Nyheter

New Year, Same Old Risks?

Publicerad

8 månader sedanden

As we step into what many hail as one of crypto’s most promising years, it’s essential to keep a balanced perspective on the potential challenges that lie ahead:

• Macro Backdrop: volatile inflation and geopolitical tensions and how it could impact the global market.

• The “MicroStrategy Trade” and its associated leveraged Bitcoin strategy and its impact on the market.

• The risk of presidential promises if they are to be unfulfilled.

• The centralization of liquid staking and restaking and its risk on the Ethereum economy.

• MICA’s impact on the European stablecoin market.

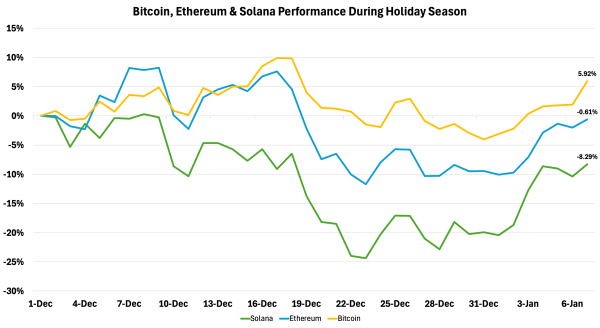

Before we get into the risks above, let’s take a quick look at how the market fared during the holiday season. Bitcoin led the charge with a 5.92% gain, while Ethereum lagged slightly, slipping by 0.61%. Solana faced a tougher time, enduring an 8.29% decline amid the seasonal lull. Despite these mixed performances, the overall crypto market saw a 5.21% increase, signaling that momentum in the industry remains strong as we move into the new year.

Figure 1: Bitcoin, Ethereum, Solana Performance During Holiday Season

Source: 21Shares, Coingecko

As shown in Figure 1, the broader crypto market experienced a downturn in momentum during the holiday season, with trading volumes dropping significantly as investors took time off. This slowdown was compounded by unexpected hawkish comments from the Federal Reserve Chair at the latest FOMC meeting. Contrary to market expectations of four rate cuts in 2025, the Fed signaled only two potential cuts, introducing a note of caution. This stance triggered a sharp rise in the 10-year Treasury yield, which surged to 4.62%, its highest level in six months. Remarkably, this yield now exceeds the Fed’s current rate of 4.25%, as illustrated below, a striking inversion that underscores how concerned the market is about the long-term outlook.

Figure 2: 10-year Treasury Yield vs FED’s Funds Rate

Source: MacroMicro

This unusual dynamic reflects renewed fears that restrictive monetary policy will persist longer than anticipated as investors demand higher returns for holding longer-term debt in an uncertain environment. Elevated bond yields further erode the appeal of riskier assets like cryptoassets, pulling capital toward safer, more predictable returns. The spike in the 10-year Treasury yield has thus become a major driver behind the recent downturn.

In light of these insights, let’s delve into the pivotal elements that may pose challenges for the market as we step into the new year.

Macro Backdrop

The global economy faces uncertainty as central banks grapple with interest rate decisions amid potential slowdowns. In the U.S., the incoming administration’s policies present a mixed economic outlook. Trump’s proposed tariffs may cause short-term inflation but offer long-term benefits, while expedited drilling permits could increase oil supply and potentially lower energy costs.

Concerns about U.S. inflation took center stage at the latest FOMC meeting, where Jerome Powell signaled a more hawkish outlook for 2025. This shift in expectations quickly dampened market sentiment and is a key factor behind the recent downturn for BTC, ETH, and other risk assets. BTC erased almost a month of price gains following the FOMC meeting, retracing $14K from $108K to $92K.

The European Union also faces a critical juncture in 2025, with political instability in Germany and France weakening the bloc’s core, thereby creating a leadership vacuum. The weakened Franco-German axis undermines the EU’s ability to respond cohesively to economic and geopolitical challenges and could result in inconsistent and conflicting crypto policies across the region. Alternatively, Japan’s central bank is poised for more rate hikes in 2025, with Governor Kazuo Ueda indicating readiness to tighten policy if economic conditions warrant. This move could impact global carry trades, reminiscent of the August 2024 market reaction.

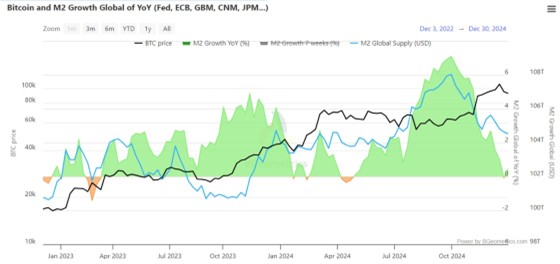

Another metric to be mindful is Bitcoin’s historical correlation with M2. Despite recent interest rate cuts, M2 has been declining since October, potentially negatively impacting Bitcoin. This decline may be due to banks adjusting balance sheets – such as by reducing lending, which decreases deposits—or turning to alternative funding methods not included in M2, like repo markets or money market funds. The lag between rate cuts and their impact on broader money supply measures adds to this complexity. As Bitcoin’s adoption grows, 2025 will be crucial in determining whether its price becomes less dependent on global liquidity or maintains its strong correlation with M2. If the correlation persists, continued M2 decline could negatively affect Bitcoin throughout the year.

Figure 3: Bitcoin vs M2 Money Supply Growth

Source: Bgeometrics

Geopolitical tensions remain another key risk factor for crypto in 2025. While Trump’s Administration is expected to adopt a less aggressive military stance, the U.S.’s strong alignment with Israel raises concerns about potential escalation in the Middle East, particularly regarding Iran. Such conflicts could undermine investor confidence in high-risk assets like crypto. Meanwhile, the situation in Ukraine appears more containable, with both Zelensky and Putin signaling a willingness to negotiate. However, failure to achieve meaningful progress could still pose a significant threat to global markets, including crypto, despite the generally favorable outlook for the industry under the Trump Administration.

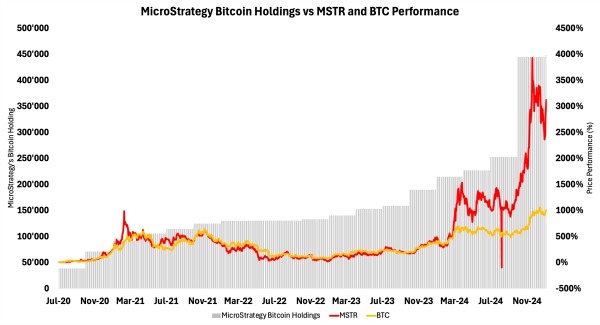

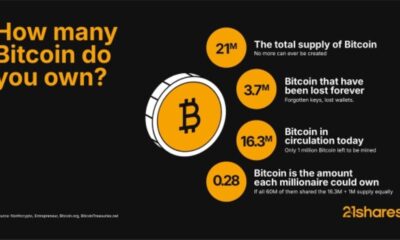

MicroStrategy has positioned itself as a proxy for Bitcoin exposure, holding a significant portion of its treasury in BTC. Their large Bitcoin holdings, which currently sit at 447,470 BTC or $45B, attract investors seeking beta to Bitcoin. For reference, MicroStrategy currently has a market cap of around $88B, almost 2x its Bitcoin holdings. With an average purchase price of approximately $62K, over $7B of outstanding debt used to purchase Bitcoin, a NAV premium of 1.91x, and holding roughly 2.5% of all Bitcoin circulating, a forced liquidation from MicroStrategy could send the crypto market tumbling. Before we go into how this could happen, let’s first describe how we got here.

How the MicroStrategy Flywheel Works: The MicroStrategy Bitcoin Flywheel operates as a self-reinforcing cycle centered around Bitcoin accumulation. Initially, the company allocated existing cash reserves to purchase Bitcoin, positioning it as a key corporate strategy that generated significant market attention. To fund further acquisitions, MicroStrategy raises capital through debt issuance (e.g., convertible or senior secured notes) or equity offerings (MSTR stock), often on favorable terms due to market enthusiasm for its Bitcoin-focused approach. As BTC’s price appreciates, the value of its holdings increases, strengthening its balance sheet and allowing the company to raise additional funds to purchase more BTC. This reinvestment process perpetuates the cycle, as depicted below.

Figure 4: Approximate # of BTC held by MicroStrategy at the End of Each Quarter

Source: 21Shares, Yahoo Finance, Investopedia

What is the current size of their Bitcoin holdings, and how does it compare to their debt levels?

Liquidation Risk: Estimating MicroStrategy’s liquidation risk is complex, but a rough calculation suggests a potential liquidation price of $16.5K/BTC. This is derived by dividing the company’s total debt outstanding by its total Bitcoin holdings, which would require an 85% drawdown in Bitcoin’s value to levels last seen during the FTX collapse in late 2022. However, this estimate is far from definitive since MicroStrategy’s debt is unsecured. Creditors, therefore, lack the authority to force the company to sell its Bitcoin holdings to repay the debt. That said, if MicroStrategy’s stock price were to decline significantly, it could trigger a scenario where debt holders exercise their rights to convert their debt into equity. This forced conversion might pressure the company to take drastic measures to meet its financial obligations, potentially including selling its Bitcoin.

• If MicroStrategy did decide to repay the entirety of its debt, it would only need to liquidate around 15% of its total Bitcoin holdings at current prices. While any sale of Bitcoin by MicroStrategy would undoubtedly make headlines and cause a temporary market dip, the actual amount of BTC they would need to sell adds up to $6.8B and would have a relatively limited effect on the broader market, and the market would likely recover after a few weeks, as we saw with the selling pressure from the German government, Mt.Gox, and Genesis during the summer of 2024.

Price Risk: When Bitcoin undergoes significant drawdowns, MicroStrategy, effectively acting as a leveraged Bitcoin proxy, often sees its stock decline faster. This amplified volatility is driven by its large Bitcoin holdings and the market’s view of MSTR as a high-beta play on Bitcoin, currently trading at around 2x its BTC NAV. A sharp decline in MSTR’s stock can trigger broader sell-offs in the company’s bonds and equities as investors worry about its ability to service debt tied to Bitcoin-backed loans or convertible bonds. Notably, one tranche of convertible debt is tied to MSTR’s price, with a margin call threshold of roughly $140–$180. If breached, this could force MicroStrategy to liquidate Bitcoin at depressed prices to maintain liquidity, further pressuring Bitcoin prices and fueling a self-reinforcing cycle of fear and selling. This feedback loop underscores the systemic risk of MicroStrategy’s leveraged Bitcoin strategy during periods of severe market stress.

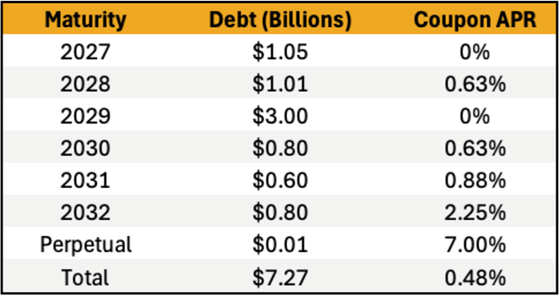

Outstanding Debt Risk: Much of MicroStrategy’s outstanding debt is long-term and carries relatively low interest rates. However, the key risk lies in the potential inability to cover rising interest payments if market conditions worsen. Fortunately, the company produces sufficient revenue from its business intelligence software segment to service this debt, with approximately $500M in revenue for 2023, with similar projections for 2024. Nevertheless, the previously mentioned price and liquidation risks would still directly impact its ability to manage these interest obligations effectively.

Figure 5: MicroStrategy Bond Maturity Table, Coupon Total as a Weighted Average

Source: 21Shares, Real Investment Advice

Option and Relative Performance Trade Risk: In equity markets, as option expiration dates approach, an asset’s price often gravitates toward its ”max pain” level—the price where the most options expire worthless, minimizing payouts for options writers. For the 17JAN25 contracts, this level is $195, while for the 24JAN25 and 31JAN25 contracts, it is $345. If these contracts expire worthless, it could amplify market consequences due to unhedging activity by market participants. This phenomenon ties into the relative-value pair trade between MicroStrategy and Bitcoin. MSTR might currently be perceived as overpriced relative to the NAV of its Bitcoin holdings. A relative-value trade, such as shorting MSTR and longing BTC, aims to profit from the eventual alignment of MSTR’s stock price with its Bitcoin NAV. However, this trade carries significant risk in bullish markets where momentum often overshadows fundamentals. If options linked to MSTR or BTC expire worthless, this could trigger a liquidation or reallocation of positions by investors, driving price instability. A significant dip in MSTR’s price could have a reflexive impact on BTC, creating a feedback loop.

Presidential Promises Unfulfilled

The 2024 election cycle brought optimism for clearer crypto regulation, with promises of support for innovation. Some of these are mentioned in our previous edition and include:

• Bitcoin as a Strategic Reserve Asset

• Favorable regulatory treatment for Decentralized Finance

• Jurisdictional clarity between the SEC and the CFTC via FIT21

• Closer integration between TradFi and crypto by rescinding SAB121

• Favorable tax treatments for U.S.-based crypto companies

• A more crypto-friendly regulatory environment

The realization of any of these initiatives will ensure that crypto maintains its momentum throughout the year. However, delays or opposition in implementing some of these pro-crypto policies could create extended uncertainty, hindering market confidence and institutional participation while dampening enthusiasm.

Liquid Staking and Restaking Centralization

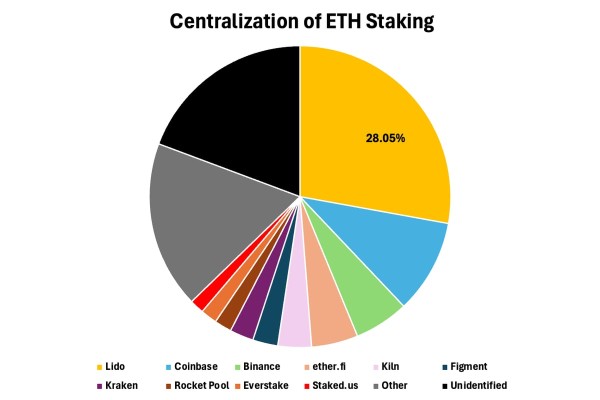

As a recap, Liquid Staking allows users to stake their ETH while maintaining liquidity by receiving tokenized representations of their staked ETH (e.g., stETH from Lido). These tokens can be used in DeFi, enabling users to earn additional yields while their ETH remains staked for network security. On that note, Lido, the largest liquid staking protocol, currently controls approximately 50% of Ethereum’s Total Value Locked (TVL), making it a dominant player in the network’s ecosystem.

The caveat is that Lido’s dominance in Ethereum staking—controlling over 28% of validators—presents a significant centralization risk to the network’s security and the principle of decentralization. While initiatives like community staking modules, permissionless validator sets, and a staking router leveraging Distributed Validator Technology aim to further diversify the validator set and mitigate these risks, Lido remains a single protocol. This concentration of power creates a potential single point of failure, where an exploit or external pressure on Lido could critically undermine Ethereum’s security.

Figure 6: Breakdown of Ethereum’s Staking Dominance Across Different Providers

Source: 21Shares, Dune Analytics

On the other hand, Restaking enables the security provided by staked ETH to be lent out to secure other protocols, amplifying the economic rewards derived from staking. The sector, which is led by services like EigenLayer, already manages approximately $15B in TVL, representing a substantial share of Ethereum’s staking economy, with over 10% already being restaked.

Restaking applies Ethereum’s security to other projects but also heightens systemic risk: a failure in any downstream protocol could compromise Ethereum’s core security. Moreover, restaking now extends beyond Ethereum—Babylon Finance, for instance, leverages a similar mechanism to secure networks with Bitcoin’s capital, with more than $6B in TVL. Thus, it’s not an embryonic sector anymore.

This cross-protocol risk could lead to instability in the broader ecosystem if not carefully managed. Namely, Ethereum’s founder, Vitalik Buterin, laid out three hypothetical scenarios which could prove harmful to Ethereum’s security:

• Overloading ETH security: Too many applications relying on the crypto-economic security of Ethereum could overburden the network and render it incapable of effectively reaching decisions, and potentially result in hard forks.

• Creating perverse motivations: Users could be tempted to secure the most profitable network, although it may not be the most secure. This can ultimately undermine ETH’s security.

• Introducing novel avenues for exploitation: Validators could be bribed from malicious actors to vote for a particular dishonest block on an external network.

MiCA’s Impact on the European Stablecoin Market

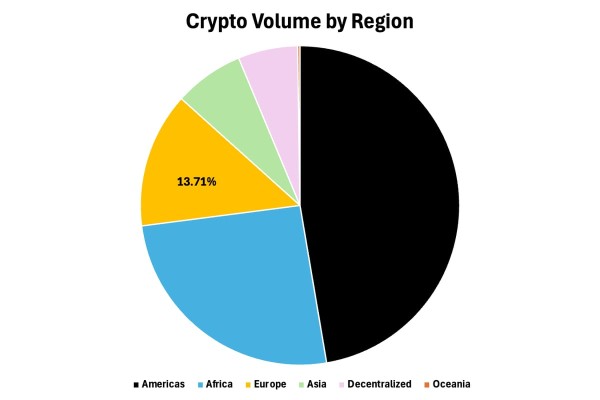

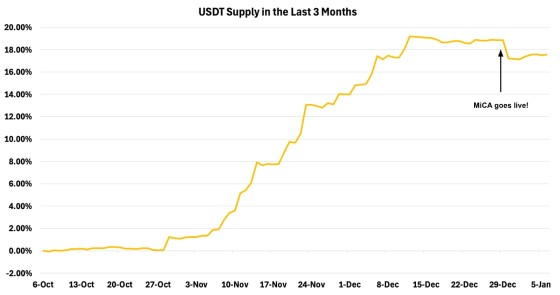

The MiCA Regulation came into full effect on December 30, 2024, ushering in a comprehensive framework for crypto oversight in the EU. Among its key provisions, MiCA mandates that stablecoin issuers secure licenses and adhere to strict reserve, transparency, and usage requirements. Non-compliant stablecoins, such as Tether’s USDT, faced delistings from major EU exchanges, raising concerns over potential liquidity risks as stablecoins are a proxy for investable capital. However, it’s worth noting that close to 87% of crypto’s trading volume exists outside of Europe, as shown in Figure 7, so the impact is rather limited.

Figure 7: Crypto’s Trading Volume on Exchanges by Region

Source: 21Shares, Messari

To that point, Tether’s circulating supply temporarily declined from its peak of $143B to $141.2B following these regulatory changes, as shown in Figure 8 below. However, the impact was largely contained, with USDT’s supply rebounding by $500M since the turn of the year. In fact, USDT supply has actually grown around 16% since early October, despite knowledge of MiCA’s formal implementation. Arbitrage opportunities briefly emerged when USDT dipped to $0.9954 on December 30, but its dollar peg held firm, demonstrating market resilience.

Figure 8: USDT Stablecoin Supply

Source: 21Shares, Artemis

While MiCA’s strict standards introduce challenges, they provide much-needed clarity for stablecoin issuance and service providers in the EU. By establishing a consistent regulatory environment, MiCA is poised to enhance stability and trust in the region’s crypto markets, paving the way for sustainable growth.

All in all, while the outlook for the new year seems overwhelmingly positive, the crypto market may face multiple headwinds this year that could stall its momentum.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

COINSOL ETP spårar kryptovalutan Solana

-

21Shares lanserar DYDX – Din port till decentraliserade perpetuals

-

Concerned about rising government debt? Bitcoin’s got you covered

-

Bitcoin is scarce. Will you get your share?

-

Bitcoin surpasses Alphabet and Amazon by market cap

-

The Bitcoin boom hiding in Americans’ retirement savings

Nyheter

IN0A ETF spårar S&P 500 med fokus på företag med höga ESG-betyg

Publicerad

18 timmar sedanden

16 september, 2025

BNP Paribas Easy S&P 500 ESG UCITS ETF Capitalisation (IN0A ETF) med ISIN IE0000VX9GN7, strävar efter att spåra S&P 500 ESG-index. S&P 500 ESG-index spårar de största amerikanska företagen utvalda enligt ESG-kriterier. Indexets sektorallokering justeras till sektorallokeringen för S&P 500.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,12 % p.a. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen ackumuleras och återinvesteras.

BNP Paribas Easy S&P 500 ESG UCITS ETF Capitalisation har tillgångar på 474 miljoner euro under förvaltning. Denna ETF lanserades den 26 april 2023 och har sin hemvist i Irland.

Handla IN0A ETF

BNP Paribas Easy S&P 500 ESG UCITS ETF Capitalisation (IN0A ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel SIX Swiss Exchange Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

Nyheter

PLTY ETP utfärdar optioner mot aktier i Palantir

Publicerad

20 timmar sedanden

16 september, 2025

IncomeShares Palantir (PLTR) Options ETP (PLTY ETP) med ISIN XS3068775009, är en aktivt förvaltad ETP. ETP-strategin är att köpa Palantir-aktier och sälja ”out-of-the-money” (OTM) och ”in-the-money” (ITM) säljoptioner på dessa aktier för att generera premier.

Den börshandlade produktens TER (total expense ratio) uppgår till 0,55 % per år. Utdelningen i ETN:n delas ut till investerarna (månadsvis).

ETNen lanserades den 19 juni 2025 och har sitt säte i Irland.

Varför Palantir Options ETP?

IncomeShares Palantir (PLTR) Options ETP fördelar dynamiskt mellan direktinvesteringar i Palantir Technologies Inc-aktier (NYSE: PLTR) och försäljning av säljoptioner på PLTR med lösenprocent från 5 % OTM till 10 % ITM. Strategin syftar till att generera hög månadsinkomst samtidigt som den bibehåller uppåtgående exponering i den utsträckning som innehavet av PLTR-aktier och utlöser säljoptioner som säljs ITM. ETP:n kommer också att generera avkastning på de oinvesterade pengarna.

Handla PLTY ETP

IncomeShares Palantir (PLTR) Options ETP (PLTY ETP) är en europeisk börshandlad produkt. Denna ETP handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETP genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

Nyheter

IVAI ETF för den som tror på Artificiell intelligens

Publicerad

2 dagar sedanden

15 september, 2025

Invesco Artificial Intelligence Enablers UCITS ETF Acc (IVAI ETF) med ISIN IE000LGWDNE5, försöker spåra S&P Kensho Global Artificial Intelligence Enablers Screened index. S&P Kensho Global Artificial Intelligence Enablers Screened-index spårar resultatet för företag som har en distinkt del av sin verksamhet och intäkter som kommer från området artificiell intelligens. Aktierna som ingår filtreras enligt ESG-kriterier (miljö, social och bolagsstyrning).

Den börshandlade fondens TER (total cost ratio) uppgår till 0,35 % p.a. Invesco Artificial Intelligence Enablers UCITS ETF Acc är den enda ETF som följer S&P Kensho Global Artificial Intelligence Enablers Screened index. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen ackumuleras och återinvesteras.

Invesco Artificial Intelligence Enablers UCITS ETF Acc är en mycket liten ETF med tillgångar på 2 miljoner euro under förvaltning. Denna ETF lanserades den 29 oktober 2024 och har sin hemvist i Irland.

Produktbeskrivning

Invesco Artificial Intelligence Enablers UCITS ETF Acc syftar till att tillhandahålla den totala nettoavkastningen för S&P Kensho Global Artificial Intelligence Enablers Screened Index (”Referensindexet”), minus avgifternas inverkan.

Värdepapper är exkluderade från ersättning för referensindex om de: 1) är involverade i tobak, kontroversiella vapen, oljesand, handeldvapen, militära kontrakt eller termiskt kol; 2) bedöms inte följa principerna i FN:s Global Compact, 3) ha ett ESG-poäng i de 10 % lägre av S&P Global BMI Index; eller 4) inte omfattas av ESG-datalösningen som används av Indexleverantören.

Företag utvärderas och väljs sedan ut om de av indexleverantören fastställs att de är fokuserade på att utveckla och möjliggöra tekniken, infrastrukturen och tjänsterna som driver tillväxten och funktionaliteten hos AI; specifikt inklusive dessa affärsaktiviteter: (a) hårdvara, inklusive chips och datorutrustning som stöder högpresterande AI-beräkningar och operationer; (b) mjukvaru- och lösningsutvecklare av AI-algoritmer och -produkter; (c) Infrastrukturtjänster som är integrerade för att möjliggöra dataintensiv AI-kapacitet. (d) produkter och tjänster som tillhandahåller ett ramverk specifikt för AI-tillämpningar, och (e) leverantörer av datakurering och hanteringslösningar som stöder effektiv utbildning och funktion av AI-modeller.

Företag klassificeras som antingen ”Core” (de med en betydande del av sin affärsverksamhet och/eller intäkter som härrör från produkter och tjänster i linje med temat) eller ”Icke-Core” (de som verkar över temats bredare värdekedja ), som bestäms av indexleverantören, och en överviktsfaktor tillämpas på gruppen av kärnvärdepapper för att öka den totala exponeringen mot dessa aktier och betona ren lekinnovation. Inom varje grupp är företagen lika viktade under förutsättning av diversifiering och likviditetsbegränsningar. Referensindexet balanserar om kvartalsvis.

Fonden strävar efter att uppnå sitt mål genom att köpa och hålla, så långt det är möjligt och praktiskt möjligt, samtliga aktier i referensindex i sina respektive vikter.

Denna ETF hanteras passivt

En investering i denna fond är ett förvärv av andelar i en passivt förvaltad, indexföljande fond snarare än i de underliggande tillgångarna som ägs av fonden.

Investeringsrisker

För fullständig information om risker, se de juridiska dokumenten. Värdet på investeringar, och eventuella intäkter från dem, kommer att fluktuera. Detta kan delvis bero på förändringar i valutakurser. Investerare kanske inte får tillbaka hela det investerade beloppet. Eftersom denna fond har en betydande exponering mot en eller ett litet antal sektorer bör investerare vara beredda att acceptera en högre grad av risk än för en ETF med ett bredare investeringsmandat.

Fonden kan vara exponerad för risken att låntagaren inte fullgör sin skyldighet att lämna tillbaka värdepapperen i slutet av låneperioden och att inte kan sälja de säkerheter som ställts till den om låntagaren fallerar. Fonden har för avsikt att investera i värdepapper från emittenter som hanterar sina ESG-exponeringar bättre i förhållande till sina jämförbara företag. Detta kan påverka fondens exponering mot vissa emittenter och få fonden att avstå från vissa investeringsmöjligheter.

Fonden kan prestera annorlunda än andra fonder, inklusive underpresterande andra fonder som inte försöker investera i värdepapper från emittenter baserat på deras ESG-betyg. Värdet på aktier och aktierelaterade värdepapper kan påverkas av ett antal faktorer, inklusive emittentens verksamhet och resultat samt allmänna och regionala ekonomiska och marknadsmässiga förhållanden. Detta kan leda till fluktuationer i fondens värde. Fonden kan vara exponerad för ett begränsat antal positioner vilket kan resultera i större fluktuationer i fondens värde än för en fond som är mer diversifierad. Fonden är investerad i en viss geografisk region, vilket kan leda till större fluktuationer i fondens värde än för en fond med ett bredare geografiskt investeringsmandat.

Handla IVAI ETF

Invesco Artificial Intelligence Enablers UCITS ETF Acc (IVAI ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Borsa Italiana | EUR | IVAI |

| London Stock Exchange | GBX | IAIX |

| London Stock Exchange | USD | IVAI |

| SIX Swiss Exchange | CHF | IVAI |

| XETRA | EUR | IVAI |

Största innehav

| Namn | CUSIP | ISIN | Vikt % |

| ORACLE CORP USD0.01 | 68389X105 | US68389X1054 | 4.21% |

| C3.AI INC-A USD 0.0010 | 12468P104 | US12468P1049 | 4.04% |

| EXLSERVICE HOLDINGS INC USD0.001 | 302081104 | US3020811044 | 3.86% |

| KYNDRYL HOLDINGS INC-W/I USD 0.0100 | 50155Q100 | US50155Q1004 | 3.76% |

| SOUNDHOUND AI USD 0.000100000 | 836100107 | US8361001071 | 3.72% |

| DELL TECHNOLOGIES -C NPV | 24703L202 | US24703L2025 | 3.71% |

| AMBARELLA INC USD 0.0005 | G037AX101 | KYG037AX1015 | 3.67% |

| EPAM SYSTEMS INC USD0.001 | 29414B104 | US29414B1044 | 3.62% |

| ALTAIR ENGINEERING INC – A NPV | 021369103 | US0213691035 | 3.60% |

| NVIDIA CORP USD0.001 | 67066G104 | US67066G1040 | 3.51% |

Innehav kan komma att förändras

IN0A ETF spårar S&P 500 med fokus på företag med höga ESG-betyg

PLTY ETP utfärdar optioner mot aktier i Palantir

IVAI ETF för den som tror på Artificiell intelligens

COINSOL ETP spårar kryptovalutan Solana

DYDX ETP spårar kryptovalutan DYDX

Utdelningar och försvarsfonder lockade i augusti

Månadsutdelande ETFer uppdaterad med IncomeShares produkter

HANetfs analyserar hur ett fredsavtal kan påverka det europeiska försvaret

ADLT ETF investerar bara i riktigt långa amerikanska statsobligationer

Septembers utdelning i XACT Norden Högutdelande

Populära

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUtdelningar och försvarsfonder lockade i augusti

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMånadsutdelande ETFer uppdaterad med IncomeShares produkter

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanHANetfs analyserar hur ett fredsavtal kan påverka det europeiska försvaret

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanADLT ETF investerar bara i riktigt långa amerikanska statsobligationer

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSeptembers utdelning i XACT Norden Högutdelande

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFastställd utdelning i MONTDIV augusti 2025

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanHANetf kommenterar mötet mellan Kina, Ryssland och Nordkorea vid militärparad

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanAICT ETF investerar i obligationer utgivna av företag från tillväxtmarknader