Nyheter

Crypto Market Compass 27. May 2024

Publicerad

1 år sedanden

Successfully navigate through Bitcoin & Cryptoasset Markets

• Cryptoassets rallye supported by the Ethereum ETF approval in the US and strong inflows into global crypto ETPs

• Our in-house “Cryptoasset Sentiment Indicator” has increased and signals slightly above neutral levels in sentiment

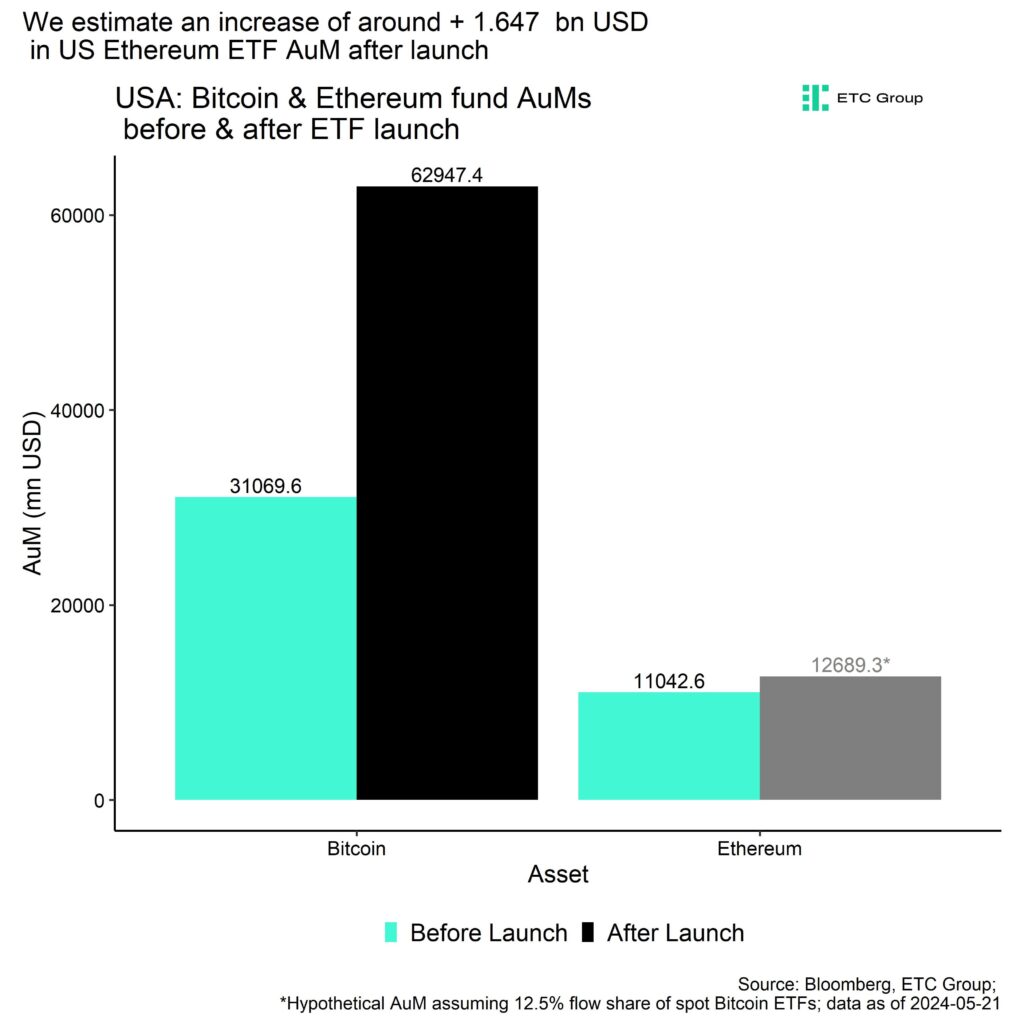

• We expect approximately 1.65 bn USD potential net inflows into US Ethereum ETFs in the first 3 months after trading launch

Chart of the Week

Performance

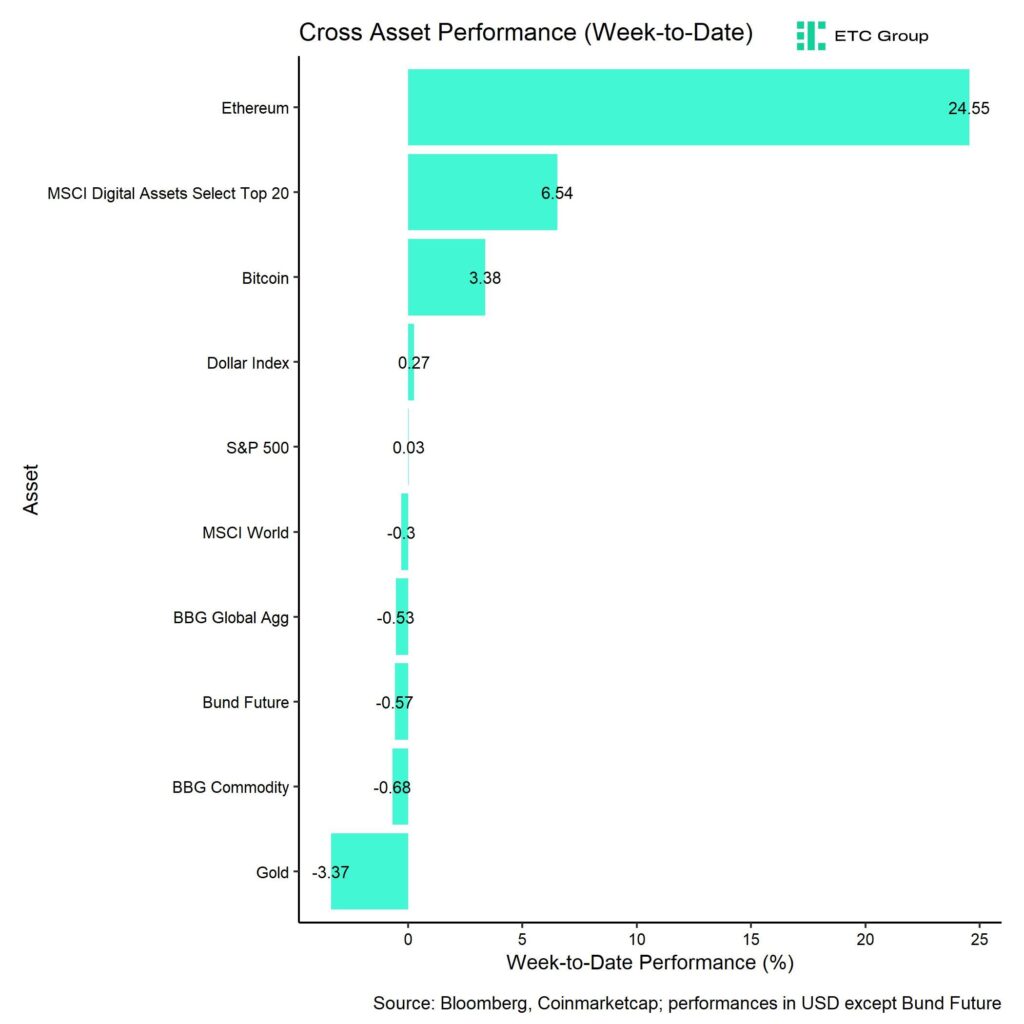

Last week, cryptoassets once again outperformed traditional assets by a very wide margin. Cryptoassets were mainly supported by strong inflows into global crypto ETPs and the final approval of spot Ethereum ETFs in the US.

Weekly net inflows into global crypto ETPs surpassed 1 bn USD last week mainly due to strong inflows into US Bitcoin ETFs while global Ethereum ETP flows were net negative.

Nonetheless, Ethereum managed to outperform Bitcoin strongly buoyed by the prospects of the Ethereum ETF approval in the US. We estimate that approximately 1.65 bn USD could flow into these new spot Ethereum ETFs in the first 3 months after the official trading launch (Chart-of-the-Week).

Although this just represents a small fraction of what has so far flown into spot Bitcoin ETFs, we expect these flows to still have a very significant influence on the performance of Ethereum.

Read more on this topic in our latest Crypto Market Espresso here.

Although the date for the official trading launch still needs to be announced, most

experts expect a trading launch within the next three months and most likely before the US presidential elections in November this year.

The important takeaway from the Ethereum ETF approval is that it marks a significant shift in sentiment within the SEC and among US regulators in general as cryptoassets have increasingly gained majority backing within the US political landscape.

The fact that the US House and Senate have approved the FIT21 Act (“crypto bill”) and that the Trump campaign has officially accepted crypto payments for campaign financing speak volumes in this regard. It seems as if no candidate and party in the US is able to run on an anti-crypto stance anymore.

The Financial Innovation and Technology for the 21st Century Act (FIT21) offers the strong consumer protections and regulatory clarity required for the ecosystem of digital assets.

By providing consumer protections and establishing the Commodity Futures Trading Commission (CFTC) as the primary regulator for digital assets and non-securities spot markets, the legislation seeks to establish a framework for regulating digital assets. This ought to offer more precise definitions for identifying cryptocurrency tokens as commodities or securities.

Despite the short-term euphoria around the Ethereum ETF approval, the market will generally lack major catalysts over the coming months.

In general, performance seasonality tends to be less supportive during the summer months and the positive effects from the Bitcoin Halving will most likely materialize later in the summer (around August onwards). The US spot Ethereum ETF trading launch is also still a couple of months away and the US presidential race will really start to heat up after the summer break.

Barring any buying announcement from a major sovereign or corporation, we still expect that increasing US recession risks could turn out to be a headwind for Bitcoin and cryptoassets in the short-term.

However, given the positive prospects towards the end of the year, any short-term price weakness should be viewed as an opportunity to increase exposure.

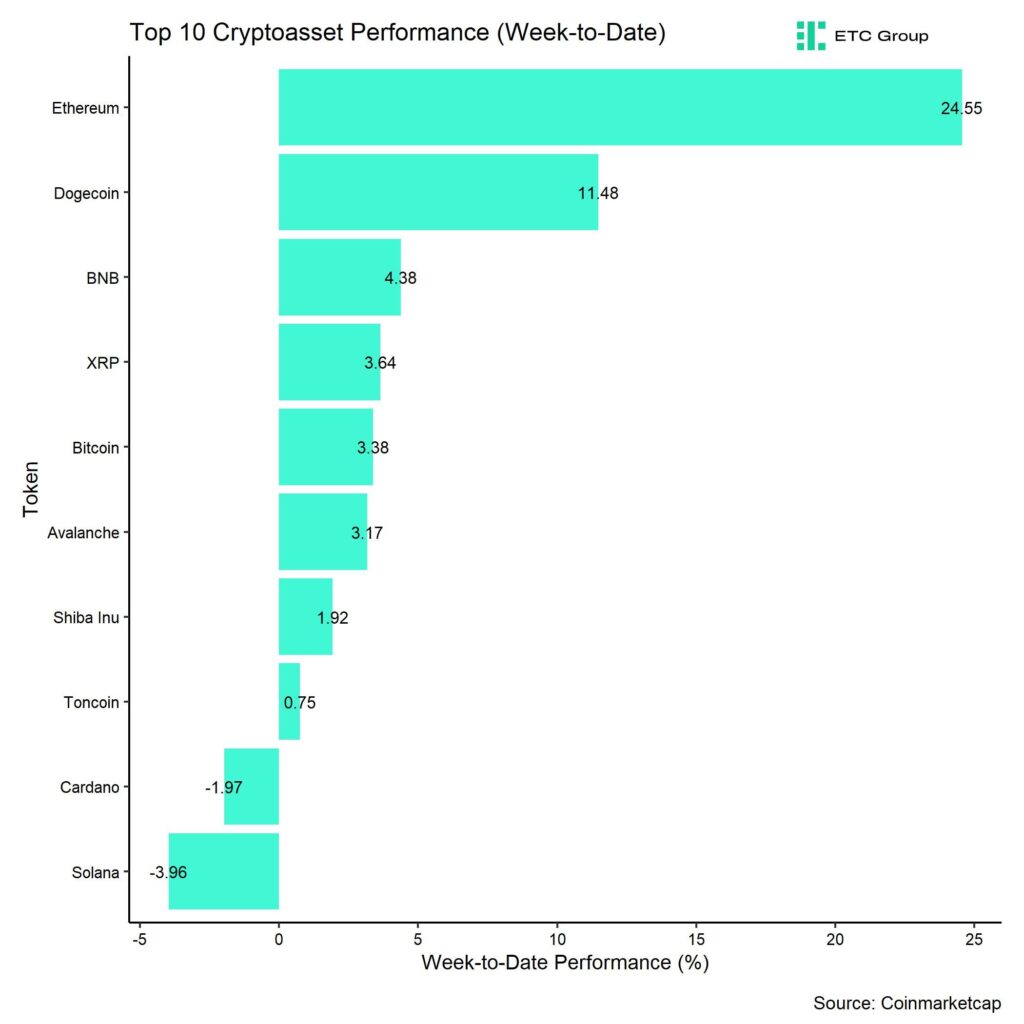

In general, among the top 10 crypto assets, Ethereum, Dogecoin, and BNB were the relative outperformers.

However, overall altcoin outperformance vis-à-vis Bitcoin has started to pick up, with around 60% of our tracked altcoins managing to outperform Bitcoin on a weekly basis.

Sentiment

Our in-house “Cryptoasset Sentiment Index” has increased last week is currently signalling sentiment which is slightly above neutral levels.

At the moment, 8 out of 15 indicators are above their short-term trend.

Last week, there were significant reversals to the upside in our altseason index and Crypto Fear & Greed Index.

The Crypto Fear & Greed Index signals ”Greed” as of this morning.

Performance dispersion among cryptoassets has started to increase, albeit from low levels. Most altcoins remain highly correlated with Bitcoin.

Altcoin outperformance vis-à-vis Bitcoin has picked up following the latest development around the Ethereum ETF approval, with around 60% of our tracked altcoins outperforming Bitcoin on a weekly basis. Altcoin outperformance was generally buoyed by a very significant outperformance of Ethereum vis-à-vis Bitcoin last week.

In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets.

Meanwhile, sentiment in traditional financial markets still remains elevated, judging by our own measure of Cross Asset Risk Appetite (CARA).

Fund Flows

Last week, we saw another week of very positive net inflows into global crypto ETPs with around +1,011.1 mn USD in net inflows across all types of cryptoassets (week ending Friday).

Global Bitcoin ETPs saw net inflows of +1,030.8 mn USD last week of which +1,060.6 mn USD (net) were related to US spot Bitcoin ETFs alone.

Flows into Hong Kong spot Bitcoin ETFs reversed last week with net inflows of around +35.5 mn USD, according to data provided by Bloomberg.

The ETC Group Physical Bitcoin ETP (BTCE) also saw significant net inflows equivalent to +14.6 mn USD while the ETC Group Core Bitcoin ETP (BTC1) saw net inflows of +0.1 mn USD last week.

The Grayscale Bitcoin Trust (GBTC) saw a return of negative net flows with approximately -20.5 mn USD last week while other major US spot Bitcoin ETFs continued to attract new capital, e.g. iShares’ IBIT took in a whopping +719.3 mn USD in a single week.

Despite the Ethereum ETF approval in the US, Global Ethereum ETPs continued to see declining ETP flows last week, with net outflows of around -18.0 mn USD.

Hong Kong spot Ethereum ETFs that saw minor net inflows last week of around +2.1 mn USD, according to data provided by Bloomberg.

Furthermore, the ETC Group Physical Ethereum ETP (ZETH) saw significant net inflows of +13.9 mn USD last week. The ETC Group Ethereum Staking ETP (ET32) also managed to attract capital in the order of +3.9 mn USD.

Besides, Altcoin ETPs ex Ethereum experienced some net inflows of around +14.1 mn USD last week.

Besides, Thematic & basket crypto ETPs continued to see minor net outflows of -15.8 mn USD, based on our calculations. In contrast, the ETC Group MSCI Digital Assets Select 20 ETP (DA20) managed to attract some net inflows last week (+0.3 mn USD).

Meanwhile, the beta of global crypto hedge funds to Bitcoin over the last 20 trading days has started to reverse and decreased to around 0.9. This implies that global crypto hedge funds have started to reduce their market exposure into last week and have currently a slightly less than neutral exposure to Bitcoin.

On-Chain Data

Bitcoin on-chain data remain lukewarm.

Overall net buying minus selling volumes on spot exchanges have been negative over the past week.

So, despite strong inflows into global Bitcoin ETPs and US spot Bitcoin ETFs in particular, spot exchanges continue to see an overhang of selling volumes.

In fact, overall net transfers to exchanges were positive over the past amid significant whale transfers to exchanges. Whales are defined as network entities that control at least 1,000 BTC.

Net transfers to exchanges generally imply increasing selling pressure.

This is generally a negative sign. It seems as if whales are “selling into strength”.

Last week saw the highest weekly net whale transfers of BTC to exchanges year-to-date. This is one of the reasons why we saw a slight increase in BTC exchange balances as well.

Ethereum exchange balances remained relatively flat over the past week with only a temporary drawdown in ETH balances following the pick-up in approval odds at the beginning of last week. However, Ethereum exchange balances are still slightly higher than in April.

In general, there was a slight pick-up in profit-taking by BTC investors as well which was significantly lower than during the all-time highs made in March though.

The market remains overall in a profit environment, i.e. both long- and short-term BTC holders have unrealized profits on aggregate. Short-term holders have recently also spent coins in profit on average.

Futures, Options & Perpetuals

Last week, both BTC futures and perpetual open interest saw a slight significant increase in BTC-terms which seems to be related to a net increase in long open interest. This was most likely associated with a net increase in short open interest.

We only saw a minor increase in BTC short futures liquidations following the turnaround in Ethereum ETF approval odds at the beginning of last week. ETH short futures liquidations spiked to the highest level since mid-April last week.

The Bitcoin futures basis remained relatively flat last week. At the time of writing, the Bitcoin futures annualized basis rate stands at around 12.7% p.a. Perpetual funding rates continued to stay relatively elevated signalling decent demand for long

perpetual contracts.

Bitcoin options’ open interest increased significantly last week as BTC option traders seem to have increased their net long exposure via calls. Relative put-call volume ratios remained below 1.0 last week meaning that relatively more calls than puts were traded.

However, the 25-delta BTC 1-month option skew increased throughout the week, implying an increased demand for puts relative to calls.

BTC option implied volatilities decreased slightly last week. Implied volatilities of 1-month ATM Bitcoin options are currently at around 52% p.a.

Ethereum’s 1-month implied volatilities also declined compared to beginning of last week as the term structure of volatility also normalized. Implied volatilities for Ethereum options expiring last Friday had increased to 140%. Now, Ethereum ATM options expiring this Friday (31st of May) only price around 64% in implied volatility.

Bottom Line

• Cryptoassets rallye supported by the Ethereum ETF approval in the US and strong inflows into global crypto ETPs

• Our in-house “Cryptoasset Sentiment Indicator” has increased and signals slightly above neutral levels in sentiment

• We expect approximately 1.65 bn USD potential net inflows into US Ethereum ETFs in the first 3 months after trading launch

To read our Crypto Market Compass in full, please click the button below:

This is not investment advice. Capital at risk. Read the full disclaimer

© ETC Group 2019-2024 | All rights reserved

Du kanske gillar

-

Bitwise har slutfört omprofileringen för europeiska ETPer

-

Bitwise lanserar världens första Aptos Staking ETP på SIX Swiss Exchange

-

91 börshandlade produkter för att investera i kryptovalutor

-

Vilken Ethereumprodukt är bäst?

-

ETC Group Crypto Market Compass #35 2024

-

Bitwise expanderar i Europa med förvärvet av ETC Group

Nyheter

WMMS ETF ETF en globalfond för värdeaktier

Publicerad

39 minuter sedanden

21 september, 2025

Amundi MSCI World IMI Value Screened Factor UCITS ETF UCITS ETF Acc (WMMS ETF) med ISIN IE000AZV0AS3, försöker spåra MSCI World IMI Value Select ESG Low Carbon Target-index. MSCI World IMI Value Select ESG Low Carbon Target-index spårar aktier från utvecklade länder över hela världen som väljs ut enligt värdefaktorstrategin och ESG-kriterier (miljö, social och företagsstyrning). Indexet har som mål att minska utsläppen av växthusgaser och ett förbättrat ESG-poäng jämfört med jämförelseindex. Jämförelseindexet är MSCI World IMI.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,25 % p.a. Amundi MSCI World IMI Value Screened Factor UCITS ETF UCITS ETF Acc är den enda ETF som följer MSCI World IMI Value Select ESG Low Carbon Target-index. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETF:n ackumuleras och återinvesteras.

Denna ETF lanserades den 30 oktober 2024 och har sin hemvist i Irland.

Investeringsmål

Amundi MSCI World IMI Value Screened Factor UCITS ETF Acc försöker replikera, så nära som möjligt, oavsett om trenden är stigande eller fallande, resultatet för MSCI World IMI Value Select ESG Low Carbon Target Index (”Indexet”). Delfondens mål är att uppnå en tracking error-nivå för delfonden och dess index som normalt inte överstiger 1 %

Handla WMMS ETF

Amundi MSCI World IMI Value Screened Factor UCITS ETF UCITS ETF Acc (WMMS ETF) är en europeisk börshandlad fond. Denna fond handlas på Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

Största innehav

Denna fond använder fysisk replikering för att spåra indexets prestanda.

| Namn | Valuta | Vikt % | Sektor |

| CISCO SYSTEMS INC | USD | 2.74 % | Information Technology |

| INTL BUSINESS MACHINES CORP | USD | 2.66 % | Information Technology |

| JOHNSON & JOHNSON | USD | 2.50 % | Health Care |

| VERIZON COMMUNICATIONS INC | USD | 2.35 % | Communication Services |

| COMCAST CORP-CLASS A | USD | 2.30 % | Communication Services |

| AT&T INC | USD | 2.21 % | Communication Services |

| APPLE INC | USD | 2.18 % | Information Technology |

| MICROSOFT CORP | USD | 2.04 % | Information Technology |

| NVIDIA CORP | USD | 1.90 % | Information Technology |

| CITIGROUP INC | USD | 1.77 % | Financials |

Innehav kan komma att förändras

Nyheter

The Investment Case for TLT (Long-Dated Treasury Bonds)

Publicerad

2 timmar sedanden

21 september, 2025

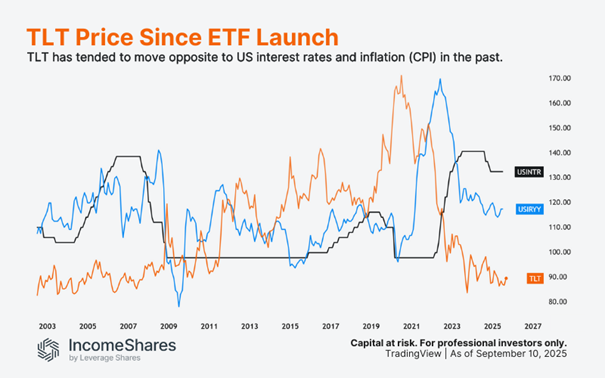

The iShares 20+ Year Treasury Bond ETF (TLT) holds US government bonds that mature in 20 years or more. Since peaking in March 2020 at $179.90 per share, TLT’s price is still down roughly 50%. Most of that drop happened as US inflation – and then interest rates – rose to multi-decade highs. But with inflation now below 3%, potential interest rate cuts ahead, and an interesting chart setup, the investment case for TLT could be building.

What is TLT?

The iShares 20+ Year Treasury Bond ETF (TLT) is an exchange-traded fund (ETF) that trades on the US stock market. The fund holds “long-dated” US government bonds with maturities of 20 years or more. By holding a basket of them, TLT reflects how investors generally value this part of the bond market.

Each bond in TLT is a 20-plus year loan to the US government. The investor lends money, and in return receives fixed interest payments (coupons) each year. The government sets the coupon rate when it issues (creates) a new bond, and that rate never changes. After issuance, the bond can trade on the bond market, where its price may move up or down.

What affects the value of long-dated US Treasury bonds (and TLT)?

All else being equal, long-dated Treasury bonds tend to be more volatile than shorter-dated ones. Interest rates and inflation expectations are the two main levers that can move their prices – and hence the price of TLT.

Interest rates: When rates rise, newly issued bonds pay higher coupons. Older bonds in TLT can then look relatively less attractive, so their prices may fall. When rates fall, it’s the opposite: new bonds pay lower coupons, so older bonds look “better” and may rise in price. Because TLT only holds long-dated bonds, its price tends to react more to interest rate changes than short-term bond funds. Rate shifts tend to have a bigger impact on long-dated bonds because their fixed coupons extend far into the future. Even a small change in yields can make those older coupons look much better – or much worse – for a very long time.

Inflation expectations: When investors expect higher inflation in the future, the fixed coupons (and principal) in TLT can look less valuable in today’s money. That perception can push bond prices down as investors sell bonds. And when investors think future inflation will be lower, the same coupons can look more valuable today, which may support bond prices. Because TLT’s bonds mature further into the future, inflation has more time to erode their interest and principal repayments. That’s why long-dated bonds are usually more sensitive to inflation than shorter-dated ones.

The chart below compares the price of TLT (orange) with US interest rates (black) and US inflation (blue). It’s not an exact science, but TLT has tended to move opposite to both of them since the ETF launched in 2003.

Other factors can also play a role. The US government regularly issues (creates) new bonds, and if supply goes up, prices can fall. On the demand side, big buyers like pension funds, insurance companies, or foreign central banks can move the market. Credit risk perception is also key. Investors usually see Treasuries as very low risk, but not “risk-free”. So if they lose confidence in the US government’s repayment ability, it could hurt bond prices.

The investment case for TLT today

We’ve explained how lower interest rates and lower inflation might be a better environment for long-dated US treasury bonds. As explained below, there are reasons to believe we could be moving into that environment now.

The US Federal Reserve (Fed) essentially has two jobs, and it’s a constant balancing act between the two:

- Keep inflation down (by raising interest rates to slow the economy).

- Keep employment high (by lowering interest rates to speed up the economy).

US inflation peaked above 9% in June 2022, and it’s been trending lower ever since. Inflation isn’t very low yet (2.9% CPI as of August) – but it’s low enough for the Fed to focus more on job number two. Factor in a slowing economy, and the Fed is more likely to cut interest rates from here to boost employment numbers.

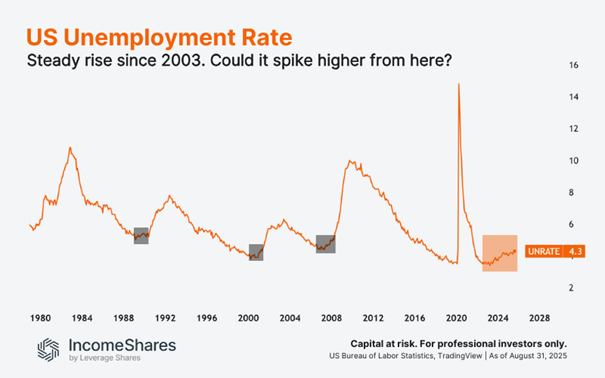

The chart below shows the US unemployment rate in orange. It’s now at 4.3% (August) – the highest unemployment rate since November 2021. In the past, unemployment rose gradually at first, before eventually breaking much higher. If that pattern repeats, we could see a bigger spike in unemployment.

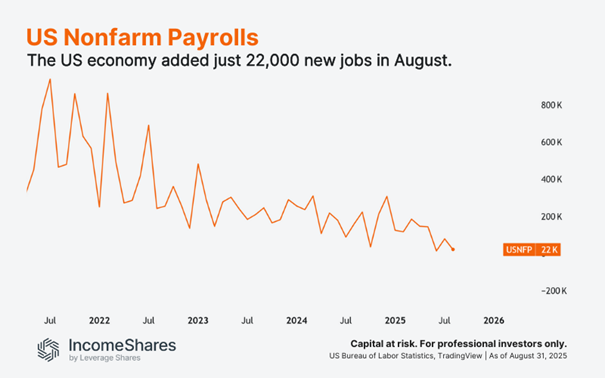

Not only is the unemployment rate rising, but the number of new job openings is dropping, too. US nonfarm payrolls (new jobs excluding farming, private households, non-profits, and the military) showed that the US economy added just 22,000 new jobs in August.

And to make matters worse, the government also revised its earlier estimates down. The adjustment meant the US added around 911,000 fewer jobs in the year through March 2025 than first reported.

AI could also factor into these numbers. After all, companies are rolling out AI tech to improve productivity – and that puts pressure on the “human” job market. AI can also make goods and services cheaper to produce, which is inherently disinflationary (the opposite of inflation).

This setup could give the Fed more ammo for bigger rate cuts in the future. Throw in lower inflation, and we could see a solid backdrop for TLT.

The technical picture for TLT

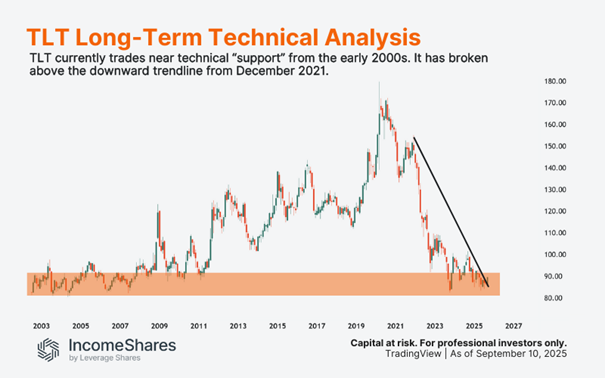

Not many assets are trading near 20-year lows. But as the chart below shows, TLT is trading near technical “support” from the early 2000s (orange). Also note that TLT recently broke above a downward sloping trendline that’s been in play since December 2021. This may signal that selling pressure is easing, and buyers are stepping in.

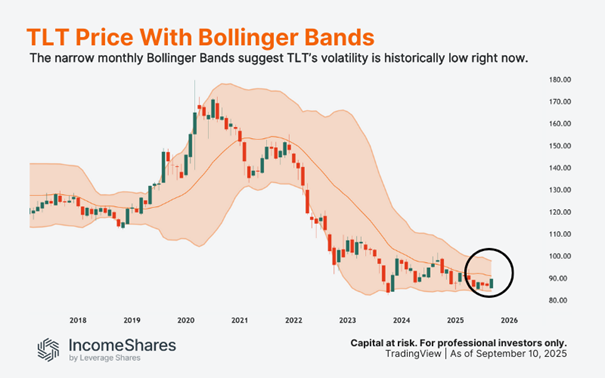

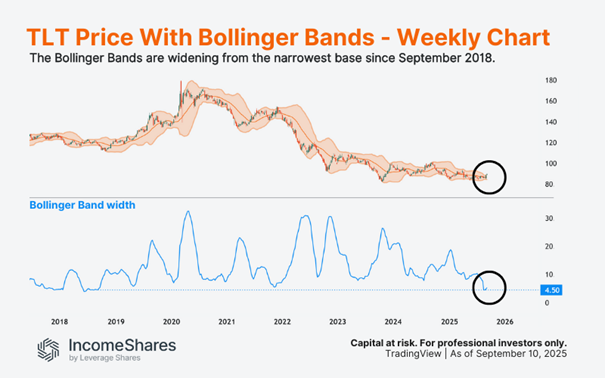

The chart below shows Bollinger Bands around TLT’s price. Here, the middle band is TLT’s 20-month average price, and each red or green candle represents one month of price movement for TLT.

The further the outer bands are from the middle band, the more volatile TLT’s price, according to the indicator. At this point, the Bollinger Bands are pinching together – a sign of relatively low volatility for TLT. Volatility tends to be “mean reverting” – meaning it usually cycles from periods of lower volatility to higher volatility. If the bands now start to widen, and the price trends higher, we could see a sustained rally for TLT.

The next chart zooms into the weekly timeframe, where each red or green candle represents one week of price movement for TLT. In this case, the Bollinger band width represents the volatility of TLT around its 20-week moving average. The blue line underneath it shows the width of the Bollinger Bands – lower is narrower, and less volatility.

Last month, the Bollinger Bands reached their narrowest level since September 2018. In other words, TLT’s volatility reached its lowest level in seven years, according to the indicator. Now notice how the bands started expanding this month – from that very low volatility base. This suggests TLT could see more volatility going into the end of 2025. Keep in mind that volatility is direction neutral.

Risks

The investment case for TLT depends heavily on inflation staying low and the Fed being willing to cut rates. If inflation rises again, TLT may fall further. Heavy government borrowing could also pressure Treasuries if investors demand more compensation to buy the debt. And if the economy holds up better than expected, the Fed might not need to cut rates.

How IncomeShares ties in

The IncomeShares 20+ Year Treasury Options ETP holds TLT and sells call options on it.

• Selling calls generates option premiums that aim to provide monthly income.

• Exposure to TLT keeps the ETP linked to bond price moves.

• If TLT rises too far, gains may be capped to the strike price.

• If TLT falls, the option income may help cushion part of the drop.

Key takeaways

• TLT holds US government bonds due in 20+ years, which are typically more sensitive to interest rates than short-term bonds.

• After years of losses, inflation is lower, yields are higher, and economic data points to a slowdown – but risks remain.

• The IncomeShares TLT Options ETP aims to generate monthly income by selling calls, while keeping some exposure to TLT.

Follow IncomeShares EU for more insights.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Nyheter

AFET ETP erbjuder investerare exponering mot världens största decentraliserade AI-ekosystem

Publicerad

3 timmar sedanden

21 september, 2025

21Shares Artificial Superintelligence Alliance ETP (AFET ETP) med ISIN CH1480821375, ger investerare likvid exponering mot ett unikt decentraliserat AI-ekosystem som skapats genom sammanslagningen av Fetch.ai, SingularityNET, Ocean Protocol och CUDOS, en sammanslagning av fyra banbrytande projekt som bildar den största AI-alliansen med öppen källkod som är dedikerad till att påskynda vägen mot artificiell generell intelligens och superintelligens.

Fördelar

Decentralisering av datorkraft

Artificial Superintelligence Alliance (ASI) har säkrat över 200 miljoner dollar i dedikerad AI-datorinfrastruktur, vilket skapar världens största decentraliserade AI-datornätverk. Detta djärva initiativ syftar till att utmana teknikjättarnas dominans och bryta de centraliserade AI-grindvakternas grepp.

Genom att kombinera datacenter i företagsklass med resurser som bidrar med gemenskapen levererar ASI premium GPU-prestanda till upp till 50 % lägre kostnad än ledande molnleverantörer. Med 524 valideringsnoder och globalt distribuerad kapacitet säkerställer ASI låg latens och tillförlitlighet.

Denna metod vänder upp och ner på traditionell molnekonomi: allt eftersom nätverket växer minskar kostnaderna för utvecklare medan prestandan förbättras. Med den globala molnmarknaden som överstiger 500 miljarder dollar och AI-arbetsbelastningar som växer snabbt är ASI redo att ta betydande marknadsandelar genom att erbjuda ett mer kostnadseffektivt, högpresterande och öppet alternativ till dagens centraliserade modell.

Nästa generations AI-ekosystem

ASI Alliance har framgångsrikt genomfört en betydande tokenintegration genom att förena Fetch.ai, SingularityNET, Ocean Protocol och CUDOS för att skapa ett av de största decentraliserade AI-ekosystemen i branschen.

Denna sammanslagning skapar en oöverträffad nytta för FET-tokeninnehavare, som omfattar autonoma agenter, utveckling av artificiell generell intelligens (AGI), datamarknadsplatser och distribuerad databehandling. Den demonstrerar också sin innovationskraft med ASI 1 Mini, den första Web3-inbyggda stora språkmodellen. ASI 1 Mini körs effektivt på minimal hårdvara, stöder modulärt resonemang och autonoma arbetsflöden och integreras sömlöst i ASI-ekosystemet, vilket gör det möjligt för communityn att staka, träna och deläga modellen.

Genom att kombinera effektivitet, tillgänglighet och decentraliserat ägande bygger ASI Alliance inte bara AI-infrastruktur; den omformar intelligensens ekonomi. Positionerad i skärningspunkten mellan Web3 och AI, är ASI redo att bli en transformerande kraft med massiv potential för tillväxt och påverkan.

Infrastruktur för intelligensens era

ASI Alliance bygger ASI Chain, den första Layer 1-blockkedjan som är uttryckligen utformad för decentraliserad AI-koordinering, autonoma agenter och interoperabilitet mellan kedjor. Till skillnad från traditionella molnleverantörer som introducerar systemrisker eller äldre blockkedjor byggda för enkla tillgångsöverföringar, är ASI Chain specialbyggd för AI-drivna arbetsbelastningar, med en skalbar arkitektur, säkerhet i företagsklass och ett dataflödesmål på över 1 000 transaktioner per sekund. Kärnan är ASI 1 Mini, som möjliggör intelligens på kedjan som ingen annan Layer 1 för närvarande erbjuder.

Lager 1-blockkedjor är hörnstenen i branschens framtid, med en marknad som redan värderas till över 1,2 biljoner dollar. Ledande nätverk har en genomsnittlig värdering på 45 miljarder dollar, vilket belyser det enorma gapet till ASIs nuvarande värdering på 1,7 miljarder dollar. Detta positionerar ASI för att framstå som det definierande Layer 1 i AI-eran och överbrygga blockkedjeinfrastruktur med intelligensens ekonomi.

Eftersom integrationen av AI och blockkedja förväntas nå 350 miljarder dollar år 2030, är ASI Chain perfekt positionerad för att dra nytta av denna tillväxt. Med stora företagspartners som Deutsche Telekom, Bosch och Alibaba Cloud som stödjer valideringsinfrastrukturen, är ASI Chain redo att accelerera AI-implementeringen inom olika branscher, vilket ger investerare en enorm tillväxtpotential.

Produktinformation

| Namn | 21Shares Artificial Superintelligence Alliance ETP |

| Lanseringsdatum | 16 september 2025 |

| Emittent | 21Shares AG |

| Förvaltningsavgift | 2,50 procent |

| Utlåning | Nej |

| Kortnamn | AFET |

| Valor | 148082137 |

| ISIN | CH1480821375 |

| Reuters | AFET.S |

| WKN | A4APVJ |

| Bloomberg | AFET SW |

| Underliggande tillgångar | 100 procent Artificial Superintelligence Alliance |

Handla AFET ETP

21Shares Artificial Superintelligence Alliance ETP (AFET ETP) är en europeisk börshandlad fond som handlas på bland annat Euronext Amsterdam.

Euronext Amsterdam är en marknad som få svenska banker och nätmäklare erbjuder access till, men DEGIRO gör det.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Euronext Amsterdam | USD | AFET NA |

| Euronext Paris | EUR | AFET FP |

WMMS ETF ETF en globalfond för värdeaktier

The Investment Case for TLT (Long-Dated Treasury Bonds)

AFET ETP erbjuder investerare exponering mot världens största decentraliserade AI-ekosystem

ONCE ETP spårar den schweiziska dagslåneräntan och hedgas i euro

Strategy (MSTR) steg med cirka 5 %

Månadsutdelande ETFer uppdaterad med IncomeShares produkter

Utdelningar och försvarsfonder lockade i augusti

HANetfs analyserar hur ett fredsavtal kan påverka det europeiska försvaret

ADLT ETF investerar bara i riktigt långa amerikanska statsobligationer

Septembers utdelning i XACT Norden Högutdelande

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMånadsutdelande ETFer uppdaterad med IncomeShares produkter

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUtdelningar och försvarsfonder lockade i augusti

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanHANetfs analyserar hur ett fredsavtal kan påverka det europeiska försvaret

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanADLT ETF investerar bara i riktigt långa amerikanska statsobligationer

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSeptembers utdelning i XACT Norden Högutdelande

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFastställd utdelning i MONTDIV augusti 2025

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanHANetf kommenterar mötet mellan Kina, Ryssland och Nordkorea vid militärparad

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAICT ETF investerar i obligationer utgivna av företag från tillväxtmarknader