- ETFerna är noterade på London Stock Exchange, Xetra och Borsa Italiana.

HANetf, Europas första och enda oberoende white-label UCITS ETF och ETC-plattform, och ledande leverantör av digitala tillgångs-ETP:er, är glada att kunna tillkännage lanseringen av tre aktivt förvaltade covered call-ETFer från REX Shares.

REX Tech Innovation Income & Growth UCITS ETF

ISIN: IE000OBK3UE0

TER: 0,65 %

| Börs | Bloomberg Ticker | RIC | SEDOL | Valuta |

| London Stock Exchange | FEGI LN | FEGI.L | BSD55C4 | USD |

| London Stock Exchange | FEPD LN | FEPD.L | BSD55D5 | GBP |

| Xetra | ASWL GY | ASWL.DE | BVBMG47 | EUR |

| Borsa Italiana | FEGI IM | FEGI.MI | BVBMJ15 | EUR |

REX Tech Innovation Premium Income UCITS ETF

ISIN: IE000HF69TA9

TER: 0,65 %

| Börs | Bloomberg Ticker | RIC | SEDOL | Valuta | ||||

| London Stock Exchange | FEPI LN | FEPI.L | BSD5591 | USD | ||||

| London Stock Exchange | FEPG LN | FEPG.L | BSD55B3 | GBP | ||||

| Xetra | ASWK GY | ASWK.DE | BVBMG03 | EUR | ||||

| Borsa Italiana | FEPI IM | FEPI.MI | BVBMG36 | EUR | ||||

REX Crypto Equity Income & Growth UCITS ETF

ISIN: IE0008BA4TY1

TER: 0,65 %

| Börs | Bloomberg Ticker | RIC | SEDOL | Valuta | ||||

| London Stock Exchange | CEGI LN | CEGI.L | BSD55F7 | USD | ||||

| London Stock Exchange | CEPG LN | CEPG.L | BSD55G8 | GBP | ||||

| Xetra | ASWM GY | ASWM.DE | BVBMG14 | EUR | ||||

| Borsa Italiana | CEGI IM | CEGI.MI | BVBMG25 | EUR | ||||

Både FEGI och FEPI erbjuder exponering mot 20 ledande amerikansknoterade teknikaktier – inklusive FANG+-aktier – och strävar efter att generera månatliga intäkter genom covered call-strategier. FEGI skriver optioner på cirka 50 % av portföljen och balanserar intäkter och tillväxtpotential, medan FEPI använder en heltäckande strategi där man skriver calls upp till 10 % av kapitalet för att öka avkastningen utan att helt begränsa uppsidan.

Samtidigt fokuserar CEGI på 25 amerikansknoterade företag kopplade till krypto- och blockkedjeekosystemet och använder även en covered call-strategi på ~50 % i syfte att leverera attraktiva månatliga utbetalningar och fånga volatilitetsdrivna intäkter utan att väsentligt begränsa tillväxten.

De tre lanseringarna markerar REX Shares första inträde på den europeiska marknaden. Företaget förvaltar över 5 miljarder dollar i förvaltat kapital (AUM) över sina strategier i USA.

ETFer baserade på covered call och options ser betydande tillväxt i Europa och representerar nu 4,35 miljarder dollar i förvaltat kapital (AUM), efter att ha registrerat över 2,56 miljarder dollar i nettoflöden hittills i år. Enligt en nyligen genomförd oberoende undersökning uttryckte fondväljare i Europa den största efterfrågan på covered call- och räntebärande strategier inom hela spektrumet av aktiva ETFer (publicerat i HANetfs senaste Thematic & Active Review).

HANetf har nu fem covered call-produkter på sin plattform, enligt nedan:

| HANetf Covered Call Products | Ticker |

| REX Tech Innovation Income & Growth UCITS ETF | ASWL |

| REX Tech Innovation Premium Income UCITS ETF | ASWK |

| REX Crypto Equity Income & Growth UCITS ETF | ASWM |

| YieldMax® Big Tech Option Income UCITS ETF | YYYY |

| YieldMax® MSTR Option Income Strategy ETC | M5TY |

Kevin Gopaul, CIO på REX Financial, kommenterade: ”Vi är glada över att markera REX inträde på den europeiska marknaden med lanseringen av tre innovativa covered call-ETF:er. Optionsbaserade inkomststrategier har sett en explosionsartad tillväxt över hela världen, och vi har haft turen att spela en ledande roll i den rörelsen. Dessa strategier är utformade för investerare som söker avkastning samtidigt som de förblir fullt investerade i aktier, och vi är stolta över att kunna erbjuda en differentierad, aktivt förvaltad strategi för att generera intäkter från ledande amerikanska teknikledare och kryptorelaterade företag.”

Hector McNeil, medgrundare och VD för HANetf, kommenterade: ”Vi är glada över att samarbeta med REX Shares för att lansera tre nya covered call-ETFer i Europa. Tillgångsslaget har tagit fart i Europa nyligen, men vi tror att det bara har börjat. REX Shares strategi är beprövad i USA, och nu har europeiska investerare en chans att delta.

”Vi har nu 5 covered call-ETFer på HANetf-plattformen och 13 aktiva ETFer. Vi tror att båda dessa områden är redo för betydande tillväxt i Europa, och detta återspeglas i ökningen av förfrågningar vi har fått om att lansera aktiva och optionsbaserade ETFer.

”Vårt mål är alltid att bryta ner inträdesbarriärerna på den europeiska ETF-marknaden och göra det möjligt för kapitalförvaltare från hela världen att lansera sina börshandlade strategier på ett snabbt och kostnadseffektivt sätt. Vårt produktutbud blir alltmer mångsidigt i takt med att vi välkomnar fler partners till plattformen, vilket säkerställer att vi alltid är innovativa och erbjuder relevanta strategier till europeiska investerare.”

iShares World Equity Enhanced Active UCITS ETF USD (Acc) (WOEE ETF) med ISIN IE000D8XC064, är en aktivt förvaltad ETF.

Denna börshandlade fond investerar minst 70 procent i aktier från utvecklade marknader över hela världen. Upp till 30 procent av tillgångarna kan placeras i private equity-instrument, värdepapper med fast ränta med investment grade-rating och penningmarknadsinstrument. Värdepapper väljs utifrån hållbarhetskriterier och en kvantitativ investeringsmodell.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,30 % p.a. iShares World Equity Enhanced Active UCITS ETF USD (Acc) är den enda ETF som följer iShares World Equity Enhanced Active-index. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen ackumuleras och återinvesteras.

Denna ETF lanserades den 31 juli 2024 och har sin hemvist i Irland.

Investeringsmål

Fonden förvaltas aktivt och syftar till att uppnå långsiktig kapitaltillväxt på din investering, med hänvisning till MSCI World Index (”Riktmärket”) för avkastning.

Handla WOEE ETF

iShares World Equity Enhanced Active UCITS ETF USD (Acc) (WOEE ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Euronext Amsterdam | USD | WOEE |

| XETRA | EUR | WOEE |

| London Stock Exchange | GBP | WOEE |

Största innehav

| Kortnamn | Namn | Sektor | Vikt (%) | ISIN | Valuta |

| AAPL | APPLE INC | Informationsteknologi | 5.45 | US0378331005 | USD |

| MSFT | MICROSOFT CORP | Informationsteknologi | 4.77 | US5949181045 | USD |

| NVDA | NVIDIA CORP | Informationsteknologi | 3.94 | US67066G1040 | USD |

| AMZN | AMAZON COM INC | Sällanköpsvaror | 2.72 | US0231351067 | USD |

| GOOGL | ALPHABET INC CLASS A | Kommunikationstjänster | 1.77 | US02079K3059 | USD |

| GOOG | ALPHABET INC CLASS C | Kommunikationstjänster | 1.45 | US02079K1079 | USD |

| META | META PLATFORMS INC CLASS A | Kommunikationstjänster | 1.42 | US30303M1027 | USD |

| USD | USD CASH | Cash and/or Derivatives | 1.40 | – | USD |

| JNJ | JOHNSON & JOHNSON | Health Care | 1.33 | US4781601046 | USD |

| MA | MASTERCARD INC CLASS A | Finans | 1.26 | US57636Q1040 | USD |

Innehav kan komma att förändras

Thinking of buying your first Bitcoin? Read these 5 tips first

REX Shares lanserar tre nya covered call ETFer i Europa

WOEE ETF en aktiv globalfond från iShares

Försvarsfondernas ägande i SAAB ökar kraftigt

EDFS ETF spårar den europeiska försvarssektorn

De bästa ETFer som investerar i europeiska utdelningsaktier

YieldMax® lanserar sin andra produkt för europeiska investerare

Big News for Nuclear Energy—What It Means for Investors

Nya börshandlade produkter på Xetra

3EDS ETN ger tre gånger den negativa avkastningen på flyg- och försvarsindustrin

Populära

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanDe bästa ETFer som investerar i europeiska utdelningsaktier

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanYieldMax® lanserar sin andra produkt för europeiska investerare

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBig News for Nuclear Energy—What It Means for Investors

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanNya börshandlade produkter på Xetra

-

Nyheter3 veckor sedan

Nyheter3 veckor sedan3EDS ETN ger tre gånger den negativa avkastningen på flyg- och försvarsindustrin

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanNordea Asset Management lanserar nya ETFer på Xetra

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanHANetfs VD Hector McNeil kommenterar FCAs kryptonyheter

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanSvenska investerare — 21Shares Nasdaq Stockholm-sortiment har just blivit starkare