Nyheter

Is Quantum Computing Approaching a Tipping Point?

Publicerad

3 månader sedanden

Wave after wave of transformative technologies have marked the past 100 years — each moving from invention to mass adoption, reshaping society and generating significant economic value along the way. Now, in the 21st century, we may be approaching the next major technological breakthrough: the advent of the quantum computing era.

From the rise of television in the mid-20th century to the smartphone revolution of the early 2000s and, most recently, the breakthrough of generative artificial intelligence, new technologies have defined generations. Take the internet, for example: in the late 1960s, a group of U.S. government researchers began linking computers, inventing a new way to share information. Over the following decades, scientists built upon that foundation. Then, in the 1990s, the World Wide Web emerged — opening the internet to the public and creating the digital backbone for email, ecommerce and social media.

Much like the internet in the 1980s, quantum computing’s evolution is accelerating — it looks closer to a ‘tipping point’ that could release its immense potential. While the technology’s theoretical foundations were established in the late 20th century, only in recent years has this set a wave of innovation in motion. As the wave gathers pace, it has the potential to disrupt industries like finance, medicine and cybersecurity. Even so, it’s important to acknowledge that — despite early use cases — commercial success is not yet assured, and broad adoption may still face challenges.

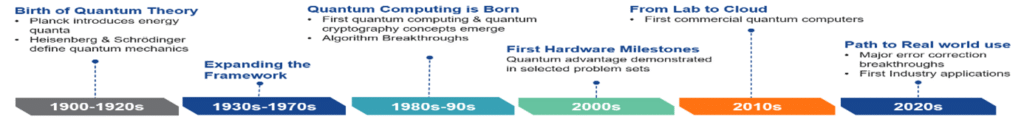

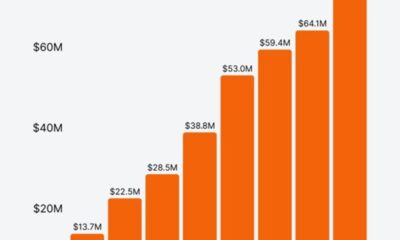

The Rise of Quantum Computing

Source: VanEck Research.

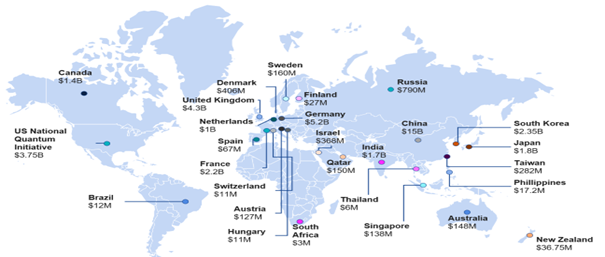

Building Momentum: Quantum Investment and Innovation

The growing commitment from governments and leading tech companies signals that quantum computing may be approaching a tipping point. According to McKinsey & Company, public investments now exceed $42 billion, underscoring national interest in this transformative technology.1 At the same time, the private sector is rapidly advancing, with over 10,000 quantum-related patents granted in the past five years.2

Global Public Quantum Technology Investments

Source: McKinsey & Company (2024). Quantum Technology Monitor.

Economic opportunities are already being explored in various industries. For instance, in finance, quantum computing could be used for optimizing investment portfolios, risk analysis and fraud detection, while also posing a long-term challenge to existing encryption standards. In healthcare, it has promise for drug discovery, molecule simulation and medical data analysis. A notable example is IBM’s collaboration with the U.S. Cleveland Clinic, where the first quantum computer dedicated to healthcare was installed in 2023. Among other applications, it is used to enhance machine learning models for prescribing antibiotics, drawing on a dataset of 4.7 million cases in a 2025 publish case study.3

More recently, D-Wave Quantum Inc, a Californian quantum computing company, made headlines by claiming quantum supremacy on a “useful, real-world problem” through a quantum-optimized simulation of magnetic materials. The achievement—peer-reviewed and published in the journal Science—has sparked widespread discussion across the scientific and tech communities. It could mark a significant step forward in applying quantum computing to materials science.4

The Current State of Quantum Computing

Putting things into perspective, quantum computing is shifting from theoretical research into early-stage commercial exploration — marked by rapid progress, but also significant technical challenges.

As part of this transition, several companies are now offering quantum computers—either through physical purchase and delivery, or via remote access through cloud platforms. Pricing ranges from free public access to enterprise-level subscription models.5 In the past six months, major players have announced notable hardware milestones: Google introduced its Willow chip, Microsoft unveiled its Majorana processor, and Amazon announced Ocelot, which uses cat qubits to improve error correction.

While these developments are promising, they primarily reflect advancements in hardware rather than immediate commercial utility. Most current systems still operate within the so-called NISQ (Noisy Intermediate-Scale Quantum) era — capable of impressive demonstrations but limited by error rates and a lack of scalability. They remain largely experimental and not yet viable for broad, real-world applications.

As a result, much of the current enthusiasm is rooted in long-term potential rather than proven performance. The gap between laboratory breakthroughs and widespread deployment remains wide — and closing it will require sustained innovation and focused execution. Leading firms have acknowledged these challenges and laid out clear roadmaps to address them. Most recently, IBM updated its quantum roadmap, aiming to deliver a fault-tolerant quantum computer by 2029.6

From Potential to Progress

Quantum computing may be approaching a tipping point, with the potential to drive significant innovation. Being an emerging technology, its progress is likely to be uneven, and widespread adoption is far from guaranteed.

Investors who recognize its long-term potential may find it worthwhile to watch the development closely. The next breakthrough could be nearer than we think — and for those who are prepared, it may offer a chance to engage with one of the most promising frontiers in modern technology.

To receive more insights, sign up to our email Newsletter.

1 McKinsey & Co 2024 Technology Monitor.

2 EconSight AG, data as of March 31st 2025, for 2020-2024.

3 Cleveland Clinic, Machine Learning and Quantum Computing Predict Which Antibiotic To Prescribe for UTIs, 2025.

4 D-Wave, Beyond Classical: D-Wave First to Demonstrate Quantum Supremacy on Useful, Real-World Problem, 2025.

5 Examples: https://www.rigetti.com/novera, https://www.ibm.com/quantum/pricing. Accessed May 2025.

6 Example: https://www.ibm.com/roadmaps/quantum/.

IMPORTANT INFORMATION

This information originates from VanEck (Europe) GmbH, Kreuznacher Str. 30, 60486 Frankfurt, Germany, and has been appointed as distributor of VanEck products in Europe by the UCITS Management Company, VanEck Asset Management B.V. The Management Company is incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM).

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: Zeidler Regulatory Services (Switzerland) AG, Neustadtgasse 1a, 8400 Winterthur, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: This is a marketing communication targeted to FCA regulated financial intermediaries. Retail clients should not rely on any of the information provided and should seek assistance from a financial intermediary for all investment guidance and advice. VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), which is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated firms such as financial intermediaries and Wealth Managers.

This material is only intended for general and preliminary information and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed.

Investing is subject to risk, including the possible loss of principal. For any unfamiliar technical terms, please refer to ETF Glossary | VanEck.

This document has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH ©VanEck Switzerland AG © VanEck Securities UK Limited

Du kanske gillar

-

Miners Find Their Mojo as Gold Consolidates

-

Tech multi-megatrend ETF utvecklar metodologi med tillägg av exponeringar mot kvantberäkning och försvarsteknik

-

WisdomTree lanserar UCITS-fond för kvantberäkning

-

WisdomTree noterar fond för kvantberäkning på Xetra

-

Europas första ETF för kvantdatorer når 100 miljoner dollar i förvaltat kapital

-

The Future of Fandom: Why Esports and Gaming Are Outpacing Traditional Sports

Nyheter

Börshandlade fonder för europeiska small caps

Publicerad

5 timmar sedanden

28 september, 2025

Det är välkänt att företag med mindre börsvärden genererar högre avkastning på lång sikt. Men de kommer också med högre risker som investerare bör hantera effektivt. Diversifiering av investeringar med ETFer är det säkraste alternativet för en oberoende investerare att närma sig småbolagsaktier. Vi tittar i denna artikel på börshandlade fonder för europeiska small caps.

Det finns i huvudsak fyra index tillgängliga för att investera med börshandlade fonder för europeiska small caps. Denna investeringsguide för europeiska småbolagsaktier hjälper dig att navigera mellan särdragen hos EURO STOXX® Small, MSCI EMU Small Cap, MSCI Europe Small Cap, STOXX® Europe Small 200 och ETF:erna som spårar dem. Det gör att du kan hitta de mest lämpliga europeiska småbolags-ETF:erna för dig genom att rangordna dem enligt dina preferenser.

Vi har identifierat nio olika index som spåras av 13 börshandlade fonder för europeiska small caps. Den årliga förvaltningskostnaden för dessa ETFer ligger på mellan 0,20 och 0,58 procent.

De största europeiska Small Cap ETFerna efter fondstorlek i EUR

| 1 | Xtrackers MSCI Europe Small Cap UCITS ETF 1C | 1,732 m |

| 2 | iShares MSCI EMU Small Cap UCITS ETF (Acc) | 872 m |

| 3 | iShares STOXX Europe Small 200 UCITS ETF (DE) | 846 m |

De billigaste europeiska Small Cap ETFerna efter total kostnadskvot

| 1 | iShares STOXX Europe Small 200 UCITS ETF (DE) | 0.20% |

| 2 | Amundi MSCI Europe Small Cap ESG Climate Net Zero Ambition CTB UCITS ETF Acc | 0.23% |

| 3 | BNP Paribas Easy MSCI Europe Small Caps SRI S-Series PAB 5% Capped UCITS ETF | 0.26% |

Olika index på europeiska småbolagsaktier

Metoder för de viktigaste indexen

| EURO STOXX® Small | MSCI EMU Small Cap | MSCI Europe Small Cap | STOXX® Europe Small 200 | |

| Antal ETFer | 1 | 2 | 2 | 1 |

| Antal aktier | 88 | 398 | 902 | 200 |

| Investeringsuniversum | EURO STOXX®-index: ca. 300 företag från euroområdet | MSCI EMU Investable Market Index: ca. 700 företag från euroområdet | MSCI Europe Investable Market Index: ca. 1 400 företag från Europa | STOXX® Europe-index: 600 företag från 17 europeiska länder |

| Index rebalancing | Kvartalsvis | Kvartalsvis | Kvartalsvis | Kvartalsvis |

| Urvalskriterier | De minsta företagen (nedre tredjedelen) av det underliggande EURO STOXX®-indexet | De minsta företagen (cirka 14 procent av det fria flytande marknadsvärdet) i MSCI EMU Investable Market Index | De minsta företagen (cirka 14 procent av det fria flytande marknadsvärdet) i MSCI EMU Investable Market Index | De 200 minsta företagen från STOXX® Europe 600-indexet (rankade från 401 till 600 efter deras marknadsvärde för fritt flytande) |

| Indexviktning | Börsvärde (free float) | Börsvärde (free float) | Börsvärde (free float) | Börsvärde (free float) |

EURO STOXX® Litet index

EURO STOXX® Small-indexet består av små företag från det underliggande EURO STOXX®-indexet. EURO STOXX®-indexet är en delmängd av STOXX® Europe 600-indexet som endast omfattar företag från länder i euroområdet. Small caps bestäms som de 33 procent lägre företagen i det underliggande indexet rankat efter deras börsvärde. Aktierna som passerar urvalsskärmen viktas av deras marknadsvärde på fritt flytande nivå.

Metodik för EURO STOXX® Small

- 88 småbolagsaktier från euroområdet

- Indexombalansering sker kvartalsvis

- Aktieurvalet baseras på företagens storlek

- Urvalskriterier: den nedre tredjedelen av EURO STOXX®-index är vald

- Index viktat med fritt flytande marknadsvärde

MSCI EMU Small Cap index

MSCI EMU Small Cap-index fångar småbolagsaktier i 10 utvecklade länder i euroområdet. Indexet representerar de minsta företagen (cirka 14 procent av det fria floatjusterade börsvärdet) i MSCI EMU Investable Market Index. Aktierna som passerar urvalsskärmen viktas av deras marknadsvärde på fritt flytande nivå.

Metodik för MSCI EMU Small Cap

- 398 småbolagsaktier från utvecklade länder i euroområdet

- Indexombalansering sker kvartalsvis

- Index har minimistorlek, free float, likviditet och handelslängd

- Aktieurvalet baseras på marknadsvärde med fritt flytande värde

- Urvalskriterier: minsta företag i MSCI EMU Investable Market Index

- Index viktat med fritt flytande marknadsvärde

MSCI Europe Small Cap-index

MSCI Europe Small Cap-index inkluderar småbolagsaktier från 15 utvecklade länder i Europa. Indexet representerar de minsta företagen (cirka 14 procent av det fria floatjusterade börsvärdet) i MSCI Europe Investable Market Index. Aktierna som passerar urvalsskärmen viktas av deras marknadsvärde på fritt flytande nivå.

Metodik för MSCI Europe Small Cap

- 902 småbolagsaktier från utvecklade europeiska länder

- Indexombalansering sker kvartalsvis

- Index har minimistorlek, free float, likviditet och handelslängd

- Aktieurvalet baseras på börsvärde med fritt flytande värde

- Urvalskriterier: minsta företag i MSCI Europe Investable Market Index

- Index viktat med fritt flytande marknadsvärde

STOXX® Europe Small 200 index

STOXX® Europe Small 200-indexet spårar de 200 minsta företagen (mätt med fritt flytande marknadsvärde) från det underliggande STOXX® Europe 600-indexet, som består av 600 europeiska företag. Aktierna som passerar urvalsskärmen viktas av deras marknadsvärde på fritt flytande nivå.

Metodik för STOXX® Europe Small 200

- 200 småbolagsaktier från europeiska länder

- Indexombalansering sker kvartalsvis

- Aktieurvalet baseras på deras fria börsvärde

- Urvalskriterier: De 200 minsta aktierna (rankade från 401 till 600) från STOXX® Europe 600-indexet väljs ut

- Index viktat med fritt flytande marknadsvärde

En jämförelse av börshandlade fonder för europeiska small caps

Förutom avkastning finns det ytterligare viktiga faktorer att tänka på när du väljer börshandlade fonder för europeiska small caps För att ge ett bra beslutsunderlag hittar du en lista över börshandlade fonder för europeiska small caps med information om kortnamn, kostnad, utdelningspolicy, fondens hemvist och replikeringsmetod.

För ytterligare information om respektive ETF, klicka på kortnamnet nedan.

| Namn ISIN | Kortnamn | Avgift % | Utdelnings- policy | Hemvist | Replikerings- metod |

| Xtrackers MSCI Europe Small Cap UCITS ETF 1C LU0322253906 | XXSC | 0.30% | Ackumulerande | Luxemburg | Optimerad sampling |

| iShares MSCI EMU Small Cap UCITS ETF (Acc) IE00B3VWMM18 | SXRJ | 0.58% | Ackumulerande | Irland | Optimerad sampling |

| iShares STOXX Europe Small 200 UCITS ETF (DE) DE000A0D8QZ7 | EXSE | 0.20% | Utdelande | Tyskland | Fysisk replikering |

| iShares EURO STOXX Small UCITS ETF IE00B02KXM00 | IQQS | 0.40% | Utdelande | Irland | Optimerad sampling |

| Amundi MSCI EMU Small Cap ESG CTB Net Zero Ambition UCITS ETF LU1598689153 | LGWU | 0.40% | Utdelande | Luxemburg | Fysisk replikering |

| UBS ETF (LU) MSCI EMU Small Cap UCITS ETF (EUR) dis LU0671493277 | UEFD | 0.33% | Utdelande | Luxemburg | Fysisk replikering |

| SPDR MSCI Europe Small Cap Value Weighted UCITS ETF IE00BSPLC298 | ZPRX | 0.30% | Ackumulerande | Irland | Optimerad sampling |

| SPDR MSCI Europe Small Cap UCITS ETF IE00BKWQ0M75 | SMC | 0.30% | Ackumulerande | Irland | Optimerad sampling |

| BNP Paribas Easy MSCI Europe Small Caps SRI S-Series PAB 5% Capped UCITS ETF LU1291101555 | EESM | 0.26% | Ackumulerande | Luxemburg | Fysisk replikering |

| Amundi MSCI Europe Small Cap ESG Climate Net Zero Ambition CTB UCITS ETF Dist LU2572257470 | X026 | 0.35% | Utdelande | Luxemburg | Fysisk replikering |

| Amundi MSCI Europe Small Cap ESG Climate Net Zero Ambition CTB UCITS ETF Acc LU1681041544 | CEM | 0.23% | Ackumulerande | Luxemburg | Fysisk replikering |

| WisdomTree Europe SmallCap Dividend UCITS ETF IE00BQZJC527 | WTES | 0.38% | Utdelande | Irland | Fysisk replikering |

| WisdomTree Europe SmallCap Dividend UCITS ETF Acc IE00BDF16114 | WTD7 | 0.38% | Ackumulerande | Irland | Fysisk replikering |

Nyheter

XMGA ETF spårar amerikanska aktier men exkluderar de största företagen

Publicerad

6 timmar sedanden

28 september, 2025

Amundi MSCI USA Ex Mega Cap UCITS ETF Acc (XMGA ETF) med ISIN IE000XL4IXU1, försöker spåra MSCI USA Ex Mega Cap Select-index. MSCI USA Ex Mega Cap Select-index spårar företagen i MSCI USA-index men exkluderar de största företagen.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,15 % p.a. Amundi MSCI USA Ex Mega Cap UCITS ETF Acc är den enda ETF som följer MSCI USA Ex Mega Cap Select-index. ETFen replikerar det underliggande indexets prestanda genom full replikering (köper alla indexbeståndsdelar). Utdelningarna i ETF:n ackumuleras och återinvesteras.

Denna ETF lanserades den 12 november 2024 och har sin hemvist i Irland.

Investeringsmål

Amundi MSCI USA ex Mega Cap UCITS ETF Acc försöker replikera, så nära som möjligt, oavsett om trenden är stigande eller fallande, resultatet för MSCI USA ex Mega Cap Select Index (”Indexet”), samtidigt som volatiliteten i skillnaden mellan fondens avkastning och avkastningen på jämförelseindex (tracking Error).

Handla XMGA ETF

Amundi MSCI USA Ex Mega Cap UCITS ETF Acc (XMGA ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

Största innehav

Denna fond använder fysisk replikering för att spåra indexets prestanda.

| Namn | Valuta | Vikt % | Sektor |

| WELLS FARGO CO | USD | 1,02 % | Finans |

| ACCENTURE PLC -A | USD | 0,87 % | Informationsteknologi |

| SERVICENOW INC | USD | 0,84 % | Informationsteknologi |

| WALT DISNEY CO/THE | USD | 0,81 % | Kommunikationstjänster |

| MCDONALD S CORP COM NPV | USD | 0,81 % | Sällanköpsvaror |

| ABBOTT LABORATORIES | USD | 0,79 % | Health Care |

| INTL BUSINESS MACHINES CORP | USD | 0,79 % | Informationsteknologi |

| PHILIP MORRIS INTERNATIONAL | USD | 0,78 % | Dagligvaror |

| GENERAL ELECTRIC | USD | 0,77 % | Industri |

| CATERPILLAR INC | USD | 0,75 % | Industri |

Innehav kan komma att förändras

Nyheter

Miners Find Their Mojo as Gold Consolidates

Publicerad

7 timmar sedanden

28 september, 2025

Gold steadies near $3,300; miners soar on strong earnings, discipline, and rising margins, hinting at a potential re-rating and new potential bull cycle for gold equities.

Monthly gold market and economic insights from Imaru Casanova, Portfolio Manager, featuring her distinctive views on mining and gold’s portfolio benefits.

To receive more Gold Investing insights, sign up to our newsletter.

Key Takeaways:

• Gold range-bound near $3,300/oz, with catalysts like Fed turmoil and global risks boosting safe- haven demand

• Gold miners surged in August on strong earnings and capital discipline

• Signs of a sector re-rating suggest gold equities may be entering a new bull cycle

Policy Whiplash, Golden Calm

Gold continues to be supported by heightened uncertainty and volatility stemming from persistent global geopolitical and trade tensions and mixed economic signals. In August, gold itself became entangled in the trade-tariff chaos when news reports suggested that the U.S. had imposed tariffs on 1-kilogram and 100-ounce bars of gold1. The White House and President Trump later reassured markets that gold will not be subject to tariffs2. TACO, indeed! The gold tariff fiasco exemplifies the confusing policy environment in the U.S., with markets trying to re-interpret and price in rapidly changing (and conflicting) information daily.

Gold Holds the Line

The gold price has been range-bound around the $3,300 per ounce level following its strong rally post “liberation” day in April3. This sideways action does not surprise us. In recent years, after significant moves to new highs, the gold price tends to consolidate around a new, higher base before the next catalyst emerges that drives it to the next level. While there are plenty of potential catalysts at present, the timing is impossible to predict, but anything that threatens the stability of the global financial system could lead to a surge in safe-haven demand for gold.

From Tariff Talk to Rally Walk

We had a taste of what some of those catalysts may look like on August 20, when President Trump called for the resignation of – and days later announced he had fired – U.S. Federal Reserve (“Fed”) Governor Lisa Cook4. This escalation in assaults on the Fed by the current administration raised fears that the Fed could lose its independence, threatening the stability and credibility of the world’s most important central bank. Gold rallied in response, also supported by increased probabilities of a Fed cut in September and a weaker dollar, closing at $3,447.95 per ounce on August 29, a $158.02 (4.80%) gain for the month5.

As of 31 August, gold was up 78% over the past five years (31 August 2020 – 31 August 2025). Investors should keep in mind that past performance is not a reliable indicator of future results, and that investment in gold is subject to risks, including volatility, the risk of investing in natural resources, and the possible loss of principal. Investing is subject to risk, including the possible loss of principal.

Returns on this investment may increase or decrease as a result of USD/EUR currency movements.

Calm Metal, Hot Miners

The NYSE Arca Gold Miners Index (GDMNTR) (“GDM”) was up a whopping 21.73% during the month6, while the mid-tier and small cap index, MVIS Global Junior Gold Miners (MVGDXJTR), was up 23.35%7. The gold price increase led to an amplified gain for the gold equities, as expected, reflecting their leverage to the metal price. However, the substantial outperformance suggests other factors, beyond the gold price, supported gold mining shares in August. We believe a key driver was a very strong Q2 2025 earnings season: companies generally reported financial and operating results that met or exceeded expectations, with many companies reporting record revenues and free cash flow. Most companies maintained their yearly guidance, and many larger players reiterated their commitment to higher shareholder returns via dividend payments and share buybacks. Investors seemed reassured that higher gold prices are indeed translating into higher margins, higher profitability, lower debt and enhanced growth prospects for the industry. And while August was not a bad month for broader equities, helped by mega-cap tech dominance and optimistic rate-cut speculation, the S&P 500® Index’s monthly increase of approximately 2%8 paled in comparison to the gold miners’ advance. Richly valued U.S. equities, concerns that growth of mega-cap stocks may be fading and high concentration in AI/tech stocks may also be driving portfolio diversification and rotation of capital that is benefiting gold stocks.

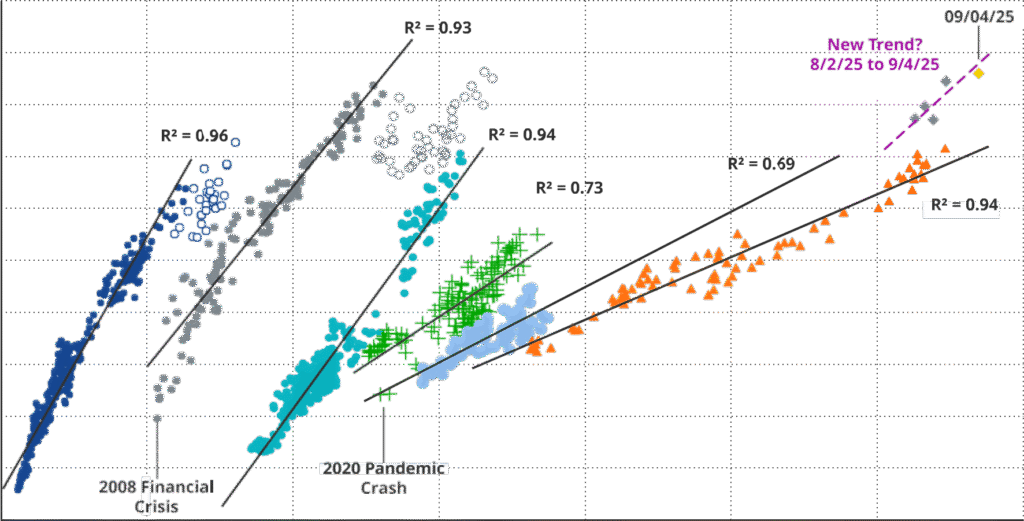

Miners Find Their Mojo

After almost two decades of persistent de-rating, could gold equities finally be getting their mojo back? Our data seems to suggest that it could be the case. We have been tracking the relationship between gold bullion and gold equities (GDM) since 2001 (see chart below) and have identified six clear (strong) trends, indicating a significant and prolonged de-rating of the gold mining sector since 2007. A de-rating occurs when a trendline shifts to the right and/or downward. De-ratings in the past were the result of companies consistently disappointing investors. Examples include massively out- of-the-money hedge books in the 2000’s; over indebtedness and low returns on capital in the 2010’s; and missing production and cost targets in the early 2020’s. Now investors are seeing expanding margins, low debt, capital-allocation discipline, and companies doing what they said they would do this year. While it is too early to tell if a new valuation trend is forming, August data is encouraging and may signal the beginning of a new bull cycle for gold mining stocks. For reference, the bull- market trend of 2001-2007 would imply a GDM value of approximately 6,000 at today’s spot gold price, compared to its present value of around 1,800. A return of those historical sector multiples may seem unrealistic and it’s not part of our outlook, but a significant re-rating of the sector is in the cards, in our view. Investors must keep in mind that past performance is not indicative of future results.

As mentioned above, the chart below maps gold prices against the GDM since 2001, highlighting the six trends—and a potential re-rating with a steeper “new trend” emerging since mid-August 2025.

Gold vs NYSE Arca Gold Miners Index

2001 – 2025 Weekly Close

Data as of September 4, 2025. Past performance is no guarantee of future results.

To receive more Gold Investing insights, sign up to our newsletter.

Imaru Casanova

Portfolio Manager,

Gold and Precious Metal

1 Reuters. (07.08.2025)

2 Reuters. (11.08.2025)

3 World Gold Council. (31.08.2025)

4 Reuters, Yahoo Finance. (20.08.2025)

5 World Gold Council. (31.08.2025)

6 FT. (30.08.2025)

7 MarketVector. (31.08.2025)

8 FT. (30.08.2025)

IMPORTANT INFORMATION

This is marketing communication. Please refer to the prospectus of the UCITS and to the KID/KIID before making any final investment decisions. These documents are available in English and the KIDs/KIIDs in local languages and can be obtained free of charge at www.vaneck.com, from VanEck Asset Management B.V. (the “Management Company”) or, where applicable, from the relevant appointed facility agent for your country.

Börshandlade fonder för europeiska small caps

XMGA ETF spårar amerikanska aktier men exkluderar de största företagen

Miners Find Their Mojo as Gold Consolidates

TLTY ETP köper långa statsobligationer och ger utdelning varje månad

EXUS ETF – Levler MSCI World ex USA by Xtrackers

Utdelningar och försvarsfonder lockade i augusti

Septembers utdelning i XACT Norden Högutdelande

HANetf kommenterar mötet mellan Kina, Ryssland och Nordkorea vid militärparad

HANetf kommenterar Norges avtal om krigsfartyg med Storbritannien

JGVE ETF köper statsobligationer som hedgas i Euro

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUtdelningar och försvarsfonder lockade i augusti

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSeptembers utdelning i XACT Norden Högutdelande

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanHANetf kommenterar mötet mellan Kina, Ryssland och Nordkorea vid militärparad

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanHANetf kommenterar Norges avtal om krigsfartyg med Storbritannien

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanJGVE ETF köper statsobligationer som hedgas i Euro

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanIncomeShares fondflöden nådde en ny rekordnivå i augusti

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUSBG ETF köper statsobligationer och hedgar dem i dollar

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSeptember är extremt