Nyheter

DeFi ”Defies” the Odds: Thriving Amidst Market Chaos

Publicerad

12 månader sedanden

Uncertainty around the U.S. economy has been taking a toll on Bitcoin and Ethereum, especially with Friday’s underwhelming nonfarm payroll data causing a 6-8% sell-off, re-echoing recession fears. On the institutional side, Bitcoin ETFs witnessed $1.2B in outflows in the eight days through last Friday, before seeing net inflows of $28.6M on September 9. Nevertheless, in the time of turbulence in the broader economy, one crypto-native market has been showing resilience.

Decentralized Finance (DeFi) is a blockchain-based financial market that operates without intermediaries like banks or brokerage firms. Instead, it uses smart contracts to facilitate peer-to-peer activity. Making financial services available to anyone with an internet connection, DeFi eliminates the barriers of traditional finance, while promoting financial autonomy and reducing reliance on centralized institutions. Another main advantage DeFi has over traditional finance is that users can trade around the clock, seven days a week.

Some of the use cases of DeFi include:

• Lending and borrowing: Just like bank loans, platforms like Aave allow users to lend their assets while earning interest, or borrow against collateral.

• Decentralized exchanges (DEXs) function similarly to stock exchanges by enabling users to trade between a variety of crypto pairs. However, instead of relying on centralized market makers, they utilize an automated market-making system (AMM) – pioneered by Uniswap – to facilitate trades in a decentralized manner.

• Stablecoins like Maker’s DAI maintain stable value to provide a way to store and transfer assets without worrying about volatility. Since they’re pegged to a stable asset, such as USD, they are also often used as collateral within DeFi ecosystems.

• Derivatives in DeFi are replicas of complex financial products found in traditional finance, such as options and futures, with cryptoassets in the underlying. In addition, synthetic assets (such as sXAU and sAAPL) allow users to participate in markets that might otherwise be inaccessible.

• Yield farming allows participants to put their idle cryptoassets to use. Users provide liquidity to DeFi protocols to facilitate trades, loans, or other financial services. In turn, these liquidity providers earn passive income in terms of rewards, which can be a portion of transaction fees, governance tokens, or just interest.

Why are we talking about them now?

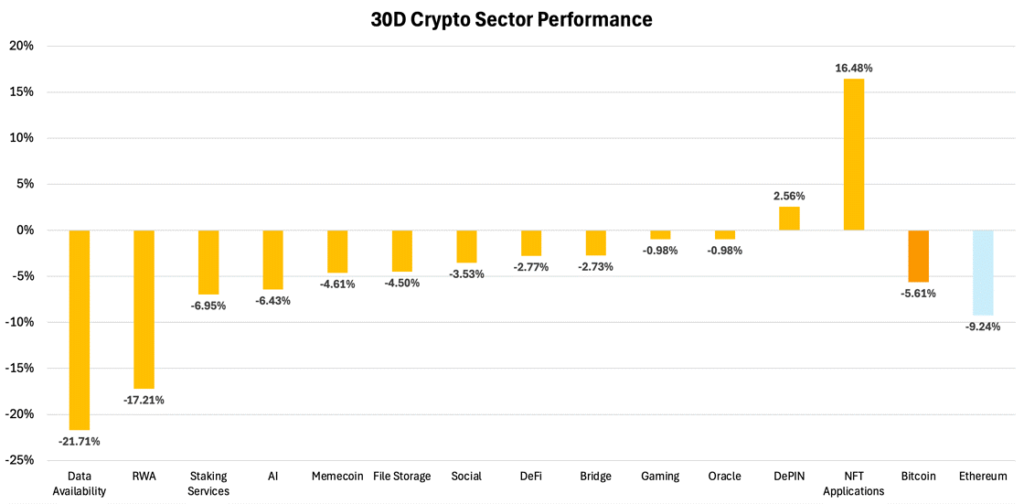

During market downturns and bearish periods, it’s crucial to take a step back and assess which businesses have fundamental value versus those propelled by hype. For example, DeFi demonstrated relative resilience compared to other crypto segments.

While Bitcoin and Ethereum experienced declines of approximately 6% and 9%, respectively, DeFi as a whole saw a more modest average decrease of around 3% over the last 30 days. For example, Uniswap increased by 6.2%, while Aave grew by 52.5%.

Figure 1 – Monthly Performance of Crypto Sectors

Source: Artemis, 21Shares

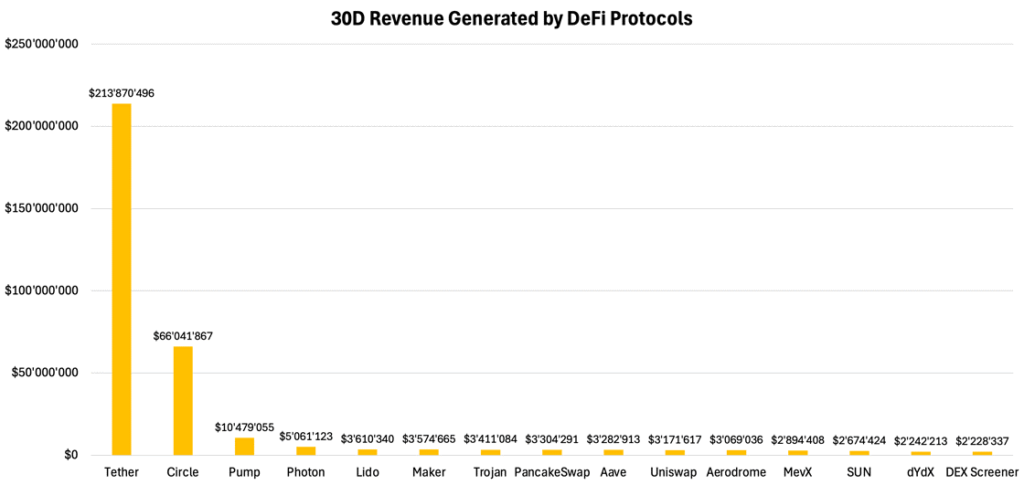

Further, when breaking down which businesses are making the most revenue across the space, DeFi protocols stand out, as shown below.

Figure 2 – Top Revenue-generating Protocols, Excluding Smart-contracts Platforms

Source: DeFiLlama, 21Shares

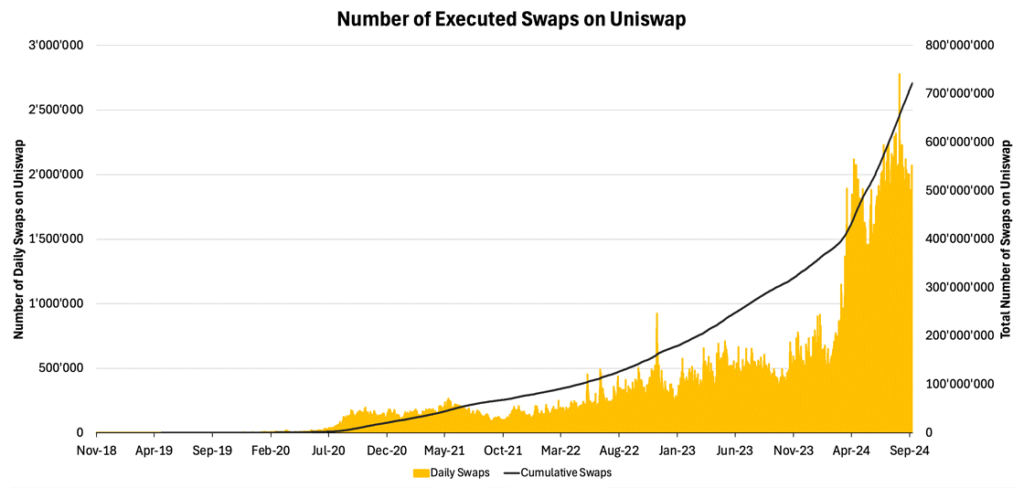

Drilling deeper into DeFi, the sector’s growth can be effectively gauged by examining exchange activity, particularly swapping transactions. As exchanges serve as the primary entry point for DeFi, their transaction volume offers valuable insight into the sector’s utilization. Currently, users are executing an average of nearly 2M swap transactions, representing a 10x increase since late 2021 on Uniswap.

Figure 3 – Total Number of Swaps Executed via the Different Iterations of Uniswap

Source: Dune Analytics, 21Shares

Further, DeFi’s monthly revenue nearly matched its November 2021 peak, reaching $70M. Notably, protocols simplifying financial market engagement, such as Pump.fun, have been the primary revenue drivers in this cycle. Pump.fun, which enables users to launch tokens without technical expertise, generated approximately $100M in less than six months. While it’s been primarily focused on meme coins, this trend highlights the growing demand for user-friendly DeFi platforms that lower barriers to participation for individual investors.

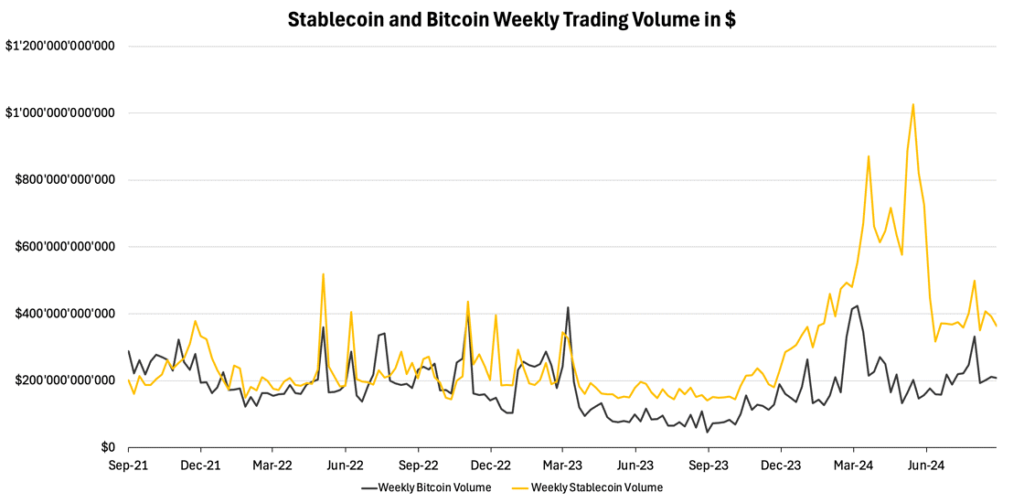

Finally, stablecoins are the bedrock of the DeFi ecosystem, serving as a volatility-free haven for crypto capital. Their pivotal role warrants a dedicated deep dive, but for now, let’s examine its remarkable growth since the Luna collapse. For instance, in Q2 of 2024, Tron processed up to one-third ($1.25T) of Visa’s annual settlement volume.

To further contextualize, the total stablecoin market capitalization is approaching its all-time high (ATH), surging approximately 38% from its July 2023 lows to reach $170B. In the same vein, stablecoins now consistently outpace Bitcoin in daily transaction volume, as shown in Figure 4, underscoring their pivotal role in enabling efficient, low-cost payments that aren’t just limited to crypto, as evident by Visa, Stripe, and Shopify’s integrations.

Figure 4 – Weekly Volume of Stablecoins and Bitcoin (USD)

Source: Artemis, 21Shares

So, where do we look?

Now that we’ve demonstrated the compelling value proposition of DeFi and its continued dominance in industry usage let’s examine the three pillars of the ecosystem: Aave, Maker, and Uniswap.

Aave: Crypto’s Leading Lending Platform

Aave is the largest money market protocol. Its token’s price, which surged over 50% from its recent August lows, is now approaching its highest level since May 2022, making it one of the rare market outperformers. While the protocol’s TVL remains approximately 45% below its 2021 peak, Aave demonstrated remarkable year-over-year growth.

Over a 12-month period from Q2 2023 to Q2 2024, the protocol saw net deposits rise by approximately 123%, growing from around $8B to $18B. Fees also surged, increasing from almost $24M to $103M, representing a growth of roughly 335%. This shift dramatically improved the protocol’s financial performance, moving from net losses of $4M by Q2 2023 to positive earnings of $7M by the end of July 2024. As a result, the protocol achieved the lowest Price-to-Fees (P/F) ratio in the last 12 months, at 3.7x.

Most impressively, Aave had the highest monthly active user count, 101.6K, in Q2 of this year, leading to a total cumulative user count of 2.2M. This is remarkable as it shows that the protocol is facilitating meaningful activity and has thereby found its product-market fit, even during times of muted activity.

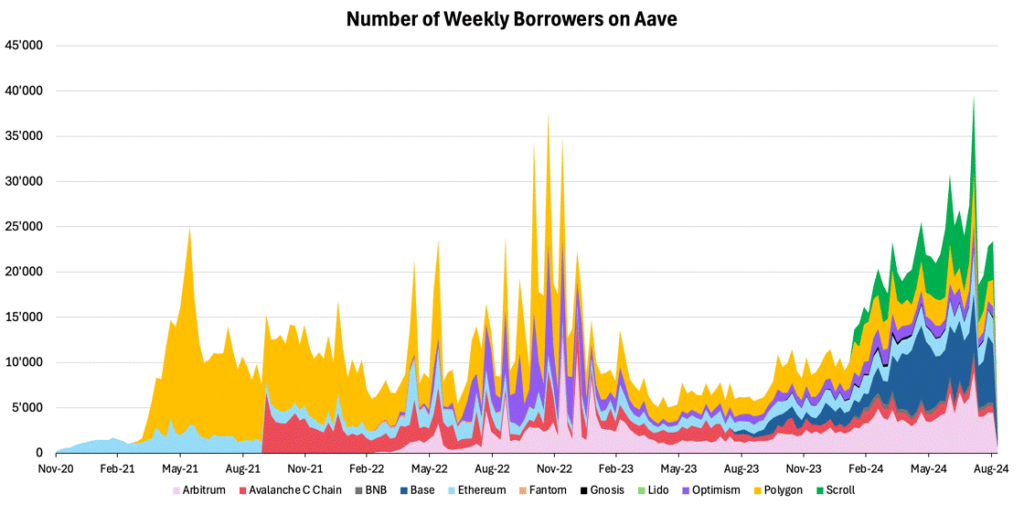

Figure 5 – Total Amount of Weekly Borrowers

Source: Dune Analytics, 21Shares

In line with this data, Aave’s total number of weekly borrowers reached an ATH in mid-August, as depicted below. This reflects the protocol’s health and its cardinal role within DeFi.

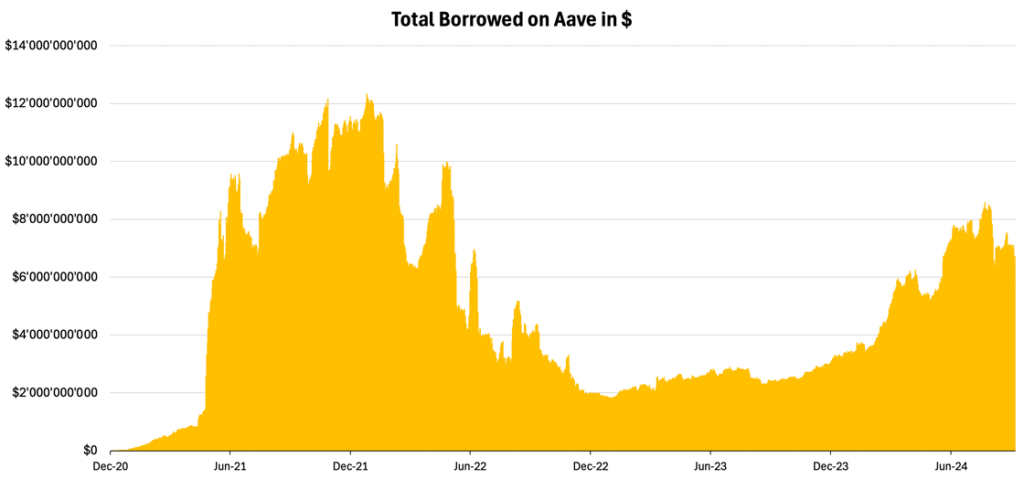

Figure 6 – Total Borrowed Amount on Aave in $

Source: Artemis, 21Shares

TLDR: Despite a 40% decrease in assets’ value amid the broader crypto market slowdown, Aave has significantly expanded its user base across multiple networks. This growth has led to increased revenue, surpassing Q4 2021 levels and resulting in positive earnings of over $7M during the last quarter. With Aave’s strategic expansion plan and its anticipated collaboration with Trump’s DeFi protocol, the outlook for the next few months appears bullish.

Maker: World’s Largest Decentralized Central Bank

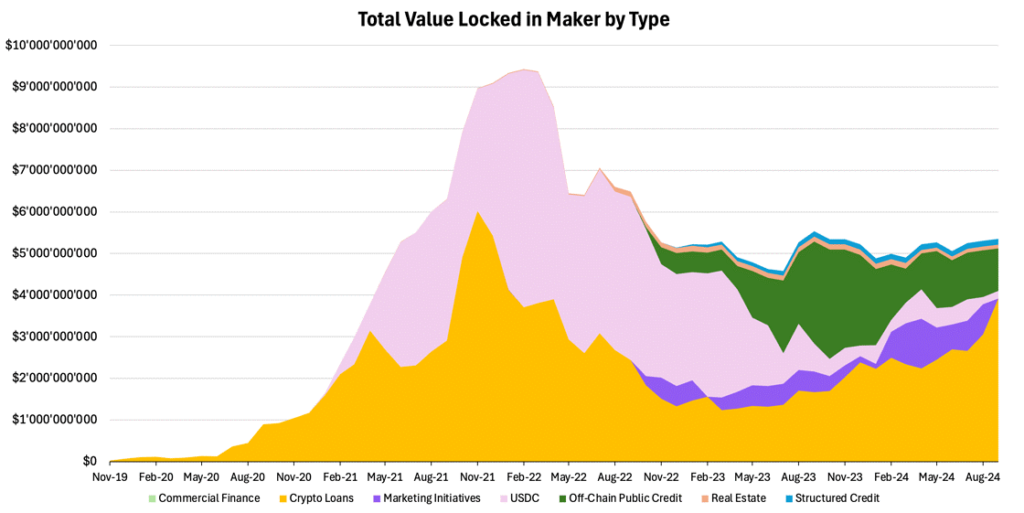

Sky, formerly known as Maker, has emerged as the top revenue-generating DeFi application, second only to stablecoin issuers like Tether (USDT) and Circle (USDC). While the full implications of the recent Sky rebranding continue to unfold, the protocol has already made a name for itself by pioneering synergies with traditional finance (TradFi), particularly through the onboarding of tokenized real-world assets onto the crypto ecosystem. This sector now makes up a significant portion of its TVL, particularly in areas such as public and structured credit, as shown below in Figure 7.

Nevertheless, Maker’s primary business remains centered on decentralized lending, which currently accounts for approximately $4B of its $5.5B TVL. Maker’s expertise in lending, alongside its expanding involvement in real-world assets, continues to drive its dominance in the DeFi ecosystem.

Figure 7: Maker TVL by Type

Source: Dune, 21Shares

Despite recent challenges, Maker continues to show resilience in the DeFi landscape. Although the token price dropped 21% last month, the protocol remains positioned for long-term growth, with underlying metrics showing steady momentum.

While Q3 2024 revenue is projected to fall slightly below Q2’s $85M peak, it is still on track to more than double the $33M from Q3 2023. This impressive year-over-year growth highlights Maker’s ability to generate consistent earnings despite varying market conditions.

A standout achievement is Maker’s net treasury, which surged over 10x from $15M in Q3 2023 to $154M in Q3 2024. This strong financial buffer helps shield the protocol from volatility and supports future initiatives like the Sky rebrand, which we’ll break down in a separate edition.

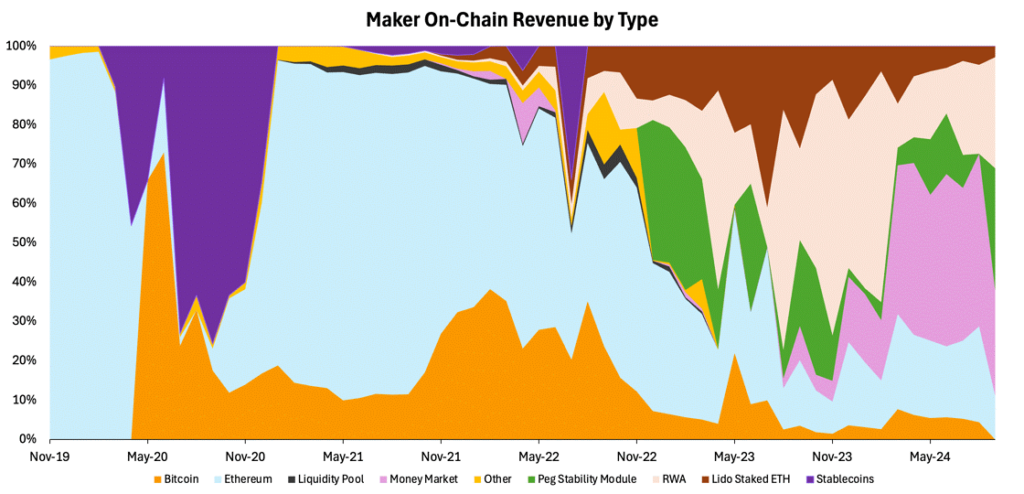

Figure 8: Maker On-chain Revenue by Type

Source: Dune Analytics

User engagement is also on the rise, with monthly active users up 15% this quarter, approaching 3,000. This growing activity reinforces Maker’s product-market fit. With increased revenue and user activity, Maker’s Price-to-Fees (P/F) ratio has improved, dropping from 11.8x in Q3 2023 to 8.1x, suggesting the protocol may be undervalued. As shown in Figure 8 above, Maker’s diversified revenue streams further strengthen its position as a key sustainable DeFi player.

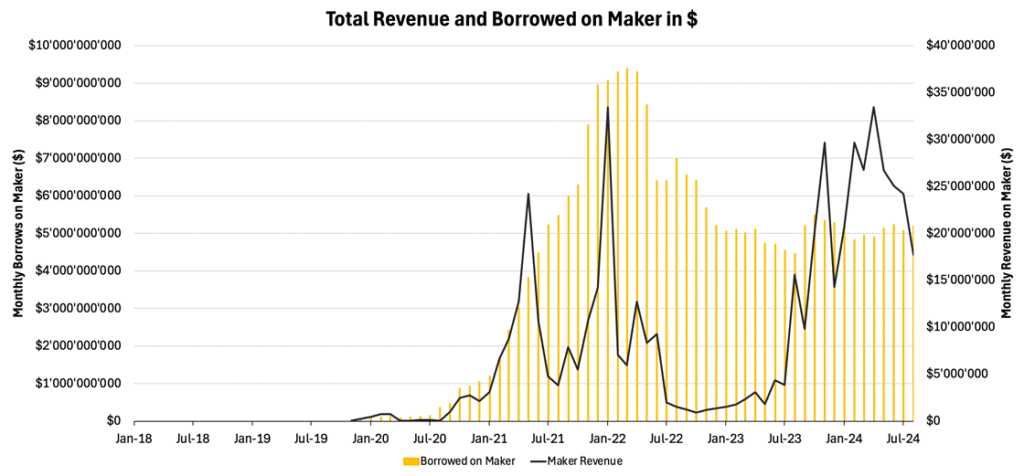

While total borrows on Maker have dropped nearly 45% from their 2021 peak, the protocol has stabilized at a healthy $5B in monthly borrowing, reflecting strong demand for its lending services, as shown in Figure 9. Notably, despite the plateau in borrowing, Maker’s revenue has grown steadily throughout 2023, indicating successful diversification beyond its original use case.

Figure 9: Maker’s Borrowed Amount in $ vs Revenue

Source: Artemis

TLDR: By expanding into new business lines, Maker is positioned for future growth as DeFi establishes itself as a sector with proven demand. The protocol is well-poised to capitalize on DeFi’s growing adoption and integration with the broader financial ecosystem, securing its place at the forefront of the industry.

Uniswap: Crypto’s Dominant Non-Custodial Stock Exchange

Generally, users prefer non-custodial crypto exchanges, which provide greater security and autonomy compared to centralized exchanges (CEX). Even with the recent market turbulence, the DEX to CEX spot volume is still close to its all-time high, showing that the conviction remains strong around DeFi’s infrastructure.

Being the biggest DEX by TVL and the pioneer behind automated market makers, let’s explore how Uniswap ranks among its centralized counterparts. In Q2, Uniswap made 81% and 65% of Coinbase and Robinhood’s volume, respectively, while just having a fraction of the resources and workforce.

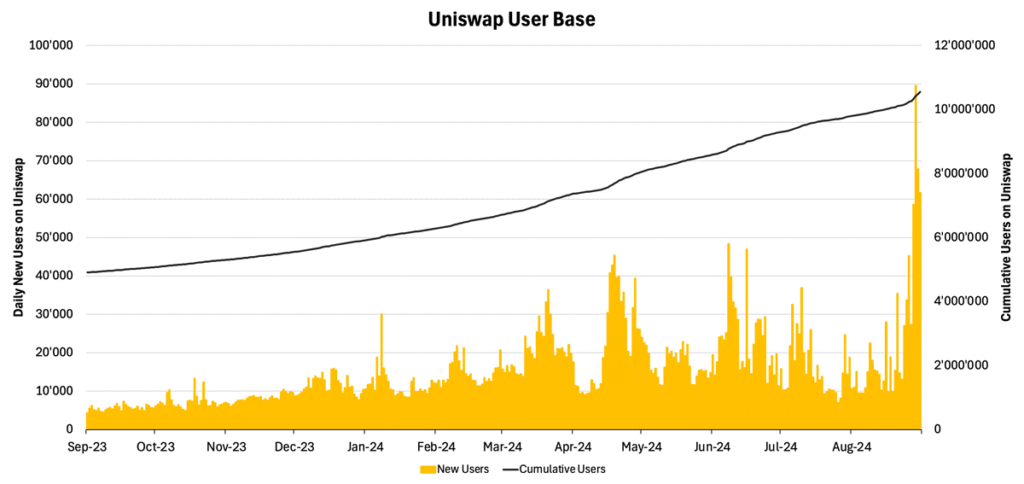

Figure 10 – Uniswap’s Daily Active Users

Source: Dune Analytics, 21Shares

In Figure 10, we can see that new users recently climbed to 90K, a number Uniswap never crossed in a single day, let alone at a time of uncertainty in broader markets. Further, with 12M monthly active users, Uniswap enjoys 60% market share. To put matters into perspective, Curve Finance is a DEX that comes right after Uniswap in TVL ranking and has 27.9K monthly users. If we have a look at Uniswap’s centralized competitors, Coinbase has 8M active users and Robinhood has 13.7M.

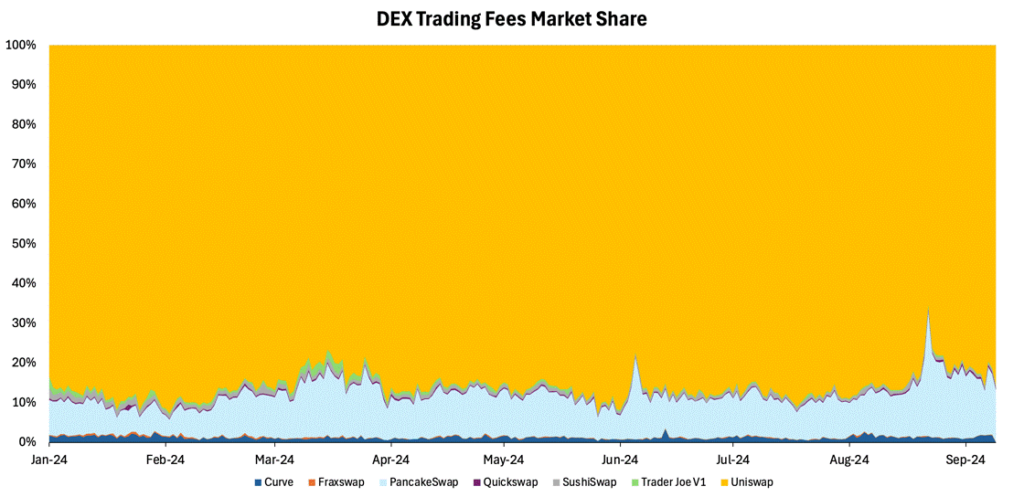

Assessing Uniswap’s business has to include a look into its revenue streams. In October 2023, Uniswap Labs imposed a 0.15% fee on specific tokens to swaps conducted on its main interface. Over the past six months, Uniswap Labs generated $45M via its interface fee, gulping the lion’s share in the fee generating vertical, excluding Solana-based DEXs, as shown below.

Figure 11 – DEX Trading Fees Market Share

Source: Artemis, 21Shares

TLDR: Despite Uniswap’s lackluster price performance, largely due to perceived utility issues compared to other major DeFi tokens, the protocol’s outlook appears promising. This optimism stems from two key factors: increasing revenue from its interface fee and the potential activation of the fee switch. The market’s reaction to the fee switch news in February was notably positive, with the token surging nearly 130%. All in all, Uniswap’s dominant position in the DEX sector, evidenced by its substantial fee generation and expanding user base, could position it as a relevant barometer for the broader DeFi landscape.

So, what are the key catalysts that could reignite the industry in the coming months?

• Fee-switch and Domino Effect on DeFi:

o In February, the Uniswap Foundation proposed activating the fee-switch, allowing token holders to share protocol revenue. Though paused, this move signaled a shift in DeFi towards transforming simple governance tokens into revenue-generating assets. Aave is now considering a similar feature, and we expect more protocols to pursue similar value accrual mechanisms.

• Falling interest rates

o As central banks lowered borrowing rates during the pandemic to stimulate economic growth, savings accounts offered unattractive yields, driving some investors to DeFi for higher returns. Although early yields were unsustainable, the sector has since relatively matured with the integration of tokenized assets, blending yields from both traditional and decentralized finance. This evolution could become a key advantage as rates continue declining in the coming months.

• Trump’s DeFi Project

o While many details are still pending, World Liberty Project appears to be a lightweight, non-custodial lending protocol designed to integrate with Aave. This setup allows users to deposit into without forking the protocol itself. The project could significantly impact Aave, enhance confidence in DeFi platforms, and consequently drive up sector valuations. It could underscore the benefits of stablecoins, which the platform is expected to heavily rely on, if it doesn’t stir regulatory scrutiny.

• Simplified User Interface

o Apple’s new NFC policy could significantly increase the demand for stablecoins by unlocking their utility as an alternative payment method through their devices, via tap-to-pay. This change could elevate DeFi’s infrastructure role, though the impact will largely be felt behind the scenes, with users primarily noticing the convenience in terms of cost efficiency.

o Features like account abstraction will enable users to create and recover smarter crypto wallets using Web2 credentials, offering a more user-friendly experience reminiscent of fintech platforms.

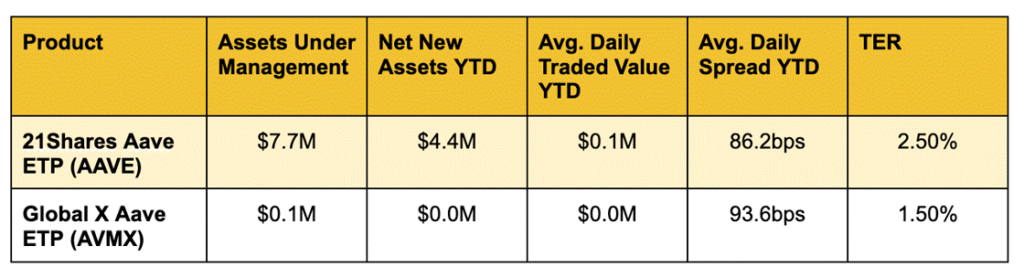

For investors looking to gain exposure to the DeFi ecosystem, one of the most established sectors with a proven product-market fit, 21Shares offers the following ETPs on the European market. These investment products provide a regulated way to invest in leading DeFi protocols and capture growth opportunities within this rapidly evolving sector.

Figure 12 – Top Aave ETPs by Assets under Management

Source: Bloomberg, Data as of September 10, 2024.

Avg. Daily Spread YTD: refers to the best daily average bid/ask spread this year across European exchanges.

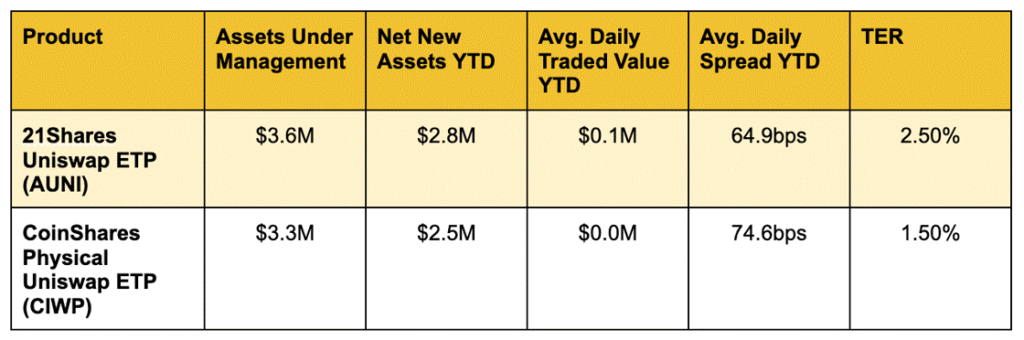

Figure 13 – Top Uniswap ETPs by Assets under Management

Source: Bloomberg, Data as of September 10, 2024.

Avg. Daily Spread YTD: refers to the best daily average bid/ask spread this year across European exchanges.

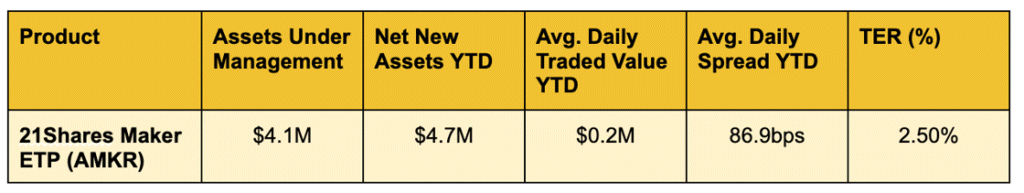

Figure 14 – Top Maker ETPs by Assets under Management

Source: Bloomberg, Data as of September 10th, 2024.

Avg. Daily Spread YTD: refers to the best daily average bid/ask spread this year across European exchanges.

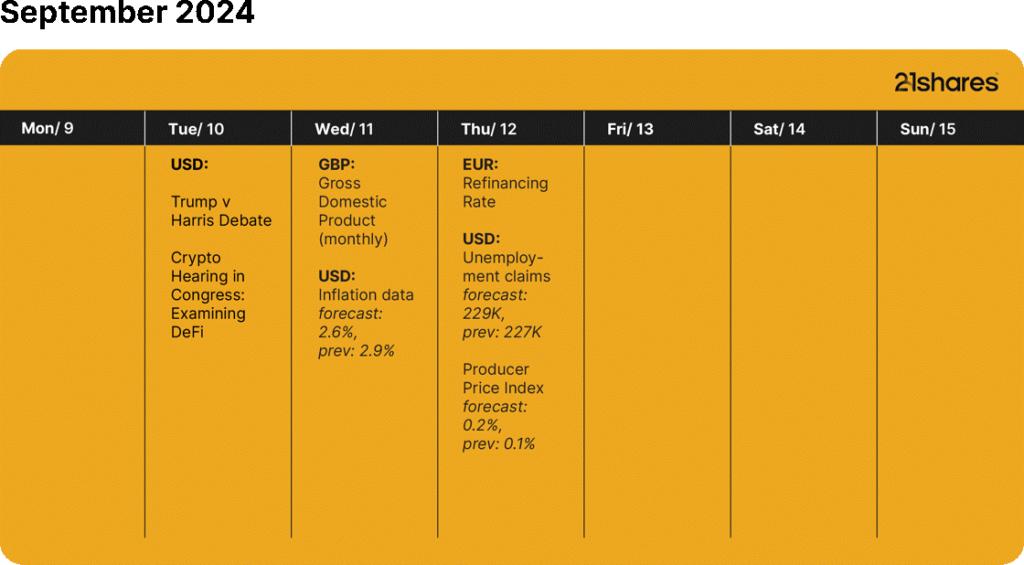

What’s happening this week?

Source: Forex Factory, 21Shares

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

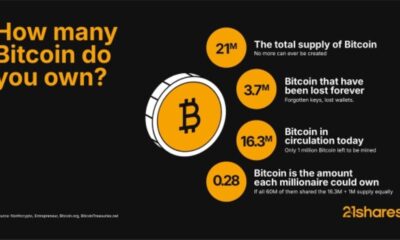

Bitcoin is scarce. Will you get your share?

-

Bitcoin surpasses Alphabet and Amazon by market cap

-

21Shares noterar två nya krypto-ETPer på Xetra

-

The Bitcoin boom hiding in Americans’ retirement savings

-

UK investors, are you ready for crypto ETNs?

-

Bitcoin likes to dance to its own beat, not to tech stock tunes

Nyheter

XB28 ETF köper företagsobligationer med förfall 2028 och stänger sedan

Publicerad

7 timmar sedanden

6 september, 2025

Xtrackers II Target Maturity Sept 2028 EUR Corporate Bond UCITS ETF 1D (XB28 ETF) med ISIN LU2810185665, försöker följa Bloomberg MSCI Euro Corporate September 2028 SRI-index. Bloomberg MSCI Euro Corporate September 2028 SRI-index följer företagsobligationer denominerade i EUR. Indexet speglar inte ett konstant löptidsintervall (som är fallet med de flesta andra obligationsindex). Istället ingår endast obligationer som förfaller mellan oktober 2027 och september 2028 i indexet (Denna ETF kommer att stängas i efterhand). Indexet består av ESG (environmental, social and governance) screenade företagsobligationer. Betyg: Investment Grade.

Denna börshandlade fonds TER (total cost ratio) uppgår till 0,12 % p.a. Xtrackers II Target Maturity Sept 2028 EUR Corporate Bond UCITS ETF 1D är den enda ETF som följer Bloomberg MSCI Euro Corporate September 2028 SRI-index. ETFen replikerar det underliggande indexets prestanda genom samplingsteknik (köper ett urval av de mest relevanta indexbeståndsdelarna). Ränteintäkterna (kupongerna) i ETFen delas ut till investerarna (Årligen).

Denna börshandlade fond lanserades den 25 september 2024 och har sin hemvist i Luxemburg.

Index nyckelfunktioner

Bloomberg MSCI Euro Corporate September 2028 SRI Index syftar till att spegla resultatet på följande marknad:

- Endast investeringsklass

- Euro-denominerad företagsobligationsmarknad med fast ränta

- Obligationer med förfallodatum på eller mellan 1 oktober 2027 och 30 september 2028

- Exklusive obligationer som inte uppfyller specifika miljö-, sociala och styrningskriterier

- Från och med den 1 oktober 2027 kommer referensindexet även att inkludera vissa eurodenominerade statsskuldväxlar utgivna av vissa europeiska regeringar med 1 till 3 månader kvar till löptid

Handla XB28 ETF

Xtrackers II Target Maturity Sept 2028 EUR Corporate Bond UCITS ETF 1D (XB28 ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| XETRA | EUR | XB28 |

Största innehav

| ISIN | Namn | Vikt % | Land |

| XS2168625544 | PEPSICO INC | 1.19% | USA |

| XS2725836410 | TELEFONAKTIEBOLAGET LM ERICSSON | 1.08% | Sverige |

| XS2292954893 | GOLDMAN SACHS GROUP INC/THE | 1.02% | USA |

| XS2327299298 | LSEG NETHERLANDS BV | 1.01% | Storbritannien |

| XS2345317510 | SVENSKA HANDELSBANKEN AB | 0.99% | Sverige |

| CH1224575899 | RAIFFEISEN SCHWEIZ GENOSSENSCHAFT | 0.97% | Schweiz |

| XS2555918270 | JYSKE BANK A/S | 0.96% | Danmark |

| XS2594025814 | ARCADIS NV | 0.96% | Holland |

| FR001400F075 | BPCE SA | 0.95% | Frankrike |

| XS2199351375 | FIAT CHRYSLER AUTOMOBILES NV | 0.95% | USA |

| XS2751688826 | CARRIER GLOBAL CORP | 0.95% | USA |

| XS2618906585 | NORDEA BANK ABP | 0.95% | Finland |

| XS2619751576 | SKANDINAVISKA ENSKILDA BANKEN AB | 0.95% | Sverige |

| XS2626022573 | WPP FINANCE SA | 0.95% | Storbritannien |

| XS2577396430 | PIRELLI & C SPA | 0.95% | Italien |

Innehav kan komma att förändras

Nyheter

IncomeShares fondflöden nådde en ny rekordnivå i augusti

Publicerad

8 timmar sedanden

6 september, 2025

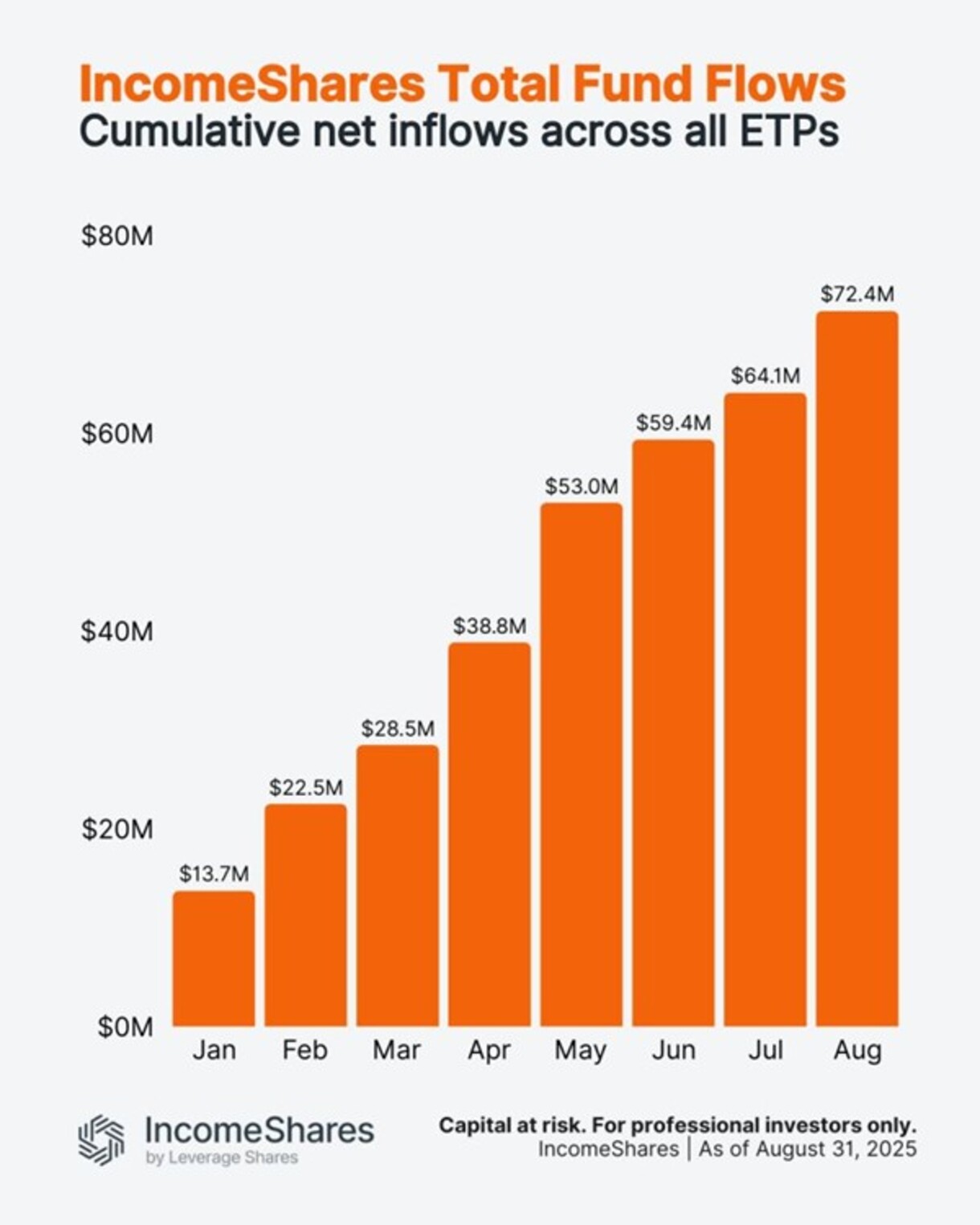

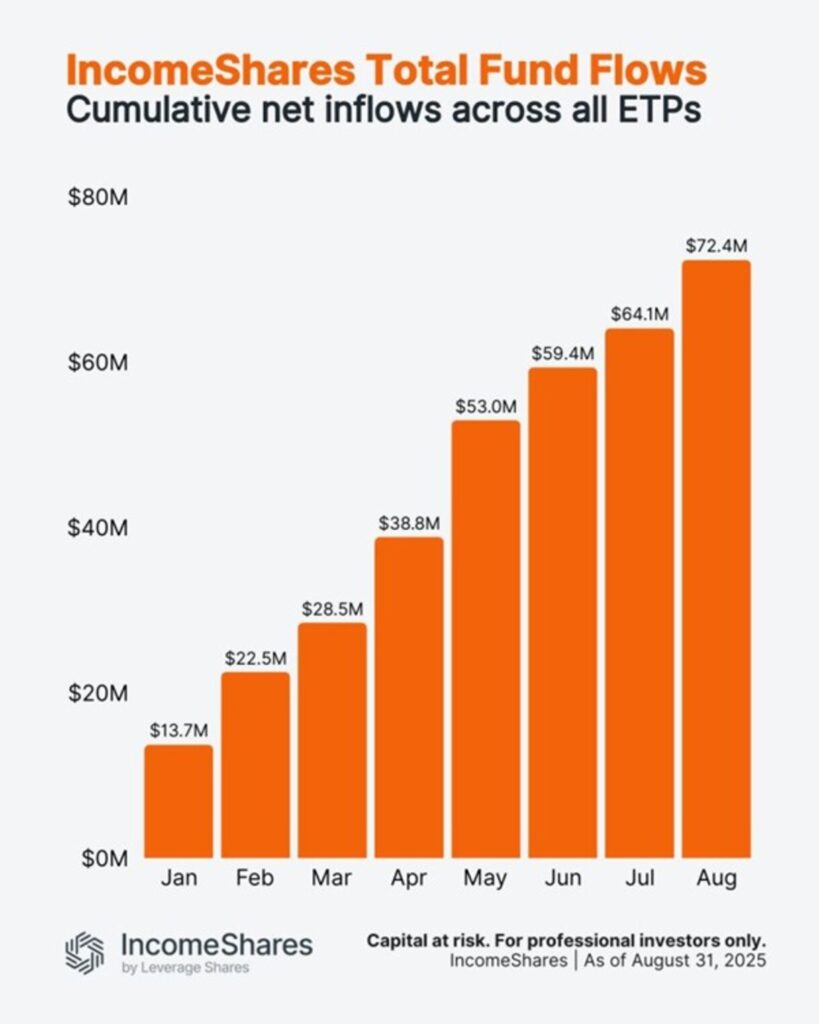

Fondflöden spårar hur mycket pengar investerare sätter in i eller tar ut från IncomeShares börshandlade produkter. Positiva fondflöden innebär att mer pengar kommer in än går ut – ett tecken på efterfrågan på börshandlade produkter.

Kumulativa fondflöden har ökat varje månad under 2025. I slutet av augusti nådde de 72,4 miljoner dollar. Det är över 8 miljoner dollar i nya pengar som tillkommit enbart i augusti – den största månatliga ökningen sedan maj.

Diagrammet nedan visar trenden.

Följ IncomeShares EU för fler uppdateringar.

Nyheter

JIGG ETF investerar i företagsobligationer från hela världen

Publicerad

9 timmar sedanden

6 september, 2025

JPMorgan Global IG Corporate Bond Active UCITS ETF USD (acc) (JIGG ETF) med ISIN IE000S2QZKI8, är en aktivt förvaltad börshandlad fond.

ETFen investerar i företagsobligationer utfärdade av företag världen över i lokal valuta. De värdepapper som ingår filtreras enligt ESG-kriterier (miljömässiga, sociala och bolagsstyrningsrelaterade). Alla löptider ingår. Rating: Investment Grade.

Den börshandlade fondens TER (total expense ratio) uppgår till 0,25 % per år. Ränteintäkterna (kuponger) i ETFen ackumuleras och återinvesteras.

JPMorgan Global IG Corporate Bond Active UCITS ETF USD (acc) är en mycket liten ETF med 10 miljoner euro i förvaltningstillgångar. ETFen lanserades den 20 maj 2025 och har sitt säte i Irland.

Investeringsmål

Delfondens mål är att uppnå en långsiktig avkastning som överstiger jämförelseindexet genom att aktivt investera huvudsakligen i globala företagsobligationer med investment grade-värde.

Riskprofil

- Värdet på din investering kan både minska och öka och du kan få tillbaka mindre än du ursprungligen investerade.

- Värdet på skuldebrev kan förändras avsevärt beroende på ekonomiska förhållanden och ränteförhållanden samt emittentens kreditvärdighet. Emittenter av skuldebrev kan misslyckas med att uppfylla betalningsförpliktelser eller så kan skuldebrevens kreditbetyg sänkas. Dessa risker ökar vanligtvis för skuldebrev under investment grade, vilka också kan vara föremål för högre volatilitet och lägre likviditet än skuldebrev med investment grade. Kreditvärdigheten för skuldebrev utan kreditbetyg mäts inte med hänvisning till ett oberoende kreditvärderingsinstitut.

- Efterställda skuldebrev är mer benägna att drabbas av en partiell eller fullständig förlust vid emittentens fallissemang eller konkurs eftersom alla skyldigheter gentemot innehavare av emittentens prioriterade skuld måste uppfyllas först. Vissa efterställda obligationer är inlösbara, vilket innebär att emittenten har rätt att köpa tillbaka dem till ett visst datum och pris. Om sådana obligationer inte ”inlöses” kan emittenten förlänga deras förfallodag ytterligare eller skjuta upp eller minska kupongbetalningen.

- Konvertibla obligationer är föremål för de kredit-, ränte- och marknadsrisker som är förknippade med både skuldebrev och aktier och för risker som är specifika för konvertibla värdepapper. Konvertibla obligationer kan också vara föremål för lägre likviditet än de underliggande aktierna.

- Villkorade konvertibla skuldebrev kommer sannolikt att påverkas negativt om specifika utlösande händelser inträffar (enligt avtalsvillkoren för det emitterande företaget). Detta kan bero på att värdepapperet konverteras till aktier till ett rabatterat aktiekurs, att värdepapperets värde skrivs ner, tillfälligt eller permanent, och/eller att kupongbetalningar upphör eller skjuts upp.

- Statliga skuldebrev, inklusive de som emitteras av lokala myndigheter och myndigheter, är föremål för marknadsrisk, ränterisk och kreditrisk. Regeringar kan fallera med sina statsskulder och innehavare av statsskulder (inklusive delfonden) kan ombedas att delta i omläggningen av sådana skulder och att bevilja ytterligare lån till statliga enheter. Det finns inget konkursförfarande genom vilket statsskulder som en regering har fallerat på kan drivas in helt eller delvis. Globala ekonomier är starkt beroende av varandra och konsekvenserna av en suverän stats fallissemang kan vara allvarliga och långtgående och kan leda till betydande förluster för delfonden.

- Tillväxtmarknader kan vara föremål för ökad politisk, regleringsmässig och ekonomisk instabilitet, mindre utvecklade förvarings- och avvecklingsmetoder, dålig transparens och större finansiella risker. Skuldpapper från tillväxtmarknader och skuldebrev under investment grade kan också vara föremål för högre volatilitet och lägre likviditet än skuldebrev som inte är från tillväxtmarknader respektive investment grade.

- Hållbarhetsrisk kan väsentligt negativt påverka en emittents finansiella ställning eller rörelseresultat och därmed värdet av den investeringen. Dessutom kan det öka delfondens volatilitet och/eller förstärka befintliga risker för delfonden.

- Delfonden strävar efter att ge en avkastning över jämförelseindexet; delfonden kan dock underprestera jämförelseindexet.

- Mer information om risker finns i avsnittet ”Riskinformation” i prospektet.

Handla JIGG ETF

JPMorgan Global IG Corporate Bond Active UCITS ETF USD (acc) (JIGG ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Borsa Italiana | EUR | JIGG |

| London Stock Exchange | USD | JIGG |

| SIX Swiss Exchange | USD | JIGG |

| XETRA | EUR | JIGG |

Största innehav

| Namn | ISIN | Tillgång | Land | Vikt % |

| Cash and Cash Equivalent | Cash | USA | 3,48% | |

| ENGIE SA 5.25% 04/10/29 | US29286DAA37 | Corp – Debt Private Placement | Frankrike | 1,04% |

| ENEL FINANCE INT 3.5% 04/06/28 | US29278GAF54 | Corp – Debt Private Placement | Italien | 0,99% |

| NATWEST GROU V/R 10/17/34/GBP/ | XS2902577191 | Corp – European MTN | Storbritannien | 0,92% |

| LOGICOR F 1.625% 01/17/30/EUR/ | XS2431318802 | Corp – European MTN | Luxemburg | 0,91% |

| AVOLON HOLDINGS 5.75% 11/15/29 | US05401AAV35 | Corp – Debt Private Placement | Irland | 0,87% |

| MORGAN STANLEY V/R 07/20/29 | US61747YFF79 | Corp – Global Bond | USA | 0,87% |

| GLOBAL PA 4.875% 03/17/31/EUR/ | XS2597994065 | Corp – European Non-Dollar | USA States | 0,83% |

| UBS GROUP AG V/R 04/01/31 | US225401AP33 | Corp – Debt Private Placement | Schweiz | 0,83% |

| MARVELL TECHNOL 5.95% 09/15/33 | US573874AQ74 | Corp – Global Bond | USA | 0,82% |

Innehav kan komma att förändras

XB28 ETF köper företagsobligationer med förfall 2028 och stänger sedan

IncomeShares fondflöden nådde en ny rekordnivå i augusti

JIGG ETF investerar i företagsobligationer från hela världen

JEQA ETF investerar i Nasdaq-100 i kombination med en derivatteknik

Bitwises Bradley Duke om marknadstrender och Bitcoin-utsikter

VALOUR ARB SEK spårar priset på kryptovalutan Arbitrum

Månadsutdelande ETFer uppdaterad med IncomeShares produkter

HANetfs analyserar hur ett fredsavtal kan påverka det europeiska försvaret

HANetfs VD kommenterar Trump-Putin-toppmötet

De bästa innovations-ETFerna

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanVALOUR ARB SEK spårar priset på kryptovalutan Arbitrum

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMånadsutdelande ETFer uppdaterad med IncomeShares produkter

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanHANetfs analyserar hur ett fredsavtal kan påverka det europeiska försvaret

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanHANetfs VD kommenterar Trump-Putin-toppmötet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDe bästa innovations-ETFerna

-

Nyheter6 dagar sedan

Nyheter6 dagar sedanUtdelningar och försvarsfonder lockade i augusti

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanADLT ETF investerar bara i riktigt långa amerikanska statsobligationer

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanIncomeShares når 60 miljoner dollar i förvaltat kapital – Tillväxtöversikt 2025