Nyheter

Crypto Market Compass 29 July 2024

Publicerad

1 år sedanden

• Cryptoassets were weighed down by increasing US macro risks and a disappointing debut of the Ethereum spot ETFs. However, there was significant performance dispersion across cryptoassets as Bitcoin was buoyed by major announcement at the latest Bitcoin conference.

• Our in-house “Cryptoasset Sentiment Index” continues to signal a slightly bullish sentiment but no euphoria.

• In the short term, the Bitcoin strategic reserve announcement should already reduce the uncertainty around potential additional distribution of the current US government bitcoin holdings, which amount to around 207k BTC.

Editorial Note: The next Crypto Market Compass will be published on the 19/08/2024 due to the summer holiday season. Happy summer!

Chart of the Week

Performance

Last week, cryptoassets were weighed down by increasing US macro risks and a disappointing debut of the Ethereum spot ETFs in the US.

However, there was significant performance dispersion across cryptoassets as Bitcoin was significantly buoyed by major announcement at the latest Bitcoin conference in Nashville over the weekend.

Ethereum spot ETFs debuted on the 23rd of July. Although all new ETFs saw positive net inflows, overall net inflows were held back by larger net outflows from Grayscale’s flagship Ethereum Trust (ETHE).

More specifically, the Grayscale Ethereum Trust (ETHE) saw -1,513 mn USD in net outflows while all other new ETFs saw a combined positive net inflow of +1,170 mn USD since trading launch. As a result, Ethereum significantly underperformed Bitcoin last week.

However, we expect these net outflows from ETHE to gradually decline over time, similar to the flow pattern we observed after the Bitcoin spot ETF debut with GBTC in January this year. So, these outflows should become less of a headwind for Ethereum over next couple of weeks.

Another very important development was the Bitcoin conference in Nashville over the weekend, that saw major announcements by US politicians.

Presidential candidate Trump delivered a pro-Bitcoin speech on Saturday at the world’s largest Bitcoin conference in Nashville where he amongst other things announced plans to add Bitcoin as a strategic reserve asset, if elected as president. This was echoed by Wyoming senator Cynthia Lummis who officially presented the “Bitcoin Reserve Bill” to live conference participants as well.

Trump’s speech included the following very positive election promises:

• If elected, his administration will keep 100% of the US government’s bitcoin, forming a strategic bitcoin stockpile.

• On Day 1, he will remove SEC chairman Gary Gensler from office.

• immediately shut down “Operation Choke Point 2.0”.

• appoint a bitcoin and crypto presidential advisory council.

• design transparent regulatory clarity within the first 100 days.

• never allow a CBDC during his presidency.

• always defend the right to self-custody.

• create a framework for the safe, responsible expansion of stablecoins.

• stop the “war on crypto”.

• make the US the world’s number one bitcoin mining powerhouse.

• commute Ross Ulbricht’s sentence.

• be a pro-bitcoin president “that America needs”.

However, the price of bitcoin reacted negatively at first in a “sell-the-news” kind of fashion as a sign that a positive speech by Trump was largely anticipated. However, the price has recently surged back towards 70k USD.

It goes without saying that, if Trump were to be re-elected and if the “Bitcoin Reserve Bill” and other points were indeed implemented, this would be a very bullish catalyst for 2024 and beyond.

The latest odds by PredictIt put Trump’s probability to become the next president at 53% compared with a odds of 49% for Harris.

In the short term, the Bitcoin strategic reserve announcement should already reduce the uncertainty around potential additional distribution of the current US government bitcoin holdings. According to the latest on-chain data provided by Glassnode, the US government controls around 207k BTC and is the largest government entity worldwide holding bitcoin (Chart-of-the-Week).

The timing of these announcements coincides with the fact that today marks exactly 100 days after the Bitcoin Halving event which took place on the 20th of April.

We expect the Halving effect to become increasingly positive over the coming 300 days as outlined here and provide a significant tailwind for Bitcoin and cryptoassets throughout the remainder of 2024 and beyond.

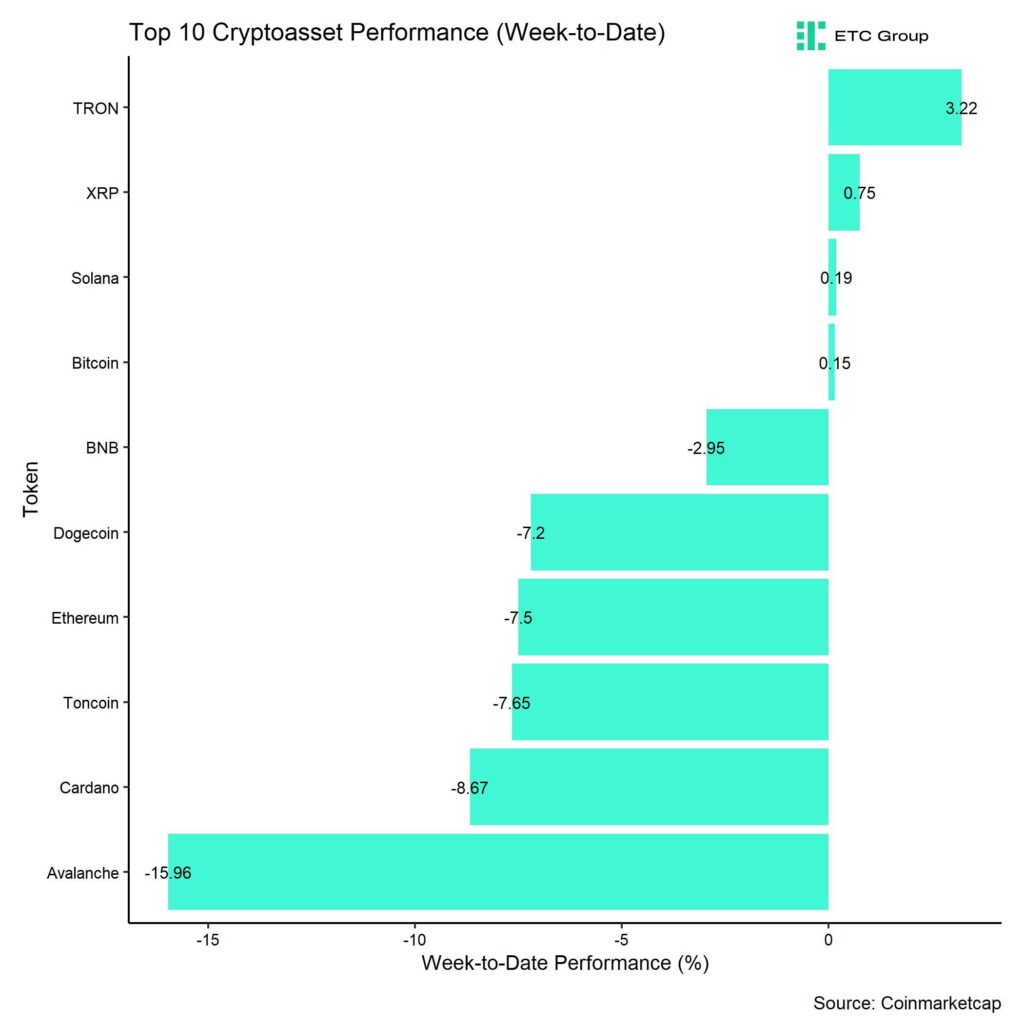

In general, among the top 10 crypto assets, TRON, XRP, and Solana were the relative outperformers.

Overall, altcoin outperformance vis-à-vis Bitcoin has continued to be low again, with only 10% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. Ethereum also signficantly underperformed Bitcoin on a weekly basis.

Sentiment

Our in-house “Cryptoasset Sentiment Index” continues to signal a slightly bullish sentiment but no euphoria.

At the moment, 7 out of 15 indicators are above their short-term trend.

Last week, there were significant reversals in the BTC 1-month implied volatility and BTC perpetual funding rate which tend to be bullish signals.

The Crypto Fear & Greed Index currently signals a “Greed” level of sentiment as of this morning.

Performance dispersion among cryptoassets has decreased slightly and remains at low levels. This means that altcoins are still very much correlated with the performance of Bitcoin.

Altcoin outperformance vis-à-vis Bitcoin has continued to be low, with only 10% of our tracked altcoins outperforming Bitcoin on a weekly basis, which is consistent with the fact that Ethereum also significantly underperformed Bitcoin last week.

In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets and the latest altcoin underperformance is a signal of decreasing appetite for risk at the moment.

Meanwhile, sentiment in traditional financial markets as measured by our in-house measure of Cross Asset Risk Appetite (CARA) worsened significantly as traditional financial markets were weighed down by increasing US macro risks.

Fund Flows

Fund flows into global crypto ETPs continued to be positive but decelerated once again compared to the prior week.

Global crypto ETPs saw only around +155.4 mn USD in net inflows across all types of cryptoassets which is significantly lower than the +1,393.1 mn mn USD in net inflows recorded the prior week.

Global Bitcoin ETPs saw net inflows of +479.2 mn USD last week, of which +535.2 mn USD in net inflows were related to US spot Bitcoin ETFs alone.

Last week saw a continued deceleration in flows into Hong Kong Bitcoin ETFs to -28.9 mn USD in net outflows.

Outflows from the ETC Group Physical Bitcoin ETP (BTCE) persisted last week with net outflows equivalent to -61.8 mn USD while the ETC Group Core Bitcoin ETP (BTC1) saw minor positive net inflows of +0.1 mn USD.

The Grayscale Bitcoin Trust (GBTC) continued to see net outflows, with around -119.7 mn USD last week.

Meanwhile, global Ethereum ETPs also saw a slight deceleration in net inflows last week.

Ethereum spot ETFs debuted on the 23rd of July. Although all new US ETFs saw positive net inflows, overall net inflows were held back by larger net outflows from Grayscale’s flagship Ethereum Trust (ETHE). More specifically, the Grayscale Ethereum Trust (ETHE) saw -1,513 mn USD in net outflows while all other new ETFs saw a combined positive net inflow of +1,170 mn USD since trading launch.

In general, US spot Ethereum ETF flows have now become a significant force for global Ethereum ETP flows as well.

Hong Kong Ethereum ETFs saw sticky AuM last week (+/- 0 mn USD).

The ETC Group Physical Ethereum ETP (ZETH) also saw sticky AuM last week (+/- 0 mn USD) while the ETC Group Ethereum Staking ETP (ET32) showed a continued increase in net inflows last week (+2.2 mn USD).

Altcoin ETPs ex Ethereum also experienced positive net inflows of around +6.0 mn USD which was lower than last week though.

Thematic & basket crypto ETPs saw negative flows with around -17.9 mn USD in net outflows, based on our calculations. The ETC Group MSCI Digital Assets Select 20 ETP (DA20) saw neither in- nor outflows last week (+/- 0 mn USD).

Meanwhile, global crypto hedge funds continued to increase their market exposure again even further. The 20-days rolling beta of global crypto hedge funds’ performance increased to around 0.86 (up from 0.80 last week) per yesterday’s close.

On-Chain Data

Despite the positive news flow, Bitcoin on-chain data have deteriorated again lately.

Whale net exchange transfers have increased significantly again, with whale wallets sending around 25.3 BTC net to exchanges over the past 7 days. This could weigh on prices in the short term. Whales are defined as network entities that control at least 1,000 BTC. This could be related to Mt Gox redistributions of bitcoins, as the Mt Gox trustee wallets have sent coins to Kraken more recently.

This has significantly weighed on net buying volumes on BTC spot exchanges, which have turned negative over the past 7 days.

BTC exchange balances have also continued to stay elevated near year-to-date highs, according to data provided by Glassnode.

A significant force of selling pressure is still emanating from short-term holders (STH) and especially whales who are still realizing losses on chain. These wallets must have bought near all-time highs and are now distributing again.

A positive sign is that the Mt Gox trustee’s redistribution of bitcoins to former creditors has so far not had a significantly negative market impact. The Mt Gox trustee balance is down to 79.6k BTC from 139k BTC according to data provided by Glassnode.

Another positive sign is the fact that the continued distribution of bitcoins by the US government has now become less likely with the promises made by Trump and others at the recent Bitcoin conference in Nashville. Note that the US government had distributed bitcoins recently at the end of June. A Trump presidency would certainly decrease further distribution from these wallets. At the time of writing, the US government still controls around 207k BTC.

Lastly, a positive sign is that distributions by BTC miners has also decelerated more recently and the BTC hash rate has reached new all-time highs which is a sign that economic pressure on Bitcoin miners has receded.

We think that a large part of the “legacy supply” overhang (GBTC outflows, Mt Gox distribution, government entity sales, BTC miner distribution) has now been digested with positive market implications in terms of declining selling pressure from these entities.

Futures, Options & Perpetuals

Last week, BTC futures open interest remained mostly flat while perpetual open interest increased significantly. Futures open interest was held back due to a significant increase in BTC long liquidations while short liquidations remained moderate.

In contrast, perpetual open interest increased by around 14 BTC last week. The fact that the perpetual funding rate also increased significantly implies a net built-up in long positioning.

When the funding rate is positive (negative), long (short) positions periodically pay short (long) positions. A positive funding rate tends to be a sign of bullish sentiment in perpetual futures markets.

However, the 3-months annualized BTC futures basis rate declined compared to the week prior to around 11.2% p.a.

Besides, BTC option open interest declined due to the large expiries on the 27th of July. The recent very significant decline of the BTC put-call open interest ratio to year-to-date lows implies that BTC option traders have significantly reduced their downside hedges/bets on bitcoin which is a positive sign. Put-call volume ratios also remained somewhat low which is also consistent with the fact that 1-month 25-delta skews for BTC also declined significantly. They have recently increased again slightly though.

Meanwhile, BTC option implied volatilities have also decreased significantly. At the time of writing, implied volatilities of 1-month ATM Bitcoin options are currently at around 51.4% p.a.

Bottom Line

• Cryptoassets were weighed down by increasing US macro risks and a disappointing debut of the Ethereum spot ETFs. However, there was significant performance dispersion across cryptoassets as Bitcoin was buoyed by major announcement at the latest Bitcoin conference.

• Our in-house “Cryptoasset Sentiment Index” continues to signal a slightly bullish sentiment but no euphoria.

• In the short term, the Bitcoin strategic reserve announcement should already reduce the uncertainty around potential additional distribution of the current US government bitcoin holdings, which amount to around 207k BTC.

To read our Crypto Market Compass in full, please click the button below:

This is not investment advice. Capital at risk. Read the full disclaimer

© ETC Group 2019-2024 | All rights reserved

Du kanske gillar

Oändlig portföljprecision. Tre nya ETP från 21shares är nu tillgänglig via din bank eller mäklare

21share är glada att kunna meddela lanseringen av tre innovativa ETPer som utökar bolagets produktsortiment.

21shares Maple Finance ETP (ticker: SYRUP) och 21shares Bittensor ETP (ticker: ATAO) är nu noterade på Euronext Amsterdam och Paris, och 21shares Pendle ETP (ticker: APEN) på SIX Swiss Exchange – alla tillgängliga i USD och EUR.

Utforska nu hur dessa produkter passar in i den föränderliga marknaden och hur de kan hjälpa dig att positionera din portfölj för framgång:

21shares Bittensor ETP (ATAO)

Investera i det decentraliserade intelligenslagret inom AI med Bittensor, ett öppet nätverk där tusentals utvecklare bygger och konkurrerar om att leverera AI-tjänster. Från avancerade språkmodeller till decentraliserade rekommendationssystem fungerar dessa verktyg utan centraliserad kontroll. TAO-token driver detta ekosystem och kombinerar knapphet med nytta samtidigt som den driver transaktioner och belönar prestanda. Denna ETP erbjuder exponering mot en snabbt växande AI-marknadsplats och överbryggar blockkedjeinnovation med den blomstrande AI-sektorn.

Factsheet

21sharesMaple ETP (SYRUP)

Få exponering mot Maple Finance, den institutionella porten till on-chain-kredit, där granskade företag får direkta lån från institutionella investerare. SYRUP-token anpassas till plattformstillväxt genom avgiftsfinansierade återköp, vilket länkar tokenvärdet direkt till Maples expanderande utlåningsekosystem. Denna ETP ger investerare tillgång till en högkvalitativ, transparent och kompatibel kreditmarknad inom DeFi.

Factsheet

Investment Thesis

21shares Pendle ETP (APEN)

Fånga möjligheter inom kryptoderivat med Pendle, som omvandlar avkastningsbärande tillgångar till omsättningsbara kapital- och avkastningskomponenter. PENDLE-token driver styrning och avgiftsbelöningar, medan Pendles infrastruktur fungerar som kärnnavet för prissättning, handel och hantering av avkastning i DeFi. Denna ETP ger exponering mot en växande, sofistikerad marknad för avkastningshantering, och erbjuder både innovation och potentiell uppsida i digitala räntestrategier.

Factsheet

Investment Thesis

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

FalconX förvärvar den ledande ETP-leverantören 21shares, vilket accelererar konvergensen av digitala tillgångar och traditionell finans

Publicerad

19 timmar sedanden

22 oktober, 2025

Förvärvet förenar FalconX marknadsledande Prime Brokerage-plattform med 21shares ETP-infrastruktur för att främja investeringsprodukter för digitala tillgångar

Markerar FalconX tredje strategiska transaktion under 2025, vilket understryker dess avgörande roll i att forma ekosystemet för digitala tillgångar

FalconX, en ledande institutionell Prime Brokerage-leverantör för digitala tillgångar, meddelade idag att de har gått med på att förvärva 21shares, leverantören av världens största utbud av börshandlade fonder och produkter (ETFer/ETPer) inom kryptovaluta. Transaktionen representerar en viktig milstolpe i FalconX strategi att accelerera konvergensen av noterade marknader och digitala tillgångar, samtidigt som den stärker sin globala närvaro i USA, Europa och Asien-Stillahavsområdet.

I en av de viktigaste ETP-branschtransaktionerna de senaste åren sammanför förvärvet 21shares expertis inom utveckling och distribution av tillgångsförvaltningsprodukter med FalconX institutionella infrastruktur, struktureringskapacitet och riskhanteringsplattform.

Tillsammans kommer de två företagen att accelerera skapandet av skräddarsydda investeringsprodukter som möter den växande institutionella och privata efterfrågan på reglerad exponering för digitala tillgångar.

Sedan grundandet 2018 av Hany Rashwan och Ophelia Snyder har 21shares vuxit till en global ledare inom digitala ETPer och förvaltar tillgångar till ett värde av över 11 miljarder dollar fördelat på 55 noterade produkter per den 30 september 2025. Dess egenutvecklade teknikplattform och väletablerade nätverk av partners ligger till grund för deras förmåga att snabbt och i stor skala lansera nya produkter på marknaden. FalconX, medgrundat av Raghu Yarlagadda, har underlättat handelsvolymer på över 2 biljoner dollar och en global kundbas på över 2 000 institutioner, tack vare sin kryptobaserade handels-, kredit- och teknikinfrastruktur.

”21shares har byggt en av de mest betrodda och innovativa produktplattformarna inom digitala tillgångar”, säger Raghu Yarlagadda, VD för FalconX. ”Vi bevittnar en kraftfull konvergens mellan digitala tillgångar och traditionella finansmarknader, då krypto-ETPer öppnar nya kanaler för investerarnas deltagande genom reglerade, välbekanta strukturer. FalconX har byggt den institutionella ryggraden för handel, derivat och kredit, och att utöka den infrastrukturen till börsnoterade marknader genom 21Shares är ett naturligt nästa steg mot att stärka marknadseffektiviteten. För FalconX är detta en medveten, långsiktig investering i att bygga ett varaktigt företagsvärde över marknadscykler.”

”Under de senaste 8 åren har vi byggt 21shares verksamhet från 0 dollar till mer än 11 miljarder dollar i förvaltat värde. Vi har skalat upp för att nå miljontals kunder i alla hörn av världen och fört in dem i krypto med våra produkter och vår forskning”, säger 21shares grundare Ophelia Snyder och Hany Rashwan. ”Vi ser verkligen fram emot att FalconX fortsätter att bygga vidare på denna starka grund för nästa kapitel i 21shares utveckling.”

”Vårt mål har varit att göra kryptoinvesteringar tillgängliga för alla genom branschledande börshandlade produkter”, säger Russell Barlow, VD för 21shares. ”Nu kommer FalconX att göra det möjligt för oss att agera snabbare och utöka vår räckvidd. Tillsammans kommer vi att vara pionjärer inom lösningar som möter de ständigt växande behoven hos investerare i digitala tillgångar världen över.”

Efter slutförandet kommer 21shares att fortsätta förvaltas oberoende under FalconX-paraplyet. Barlow kommer att fortsätta som VD för 21shares och arbeta nära ledningsgruppen på FalconX för att främja en gemensam vision för framtiden för ekosystemet för digitala tillgångar. Inga förändringar av konstruktionen eller investeringsmålen för de befintliga 21shares ETPerna (Europa) eller ETFerna (USA) är planerade.

Detta förvärv bygger på FalconX strategi för 2025 för att stärka sin globala verksamhet inom handel, kapitalförvaltning och marknadsinfrastruktur. Det följer integrationen av Arbelos Markets och majoritetsandelen som togs i Monarq Asset Management tidigare i år, tillsammans med expansioner i Latinamerika, Asien-Stillahavsområdet och Europa, Mellanöstern och Afrika. I takt med att digitala tillgångar utvecklas till vanliga investeringsprodukter placerar detta drag FalconX i centrum för hur institutioner och investerare får tillgång till kryptoekonomin.

Om FalconX

FalconX är en ledande mäklarfirma för digitala tillgångar för världens främsta institutioner. Vi erbjuder omfattande tillgång till global likviditet för digitala tillgångar och ett komplett utbud av handelstjänster. Vårt dedikerade team, som är tillgängligt dygnet runt för konto-, operativa och handelsbehov, gör det möjligt för investerare att navigera på marknaderna dygnet runt. FalconX Bravo, Inc., ett dotterbolag till FalconX, var den första CFTC-registrerade swap-handlaren som fokuserade på kryptovalutaderivat.

FalconX stöds av investerare som Accel, Adams Street Partners, Altimeter Capital, American Express Ventures, B Capital, GIC, Lightspeed Venture Partners, Sapphire Ventures, Thoma Bravo, Tiger Global Management och Wellington Management. FalconX har kontor i Silicon Valley, New York, London, Hongkong, Bengaluru, Singapore och Valletta. För mer information, besök falconx.io eller följ FalconX på X och LinkedIn.

”FalconX” är ett marknadsföringsnamn för FalconX Limited och dess dotterbolag. Tillgängligheten av produkter och tjänster är beroende av jurisdiktionella begränsningar och FalconX-enhetens kapacitet. För mer information om vilka juridiska personer som erbjuder specifika produkter och tjänster, vänligen se informationen på vår offentliga webbplats, som ingår häri, eller kontakta din relationskontakt.

Om 21shares

21shares är en av världens ledande leverantörer av börshandlade produkter för kryptovaluta och erbjuder de största sviterna av fysiskt stödda krypto-ETPer på marknaden. Företaget grundades för att göra kryptovaluta mer tillgänglig för investerare och för att överbrygga klyftan mellan traditionell finans och decentraliserad finans. 21shares noterade världens första fysiskt stödda krypto-ETP 2018 och byggde upp en sjuårig meritlista av att skapa börshandlade fonder för kryptovaluta som är noterade på några av de största och mest likvida värdepappersbörserna globalt. Med stöd av ett specialiserat forskarteam, egenutvecklad teknik och djupgående expertis inom kapitalmarknaden levererar 21shares innovativa, transparenta och kostnadseffektiva investeringslösningar.

För mer information, besök www.21shares.com.

Nyheter

Hybridreplikering: nästa stora grej för ETFer?

Publicerad

20 timmar sedanden

22 oktober, 2025

ETFer replikerar sitt index antingen fysiskt eller via syntetisk replikering – nu introduceras en ny replikeringsmetod av Scalable Capital

I ETF-världen sker det mindre och större produktrevolutioner då och då. En av dessa i år är förmodligen den nya ”hybridreplikeringen”. I den här artikeln tittar vi närmare på vad detta handlar om och vem som är först med att använda den i sina ETFer.

Hybridreplikering: Vad är det?

Replikeringsmetoder för ETFer kunde tidigare delas in i två grundläggande varianter: Fysisk och syntetisk replikering (även om fysisk replikering fortfarande har en underkategori med ”optimerad sampling”).

Som namnet ”hybridreplikering” antyder är denna nya replikeringsmetod en blandning av fysisk och syntetisk replikering.

ETFen replikerar således dynamiskt sitt underliggande index och kan använda både den ena och den andra varianten för att följa sitt index. Detta kan vara särskilt fördelaktigt för brett diversifierade globala ETFer för att optimalt kunna följa respektive delmarknader.

Vi ska titta närmare på exakt hur detta fungerar och fördelarna och nackdelarna med denna metod om en stund. Men först ska vi titta på de grundläggande skillnaderna mellan de olika replikeringsmetoderna.

Skillnaden: Fysisk, syntetisk och hybridreplikering av ETFer

I grund och botten erbjuder varje form av replikering vissa fördelar och nackdelar. Det är därför det tidigare fanns tre olika replikeringsmetoder som ETFer kunde använda för att replikera sitt motsvarande index. Nu läggs hybridreplikeringsmetoden till:

- (Fullständig) fysisk replikering används för att spåra lättillgängliga och mycket likvida marknader. ETF:er på DAX 40, FTSE 100 eller S&P 500 replikeras därför ofta direkt och fullständigt. De aktier som ingår är bland de största aktiebolagen i respektive land och är lätta att handla med. Dessutom är ansträngningen från ETF-leverantörernas sida att köpa några dussin eller några hundra aktier begränsad.

- Optimerad sampling används huvudsakligen för stora index med flera tusen aktiebolag. För att följa ett globalt globalt aktieindex som MSCI ACWI IMI räcker det till exempel att köpa ett representativt urval på cirka 3 500 aktier istället för de cirka 9 000 aktier som indexet innehåller. Detta sparar ETFen, och därmed dig som investerare, pengar och är mycket mer effektivt.

- Syntetisk replikering används företrädesvis för marknader som är svåra att komma åt, där direktköp av aktier är alldeles för dyrt eller försvåras av regulatoriska förhållanden. Swap-ETFer erbjuder också strukturella fördelar på vissa marknader – till exempel när det gäller källskattebesparingar. Mer om detta strax …

- Hybridreplikering är en kombination av fysisk och syntetisk replikering. En ETF som använder hybridreplikering kan själv inom ETFen bestämma vilka marknader den vill replikera direkt via fysisk replikering och vilka marknader som är bättre inkluderade i portföljen via swappar.

Jämförelse av ETF-replikeringsmetoder

| Fysisk (fullständig) | Fysisk (sampling) | Syntetiskt | Hybrid | |

| Replikerings- metod | Fullständig replikering | Sampling | Swap-based | Blandning av fysisk och syntetisk replikering |

| ETF-beskrivning | Indexet replikeras 1:1 i ETFen | ETF:n innehar ett representativt urval av indexaktier | Indexreplikering sker via en swaptransaktion | ETF innehar aktier både direkt och via swappartners |

| Underliggande tillgångar | Aktier, obligationer | Aktier, obligationer | Aktier, obligationer, råvaruindex, penningmarknadsindex, korta och hävstångsindex | Aktier |

| Typiska egenskaper hos index- komponenterna | Likvida värdepapper | (Delvis) illikvida värdepapper | Likvida och illikvida värdepapper, investeringsrestriktioner (handelsrestriktioner, beskattning), olika tidszoner | Likvida och illikvida värdepapper, investeringsrestriktioner (handelsrestriktioner, beskattning), olika tidszoner |

| Idealt antal indexkomponenter | Lågt | Högt | Låg till hög | Låg till hög |

| Ideal utdelnings- policy | Utdelande och ackumulerande | Utdelande och ackumulerande | Övervägande ackumulerande | Övervägande |

| Exempel index | DAX, Eurostoxx 50, FTSE 100, Dow Jones 30 | MSCI World, MSCI Emerging Markets, MSCI ACWI IMI | MSCI World, MSCI Emerging Markets, Eurostoxx 50 Rohstoff-Indizes, Short DAX, Leverage DAX | MSCI World, MSCI Emerging Markets, MSCI ACWI IMI, Eurostoxx 50 |

Hybrida replikerande ETFer är för närvarande endast tillgängliga på aktieindex

Hur fungerar hybridreplikering med ETFer?

Styrkorna med den nya replikeringsmetoden är särskilt tydliga i brett diversifierade aktieindex som MSCI ACWI eller FTSE All World. Syftet med hybridreplikeringsmetoden är att kombinera fördelarna med fysisk replikering med fördelarna med den syntetiska replikeringsmetoden. Hur fungerar detta i praktiken?

Ett exempel är swap-ETFer på S&P 500, som har en avgörande fördel jämfört med sina fysiskt replikerande syskon – det finns ingen källskatt på utdelningar.

Hur då? Medan fysiskt replikerande ETFer måste betala minst 15 % källskatt på amerikanska utdelningar eftersom de investerar direkt i amerikanska aktier, byter en swap-ETF helt enkelt indexets avkastning med ett motsvarande finansinstitut (motparten eller swappartnern).

Inga amerikanska aktier krävs i ETFens bärarportfölj. Och där inga amerikanska aktier köps direkt uppstår ingen källskatt. Detta är också anledningen till att syntetiska ETFer på S&P 500 har något högre långsiktig avkastning än fysiska S&P 500-ETFer.

Med syntetiska ETFer kan investerare också dra nytta av en unik strukturell dynamik på den kinesiska lokala A-aktiemarknaden. Denna specifika aktiemarknad är starkt begränsad eller reglerad och erbjuder samtidigt en attraktiv miljö för professionella investerare (t.ex. hedgefonder) som följer marknadsneutrala strategier.

Dessa investerare har dock ofta begränsad tillgång, till exempel för blankning för att säkra sin marknadsrisk. Som ett resultat är dessa marknadsaktörer beredda att betala swap-motparterna i syntetiska ETFer (vanligtvis stora banker) en premie på den korta exponering som motparterna är exponerade för.

Denna extra premie förs delvis vidare till investerare i syntetiska A-aktie-ETFer och har historiskt sett lett till överavkastning. Premien kan fluktuera över tid och är främst beroende av efterfrågan från dessa marknadsaktörer.

Jämförelse

En nackdel med en syntetisk ETF jämfört med en fysiskt replikerande ETF är att den kanske inte kan genomföra värdepappersutlåning om den inte innehar de nödvändiga värdepapperen i sin portfölj. Många swap-ETFer använder ändå inte värdepappersutlåning. Detta är dock ett vanligt sätt för ETF:er att generera ytterligare intäkter för fondinvesterare.

Motpartsrisk med swap-ETFer

Med swap-ETFer anges ofta den så kallade motpartsrisken som en stor nackdel. Men är risken med swap-ETFer verkligen så stor? Det korta svaret är: Nej. Därför att:

- Som regel innehar både ETFen och swap-motparten säkerhet i form av likvida värdepapper.

- Denna säkerhet måste alltid fysiskt säkra minst 90 % av nettotillgångsvärdet (NAV). Eller tvärtom: motpartsrisken är begränsad till maximalt 10 % av fondens tillgångar och balanseras dagligen.

- I praktiken är syntetiska ETFer ofta översäkrade (säkerhet > NAV) och du kan när som helst se säkerhetsportföljen och de valda swap-partnerna transparent på webbplatserna för många ETF-leverantörer.

- Hittills har europeiska investerare inte lidit några förluster på grund av swap-motpartsrisk – inte ens under de allvarligaste kriserna (t.ex. 2008 och 2020).

Och det är här hybridreplikeringsmetoden kommer in i bilden – eftersom den till exempel kan användas för att syntetiskt replikera den amerikanska marknaden ”källskatteoptimerad” i en global ETF, medan den europeiska eller japanska aktiemarknaden fysiskt replikeras ”värdepappersutlåningskonformt”. Resultatet är faktiskt kombinationen av ”det bästa av två världar” – eftersom respektive ETF optimalt kan kartlägga motsvarande delmarknader beroende på de strukturella förhållandena och därmed möjliggöra en minimalt högre avkastning för dig som ETF-investerare.

Viktigt: Syntetiska ETFer kan också låna ut värdepapper från carrierportföljen. Det beror sedan på vilka värdepapper i carrierportföljen som är efterfrågade och hur. Med högre efterfrågan eller mindre likviditet kan till exempel vanligtvis högre avkastning uppnås än med mycket likvida värdepapper. Du kan läsa mer om detta i vår artikel om värdepappersutlåning med ETF:er.

Vilka ETFer använder den nya hybridreplikering?

I dag erbjuder endast en leverantör en ETF på MSCI ACWI med hybridreplikering: Xtrackers. Den Frankfurt-baserade kapitalförvaltaren har samarbetat med onlinemäklaren Scalable Capital för att lansera en global ETF.

Tre nya ETP från 21shares

FalconX förvärvar den ledande ETP-leverantören 21shares, vilket accelererar konvergensen av digitala tillgångar och traditionell finans

Hybridreplikering: nästa stora grej för ETFer?

31IG ETF företagsobligationer med förfall 2031

Investera i Worldcoin med en börshandlad produkt

Fokus mot en helt ny börshandlad produkt i september 2025

M5TYs senaste utdelningstakt (55 %) belyser covered call-strategins inkomstpotential

Could Bitcoin be the key to your dream house?

Börshandlade fonder för europeiska small caps

Levler noterar ytterligare fyra börshandlade fonder i Sverige

Populära

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFokus mot en helt ny börshandlad produkt i september 2025

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanM5TYs senaste utdelningstakt (55 %) belyser covered call-strategins inkomstpotential

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanCould Bitcoin be the key to your dream house?

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBörshandlade fonder för europeiska small caps

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLevler noterar ytterligare fyra börshandlade fonder i Sverige

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMiners Find Their Mojo as Gold Consolidates

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanState Street och Blackstone lanserar aktivt förvaltade CLO-ETFer i Europa

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKärnkraftsavtal mellan Storbritannien och USA väcker förhoppningar om uranboom