Nyheter

Avalanche (AVAX) Research Primer

Publicerad

2 år sedanden

Avalanche (AVAX) is a Proof-of-Stake blockchain using the “Avalanche consensus mechanism”. It is a blockchain network that promises high transaction throughput of 4,500 transactions per second (TPS) and the first smart contract platform that can confirm transactions in under one second. In contrast, Ethereum processes 15 to 30 transactions per second with over 1 minute finality. Avalanche is a high-performance, scalable, customizable and secure blockchain platform targeting building application- specific blockchains, scalable decentralized applications and complex digital smart assets.

Avalanche was launched by Ava Labs in 2020. Emim Gun Sirer, a Turkish- American computer scientist and associate professor at Cornell started Ava Labs in 2018. The company currently has offices in New York City and Miami and was initially funded by Andreessen Horowitz, Polychain Capital, Initialized Capital and angel investors such as Balaji Srinvasan and Naval Ravikant of AngelList.

In this report, 21Shares will offer an exhaustive overview of the Avalanche network, AVAX as a cryptoasset, and discuss the various investment risks associated with AVAX — in addition to how an investor can think about the future value of its underlying cryptoasset. This report offers an exhaustive coverage of Avalanche and AVAX available on the market.

How Avalanche Works

The Avalanche network comprises multiple blockchains and employs a proof of stake consensus mechanism to achieve high throughput of over 4,500 transactions per second. Each chain in the Avalanche architecture represents its own virtual machine, with support for numerous custom virtual machines like EVM and WASM. This allows chains to include case-specific functionality. Each of these virtual machines is connected to a subnet with its own set of incentives to keep validators honest, it is a custom blockchain network made up of ”a dynamic set of validators working together to establish consensus.” As a result, Avalanche might be regarded as a ”platform of platforms,” made up of thousands of subnets that work together to build a single interoperable network.

The Avalanche Consensus Protocol is a family of four mechanisms — Slush, Snowflake, Snowball, and Avalanche, these build upon each other and become more secure in the process. In short, the Avalanche Consensus Protocol is a unique voting protocol that relies on “repeated random subsampling”. In this process, validator nodes randomly query other validators until the network reaches a consensus and decides whether to accept or reject an incoming transaction.

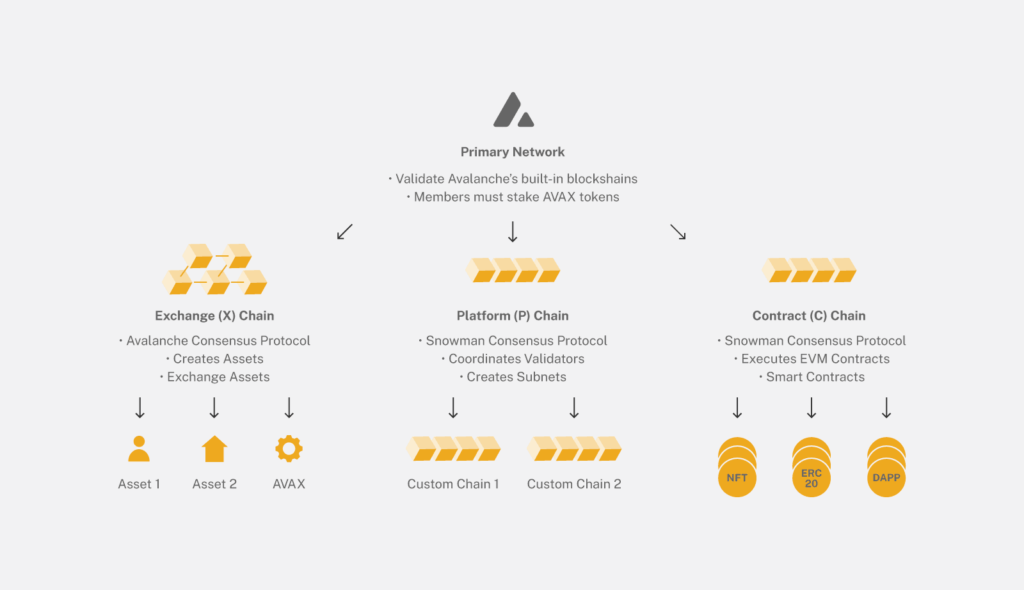

All validators are members of the Primary Network consisting of three blockchains: the Exchange Chain (X-Chain), Contract Chain (C-Chain), and Platform Chain (P-Chain).

In a given round, each validator randomly selects K nodes from the entire validator list (probability of selection is weighted by stake amount) to query for their preferred decision. Each queried validator responds with their preferred decisions, and if the majority of responses returned in a round differ to the node performing the query then it will update its own preferred decision to reflect that and respond to other nodes with that answer.

By having every validator randomly select other validators in order to ask them what their preferences are, participants in Avalanche build confidence in the correct decision shared by all nodes in the network. While one node does not query every other node like in classical consensus, each node performs their own sample of randomly selected nodes, thus is able to scale to hundreds of thousands or millions of nodes without adding lots of additional overhead on each node, as they are querying the same number of nodes. With enough confidence, a decision is finalized immediately. This process happens so quickly that Avalanche rivals major payment systems in its ability to process and clear transactions in the network.

Avalanche supports an arbitrarily large and parameterizable set of adversaries. If the network is parameterized for a 33% attacker, and an attacker has 34% stake, unlike with classical consensus protocols, the attacker can launch a double spend attack which is guaranteed to succeed. However, with Avalanche, this only results just in a slightly higher chance to succeed rather than becoming a guarantee. Because there is no leader, the network is immune to a large class of attacks that other consensus protocol families face. The large number of validators ensures immutability and censorship resistance that proof-of-work protocols, backed by small numbers of mining pools, cannot achieve.

• Peer-to-peer transmission: Any participant can transmit AVAX to another participant with a digital wallet without bureaucracy, banks, excessive fees or delays. AVAX can be transferred among an unlimited number of people, instantly and simultaneously.

• Distributed database: Avalanche is designed to provide unprecedented decentralization with a commitment to multiple client implementations without centralized control of any kind. The ecosystem is designed to avoid divisions between classes of users with different interests. Crucially, there is no distinction and preferences between miners, developers and users.

• Transparency: Avalanche is open-source and the code can be seen and edited by anyone. The network is interoperable, which allows developers to build new permissionless or permissioned interoperable blockchains seamlessly. Network participants can easily create and trade digital smart assets.

• Record keeping: The Avalanche network technically consists of three blockchains that record different types of transactions. Firstly, the exchange chain or X-chain which hosts the native token of Avalanche, AVAX as well as other digital assets. The second is called the Platform Chain or P-chain, which is the metadata blockchain on Avalanche and coordinates validators, keeps track of active subnets, and enables the creation of new subnets. The P-Chain implements the Snowman consensus protocol. The third and final blockchain is the Contract Chain or C-Chain, which allows for the creation of smart contracts using the C-Chain’s API.

• Computational Logic: The Avalanche network relies on computational logic by way of a family of consensus protocols called Snow. The system operates by repeatedly sampling the network at random, and steering correct nodes towards a common outcome. Each node polls a small, constant-sized, randomly chosen set of neighbors, and switches its proposal if a supermajority supports a different value. Samples are repeated until convergence is reached, which happens rapidly in normal operations.

The AVAX Token

AVAX allows stakeholders of the network to:

- Make payments and provide a basic unit of account between the multiple subnetworks created on the Avalanche blockchain.

- Pay network fees.

- Secure the network and validate transactions through the Proof of Stake mechanism also dubbed staking.

AVAX is a capped-supply token.

• Capped at 720 million AVAX tokens, and 50% of those tokens (360 million) will be on the mainnet.

• AVAX serves as the base unit of account in the Avalanche network, provides the base security guarantees, pays for operations, and provides a wide suite of utility services.

• AVAX transaction fees are burned, increasing the scarcity of AVAX.

• About 10% of all tokens are allocated to the founding and non-founding team at AVA Labs.

• All tokens are subject to a vesting schedule.

Token Distribution

Purchaser Distribution

• Seed Sale: This sale was completed in February of 2019, where a total of 18M tokens were sold. Tokens were sold at a price of approximately $0.33 per token. The implied fully-diluted mainnet valuation of this sale was $120M. These tokens were sold to help initiate the development of the Avalanche codebase.

• Private Sale: This sale was completed in May of 2020, where a total of around 24.9M tokens were sold. Tokens were sold at a price of $0.50 per token. The implied fully-diluted mainnet valuation of this sale was $180M. These tokens were sold to distribute AVAX and build staking infrastructure.

• Public Sale: Option A1, Public Sale Option A2, and Public Sale Option B. These tokens are allocated for the current public sale, where at most 17M tokens will be sold. Since Public Sale Option A1 and Public Sale Option B take from the same pool of 12M tokens, public purchasers will decide the final percentages of each allocation. On other hand, in order to allow for a fair and equitable distribution of tokens, Public Sale Option A2 will have its own dedicated pool of 60M tokens. Public Sale Option A1 and Public Sale Option A2 tokens will be sold at a price of $0.50 per token, and Public Sale Option B will be sold at a price of $0.85 per token.

Ecosystem Distribution

• Foundation: These tokens are allocated to an independent, non-profit Singaporean foundation, called the Avalanche Foundation, which manages these tokens for various ecosystem-building initiatives, including marketing, bounties, incentive programs, and more. The current public sale will be conducted by Avalanche Foundation and its affiliates. Any unsold tokens from the sale were returned to the Foundation allocation.

• Strategic Partners: These tokens are allocated with the specific mandate of being distributed to groups, organizations, and enterprises that are building businesses using the Avalanche technology and network. For example, these may include entrepreneurs looking to build a business that does fast international remittance using Avalanche or financial institutions that are looking to tokenize assets on Avalanche through their own subnets.

• Community & Developer Endowment: These tokens are allocated with the specific mandate of being distributed to individuals and groups that are developing core tooling and infrastructure on Avalanche as well as supporting Avalanche through grassroots community building and marketing. For example, these may include Avalanche Hub (previously AVA Hub), Avalanche Ambassadors (previously AVA Ambassadors), Avalanche-X (previously AVA-X) grantees, and more.

• Airdrop: These tokens are allocated with the specific mandate of being distributed to various communities in order to onboard more people to the Avalanche community.

• Testnet Incentive Program: These tokens are allocated for participants that validated in the Avalanche incentivized testnet programs.

Team Distribution

• Team: These tokens are allocated to founding and non-founding members of AVA Labs. Team members, including founders, who have vested tokens prior to launch are voluntarily re-locking all tokens for four years, starting from three months after mainnet launch.

Token Unlocking Schedule

All tokens, except for Public Sale Option B, have some vesting schedule. Seed Sale (1 year vesting), Private Sale (1 year vesting), Public Sale Option A1 (1 year vesting), Public Sale Option A2 (1.5 years vesting), Foundation (10 years vesting), Incentivized Testnet Program (1 year vesting), and Team (4 years vesting) allocations start unlocking from mainnet launch, as outlined in more detail in Section 4.2.1 below. On the other hand, Community & Development Endowment (1 year vesting), Strategic Partners (4 years vesting), and Airdrop (4 years vesting) allocations do not start unlocking from mainnet launch, but instead start unlocking from grant date, as outlined in more detail in Section 4.2.2 below. The percentages in the following sections are shown as a function of the mainnet supply of tokens, namely 360M tokens.

The State of Avalanche

Q1 of 2021 saw several major improvements to the Avalanche platform including the Apricot upgrade that enabled a 50% reduction in transaction fees, improvement in C-Chain block indexing and API upgrades, strengthened default security options and various optimizations in the P-chain, C-chain and networking library. These upgrades greatly reduced the load on each validator and assisted in optimizing the network for scaling to meet future network growth and user demand.

The Avalanche ecosystem experienced exponential growth in Q2 of 2021 with assets under management in DeFi or total value locked (TVL) peaking at $10.55 billion at the end of October. Avalanche’s TVL growth trajectory was accelerated by the Avalanche Foundation’s announcement of Avalanche Rush, a $180 million liquidity-mining incentive program to attract applications and assets to the DeFi ecosystem. Phase 1 of this program was spearheaded by Aave and Curve over a 3-month period, with $20 million AVAX tokens for Aave users and $7M AVAX for Curve users. Other protocols contributing to Avalanche’s significant growth include BENQI, a lending and borrowing protocol native to Avalanche and StakeDAO, a yield optimizer leveraging Aave and Curve. Q2 also saw additional upgrades to the Avalanche platform to support several Ethereum-compatible software improvements.

The Avalanche Bridge (AB) is the key infrastructure piece used to transfer ERC20 tokens from Ethereum to Avalanche’s C-Chain and vice versa. The Avalanche bridge received several upgrades in Q3 for additional chain support and optimization for faster clearing and settlements.

Relatively user friendly, Ethereum transactions take 10 to 15 minutes and Avalanche transactions take only a few seconds, so far $5.62 billion has been transferred from Ethereum on the official AB. The speed of Avalanche’s bridge puts the network in a competitive advantage over networks like Polygon PoS which takes up to one hour and Optimism and Aributrum which take seven days for asset withdrawals. One caveat to AB is that, at the time of writing, it is unable to support transfer of native tokens created on Avalanche, Avalanche have announced however this functionality is on the long-term roadmap. To further incentivize the initial adoption of Avalanche, early users of the bridge were airdropped with a small amount of AVAX tokens. Aside from the official bridge, protocols such as Anyswap and Synapse currently provide bridging of assets for non-Ethereum networks such as Polygon, Arbitrum, Fantom and more. The continuous development of the cross-chain DeFi infrastructure on Avalanche in Q3 2021 was undoubtedly one of the key facilitators of the network usage and growth.

The Avalanche ecosystem currently has +100 dapps spanning DeFi, gaming, NFTs, exchanges and cross-chain solutions. The rise of Avalanche dapps is widely attributed to the EVM compatibility of the native programming language, reducing the barriers of existing Ethereum developers. As of November 2021, Trader Joe is the second leading exchange protocol on Avalanche, after Aave, with $2.04 billion in TVL and 32.85K daily users. The DEX boasts $347 million in daily trading volume and made a record of $1.9 million in single-day trading revenue on November 8th. In comparison, Ethereum’s Uniswap has 35.05k daily users and $10.3 billion in TVL.

This clearly demonstrates how Avalanche’s affordable transaction fees allows less friction and reduces the barriers to entry for DeFi and the long tail of Web 3 users. This chart presents a comparison of daily trading revenue between Pangolin, the second largest DEX on Avalanche and SpookySwap the leading DEX on Fantom.

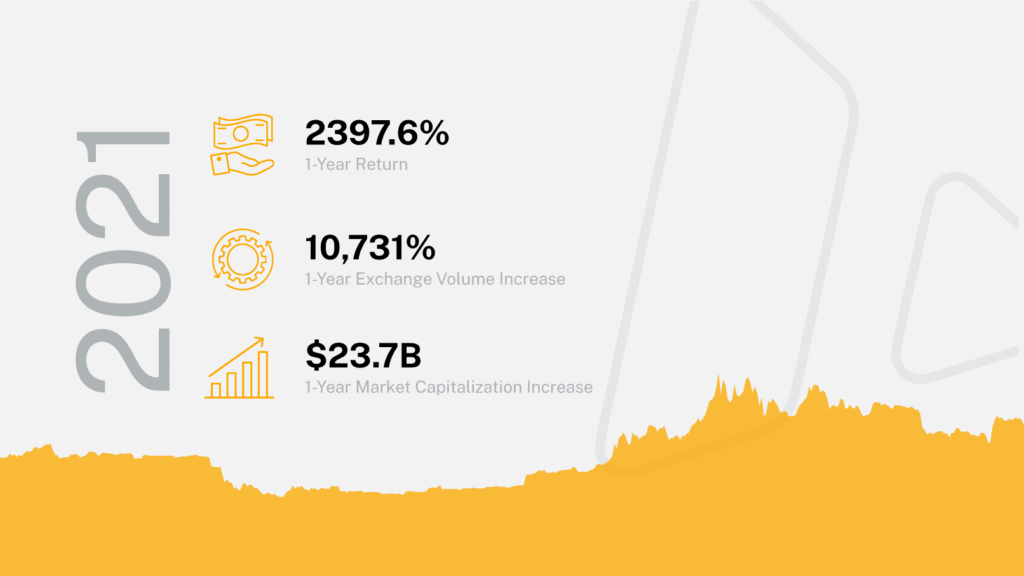

Reviewing the performance of AVAX in the last year, the YTD growth recorded 2,695%. Validator staking APR is at ~10% with 61.96% of AVAX staked and the network is currently supported by 1,158 distributed validators. A minimum of 2,000 AVAX is required to run a validator node and 25 AVAX to delegate. Assessing network performance, a reported average time to finality was 0.7299 seconds, well within the advertised sub 1 second in Avalanche’s documentation.

Outside of DeFi, Q3 of 2021 also saw Avalanche’s first Initial Litigation Offering (ILO) go live on Republic after its introduction in December 2020. The first of its kind token is a blockchain-enabled litigation financing product open to anyone. Legal financing or third-party litigation funding provides individuals who might otherwise lack the necessary funds to litigate or arbitrate a civil claim with the resources they require. An ILO not only raises the funding to pursue litigation, it tokenizes an economic right in such claims and can represent a legal claim to a portion of the financial recovery as a digital asset. The use of Avalanche’s blockchain technology to democratize financial products in the $10B asset class of litigation financing will allow individuals and small organizations to assert their legal rights against well-funded corporations.

The Future of Avalanche

Looking forward, we expect to see four key areas of growth across the ecosystem, DeFi, enterprise applications, NFTs and culture applications. This will be primarily driven by the Avalanche Foundation’s fund, Blizzard, consisting of $200M worth of contributions dedicated to development, growth and innovation on the network. The fund was announced in early November 2021 and was raised from Ava Labs, Polychain Capital, Three Arrows Capital and Dragonfly Capital to name a few.

Perhaps the most bullish case for any Layer 1 is its ability to integrate real-world use cases for social-economic benefit. Deloitte announced in November 2021 their strategic partnership with Ava Labs to leverage Avalanche’s blockchain technology in the Federal Emergency Management Agency’s new disaster recovery platform. The Close As You Go (CAYG) platform will help state and local governments to demonstrate their eligibility for federal funding and was designed by first responders, public works departments and grant-making agencies. Blockchain technology allows the platform to operate in a decentralized, transparent and cost-efficient manner for authorizing funds to recipients. In addition, it utilizes Avalanche’s security features to gather, process and authenticate documentation accurately to prevent fraud, waste and potential systemic abuse. The ability for Avalanche to streamline recovery efforts, simplify documentation and minimize administrative costs is a clear demonstration of how the integration of blockchain technology will fundamentally change and help build resilient modern financial systems.

The future of Avalanche will likely see a greater number of dapps verticals taking advantage of the network’s fast speed and low transaction fees. In Q4, 2021, we can expect Avalanche bridge upgrades as well as implementation of Apricot Phase 5 with X-Chain Dynamic Fees, X-Chain State Pruning and X-Chain Sync. It will also hail the start of the Blueberry upgrade which will enable the creation of independent blockchains with custom virtual machines and rulesets. These features will provide the essential infrastructure for enterprises and institutions who require greater control over their development and data. Retok is one such service utilizing Avalanche, they aim to enable fractional property ownership and increased liquidity in the real estate market through tokenization.

Focusing on the DeFi user experience, multi-chain wallet integration and the Avalanche wallet will undergo its V6 facelift and expand functionality to mobile devices. Similar to Ethereum Name Service for .eth names, Avvy Domains recently partnered with Avalanche so users will soon be able to register .avax names to their Avalanche wallet addresses. Plans are also in place for greater trading venues and exchange integration for AVAX, removing the need for cross-chain transfers ultimately leading to a more seamless on-ramp experience. These upcoming developments on the Avalanche network are likely to drive greater value creation across the entire ecosystem.

Valuing Avalanche

There are two ways we can think of the potential value of Avalanche’s native asset, AVAX. The first is carrying out a market sizing exercise to compare its value to that of its main competitors as its target market. Secondly, we can compare Avalanche’s current adoption — through the proxy of fees paid on the network — to that of Ethereum in order to understand if the current value of Avalanche can be justified whether there’s product-market fit.

Market Sizing:

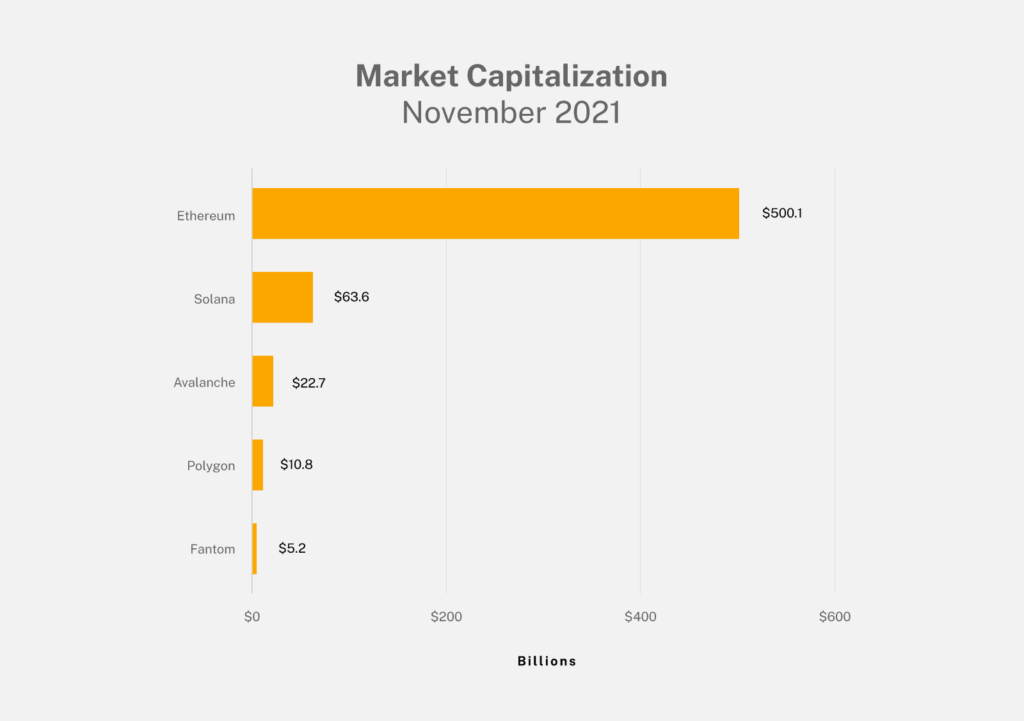

The chart below shows the current market capitalization of Solana, Avalanche, Ethereum, and Fantom. Ethereum represents what the market has judged as the current best use-case of blockchain technology while the smart contracts use case can be argued to be just as valuable in the long term. Fantom and Solana are networks that similarly experienced substantial growth in Q3 of 2021 and serve as comparison for ecosystem development.

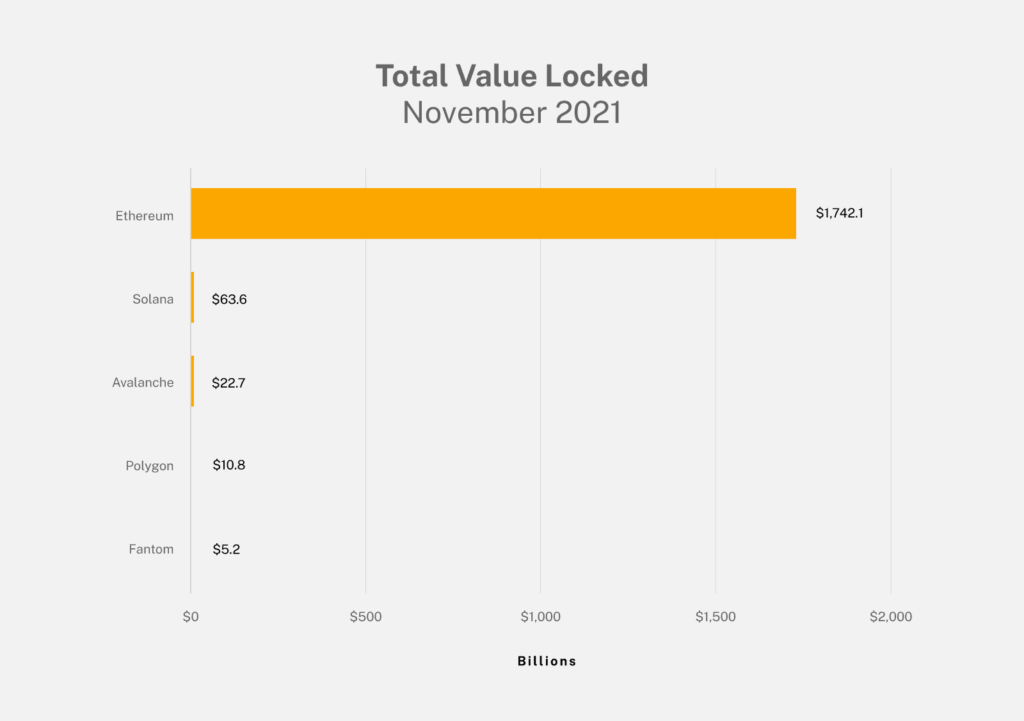

Total Value Locked

This section compares the current TVL of Avalanche relative to other major networks such as Ethereum, Fantom, Polygon, Solana and Bitcoin. TVL can be a useful tool to compare network utilization and a method to measure the flow of capital within DeFi. As the number of DeFi apps grow and the use cases like ILO and CAYG evolve on the Avalanche network, we can expect TVL to grow. The scalability of the network and relatively low transaction costs will likely capture more of Ethereum’s market share.

Fees

Revenue generation is often a key metric when assessing network value. By assessing the total number of transactions and the average cost per transaction we are able to estimate the total revenue generated. Fees are a good signal for the overall demand for a given smart contract platform and arguably the strongest barometer of fundamental growth. Avalanche’s estimated annualized revenue is $54.66 million compared to Ethereum’s annualized revenue of $21.28 billion. Along with greater network usage by DeFi applications, gaming, greater institutional adoption, and real world use cases mature, we can expect the number of transactions to exponentially increase, and with it, revenue derived from fees.

Price-to Sales (P/S) Ratio compares a protocol’s market cap to its revenues. Unlike the Price to Earnings ratio, where inflated token prices can be inaccurately depicted, P/S ratio derives the network’s value from tangible revenues. This metric is particularly useful for early-stage protocols where income is often reinvested into growth. A low ratio could imply that the protocol is undervalued and vice versa. An evaluation of historic P/S ratio against its market cap can also demonstrate the consistency of fees and revenue. This chart indicates the P/S ratio for other Layer 1s in comparison to Avalanche. AVAX is yet to launch on several major centralized exchanges, with retail and institutional investors on the precipitous end of recognizing its value, we can expect the P/S ratio to increase dramatically in the short term before stabilizing.

Risks

Technological risks

Avalanche has a limited operating history and has not been validated over a long run. The network launched the genesis block in late September 2020. Despite rigorous audits, the crypto network is still developing and making significant decisions that will affect the design, functionality, and governance. These factors may adversely affect public perception alongside AVAX’s price action.

For example, in February of 2021, the Avalanche network, under heavy load, experienced a trigger of a non-deterministic bug related to state verification. An increase of network traffic due to the launch of Pangolin (DEX) caused the number of processing blocks to increase concurrently. The event caused validators to accept invalid mint transactions, as the rest of the network refused to honor these transactions, it stalled the C-chain. Fortunately the other two Avalanche blockchains, X- and P-chains did not contain the minting bug and the network continued to process transactions.

The problem was quickly identified and although the easiest method to fixing the problem was to rewrite the blockchain and undo accepted transactions, the decentralized nature of the network meant that this was not feasible. Instead, an incrementally deployable patch disabled the cache and introduced the notion of special blocks which respected the invalid mints.

One major downfall of the patch was that it permitted the generation of 790.2 additional AVAX. In order to prevent the number of total AVAX not exceeding the hard cap of 720 mm AVAX, the Avalanche foundation decided to burn the additional AVAX created. Although the code was patched, and the technical bug never had the possibility of losing funds, it was a blatant reminder that blockchain technology is still in its infancy. The rapid rate of development and the relative experience of developers in the space means that no smart contract is immune to flaws despite extensive auditing by third-party firms. The health and integrity of the network will therefore continue to depend on a strong and supportive community.

Adoption risks

Adopting Avalanche is predicated on developers bidding and attempting to launch their applications and users (and developers) then choosing to build and use Avalanche-native applications. To date, there has been sizable investment and funding put towards projects that are building Avalanche applications amounting to $11 billion USD with Aave representing 29% of Avalanche’s assets under management or TVL. Still, actual adoption is limited and relatively small at the moment compared to Ethereum with +$170B in TVL. However, it’s important to note that Avalanche’s total AUM in DeFi grew by 3,164% since mid August while Ethereum’s assets grew by 46% in the same time frame. Part of this outsized growth rate is attributed to liquidity mining incentives and speculation, which at 21Shares, we believe is not a sustainable strategy to build a long term user base. On the other hand, these incentives foster greater innovation and adoption. The open question is to what extent applications on Avalanche will become constructive and meaningful for DeFi and Web 3 in the long run, especially when compared to applications currently existing on Ethereum.

Regulatory risks

Avalanche was funded initially by a token sale and, as such, is vulnerable to some level of potential regulatory scrutiny due to the suspicion of some jurisdictions, namely the United States. As Avalanche continues to further decentralise and build working applications, in a similar vein to what Ethereum has done, the likelihood of serious regulatory scrutiny from any governmental body would likely decrease. It can be argued that Ethereum’s “safety” in the eyes of US-based regulators, who stated that Ether is not a security, is one key moat that it has over the other smart contract networks such as Avalanche.

Disclaimer

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable. However, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential to not grow as expected.

There is currently relatively little use of crypto assets in the retail and commercial marketplace compared to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment. Nothing in this report does or should be considered as an offer by 21Shares AG and/or its affiliates to sell or solicitation by 21Shares AG or its parent of any offer to buy bitcoin or other crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction.

Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax, or other advice and users are cautioned against basing investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

Time in Bitcoin beats timing Bitcoin

-

21Shares lanserar DYDX – Din port till decentraliserade perpetuals

-

Concerned about rising government debt? Bitcoin’s got you covered

-

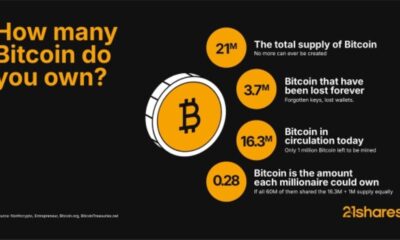

Bitcoin is scarce. Will you get your share?

-

Bitcoin surpasses Alphabet and Amazon by market cap

-

The Bitcoin boom hiding in Americans’ retirement savings

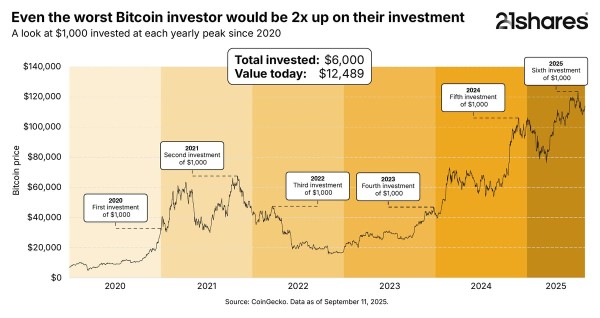

Even buying Bitcoin at its yearly peak since 2020 would still have doubled your investment, proving the power of long-term growth versus trying to time the market.

Why Solana matters: Exploring its use cases and growing adoption

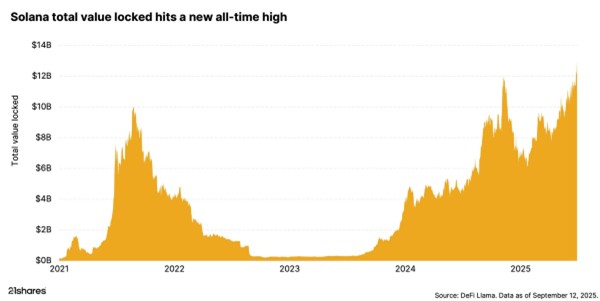

Solana’s surge isn’t just market speculation; it’s driven by real-world adoption. From payments and DeFi to tokenization, the blockchain is seeing record engagement, reflected in its all-time high total value locked (TVL).

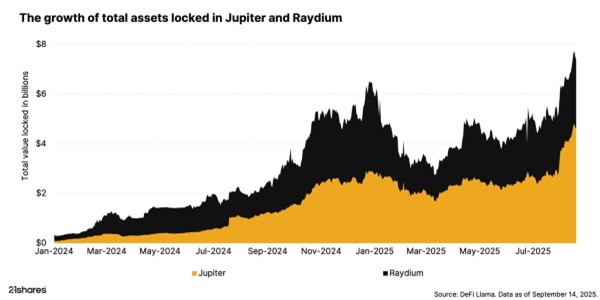

How Raydium and Jupiter are powering Solana DeFi

Raydium and Jupiter are the pillars of Solana’s DeFi ecosystem, delivering deep liquidity, seamless trading, and efficient execution that keep the network thriving. They make crypto markets faster, cheaper, and more accessible for everyone.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

WMMV ETF en lågvolatilitetsfond som handlas i euro och pund

Publicerad

11 timmar sedanden

17 september, 2025

Amundi MSCI World Minimum Volatility Screened Factor UCITS ETF UCITS ETF Acc (WMMV ETF) med ISIN IE0001DKJVC2, försöker spåra MSCI World Minimum Volatility Select ESG Low Carbon Target-index. MSCI World Minimum Volatility ESG Reduced Carbon Target-index spårar aktier från utvecklade länder över hela världen som är valda enligt låg volatilitet och ESG-kriterier (miljö, social och företagsstyrning). Indexet har som mål att minska utsläppen av växthusgaser och ett förbättrat ESG-poäng jämfört med jämförelseindex. Jämförelseindex är MSCI World-index.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,25 % p.a. Amundi MSCI World Minimum Volatility Screened Factor UCITS ETF UCITS ETF Acc är den enda ETF som följer MSCI World Minimum Volatility Select ESG Low Carbon Target-index. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETF:n ackumuleras och återinvesteras.

Denna ETF lanserades den 30 oktober 2024 och har sin hemvist i Irland.

Investeringsmål

Amundi MSCI World Minimum Volatility Screened Factor UCITS ETF Acc försöker replikera, så nära som möjligt, oavsett om trenden är stigande eller fallande, resultatet för MSCI World Minimum Volatility Select ESG Low Carbon Target Index (”Indexet”). Delfondens mål är att uppnå en tracking error-nivå för delfonden och dess index som normalt inte kommer att överstiga 1 %.

Handla WMMV ETF

Amundi MSCI World Minimum Volatility Screened Factor UCITS ETF UCITS ETF Acc (WMMV ETF) är en europeisk börshandlad fond. Denna fond handlas på Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

Största innehav

Denna fond använder fysisk replikering för att spåra indexets prestanda.

| Namn | Valuta | Vikt % | Sektor |

| T-MOBILE US INC | USD | 2.00 % | Communication Services |

| MOTOROLA SOLUTIONS INC | USD | 1.86 % | Information Technology |

| MCKESSON CORP | USD | 1.57 % | Health Care |

| ZURICH INSURANCE GROUP AG | CHF | 1.56 % | Financials |

| CISCO SYSTEMS INC | USD | 1.56 % | Information Technology |

| WASTE MANAGEMENT INC | USD | 1.47 % | Industrials |

| UNITEDHEALTH GROUP INC | USD | 1.42 % | Health Care |

| MICROSOFT CORP | USD | 1.35 % | Information Technology |

| KDDI CORP | JPY | 1.32 % | Communication Services |

| REPUBLIC SERVICES INC | USD | 1.32 % | Industrials |

Innehav kan komma att förändras

Nyheter

UBS AM lanserar UBS Treasury Yield Plus ETFer

Publicerad

12 timmar sedanden

17 september, 2025Av

Erik Forsell

· UBS Asset Management lanserar EUR och USD Treasury Yield Plus UCITS ETFer

· ETFerna syftar till att öka avkastningen samtidigt som riskegenskaperna hos deras referensindex bibehålls

· En egenutvecklad regelbaserad modell används för att bredda investeringsuniversumet för att förbättra tillgången till en större uppsättning möjligheter

UBS Asset Management (UBS AM) tillkännager idag lanseringen av två nya ETF:er som syftar till att leverera förbättrad avkastning, samtidigt som riskprofilen för deras underliggande statsobligationsindex bevaras. UBS EUR Treasury Yield Plus UCITS ETF och UBS USD Treasury Yield Plus UCITS ETF syftar till att överträffa sina respektive Bloomberg Treasury-index genom att rikta in sig på högre optionsjusterad spread (OAS), samtidigt som de bibehåller en strikt anpassning till duration, kreditkvalitet och landsexponering1.

Portföljkonstruktion

· Universumsdefinition: Varje ETF börjar med sitt respektive Bloomberg Treasury Index (EUR eller USD) och utökar uppsättningen möjligheter till att inkludera högkvalitativa statsobligationer, överstatliga obligationer och agentobligationer (SSA), vilka kan erbjuda en högre avkastning än statsobligationer.

· Optimering: SSA-obligationerna väljs ut med hjälp av en egenutvecklad regelbaserad modell som maximerar OAS samtidigt som strikta begränsningar för rating, land, sektor, duration och kurvrisk följs.

· Dynamisk allokering: Portföljförvaltaren kan använda sitt eget omdöme för att ytterligare förbättra portföljens avkastning och/eller riskprofil.

André Mueller, chef för kundtäckning, UBS AM, sa: ”De snabbt ökande tillgångarna i förbättrade ränte-ETF:er signalerar en växande investerarefterfrågan på fonder som går utöver traditionella passiva riktmärken. UBS AM har långvarig expertis inom regelbaserade strategier, så jag är glad att vi för första gången kan erbjuda denna möjlighet till ett bredare spektrum av kunder genom det bekväma, transparenta och effektiva ETF-omslaget.”

Fonden är registrerad för försäljning i Österrike, Danmark, Finland, Frankrike, Tyskland, Irland, Italien, Liechtenstein, Luxemburg, Nederländerna, Norge, Spanien, Sverige, Schweiz och Storbritannien.

| ETF | Share class | TER | ISIN | Börs | Valuta | Bloomberg Ticker |

| UBS EUR Treasury Yield Plus UCITS ETF EUR | EUR acc | 0.15% | LU3079566835 | SIX Swiss | EUR | EUTYP SW |

| Borsa Italiana | EUR | ETY IM | ||||

| XETRA | EUR | CHSW GY | ||||

| EUR dis | 0.15% | LU3079566918 | XETRA | EUR | CHSZ GY | |

| UBS USD Treasury Yield Plus UCITS ETF USD | USD acc | 0.15% | LU3079567056 | SIX Swiss | USD | USTYP SW |

| Borsa Italiana | EUR | UTY IM | ||||

| XETRA | EUR | ’CHSY GY | ||||

| USD dis | 0.15% | LU3079567130 | XETRA | EUR | CHSX GY | |

| London Stock Exchange | GBP | UTYP LN |

Time in Bitcoin beats timing Bitcoin

WMMV ETF en lågvolatilitetsfond som handlas i euro och pund

UBS AM lanserar UBS Treasury Yield Plus ETFer

COINUNI ETP spårar kryptovalutan Uniswap

ETF- och ETP-noteringar den 16 september 2025: nytt på Xetra och Börse Frankfurt

Utdelningar och försvarsfonder lockade i augusti

Månadsutdelande ETFer uppdaterad med IncomeShares produkter

HANetfs analyserar hur ett fredsavtal kan påverka det europeiska försvaret

ADLT ETF investerar bara i riktigt långa amerikanska statsobligationer

Septembers utdelning i XACT Norden Högutdelande

Populära

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUtdelningar och försvarsfonder lockade i augusti

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMånadsutdelande ETFer uppdaterad med IncomeShares produkter

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanHANetfs analyserar hur ett fredsavtal kan påverka det europeiska försvaret

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanADLT ETF investerar bara i riktigt långa amerikanska statsobligationer

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSeptembers utdelning i XACT Norden Högutdelande

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFastställd utdelning i MONTDIV augusti 2025

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanHANetf kommenterar mötet mellan Kina, Ryssland och Nordkorea vid militärparad

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanAICT ETF investerar i obligationer utgivna av företag från tillväxtmarknader