Nyheter

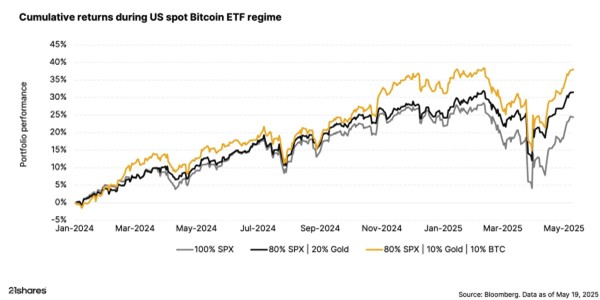

Bitcoin + Gold: The power couple for smarter portfolios

-

Nyheter3 veckor sedan

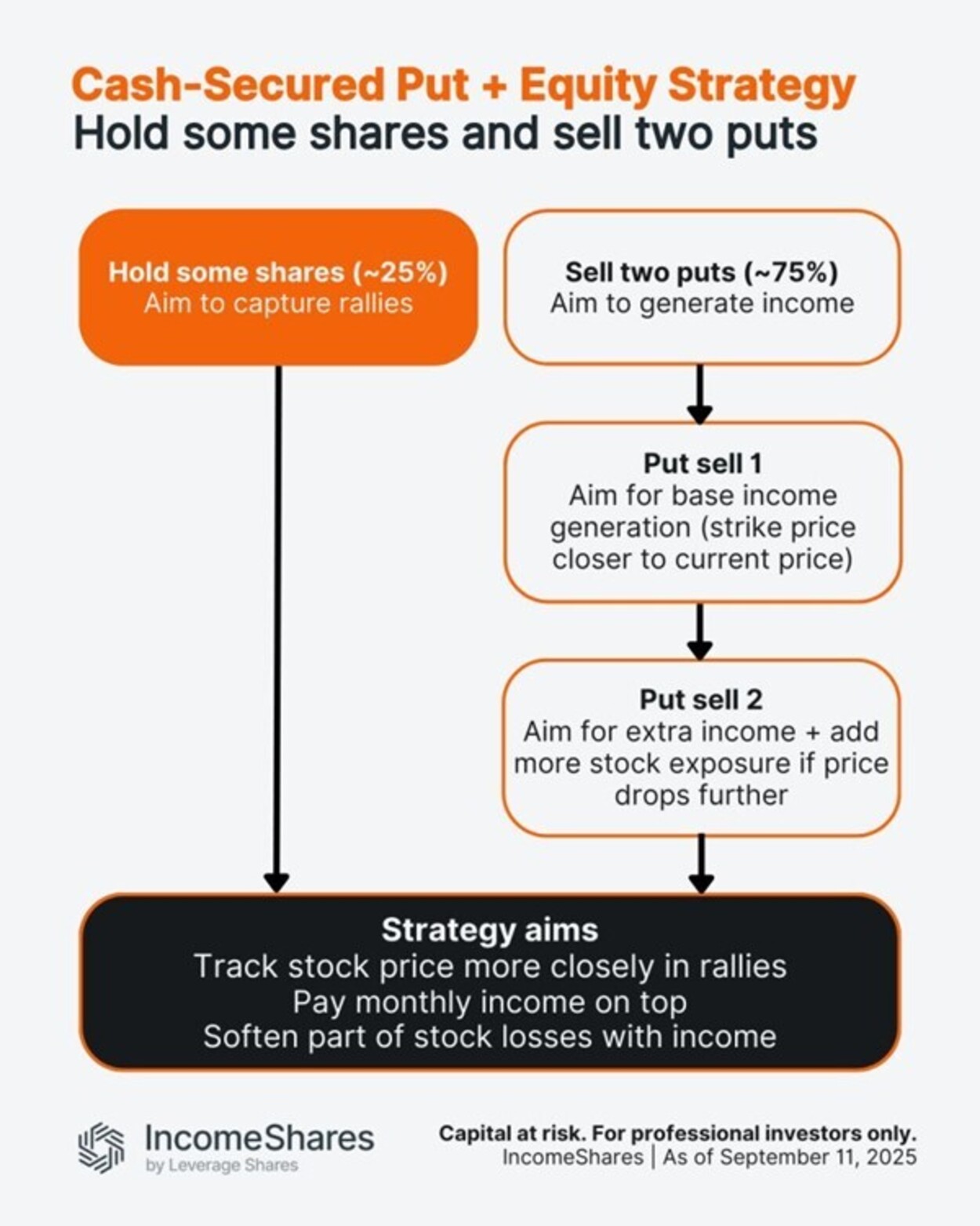

Nyheter3 veckor sedanMånadsutdelande ETFer uppdaterad med IncomeShares produkter

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUtdelningar och försvarsfonder lockade i augusti

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanHANetfs analyserar hur ett fredsavtal kan påverka det europeiska försvaret

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanHANetfs VD kommenterar Trump-Putin-toppmötet

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanADLT ETF investerar bara i riktigt långa amerikanska statsobligationer

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanSeptembers utdelning i XACT Norden Högutdelande

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFastställd utdelning i MONTDIV augusti 2025

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanHANetf kommenterar mötet mellan Kina, Ryssland och Nordkorea vid militärparad